Weekly Update 07/29/2024

Good morning to all from the East Coast!

As you know, this is my first email in many months. I’m hopeful to start sending them out again regularly beginning with this one. I only stopped because I misjudged the popularity but I was, apparently, wrong. With that, here is this weeks starter.

First a quick note for those in Jay’s audience

I wanted to take the time to quickly express my appreciation for everyone in Jay’s group. I’m honoured to be nominated into the HOF and be sure to not miss the seventh nominee who will be inducted this morning live at 9am before market open. Since Jay’s group mostly pertains to traders and not strategist and econ (which is what this Substack focuses on) I will post a better note later in the week with updated Market on Close (MOC) research plus more. With that, here is this weeks update - Nick W

Visit the Sell-side Research Website to read reports like this one as they’re released

*Real-time updates, news, and commentary 24/7*

Week Ahead

McDonalds Earnings - Monday 07:00

Proctor & Gamble Earnings - Tuesday 06:55

FOMC INTEREST RATE DECISION - TUESDAY 14:00

Fed Powell Press Conference - Tuesday 14:30

MICROSOFT EARNINGS - TUESDAY 16:00

Boeing Earnings - Wednesday 07:30

META EARNINGS - WEDNESDAY 16:00

Mastercard Earnings - Wednesday #tba#

AMAZON EARNINGS - THURSDAY 16:01

APPLE EARNINGS - THURSDAY 16:30

Chevron Earnings - Friday 06:15

ExxonMobil Earnings - Friday 06:30

NON-FARM PAYROLLS - FRIDAY 08:30

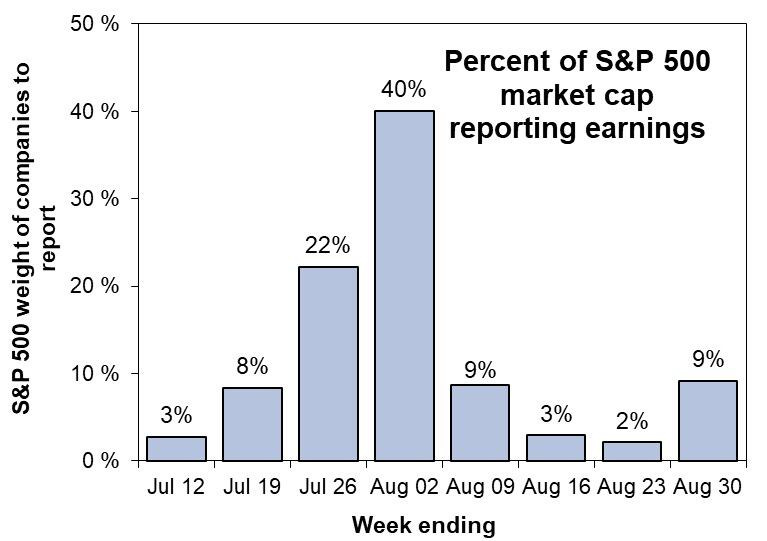

Four-of-seven of the Mag Seven reporting earnings this week, adding up to almost $10Tr in value alone. I will provide real-time updates and analysis on each of these reports, all of which are immediately after market close. If you’re a member of the DN Discord, stay tuned there.

For macro: rate decision on Tuesday although the consensus remains near unanimous for a hold, thus no need for comment. However, be advised the next meeting is September which is now the consensus for the first cut. This can change so stay tuned for live coverage on Tuesday from 2p until market close. The main focus for econ this week is NFP on Friday. I will release a note later in the week with details.

!! MUST READ !!

Goldman Sachs strategist Rubner explains why he is on “correction watch”

Goldman Sachs: I'm on correction watch [Rubner]

This is the last bullish email on US stocks I will send for now as the last bears have capitulated and everyone is in the pool.

