Week Ending 02/16/2024

Here’s your recap of institutional sell-side research for the past week

Goldman Sachs Equity Research Team:

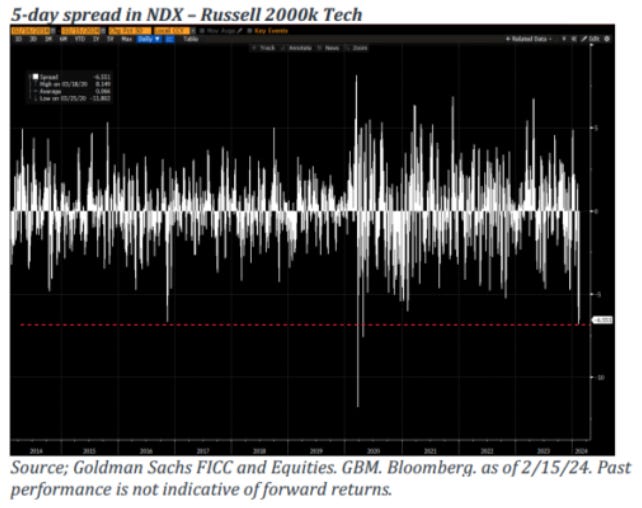

The NDX (Nasdaq 100) Vs. R2K (Russell 2000 Technology Index)… The NDX has underperformed the R2K Technology Index by approximately 6.5% over the last 5 sessions, making it one of the worst 5-day periods in the last 10 years. Interestingly, the R2K Technology Index (RGUSTS) has risen 11.6% in 2024, although 90% of this gain comes from SMCI alone (for example, SMCI accounts for 616 points of the 684 the index has gained this year) – h/ t Callahan."

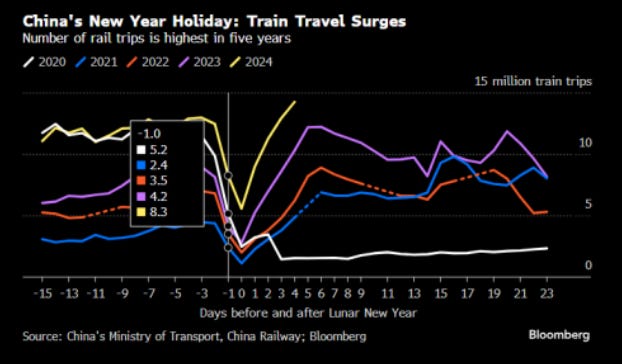

Lunar New Year Travel in China: The resurgence of travel in China offers some signs of increased spending. More than 61 million train trips were made in the first six days of the Lunar New Year holiday, the highest number in five years (BBG). Meituan showed average consumer online spending 39% higher than in 2019.

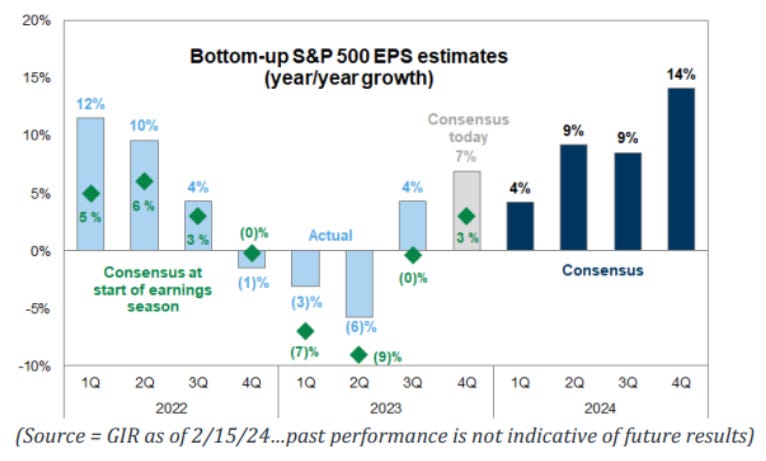

EARNINGS… S&P 500 year-over-year earnings per share (EPS) growth is at 7% compared to 3% expected; The consensus for Q1 2024 earnings is 4%. These moderate expectations continue to be exceeded.

ELECTORAL MOVEMENTS… Implicit movement due to the elections: “We estimate that SPX options are pricing in a movement of +/- 3.3% for Election Day in November. This 'implied move' summarizes the level of uncertainty within the stock market for the election; The implied move has remained fairly stable over the past month, suggesting that stock investors' focus on the election has neither increased nor decreased. In the Appendix, we detail Election Day movements over the past 60 years; This analysis shows that the SPX has only had a one-day move greater than 3.3% on an election day in the last 60 years.”

