Exclusive - Week ahead 01/21/2025

Happy Tuesday…

Find reports and exclusive reports below. It’s always better on the website

Recommended:

Contents of todays research:

Biggest story of the week: Trump 47

Immigration reform

Stricter trade policy

Tax cuts

Looser regulation

Econ Data

Positioning and Technicals

Biggest story of the week: Trump 47

It’s easy to become controversial when discussing politics during such a sensitive time in American history, so I will keep this simple and focused on the transition's economic impact.

Whether you like it or not, Trump is back and he will undoubtedly do things Trump’s way.

His full plan isn’t exactly straightforward, such as talks to buy other countries, etc, so I’ll save time to talk about that later. Some things are obvious though:

Immigration reform

Stricter trade policy

Tax cuts

Looser regulation

Immigration

Trump is promising to secure the Southern border and is establishing plans to deport millions of illegal immigrants. Regardless of how you feel about how this will change crime among other things, one thing must be recognized:

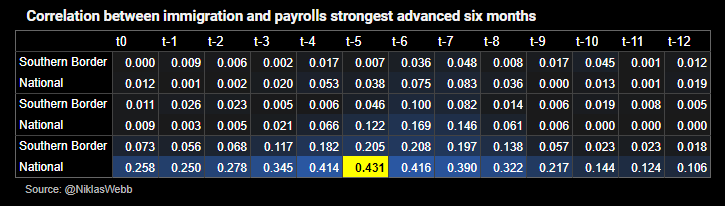

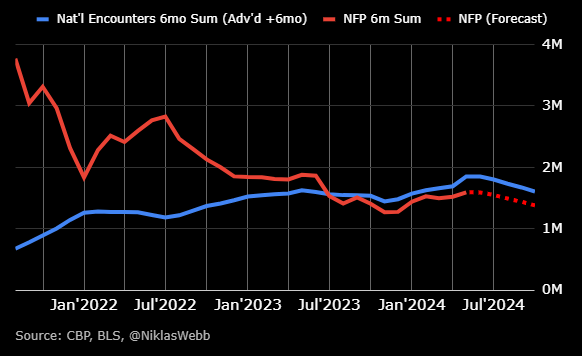

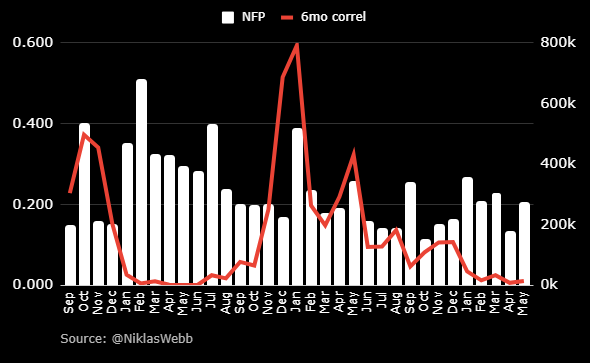

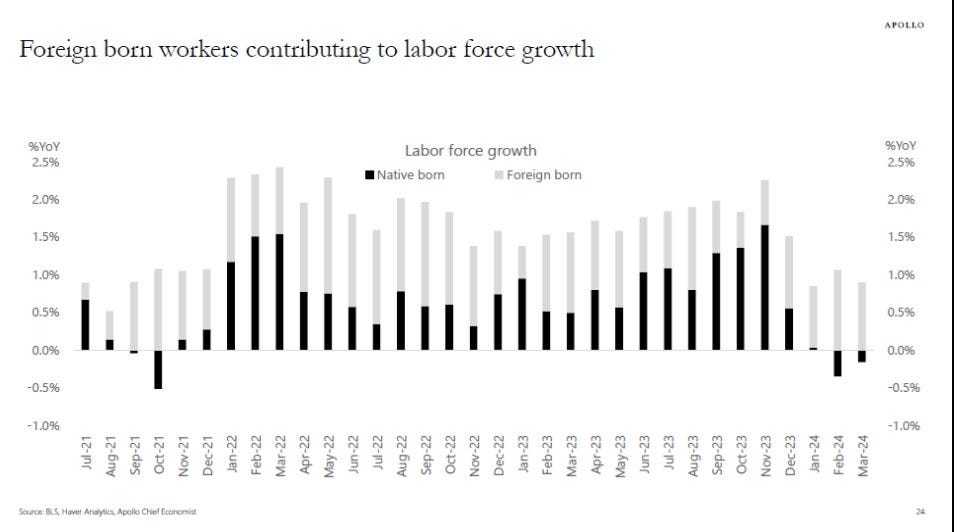

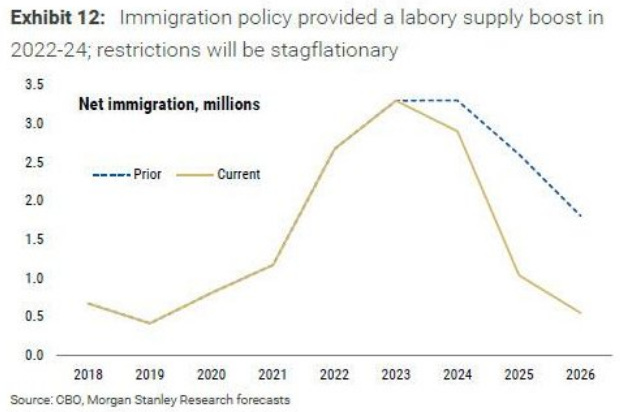

American job growth struggled in the past two years without immigration. As demonstrated below in my exclusive research, payrolls were a big beneficiary of the huge inflow of immigrants, mostly illegal, especially in the past two years.

