Goldman Sachs: Trading Desk Top Questions

What Just Happened In Markets & Why Did We Sell Off?

Risk Off Not Unexpected

We have been feeling more bearish for a while, with growth slowing and financial conditions still very tight, the market has been on look-out for what might break. Add to this the complacency that’s in the market with the “summer of carry” (credit spreads tight, VIX grinding lower, the cost of SPX protection on the floor), positioning stretched and seasonals poor.

Why Did We Sell Off?

China’s price action has been poor recently after some bad GDP prints and its started to spill over into the broader macro complex. There has been a change in narrative in the US from hot and higher for longer to disinflation and growth worries. The move lower in yields and expected lower cost of capital incoming led to the rotation out of large tech and into small caps which was the worst 5 day streak of large caps over small caps since 2020 (here and here).

Odds of a Trump victory have also been moving lower which helped add to the risk off over the last few days. A Trump victory should benefit stock prices given his inflationary policies, pressure on the FED to cut rates and weaken the USD along with his deficit spending.

China pricing had started to spill over into other markets post the poor China GDP numbers: CSI 300 vs NDX below:

Does Bad News Still Mean Good News?

Bad news used to be good news with inflation worries front and center of investors’ minds; bad news meant potential cuts which was risk asset friendly. Yesterday was the first time for a while that hot data was cheered by markets. QoQ PCE came in hot and QoQ GDP was strong and yields and equities moved higher post the data.

This is testament to a market now more concerned with disinflation and growth with runaway inflation no longer a main concern for markets with breakevens well anchored. Bad news is no longer good news, good news is good news imo.

A Healthy Pull Back Or Something More Sinister?

It feels to me as though the rotation and momentum/carry unwind caused a risk off event rather than something more underlying and worrisome.

Our Momentum basket was our worst performing macro thematic basket yesterday down -2.23%. Essentially the trades that had worked stopped working across assets which included gold and USDJPY and as we sold off yesterday Russell’s outperformance of Nasdaq also continued. Would we have seen gold down and Russell outperforming Nasdaq in a real growth slowdown risk off event? No.

As momentum sold off, US GDP numbers came in solid which illustrates a momentum unwind vs anything more serious to worry about. Having said that, we shifted neutral equities (from overweight) in our 3m global asset allocation (here) and like hedging into the summer on growth slowdown, US election risk and market concentration (here).

Yesterday Russell (white) outperformed the Nasdaq (blue) again and gold sold off (orange):

Our Momentum Basket has underperformed recently:

What’s The Biggest Concern For Macros Right Now?

China Growth

Global growth and markets need China to perform and that’s not really happening right now. China remains in a balance sheet recession with inflation continuing to decline and GDP continuing to disappoint. The market wants fiscal stimulus and continues to fade rate cuts which the PBoC delivered again yesterday.

China rates just hit all time lows as the PBoC continues to cut rates in order to try and stimulate:

From Hot & Higher For Longer Into Growth Slowdown & Cuts Incoming

A few months ago the no cuts to even potential hikes chat was gaining traction. Cuts have moved from x7 at the beginning of the year to x1 at the end of April and now back down to almost x3 for the rest of the year.

Hatzius came out with his latest Why Wait? (here) arguing a rationale for a July cut given the direction of growth, inflation and unemployment. What’s on the mind of macros now is if this growth slowdown turns into a recessionary slowdown with the bulls saying private sector debt is small in this cycle (its all fiscal debt) vs the bears saying with rates so high for so long something is bound to break soon.

US cuts priced for this year:

Election Risks

Markets aren’t sure how to play the upcoming election. Odds of a Trump victory had moved up to 70% with Trump trades in full steem; our Republican basket was outperforming and the Trump steepener began making moves.

However Trumps odds of winning have now dropped to 57% at time of writing post Harris stepping into the race and Democrats’ odds of winning have edged up slightly (here). Republican sweep odds have moved lower.

We are still confident that a Trump victory means a stronger USD (here) but the USD has been selling off as more cuts get priced and inflation moves lower. Tariffs would be inflationary but Volatility has failed to pick up (until the recent sell off).

The negative spillover effects on other economies is also now a real concern; with the 10% proposed tariffs on all imports to the US being a key risk with our economists estimating that it could take out 1% from Euro area GDP (here). European PMIs yesterday weren’t good and as such we have downgraded our European GDP estimates (here).

Our Republican Policy Pair Basket:

Carry Unwinds

Carry can be a problem; as markets grind higher, investors sell Vol pocketing premium which moves Vol lower in a feedback loop that stretches positioning causing overcrowding and unwind risk.

In a drawdown carry players can lose their YTD PnL in a day; just look at the moves in USDJPY and MXNJPY. With positioning in carry so stretched, once these trades are unwound it adds to Vol and price action on the downside.

What’s The Most Talked About Macro Thematic Basket This Week?

