Weekly Warmup - 02/26/2024

I started publishing exclusive news stories again starting this weekend. Some interesting reads here:

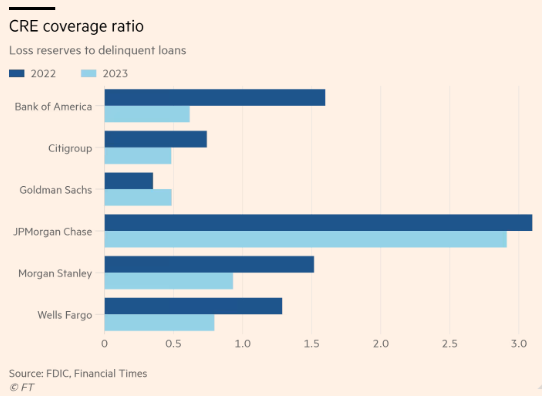

FT: Bad property debt exceeds reserves at largest US banks

Stephen Gandel in New York FEBRUARY 20 2024 Bad commercial real estate loans have overtaken loss reserves at the biggest US banks after a sharp increase in late payments linked to offices, shopping centres and other properties. The average reserves at JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley have fallen fro…

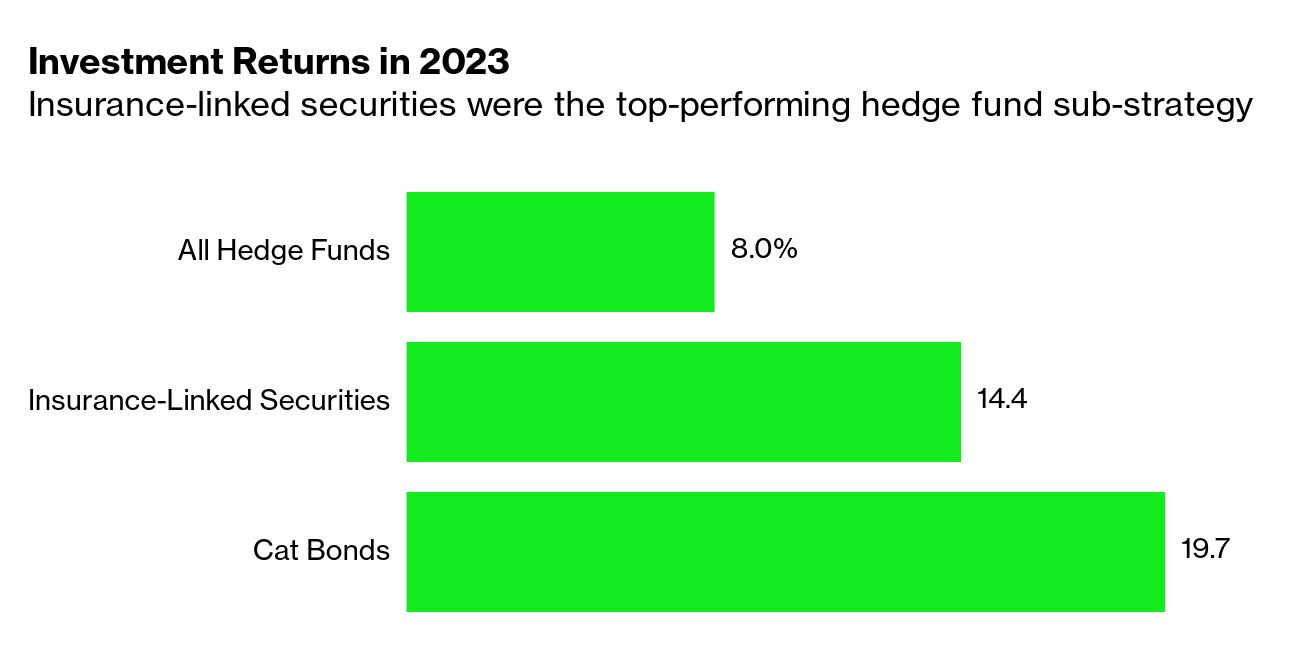

Bloomberg: Risk Models Behind World’s Best Hedge Fund Strategy Are Getting a Lot Harder to Crack

By Gautam Naik and Sheryl Tian Tong Lee February 25, 2024 at 12:00 PM UTC As the best hedge fund strategy of 2023 becomes a magnet for mainstream investors, the risk models it relies on are getting a lot tougher to crack. The strategy in question is tied to insurance-linked securities, which are dominated by catastrophe bonds (often dubbed cat bonds). In 2…

I will try to post interesting stories, but feel free to reach out and make a request. I only have Bloomberg, WSJ, NYT, and FT. You can find these under ‘News’

Goldman’s economic research team published an interesting report last week on the ‘January Effect’ and inflation. It goes into further detail explaining the unusual jump in consumer prices in January, especially in rent, which is reevaluated for the new year. It is worth a read:

Goldman Sachs: OER You Serious - The January Effect

We expected and indeed received a large “January effect” in last week’s price data, with CPI and PPI both surprising consensus to the upside. In our view, the bigger surprise was the 0.56% spike in owners’ equivalent rents (OER), which outperformed the primary rent measure by the most since 1995. In this edition of the Analyst, we explore the scope for …