The question this raises then is, how stable will labor supply be under Trump 2.0?

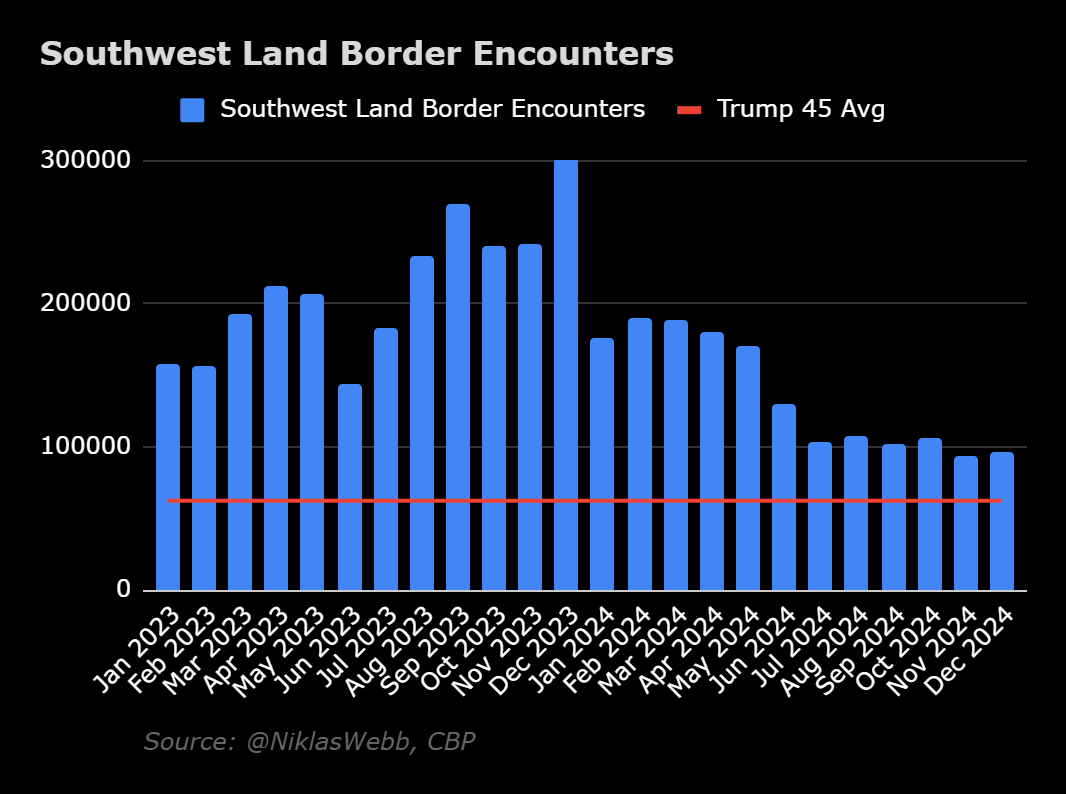

The good news is that border encounters are already slowing, and payrolls have adapted moderately untouched. Last month, border encounters were 35% higher than the average during Trump 45 (2017-2020), the lowest since at least 2021. Meanwhile, December job growth was 256k, above the 12-month average of 190k.

Therefore, it seems reasonable to not be overly worried about immigration having an immediate, measurable impact on payrolls.

