Goldman Sachs: I'm on correction watch [Rubner]

This is the last bullish email on US stocks I will send for now as the last bears have capitulated and everyone is in the pool.

I'm so bullish after 34 new ATHs (all-time highs), that I'm actually turning tactically bearish. The pain trade has shifted from upside to downside.

Buyers are full and running out of ammunition after the best trading days of the year are already behind us. The cash flow euphoria of the second half of July usually peaks on July 17. Trade after trade will soon turn into earnings and election hedging (double E).

What is typical pre-election cash flow behavior? How high is the bar for Q2 earnings? Trading ideas available.

It's time for a thread...

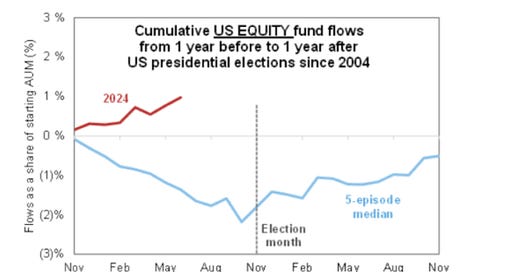

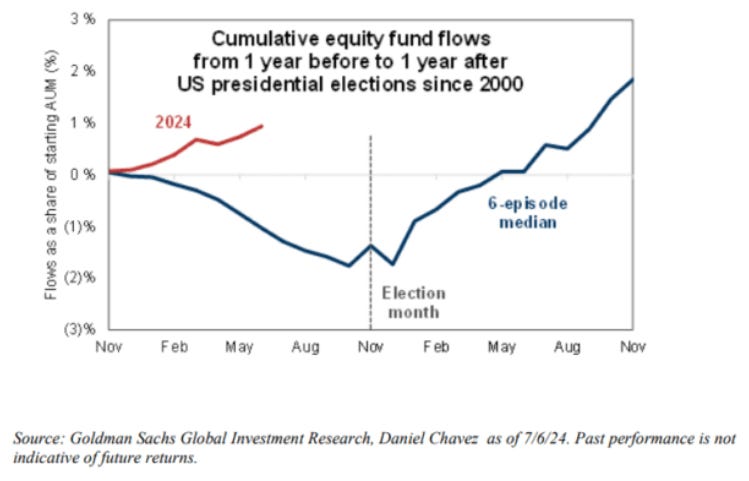

a. U.S. and global stocks typically experience outflows before elections, followed by inflows again in November.

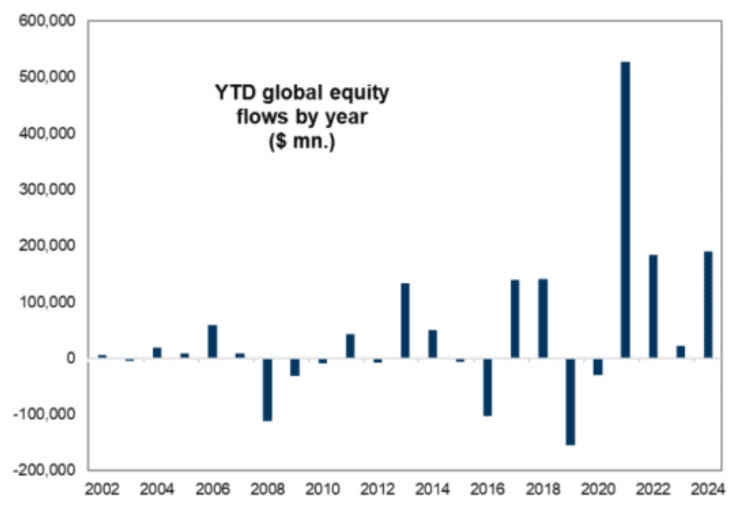

b. The first half of 2024 saw the second-largest inflow of funds into equities on record.

c. Money markets typically see inflows before elections and outflows after November.

d. Hedge funds (HF) net exposure is typically low before elections, before quickly re-leveraging… current hedge funds net exposure is above average before elections.

e. US bond funds are following historical pace, with large potential fixed-income flows following the election.

