Goldman Sachs: Gamma Dashboard - 02/16/2024

$2.4Tr in options set to expire this Friday (+PB Data)

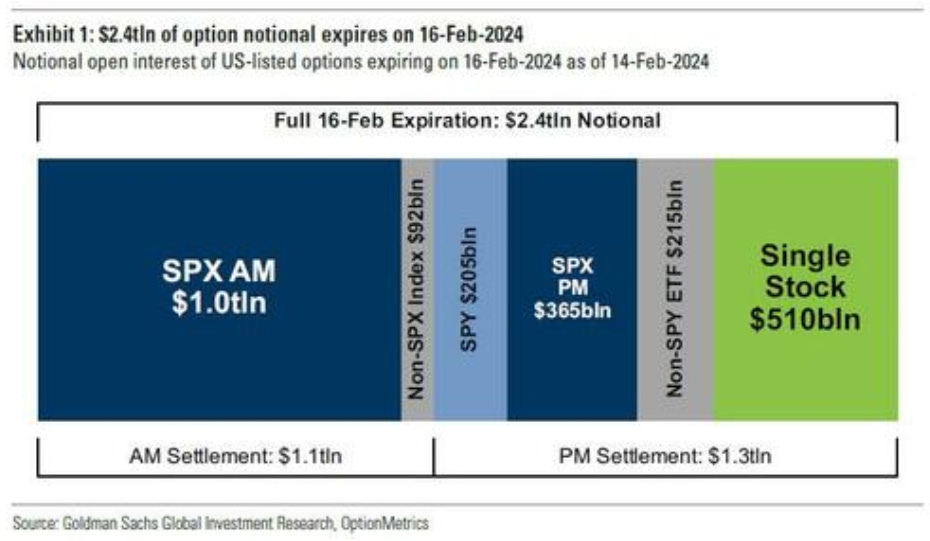

GAMMA… $2.4 trillion worth of options expire tomorrow, long gamma will expire.

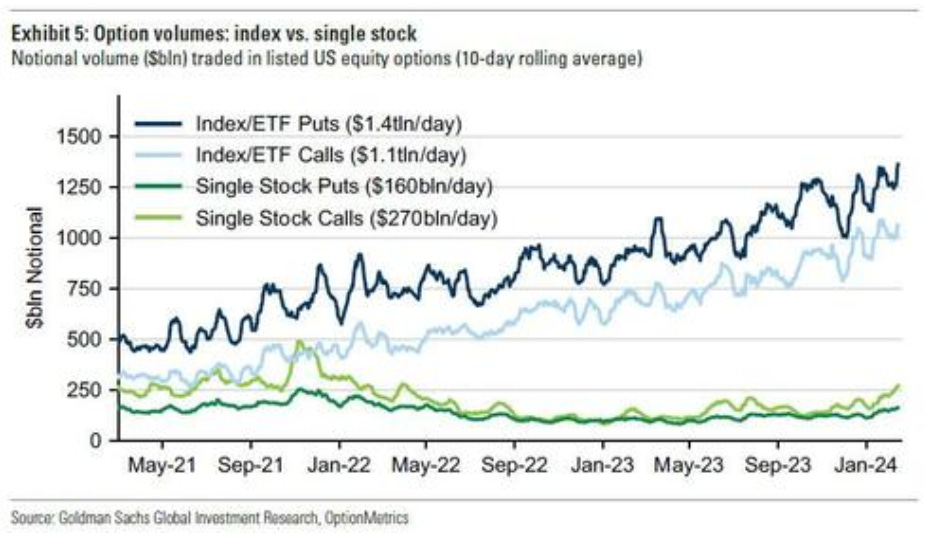

We estimate that more than $2.4 trillion of nominal options exposure will expire on Friday, including $510 billion of individual stock options. Index options volumes continue to grow, driven by short-term options;

Individual stock option volumes have rebounded to their highest level in 18 months driven by significant growth in call option volumes;

Based on recent options flows, we view the stock position as crowded from a short-term perspective and recommend hedging with puts on low free cash flow stocks and ETFs.

Google searches for "call options" just hit a 2 year high. One would think it's not professional asset managers looking this up.

Based on recent options flows, we see equity positioning as crowded from a short-term perspective and recommend hedging with puts on low free-cash-flow stocks and ETFs.

Consistent with the past few quarters, there is unusually large open interest expiring around the 4000 and 5000 strikes in the SPX.

Options expiring Friday represent a notional value that is equal to 4.7% of the Russell 3000 market capitalization. This expiration’s relative size is higher than the average February.