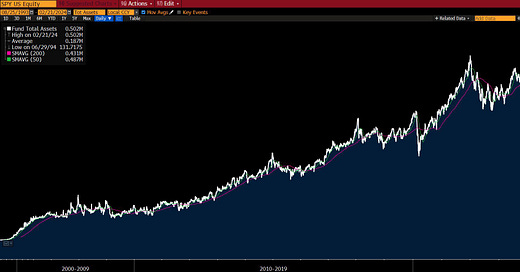

The biggest and oldest ETF, the SPDR S&P 500 fund, reached a new all-time high in assets under management AUM:

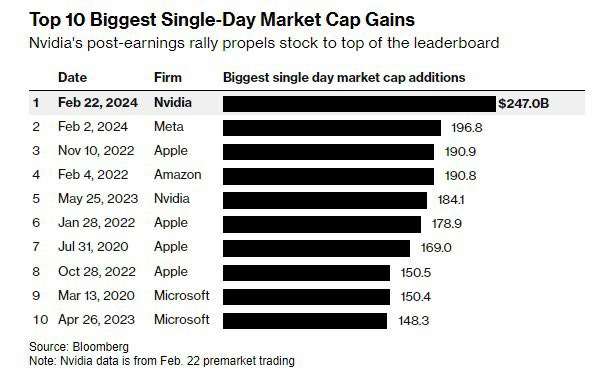

On earnings last week, NVDA closed setting a record single-day market cap gain just a month after META:

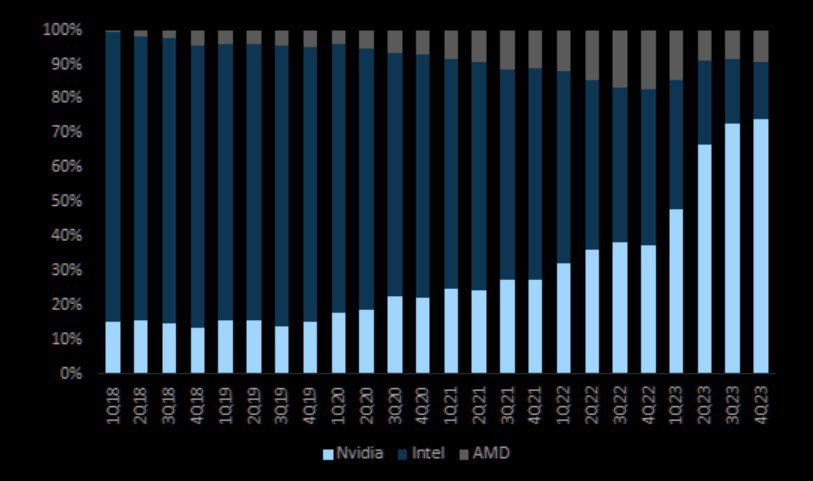

This chart shows NVDA, AMD, and INTC market share history, where AMD and especially Nvidia have taken Intel’s share in just the past five years:

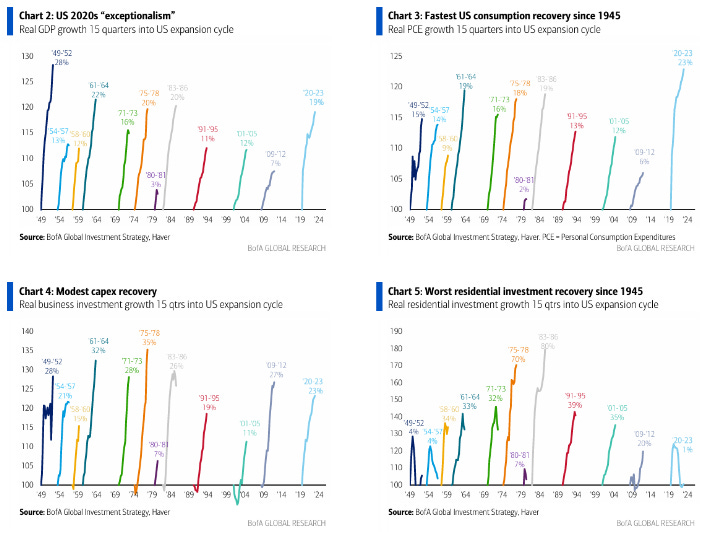

Over the weekend BofA’s strategist Hartnett released an interesting weekly report:

BofA: Hartnett Weekly 02/25/2024

US “Exceptionalism” in the 2020s: Driven by: Wall Street… The United States has raised capital through debt and equity, not through banks as in Europe/Asia, which has led to higher asset prices and a higher multiplier through capital and business confidence and consumers.

This upcoming week, we see several countries GDP data including the second revision to US GDP and primary Personal Income/Spending, as well as EU and Japan inflation.

Earnings from more than 100 large-caps including CRM, LOW, TJX, AMT, WDAY, SNOW, NTES, DELL, RSG, MNST, ADSK, CRH, AZO, SRE, AEP

That’s it for this week’s warmup, DM me for feedback comments requests