First half of 2024 – Equity ETFs and mutual funds saw the second-largest inflows on record, at $231 billion in the first half of the year. Passive funds had inflows of +$436 billion, while active funds saw outflows worth -$205 billion. This means passive inflows into larger-cap companies and a long-term momentum. This changes completely in August.

August is the worst month of the year for equity flows. No capital inflows are predicted for August as capital has already been deployed for the third quarter. Buyers have run out of ammunition and I am expecting capital outflows.

a. The first half of July has been the best two-week trading period for the S&P since 1928. We are finishing the best trading period of the year. 2024 has had the 15th best start to a year on record.

b. Since 1928, July 17 has marked the local top of the month, leading to a materially lower August. I am modeling a late summer stock market correction.

c. For the S&P, the first half of August was the fifth worst two-week period of the year since 1950.

d. For the Russell 2000, the first half of August was the second worst two-week period of the year since 1983.

August is the month with the largest outflows of the year from passive funds and equity mutual funds. The most important dynamic here is that passive inflows will stop as buyers run out of ammunition.

Passive inflows into target-date funds and retirement funds have been one of the key pillars of this movement of fund flows into equities. This pauses somewhat in August.

August is typically the biggest month of the year for fund outflows, as allocations are full. We have seen a massive amount of equity buying in passive indexes, given the “RINO” (recession in name only) coming from target date funds, 401k and 529 plans. This happens every third quarter.