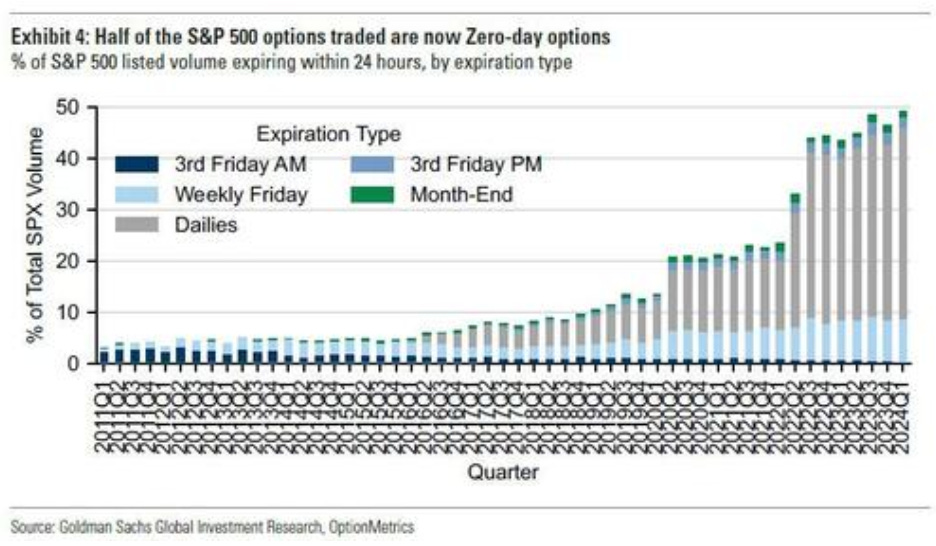

The percentage of 0DTE options traded in the market has just hit a new all time high.

Single stock options volumes have picked-up along with Index options

SPX options volumes have grown significantly across zero-day options as well as longer-dated options. Single stock options volumes grew compared to 2023, 2022.

That said, Zero-day options volumes remain balanced between puts and calls.

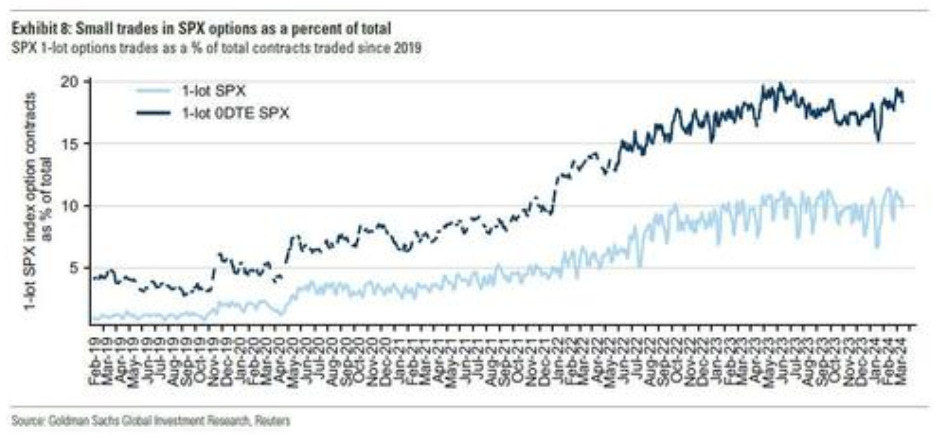

Meanwhile, both SPX 1-lot options and zero-day 1-lot options trades remain high as a proportion of total trades. The recent rise in 1-lot trades in zero-day options suggests increased retail involvement, which is another way of calling "distribution" by insiders and institutions to retail bagholders ahead of a market drop.

SMALL BUSINESS APPETITE… Our PB data suggests that hedge funds have been showing interest in US small company stocks so far this year. The Russell 2000 Index constituents have collectively been net bought on 15 of the last 16 days (27 of the 30 year-to-date trading sessions) on the Prime book, driven by long buying outpacing short selling by a ratio of approximately 4 to 1 (GS PB – until 02/14). Despite recent net buying activity, the aggregate long/short ratio in the Russell 2000 constituents remains well below average historical levels at 1.73 (up from 1.63 at the beginning of the year), corresponding to the 41st percentile compared to the last year and to the 29th percentile in a 5-year retrospective analysis.

We continue to prefer the GS US Small Business Quality Basket (GSCBSMQB Index), which is comprised of publicly traded small US companies with positive expected free cash flow (FCF) metrics (yield and margin) and growth of sales until 2025 (thanks to Lou Miller). The basket is liquidity-optimized to trade $200 million in one day, representing 10% of the volume.

Small Business Quality (white line) has been decoupling from the IWM (blue line).

*EARNINGS THEME… 3 Topics from Q4 2023 Conference Calls: Artificial Intelligence (AI), Supply Chains and the Labor Market – LINK

AI remains a key topic in companies' earnings calls. Some companies expect AI to improve productivity, reduce costs and improve product offerings. Examples: MSFT, BK, UNH, AMZN, IBM. Companies are starting to see demand for AI-related products and services. Examples: AMD, NOW, GOOGL, FCX, FFIV. Managers discussed the need to continue investing in AI. Examples: GM, META, ADP, BEN, RHI.

The companies discussed the current state of their supply chains. Several companies noted that bottlenecks in supply chains have disappeared or improved significantly. Examples: AZO, URI, KMB, JCI, CAG. Other companies mentioned that their supply chains remain under pressure and see risks of potential congestion. Examples: CHRW, AMZN, BKR, CL, DAL. Several companies highlighted the measures they took to strengthen and diversify their supply chains. Examples: CAH, EL, AME, AMD, AOS.

Management has taken note of a more balanced labor market, although there is a wide range of opinions and hiring plans. Some companies discussed staff reductions or slowing the pace of hiring. Examples: GOOGL, C, MSFT, UNP, META. Other companies continue to hire or face hiring challenges. Examples: SYY, HII, HCA, ODFL, IT.