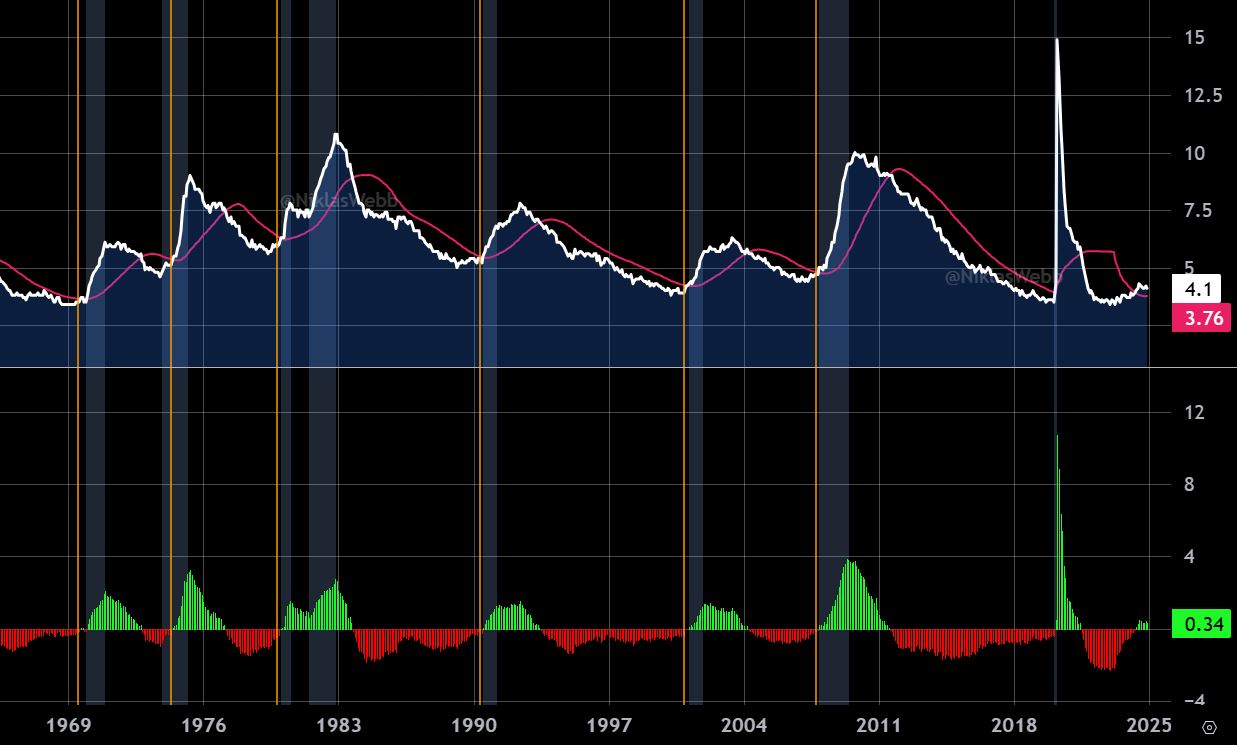

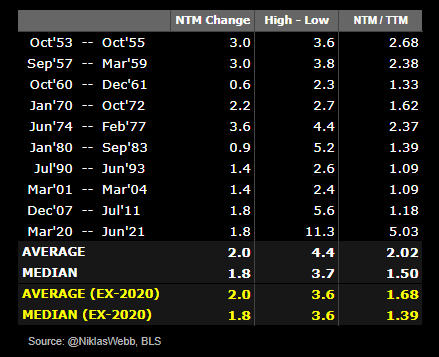

Another area to closely monitor is full-time employment and temporary workers. As I’ve pointed out previously, U.S. full-time employment level has never been negative for more than three consecutive months without a recession in the trailing 12 months (Source: BLS, 1968-present). This past month, FTE went positive y/y again after a ten month down streak.

Unemployment is also firmly above its 36-month moving average. My exclusive research shows that this has historically always been consistent with a recession (NBER, 1948-present).

None of this is to say we’re heading into a recession. Just pointing out the indicators I’ve been watching over the past year. Importantly, this is regardless of who is in office.

Trade Policy

Another important goal for the administration is to impose harsh tariffs on any country undermining U.S. productivity, mainly China, Canada, and Mexico.

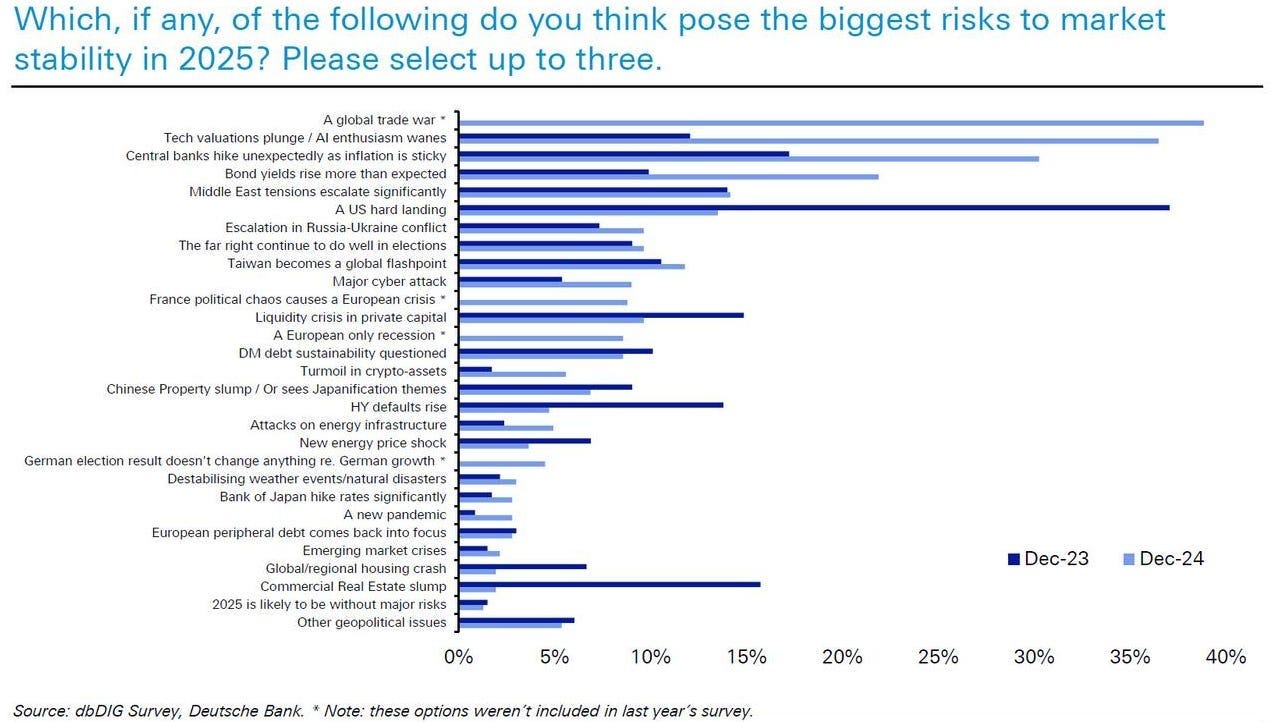

A Deutsche Bank survey of investors showed ‘A global trade war’ was perceived as the biggest risk to market stability in 2025.

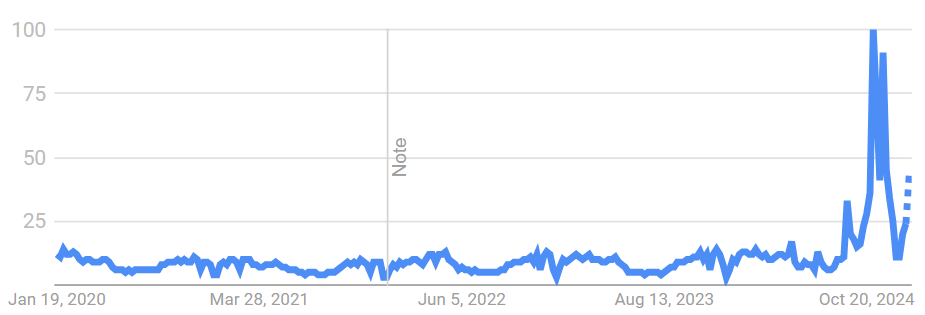

Google searches for ‘Tariffs’:

A recent Axios survey of S&P 500 executives shows a global trade war and de-coupling from China are trending concerns:

Trump has threatened excessive Tariffs and trade policy repeatedly, but the actual timing and impact are yet to be officiated.

*TRUMP MEMO STOPS SHORT OF IMPOSING NEW TARIFFS ON HIS FIRST DAY IN OFFICE — WSJ

A WSJ Report citing a memo described no intentions of imposing new tariffs on day one. It was confirmed today by administration officials that Trump is unlikely to make a final decision until at least February.

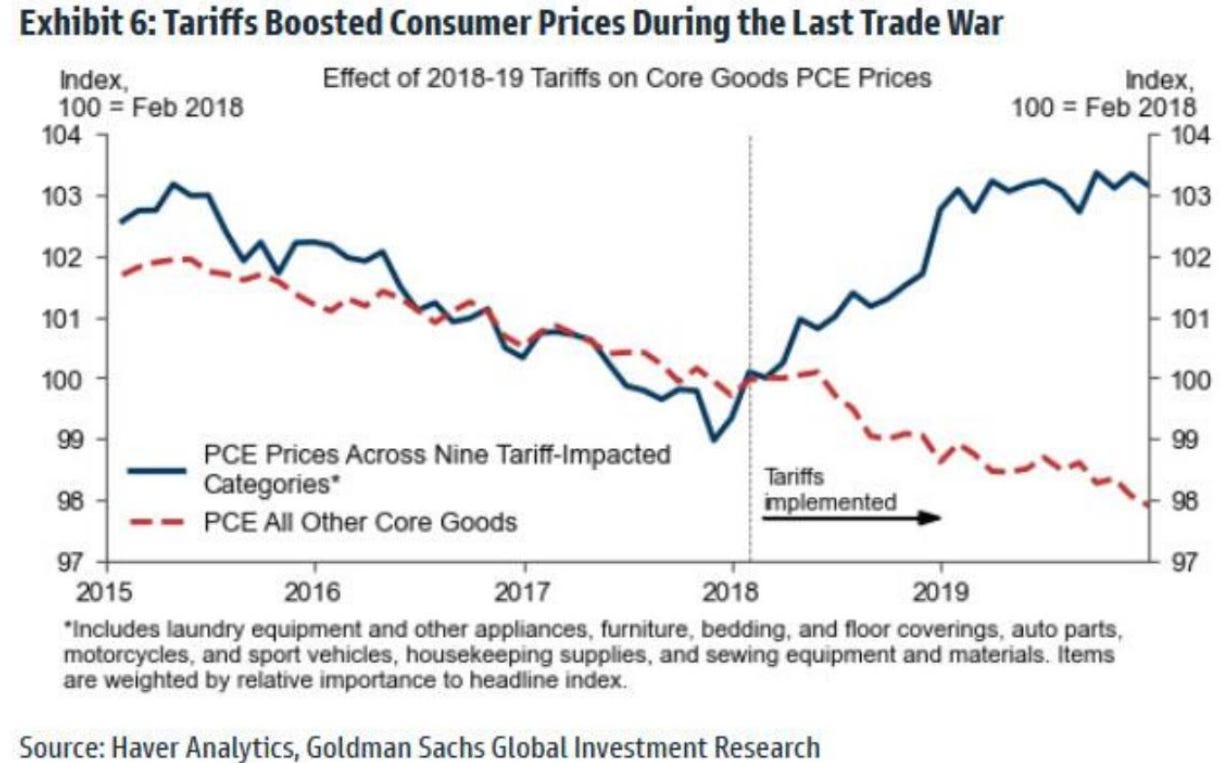

If tariffs are limited to Chinese goods and foreign auto manufacturers, with no impact on wages or inflation expectations, the result should be a modest, one-time hit to PCE. As a reminder, here is how the last “Trade war” went:

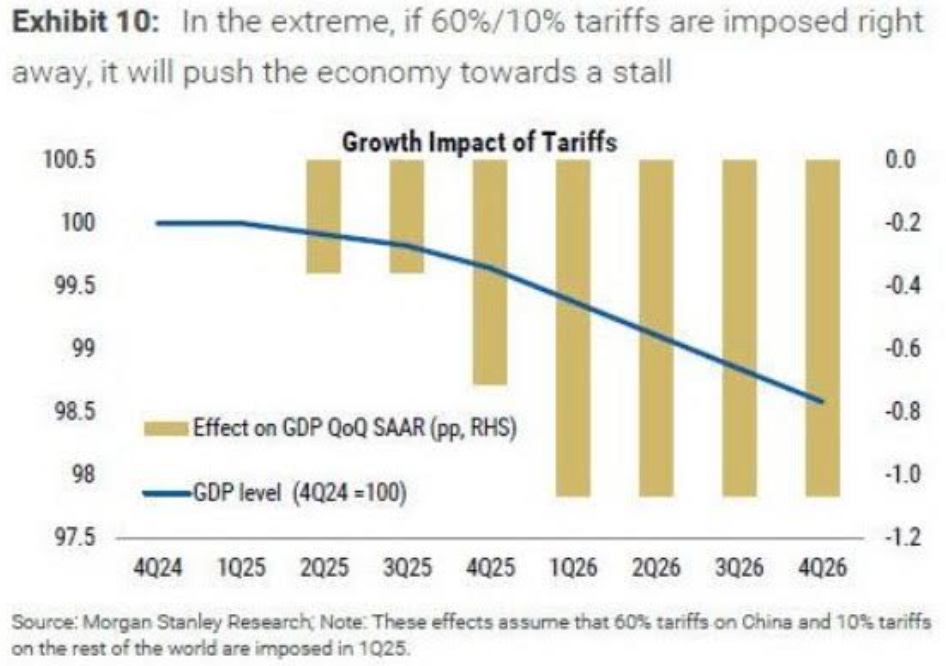

60%/10% tariffs effect on GDP:

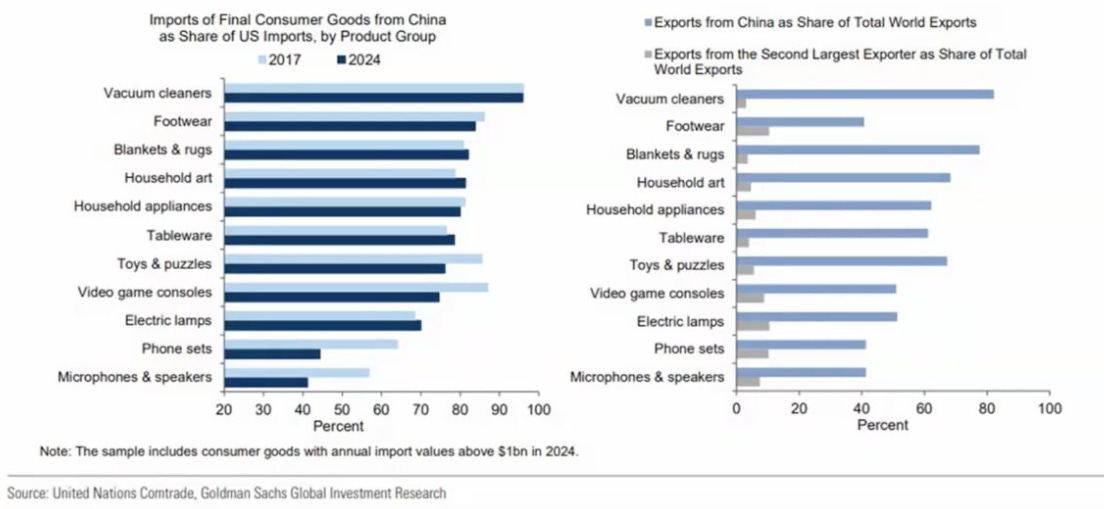

Vacuum cleaners, footwear, and appliances among the most sensitive to Tariffs on China:

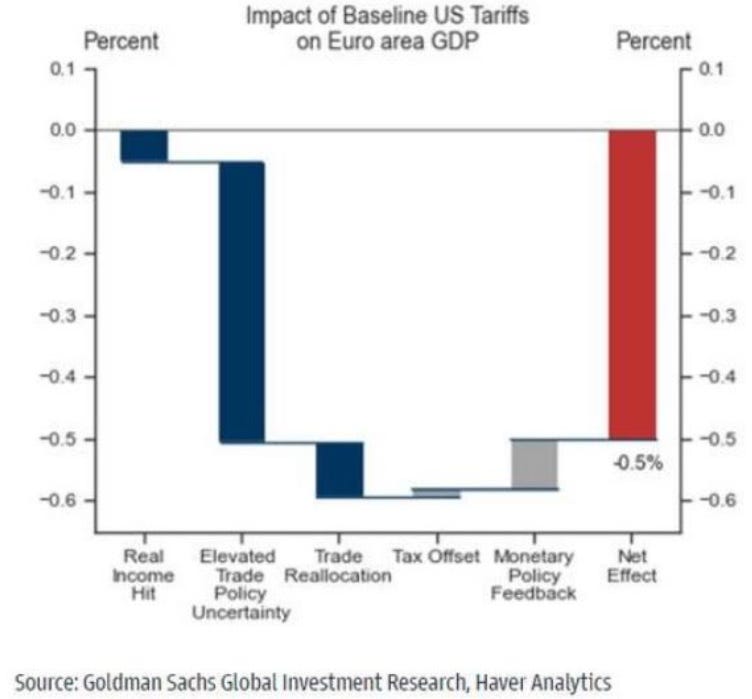

European countries will be hit hardest by tariffs on automakers. Euro area GDP forecast:

Tax Cuts

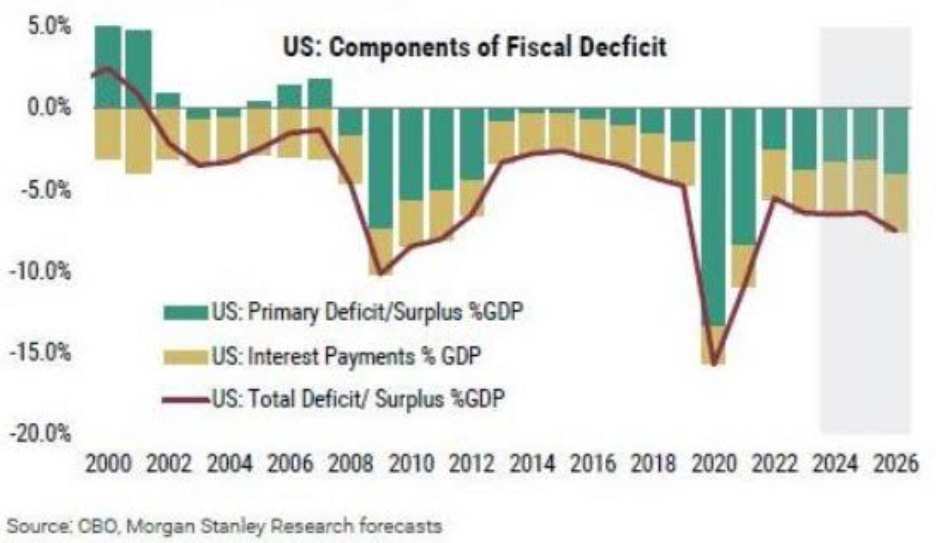

Tax cuts of any kind would obviously be consequential for the fiscal deficit. I want to avoid speculation about Trump’s plans to offset this with the "External Revenue Service”.

In a scenario where TCJA tax cuts are extended, all else equal, it could grow the deficit by around half-a-trillion.

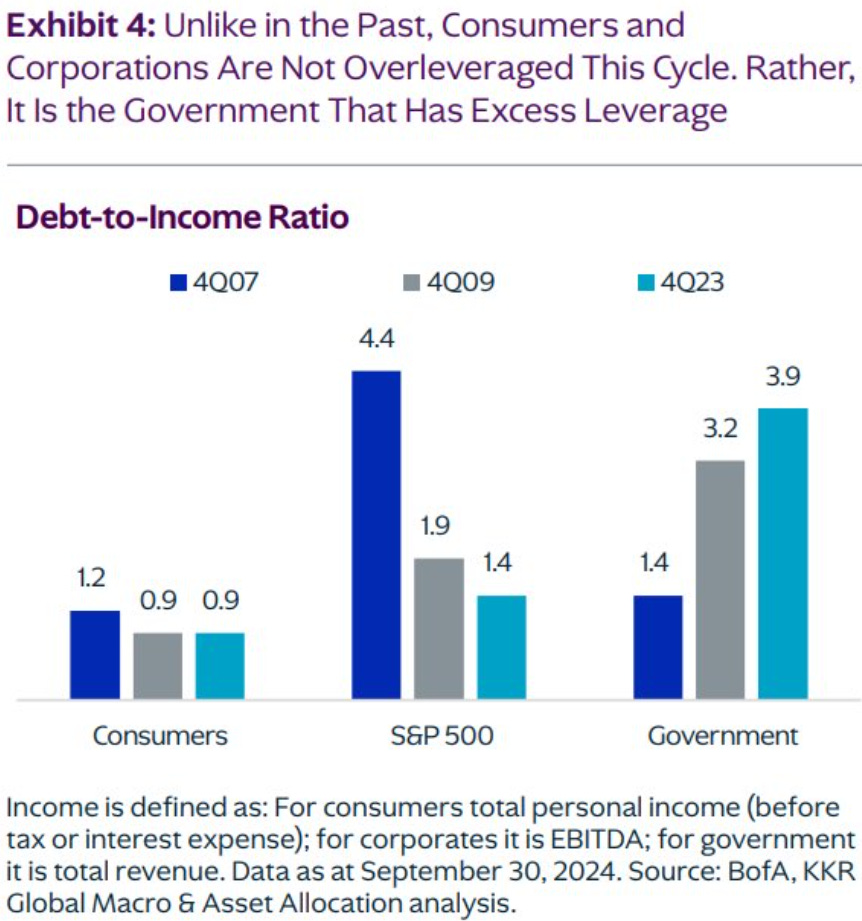

A fun little chart from KKR:

Looser Regulations

Federal Reserve governor Michael Barr announced his decision to step down from his role as Vice Chair of Supervision ahead of the transition. Barr’s choice could have to do with his tougher approach to oversight of the financial sector, which Trump relaxed in his last term. His resignation also jeopardizes a bank capital requirement hike proposal. Trump will also have the opportunity to appoint a new supervisor.

As for interest rates, Trump has repeatedly stated rates are too high. The first interest rate decision of the year is scheduled for January 29th. Assuming Powell and Trump haven’t had any direct contact since the chairman was threatened his job, it will be interesting to see how the incoming president responds to this.

On a different topic, Trump spent a lot of time campaigning for looser regulations on crypto. He promised to fire SEC chair Gary Gensler.

Trump confirmed his association with the $TRUMP meme coin over the weekend, resulting in the token soaring >25,000%. No further comment needed…

Econ Data

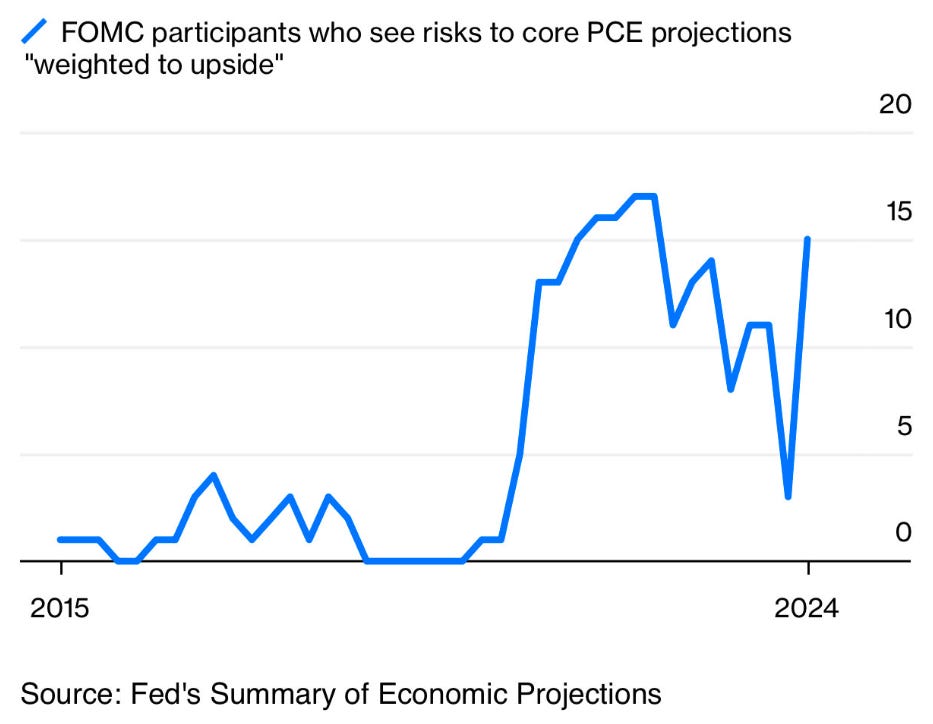

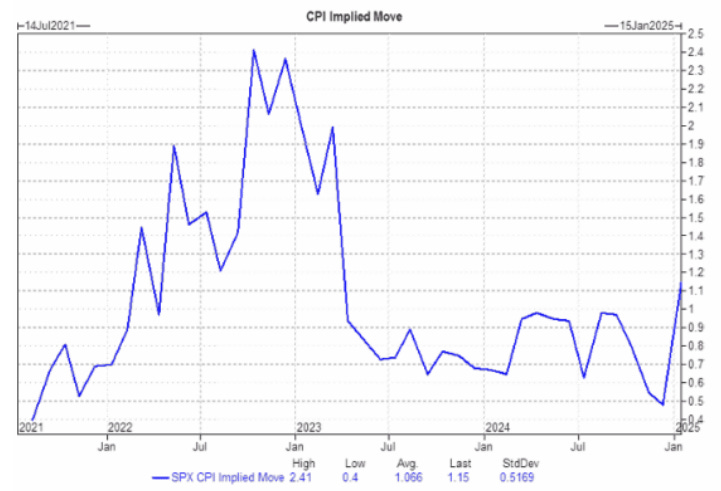

The S&P straddle covering December CPI report implied a market move of 1.15%, the highest level of the CPI-related straddle since March 2023.

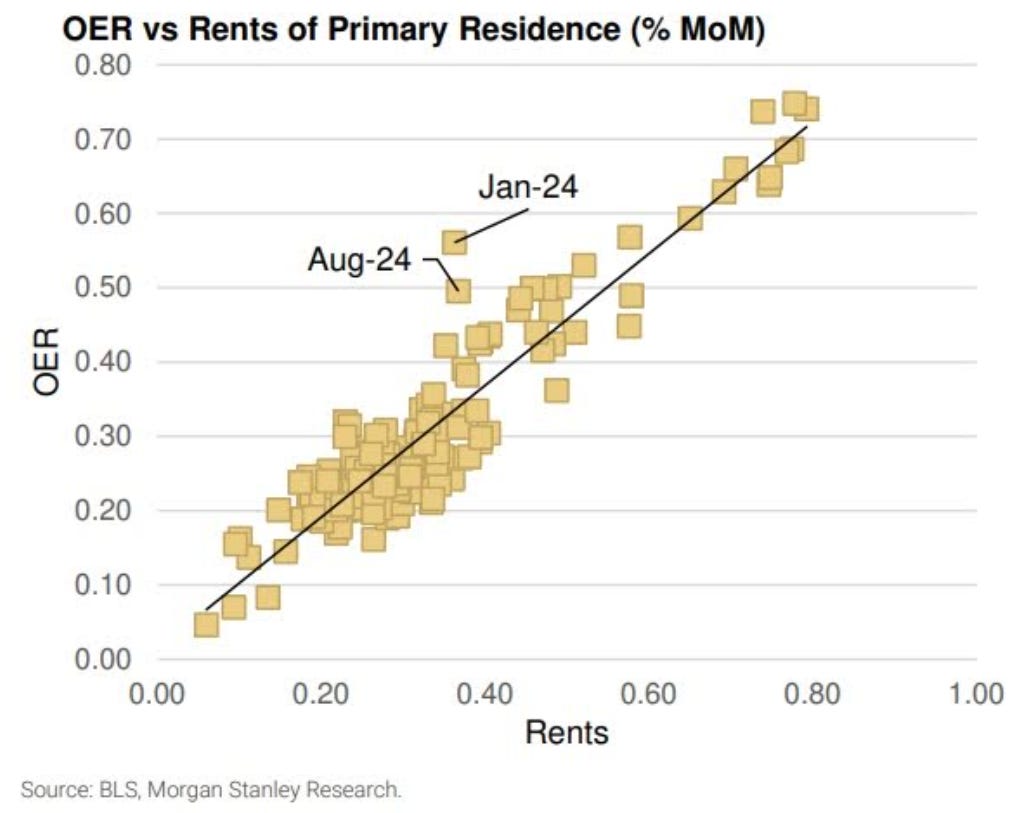

January CPI is scheduled for release on February 12th. Friendly reminder to look out for the “January Effect”, which caused huge irregularities in last year’s inflation index. Last January was the biggest OER outlier in more than a decade:

Positioning and Technicals

ETFs, as a percent of hedge fund short positions (GS PB), are at their highest level since December 2023. ETF short positions have increased at the fastest pace since February 2021, (i.e. the last meme stock phenomenon).