Election

With the election approaching, here are some interesting points to consider:

The best performing sector under Biden presidency (to-date) has been Energy

The current administration has been the most beneficial to XLE 0.00%↑ in the funds history, the best return since W Bush and the Iraq war

To read more on the upcoming election, Goldman Sachs has a great note free to read on this website here

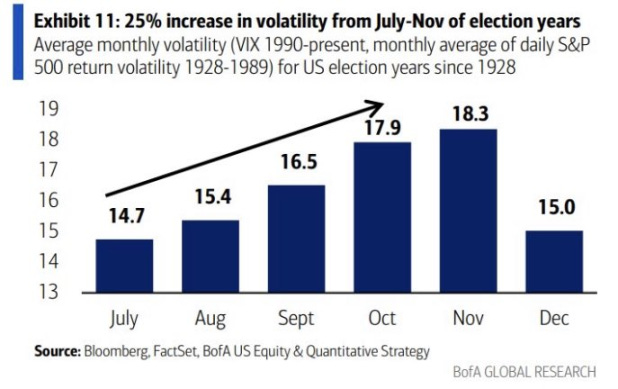

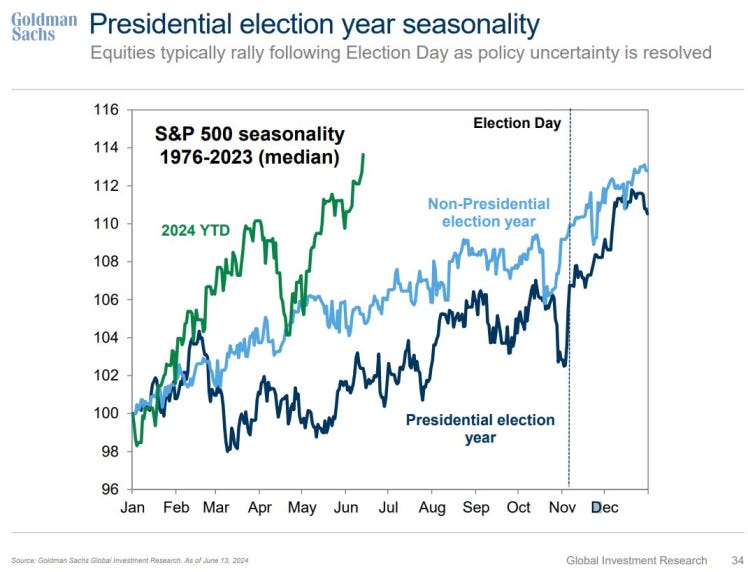

Expect increased volatility from now until November…

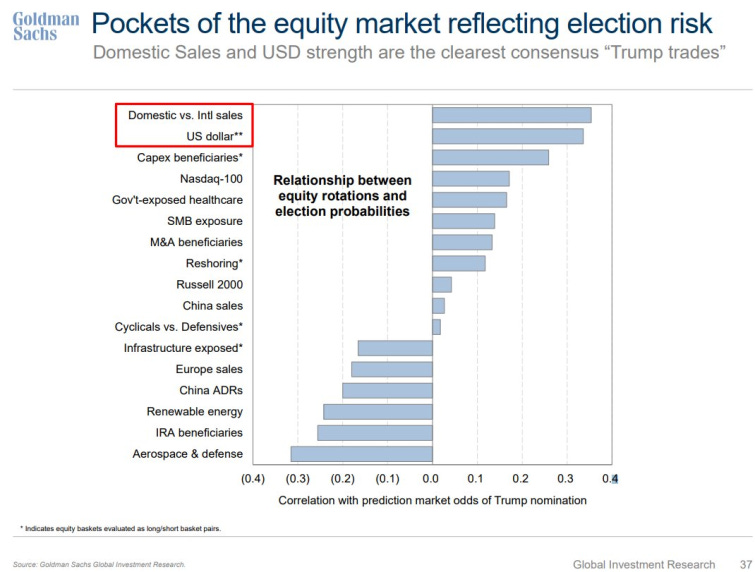

A potential Trump win could benefit the Dollar and companies with higher domestic sales…

Small Caps Catching Up to Mega

The R2K had it’s best week of the 21st century relative to the S&P 500:

