Goldman Sachs: Prime Book, Earnings

Short positions were net-covered for the first time in 7 weeks, with the largest nominal net buying of cyclicals since September 2021. Hedge funds net-bought individual stocks for the second week in a row (4 of the last 5), driven by long buying and, to a lesser extent, short hedging. Short positions in individual stocks were net-covered for the first time in 7 weeks. 10 of the 11 U.S. sectors (excluding Staples) were net bought for the week, led by cyclical sectors that collectively posted the highest nominal net buying since September 2021 (95th percentile over the past 5 years).

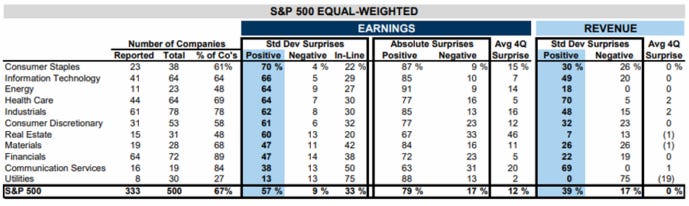

With 77% of the S&P 500's market capitalization having reported fourth-quarter 2023 results, companies have generally beaten consensus expectations. 57% of S&P 500 firms have beaten consensus EPS expectations by more than one standard deviation from analysts' estimates, roughly in line with the past two quarters and above the long-term average of 48% (see page 5). Fourth-quarter S&P 500 earnings per share (EPS) are on track to grow 7% year-over-year compared to analysts' estimates of 3% at the start of the season.

Companies are returning cash to shareholders and further reducing spending on capital investments. After negative year-over-year growth for 5 consecutive quarters, share buybacks are up +6% in Q4, driven by a combination of positive earnings growth, a spike in bond yields, and easier comparisons to the previous year. As is often historically the case, dividends have been less volatile in 2023 and DPS grew by +6% YoY in the fourth quarter. In contrast, year-over-year growth in S&P 500 capital expenditure has slowed from +11% in the second quarter of 2023 to +3% in the third quarter and is at 0% in the fourth quarter. Research and development (R+D), which is highly concentrated in a handful of technology and pharmaceutical stocks, remained resilient in the fourth quarter (+10% year-on-year).