BofA: Hartnett Weekly 02/25/2024

US “Exceptionalism” in the 2020s: Driven by:

Wall Street… The United States has raised capital through debt and equity, not through banks as in Europe/Asia, which has led to higher asset prices and a higher multiplier through capital and business confidence and consumers.

Government… The US budget deficit has averaged 9.3% of GDP over the last 4 years.

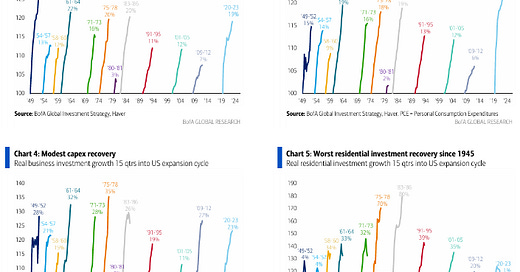

Consumer… Stimulus and the US labor market have meant a 4-year recovery in US consumption from COVID-19 lows (23%), representing the fastest recovery since 1945 (Chart 3)… In contrast, the much-hyped recovery in fixed capital investment ranks seventh of the 12 recoveries since World War II (Chart 4), and the recovery in housing is one of the worst (Graph 5).

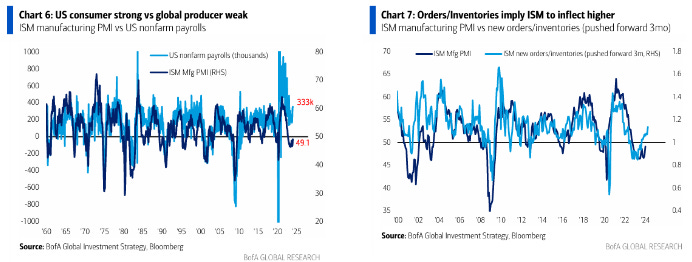

The US consumer has been strong in the last 12-18 months, while the global producer has been weak… there is a contrast between payroll and the ISM (Chart 6);

Roles are set to reverse in the coming quarters…global PMIs tentatively indicate an upward inflection as orders now exceed inventories (Chart 7), while consumer tailwinds from excess savings have faded. extinct, the savings rate is falling (now <4%), payment arrears are increasing (although low) and hiring is slowing; all cyclical assets are trading at an inflection point on the ISM;

Based on the historical relationship with the ISM and current valuations, the best trades for “long producer, short consumer” in '24 are commodities, mercantilist stock indices (KOSPI/OMX/DAX) and EM excluding China, cyclical assets that still they are not operating with a jump from the ISM to 55-60 (Table 1 and Graphs 8-11);

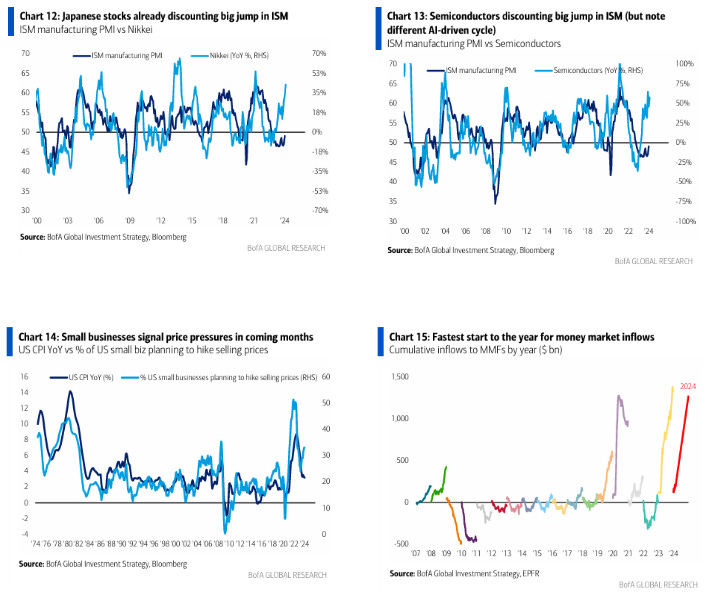

Semiconductors, Japan, Housing (Charts 12 and 13) are already pricing in a big jump in the ISM, so they have less relative upside potential (semiconductors are obviously in a different cycle due to the AI arms race and the risks very obvious bubble bubbles until real rates rise above 2.5-3% – see last week's Flow Show); AI “little bubble” growing + ISM accelerating towards Fed rate cuts is magic formula for more upside potential; higher inflation and higher nominal yields/real rates are the catalysts to limit/dismantle the upside potential…

It should be noted that the number of small businesses planning to increase prices in the coming months is increasing again (correlated with the CPI – Chart 14).

There are 256 days left until the US elections… it's “Super Tuesday” on March 5: the basic framework for the impact of the elections on Wall Street is the macroeconomic conclusion that the winner of the election will draw from the result (obviously, there are many other factors at play);

If Biden wins and the bottom line for the next administration is that low unemployment is more important than high inflation for most voters… there will be less need for lower inflation/lower bond yields;

If Trump were to win, the takeaway for the next administration would be that high inflation is more important than low unemployment, and the need to keep inflation and interest rates low.

Flows to take into account:

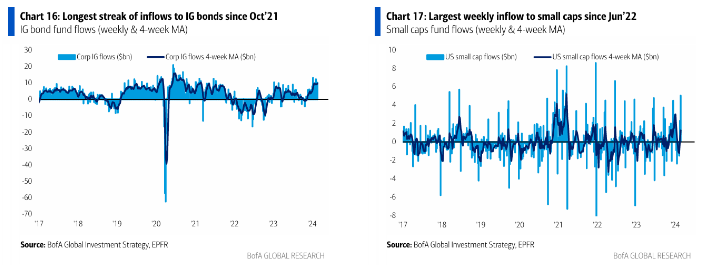

Investment Grade (IG) Bonds: Large inflow of $10.2 billion, 16th consecutive week of inflow = longest streak since October 2021 (Chart 16);

US small businesses: highest weekly revenue since June 2022 ($5.1 billion – Chart 17);