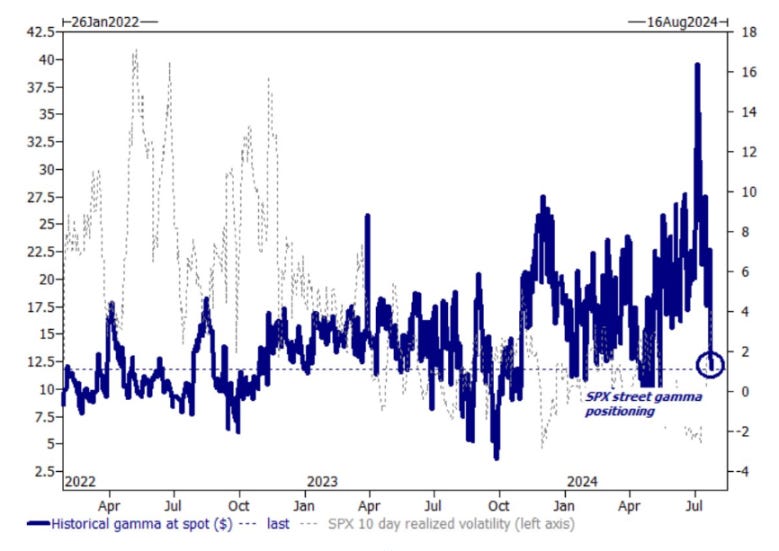

Spot gamma rolling over after all-time record $16Bn → ~1$Bn:

Tesla & Legacy Automakers

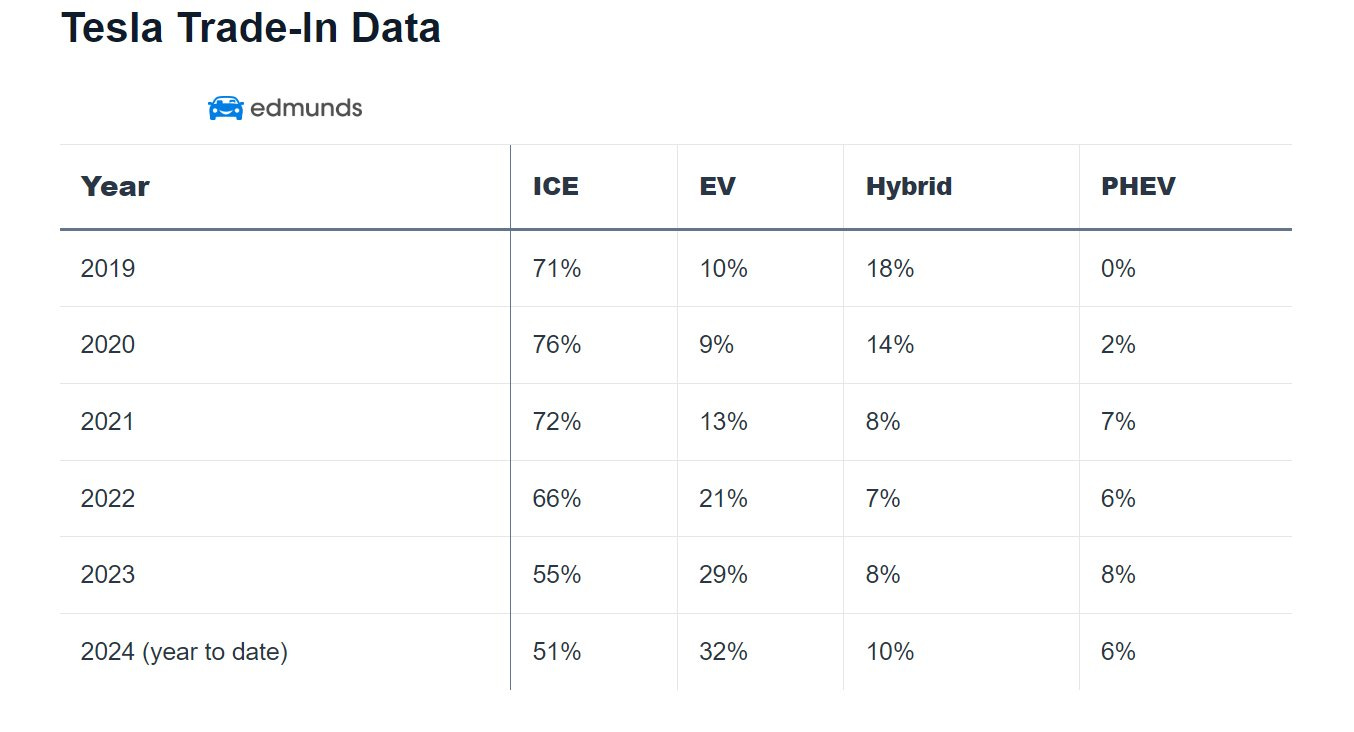

Over half of Tesla TSLA 0.00%↑ trade-in's are for ICE gas cars

Further, trade-in's for EV's have mostly been for legacy auto makers other than Tesla as they roll out new alternatives

