Goldman Sachs: Largest Options Expiry in History

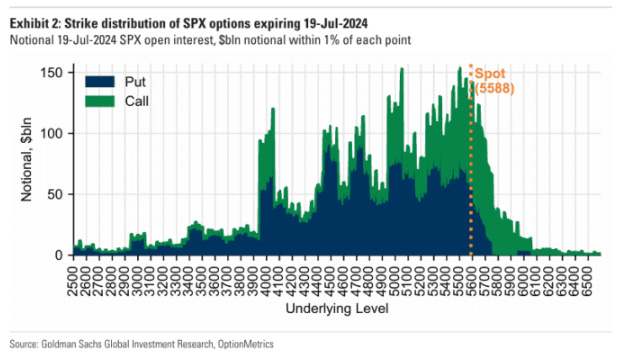

We estimate that this Friday will be the largest July options expiry on record, driven by a pickup in growth in index and ETF options volumes. We estimate that over $2.7 trillion in notional options exposure will expire this Friday, including $555 billion notional in individual equity options. July tends to be one of the smaller expiries of the year; January, March, June, September and December are the largest expiry months.

The options expiring today represent a notional value equal to 4.7% of the market capitalization of the Russell 3000 index. The relative size of this expiry is larger than the July average.

Index options and individual stock call options volumes have increased, while individual stock put option volumes remain stable.

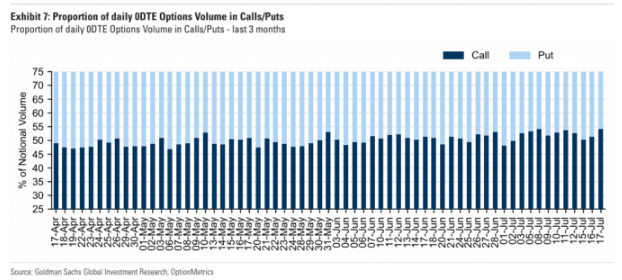

Volumes for same-day options, as well as for options with longer maturities, are lower this quarter compared to the previous quarter.

Same-day options volumes remain balanced between puts and calls.

Trading in both single-lot SPX options and single-lot same-day options remains high as a proportion of total trading.