Goldman Sachs: Election Outlook

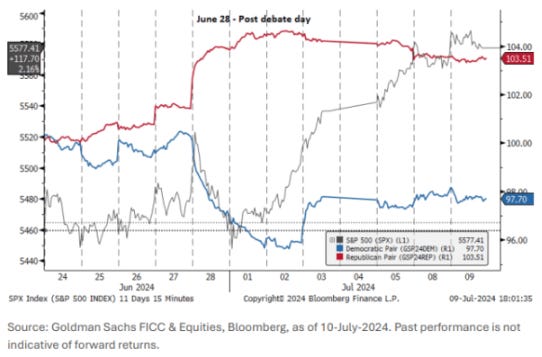

On June 28, the day after the debate, the market anticipated a Trump victory and a Republican win. Our Republican Policy Outperformers vs. Underperformers pair (GSP24REP) was up +4.51 standard deviations and our Democratic Policy Outperformers vs. Underperformers pair (GSP24DEM) was down -3.78 standard deviations (YTD). We note similarities between the market reaction after the debate and the 2016 election week: both the Size factor and the Consumer Staples/Utilities sectors underperformed on June 28 as well as during the 2016 election week, while the Value factor and the Financials sectors outperformed during the same periods.

We share our thematic/factor observations below and favorite implementations from our volatility trading desk:

Republican Policy Outperformers (Long) : GS24REPL 2-month 105% call option costs 1.34% (buying a volatility of 17.55). It has a delta of 25 at the start.

Companies at Risk from Tariffs (Short) : GS24TRFS 3-month put option at 82% 92% spread costs 1.29% (buying a 29.3 volatility call to sell a 35.4 volatility call). It has a delta of 12 at the start and offers a potential payout of 7.75:1.

Democratic Policy Outperformers (Short) : GS24DEML 3-month 81% 91% spread put option costs 1.35% (buying a 30.82 volatility call to sell a 35.3 volatility call). It has a delta of 13 at the start and offers a potential payout of 7.41:1.

Overcoming Republican Policies and Tariff Policy :

Buy 20Dec24 .GS24REPL>105% & EURUSD<97.5% @ 8.5% (52%/21% EQ/FX indivs)

Buy 20Dec24 .GS24REPL>110% & USDCNH>101.5% @ 7.5% (34%/22% EQ/FX indivs)

Overcomers of Republican Policies and Expansive Fiscal Impulse :

Buy 20Dec24 .GS24REPL>112.5% & 10ySOFR>ATMF CMS+0.5% @ 8% (27%/25% EQ/IR indivs)

The performance of the Republican and Democratic basket pairs over the past ten days shows how reactive the market was to the first presidential debate, with investors positioning for a Trump victory and a Republican triumph.

If PredictIt odds on Trump continue to rise and reach 70%, our desk expects an upside of approximately 9.8% on our Republican pair (GSP24REP).

On the other hand, with the uncertainty surrounding the Democratic candidate, we like to compare the Democratic pair with PredictIt's odds of Trump not winning the presidential election. This implies a drop of approximately 8.43% in the GSP24DEM pair.

The volatility of the election pairs (GSP24DEM and GSP24REP) was lower than the SPX volatility before the debate, but that has quickly changed. Our volatility trading desk shares their latest thoughts here:

Before the discussion : The volatility of the GSP24DEM and GSP24REP pairs was relatively low compared to the volatility of the SPX, indicating a lower expectation of significant fluctuations in these pairs relative to the overall index.

Post-debate : A rapid increase in volatility has been seen across both electoral pairs, suggesting that markets are now anticipating larger, less predictable moves in response to political uncertainty and debate outcomes.

Changes in volatility reflect increased market sensitivity to current political developments, which may provide opportunities for trading strategies that take advantage of these fluctuations.

It is worth noting that within the industries that may benefit or face challenges if policies are implemented, the most sensitive and reactive segments of the market are those exposed to traditional energy versus renewables and those exposed to deregulation.

This observation is in line with our diversified sector baskets on the day after the debate, as well as during the election weeks in 2016: financials and energy sectors outperformed, while consumer staples and utilities sectors underperformed.

From a factor perspective, we note that Momentum excluding AI/BTC is correlated with Republican outperformers this year, but was not in 2016, while the Value and Size factors are in line with 2016.

A very common question we've gotten around the desk is whether our secular issues are election sensitive; we assume they are not. None of our baskets moved more than 1 standard deviation during the day after the debate, except for our Power Up America. The latter has a small exposure to renewables and underperformed after the debate because of that exposure.