Goldman Sachs: Comment on Flows 07/17/2024

July 17th (today) is here and typically marks the end of BBQ, pool, or pirate-themed summer parties for the S&P 500 since 1928. The S&P has hit 38 new all-time highs, on track to have the 2nd most closing highs in ~100 years, only 1995 is proving to be stronger. The top is over (up 13 in 15 sessions), and the summer dip has now kicked in. The painful tr…

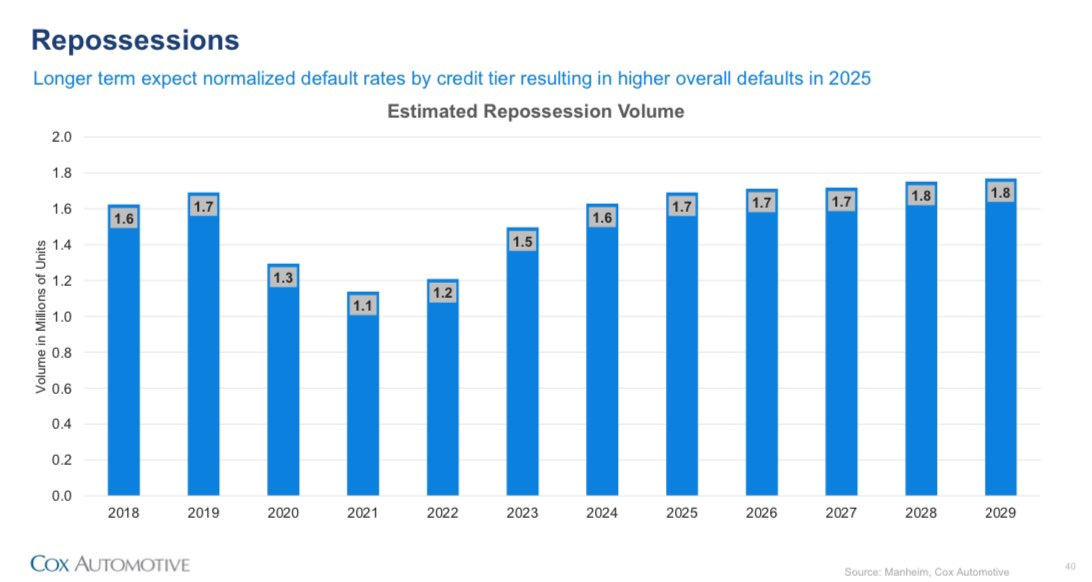

Vehicle repossession are up 23% YTD 2024

Subprime auto borrowers who were delinquent >60 days in June was 5.62%, down just slightly from a record in February

Read full story on Bloomberg here

Mid-Year Outlook & Portfolio Strategy

From the Trading Desk

My top pick : [07/24/2024]

Last PB update : [Largest Expiry in History] ← !! MUST READ !!

Recent:

Bitcoin

*TRUMP: ON DAY 1 I WILL FIRE GARY GENSLER

*TRUMP: WILL ORDER TREASURY DEPT TO CEASE CREATION OF A CENTRAL BANK DIGITAL CURRENCY

*TRUMP: WILL NEVER BE A CBDC WHILE I’M PRESIDENT

*TRUMP: NEVER SELL YOUR BITCOIN *TRUMP: POLICY OF GOVERNMENT WILL BE TO KEEP A STRATEGIC NATIONAL STOCKPILE

Watch the full video here

That concludes this weeks warmup. Thanks for viewing if you’ve made it this far and feel free to send feedback or requests. If you don’t already, follow me on Twitter @NiklasWebb

Visit the Sell-side Research Website to read reports like this one as they’re released

*Real-time updates, news, and commentary 24/7*

Nick

![Goldman Sachs: I'm on correction watch [Rubner]](https://substackcdn.com/image/fetch/w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F527034fa-43b1-4db2-9d59-2db70a91c080_756x478.png)