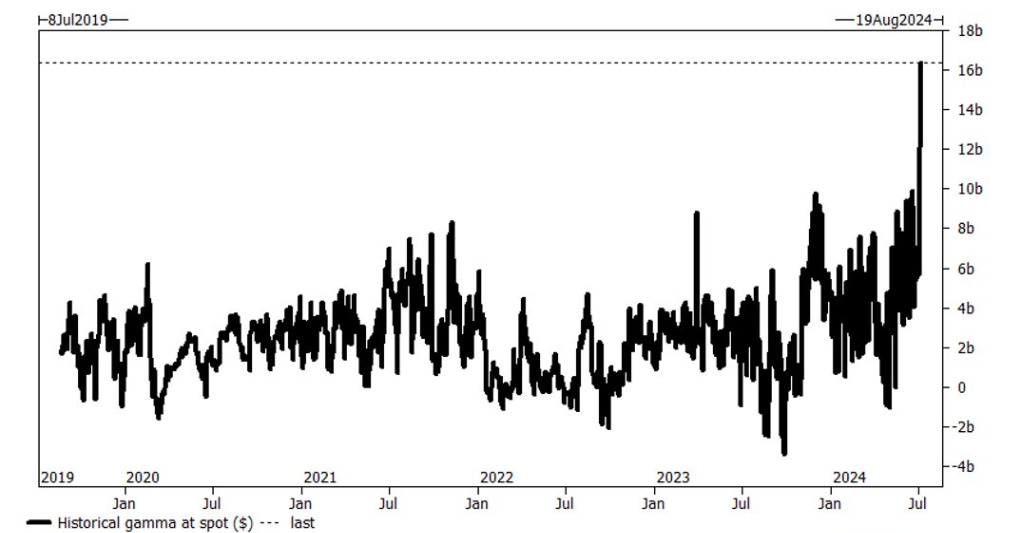

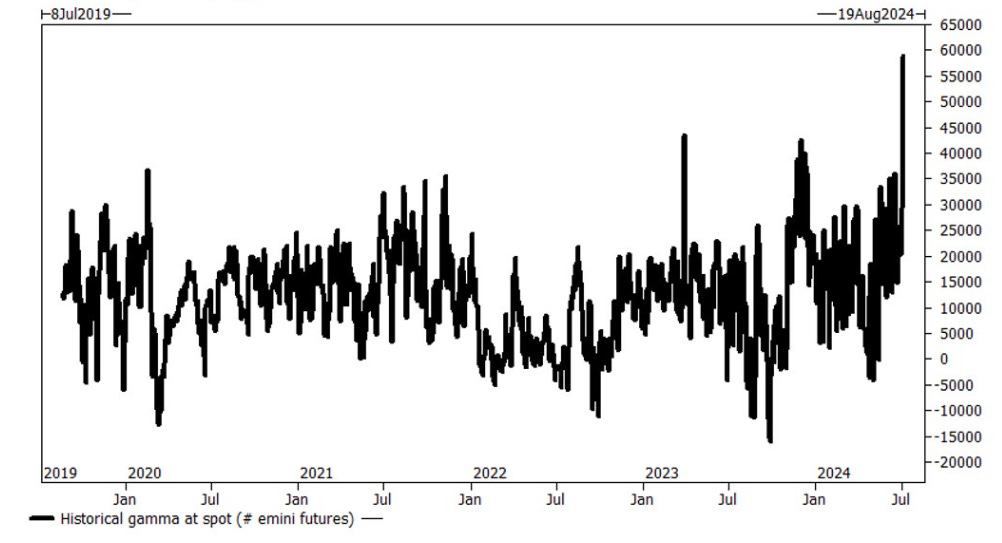

e. Liquidity in August will likely deteriorate rapidly. The biggest bears in the room have capitulated and top-book liquidity has been excellent at these highs.

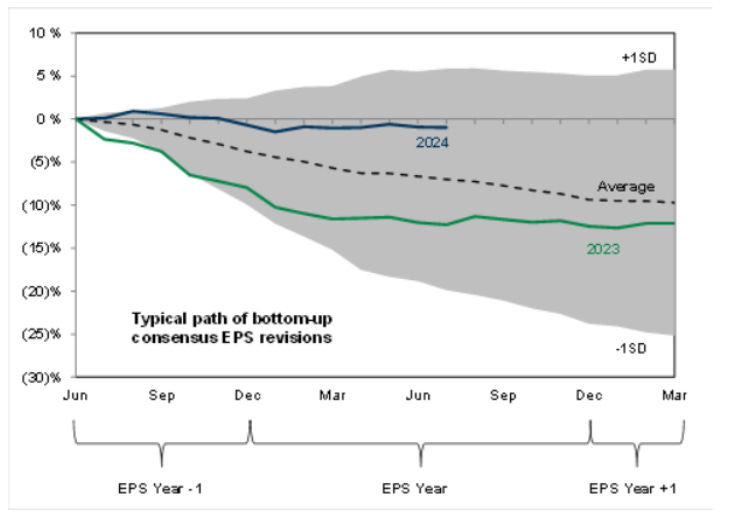

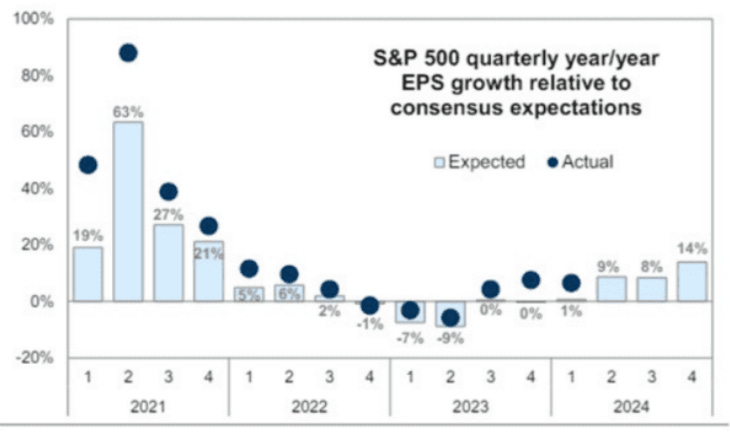

Earnings are starting this week. The bar for second-quarter earnings is no longer a tailwind.

The bar has been raised for the best and highest quality companies.

The positioning is high.

Fuller House: The bar has been raised for the top 10 index weights, which have driven most of the S&P 500's performance so far this year.

Systematic positioning is elevated. Increased volatility and failures in the most widely held market cap weights may force non-fundamental sellers to reduce risk.

I have backtested typical pre-election behavior.

There has been absolutely no demand for electoral protection at this stage.

My cash flow analysis shows a significant reduction in exposure to the event.

Seasonal patterns in August during election years are not good.