On earnings and flows

Goldman Sachs issues their prime book customer data this week:

Goldman Sachs: Prime Book, Earnings

Short positions were net-covered for the first time in 7 weeks, with the largest nominal net buying of cyclicals since September 2021. Hedge funds net-bought individual stocks for the second week in a row (4 of the last 5), driven by long buying and, to a lesser extent, short hedging. Short positions in individual stocks were net-covered for the first t…

If you haven’t already got the chance, you can also see the flows from BofA customers on a weekly basis, last reported here

BofA Fund Manager Survey

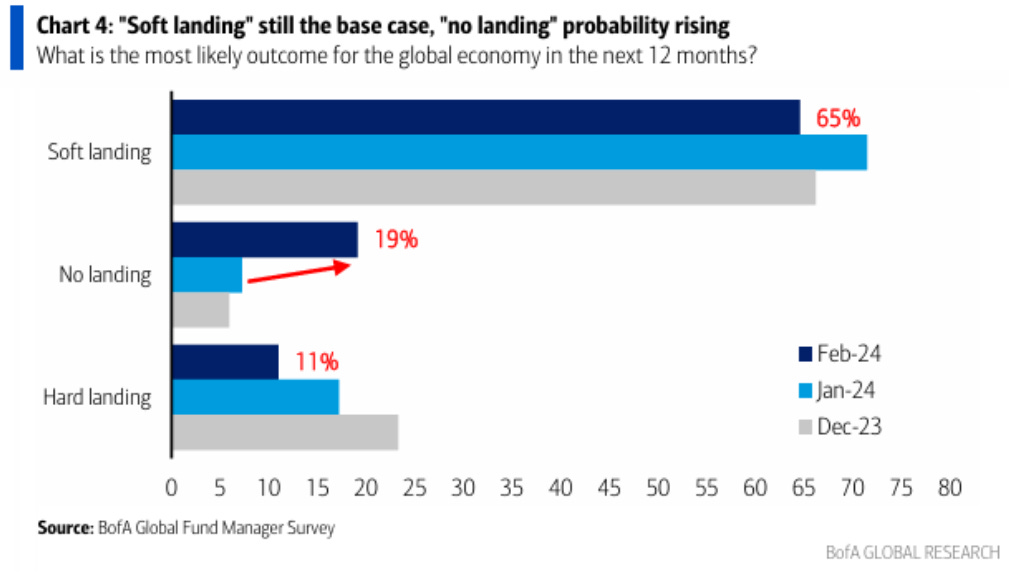

Fund managers were the most optimistic since Jan ‘22. A ‘no landing’ case was the leading scenario for the current cycle, while hard landing continued to lose ground. FMS investors continue to view the Mag 7 as the most crowded trade.