Surprise surprise its election and tariff focused. With confusion around cross asset performance its pretty clear in equity land what should outperform/underperform under the surface and we like the tariff play in Europe via our Short EU Tariff Exposed Names Basket {GSXETRFS Index}.

Most European cyclicals with large US sales have factories in the US, thus out of scope of incremental tariffs, which is why we have built this basket. It is composed of European stocks producing in Europe, with factories in Europe, then shipping goods into the US and in scope of tariffs.

Where Are The Macro Opportunities/Trades Right Now?

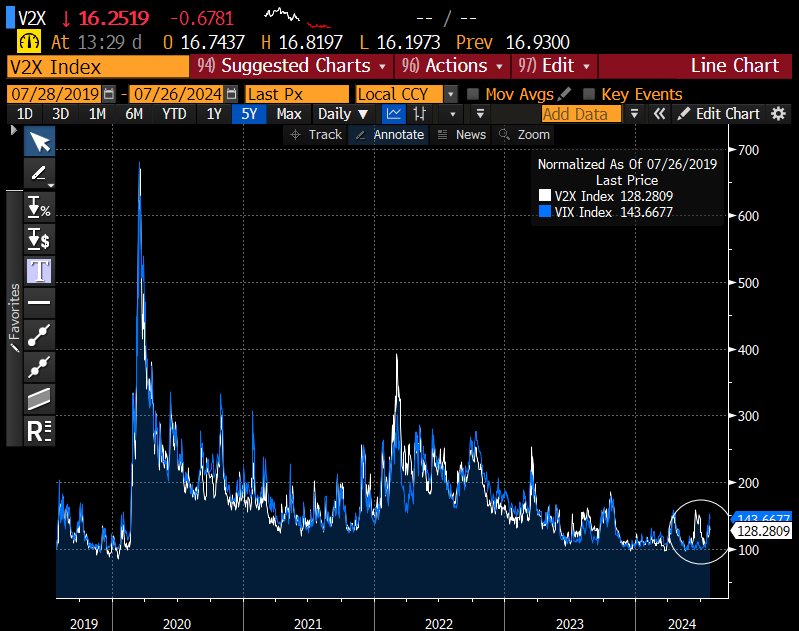

US Election Vol Risk Premium Through The V2X Sep/Oct/Nov Fly

Jan highlighted the implications of higher tariffs here and the desk has been fielding lots of incoming from clients about how to trade the upcoming US elections. In short, we think this will be a significant vol event and we are anticipating an increase in client hedging over the coming months.

Buy DAX Downside To Protect Against Tariff Risks Given Global Growth Exposure

The DAX is heavily geared towards global growth, and for those looking to protect against increased tariff rhetoric put spreads out to December look good here

UK Upside For The Bulls

Worth noting that FTSE upside calls once again trade on an extremely low vol handle. Value can outperform into a BoE (and global) cutting cycle and it's one of the few countries with an absolute majority party in power. Cheap way to rent delta for a bounceback (Thilo Deller)

Indicatively: FTSE Sep24 102% Call costs 90bps [32-delta | 10v]

Despite the recent spike Vol is still at very low levels historically, V2X vs VIX below:

SPX Lower/USDCNH higher

Granted with the sell off that just occurred SPX moved lower and USDCNH didn’t go higher, however on a proper risk off event the USD should act as a safe haven and the trade also protects you against a China wobble at the same time. Long USDCNH is also positive carry.

SPX vs USDCNH:

US2S10S Steepener

The trade is now working and should continue to work if Trump wins and or Powell starts cutting in the front in a bull steepening scenario. A pick up in Vol will help. (GIR link)

BTP/Bund Spreads / Wider Credit Spreads

As part of the carry trade and complacency in the market credit spreads are very tight. Unfortunately for investors credit spreads don’t tend to blow out until after the fact so they can be misleading. We think there is more scope for widening in the near term

Stay Long Gold

Macro conditions remain bullish for gold with peak rates, growth slowing and central bank demand remaining robust. Gold also provides good hedging value against geopolitical shocks and we maintain our $2700 price target for 2025 (GIR here).

What’s The Latest In Crude?

Oil Downside To Hedge For A Tail Negative Outcome & Potential Trump Tariffs

Crude remains range bound and has recently sold off to the lower end of our $75-$90 range on concerns around China demand which is below our expectations (here).

There are downside risks to our forecasts as a result of potential Trump policies; we think tariffs could hit 2025 oil prices by $11 as a result of weaker GDP and oil demand in a scenario where the US imposes an across-the-board tariff of 10% on goods imports.

Our estimated tariffs hit to oil prices rises to $19/bbl in a scenario where the Fed delays cut beyond 2025 due to higher core inflation but moderates to $6/bbl if the Fed doesn't delay cuts and OPEC+ reverses its announced supply increases.

Dec 60 Brent puts around 0.35 are a cheap convexity hedge for a tail negative outcome (here). Time spreads have been indicative of a healthier market vs flat price action: