Goldman Sachs: Cash flow - Post CPI thread (Rubner)

I have been contacted more times this morning after the CPI than I can remember.

Here are the main issues that clients mention:

a. Large current base of short positions in equities.

b. High level of systematic short positions in fixed income.

c. Short positions in gamma of equity indices.

d. Falling sentiment and leverage.

e. The corporate blackout period ends next week.

f. Favorable season for the second half of the year.

Bottom line: This is a green sweep. Fund flows into equities look favorable for a near-term rally, which was on hold at the start of 2025. Here are the 10 things I'm watching today.

It's time for a thread.

1 – Highest level of macro ETF short positions since 2021 at GS PB

Current discretionary macro equity short positioning is elevated at GS PB. ETF short positions have increased by +24% over the past month (the fastest pace since February 2021, i.e. the meme stock phenomenon). ETFs, as a percentage of the GS Prime US short book, have reached their highest level since December 2023.

2 – Systematic short positions in global fixed income

Systematic short positions in global fixed income are elevated, and equity investors have been very attentive to the bond market.

Next week (DV01):

a. Flat Market : Sellers for $20.16 million ($0.90 million outside the US).

b. Up Market : Sellers for $15.67 million ($1.53 million into the US).

c. Down Market : Sellers for $23.65 million ($2.24 million outside the US).

Next month (DV01):

d. Flat Market : Sellers $25.40M ($0.74M outside the US).

e. Up Market : Buyers $93.56M ($34.05M into the US).

f. Down Market : Sellers $7.91M ($5.52M into the US).

3 – Gamma shorts indices today with relaxation expected towards options expiry on Friday

Gamma's position in indices is now short ($-700 million) for the first time in 2025, reaching the highest level of short positions since December 30, 2024 and September 18, 2024.

According to our model, gamma exposure increases on downside moves and becomes shorter during rallies.

4 – General reduction of leverage in the market

A decrease in leverage is observed among both professional and systematic investors.

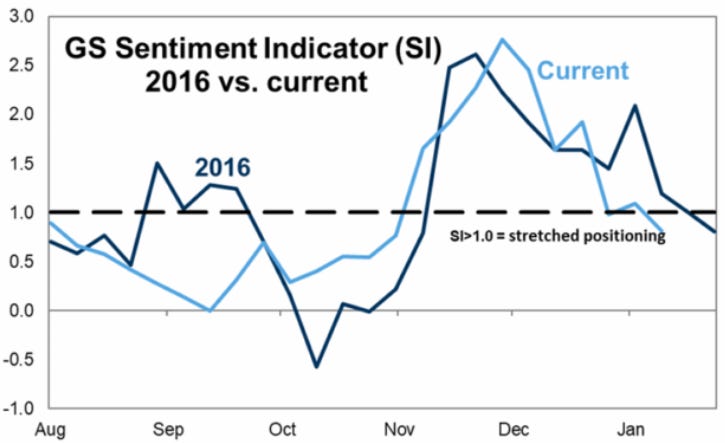

5 – Decompressed feeling and similar to the Trump 1.0 period

Sentiment is no longer elevated and resembles the level seen after the election during Trump's first term (Trump 1.0).

6 – Money markets

Global money market funds saw inflows of $143.3 billion last week. This was the largest weekly flow since March 25, 2020 (i.e. the start of COVID).

The point here is clear: money is moving and is ready to enter equities once headlines (and prices) begin to stabilize.

7 – Peak corporate blackout right now

Reminder: GS’s US portfolio strategy projects demand of $1 trillion in 2025 , starting next week.

The corporate buyback window opens on January 24th , with 45% of the S&P market cap returning to the market. We are currently at the peak of the corporate blackout window.

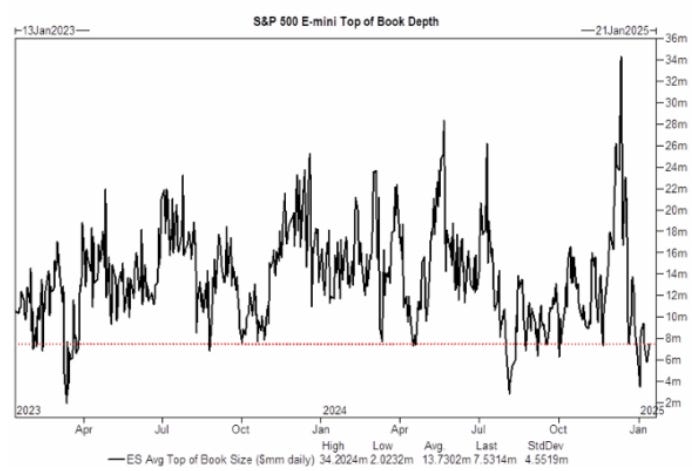

8 – Liquidity remains low and faces challenges (works both ways)

Liquidity in the markets remains limited , creating significant challenges. This can amplify both upward and downward movements.

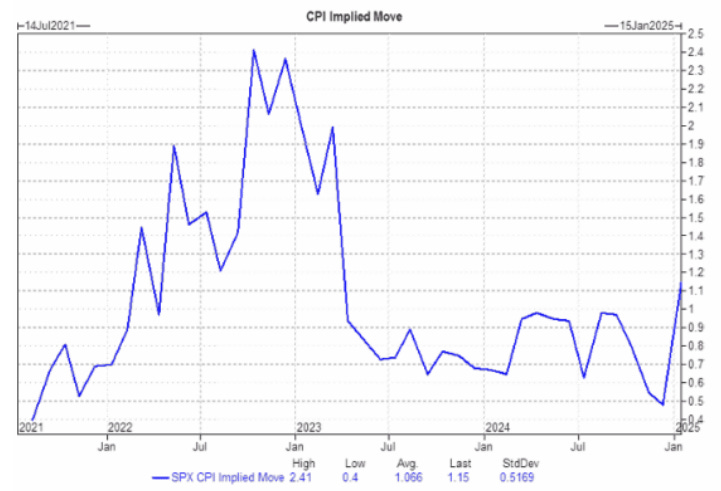

9 – The options market: the IPC straddle was high

The S&P straddle covering today's CPI report implies a market move of 1.15% .

This is the highest level of the CPI-related straddle since March 2023. We believe there is more upside than downside potential for stocks.

10 – Seasonality

The S&P 500 is entering a period of seasonal consolidation , with a local low expected around January 22 , before rebounding towards mid-February.