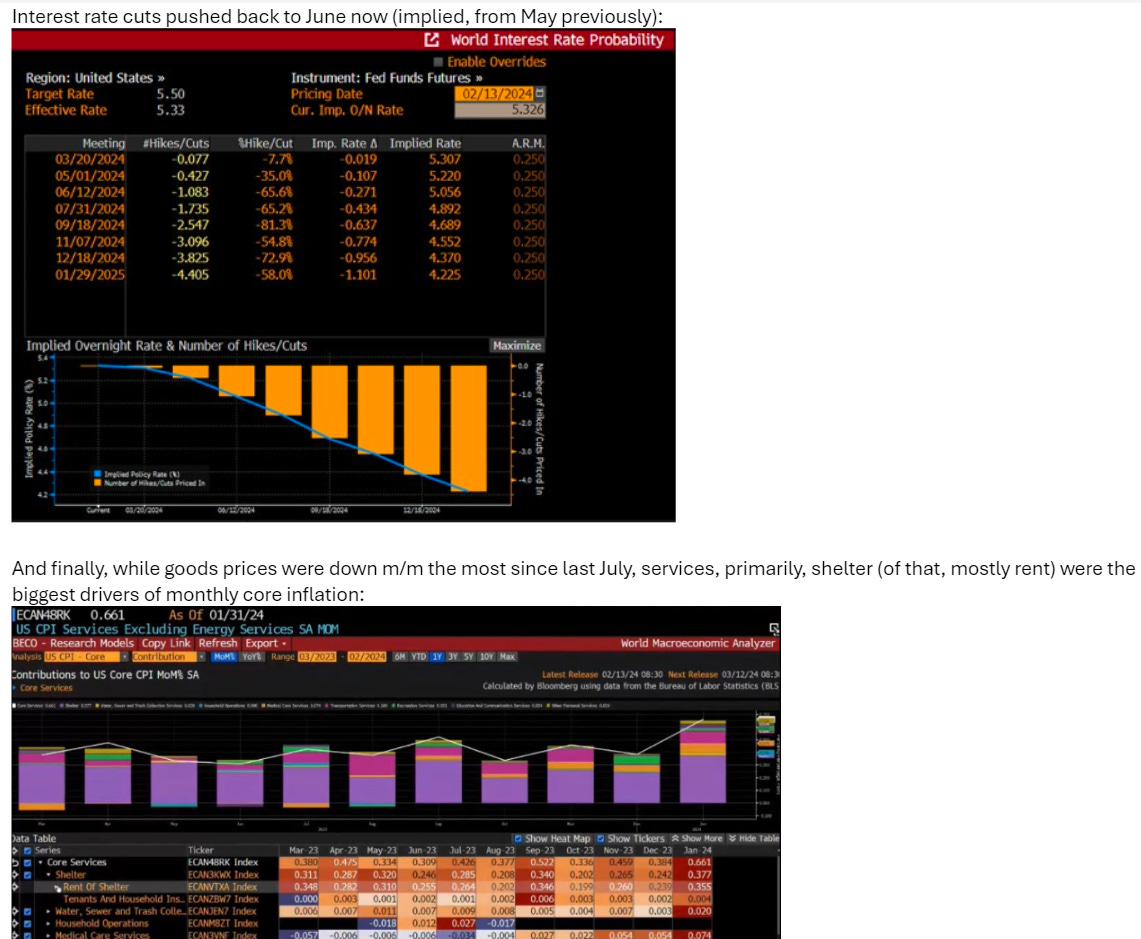

Inflation

Although I post Goldman Sachs trading desk reports every day (mainly for archival purposes), I would encourage readers to especially read this Tuesdays closing report listed blow. It had some good insights into CPI report.

Goldman Sachs: Trading Desk 02/13/24

S&P -1.37% close @ 4,953 with a Market Order of -$2.4bn to SELL. NDX -1.58% @ 17,600, R2K -4.16% @ 1,969 and Dow -1.35% @ 38,272. 12.9 billion shares were traded across all US stock exchanges versus the year-to-date daily average of 11.5 billion shares. VIX +13.8% @ 15.85, crude oil +107 basis points @ 77.74, 10-year yields +14 basis points @ 4.32%, gol…

On this topic, I disclosed some internal emails on CPI below as promised, discussing the misleading “surprise” and subsequent market reaction:

JP Morgan trading desk also on the matter:

“The last two days make us wonder whether Tuesday’s CPI print was just a rotation that was interrupted rather than an actual stall of the rally. The JPM Most Shorted Basket retraced 75% of its Tuesday losses. RTY retraced ~60% of its CPI losses and JPM Cyclicals closed higher than its Monday level. The conclusion is that the market went through the details of the CPI print and came away less concerned that we are creating a second inflation peak and instead that the deflationary trend remains intact.”

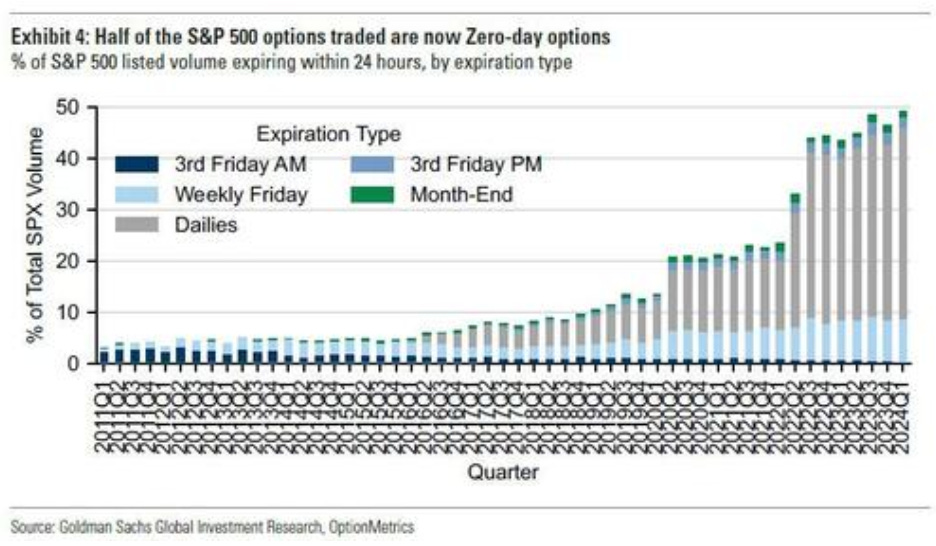

0DTE Options new record

From Goldmans gamma exposure dashboard on Friday’s close:

If you’re interested in reading the entire report, it’s located here

Magnificant 7

While not about the Mag 7 but rather the ‘Mag 5’ if you will, Deutsche Bank points out interestingly this week that the current top five US companies are around the same relative size as the top five in the ‘70s (IBM, AT&T, Exxon, Eastman Kodak, and GM)

Red Sea

Finally, note that the Red Sea will continue to be a significant catalyst as Suez Canal traffic is down more than 95%, while Cape of Good Hope traffic is up three-fold (six-fold at the peak)

This, as Shanghai freight rates double (even to West coast)

That’s it for this week. Markets closed on Monday. -Nick