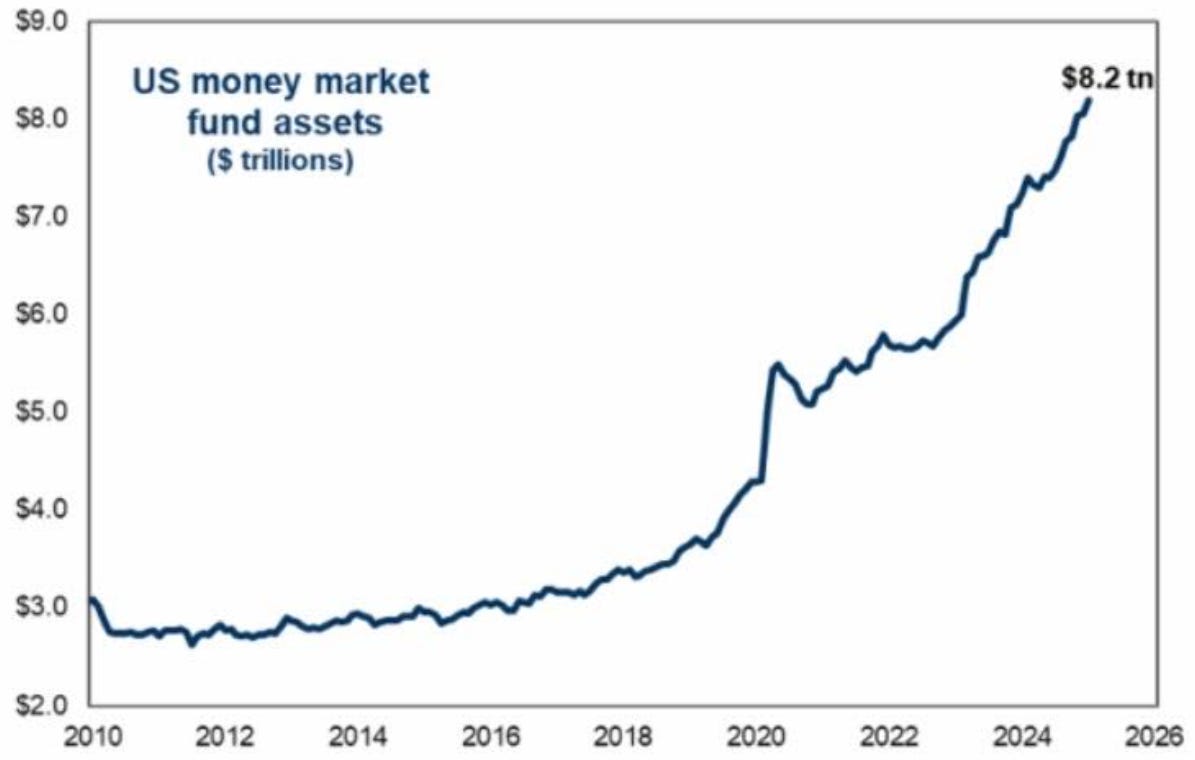

As I often do, I wanted to point out we’ve been waiting on all-time high money market fund levels to rotate into equities for as long as I can remember. In reality, as a share of money supply (M2), MMF’s aren’t actually historically concentrated. Money Market Fund’s tend to drain coming out of recessions and gain traction during risk off periods. If my judgement that we’re not currently in a recession is right, then there’s no expectation for a big liquidity boost any time soon. :)

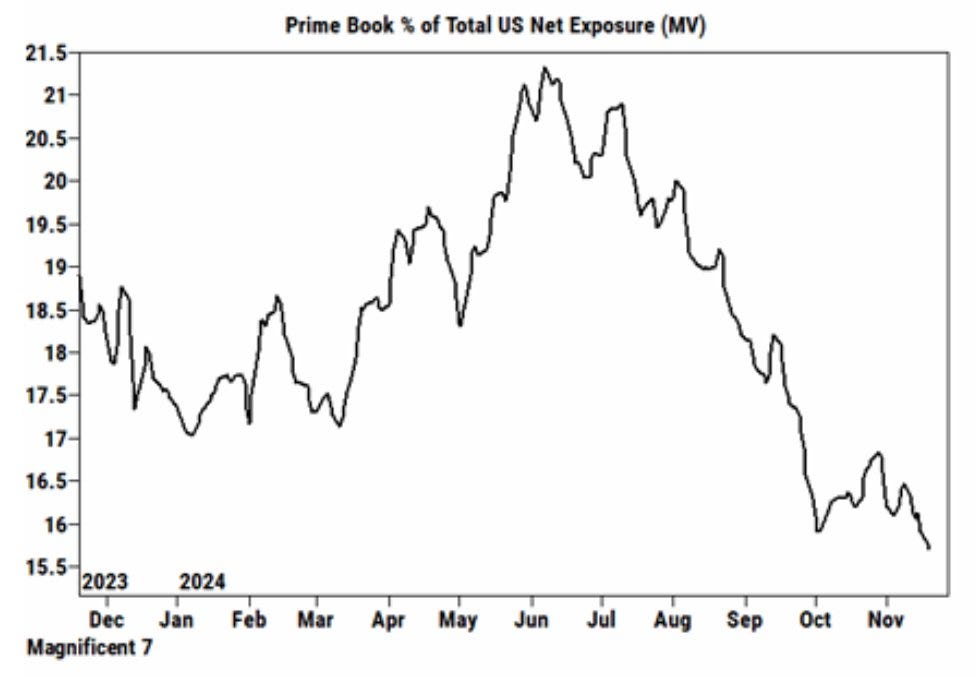

Hedge fund positioning (GS PB) in Mag 7 stocks reached a new one-year low. Hedge funds have decreased exposure to these mega-cap names and are moving into other underappreciated, small cap, AI stocks, according to the Goldman desk.