Weekly Update 03/18/2024

On a brief note before this weeks weekly update, I apologize for being missing the past two weeks. I should be able to fully resume starting today.

Top Reads

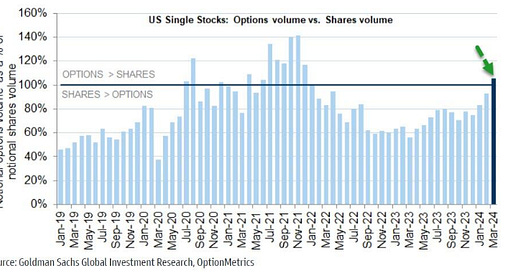

Firstly, Goldman explains how options volumes have exceed stock volumes for the first time in three years.

See graphs from report here:

Also from Goldman Sachs, an interesting report on the concentration in markets, both by sector and region, and what to do about it.

Read full report here:

Goldman Sachs: The Concentration Conundrum; What to do about market dominance

Stock market concentration has increased dramatically and has taken three broad forms: the rise in the share of the US equity market in the world, the rise in the share of the technology sector, and the rise in the dominance of the biggest companies in most regions.

Apollo Global’s most recent credit conditions update had some interesting charts and graphs:

Apollo Global: Update on Credit

Key topics for credit investors: M&A volumes increased in February, a trend we expect to continue amid an improving macroeconomic outlook, with dry powder high in private equity and cash near record highs on U.S. corporate balance sheets. M&A-driven issuance weighed on US investment grade valuations as spreads remained unchanged in February, lagging US hi…

Other reports to read:

Goldman Sachs: Cutting Through the Noise

Goldman Sachs: The Ex Post Story of GDP

Goldman Sachs: Wobble

In Case You Missed It

(Actually, I missed it)

If you want to read analysis before and after the February CPI surprise last week (albeit outdated now)

Goldman (reaction):

Core CPI Beats Again but OER and Non-Housing Services Both Normalize

February core CPI rose 0.36%, 6bp above consensus expectations, and the year-on-year rate fell by less than expected to 3.8%.

The composition was disinflationary however, with a sharp normalization in non-housing services inflation and a return to the Q4 trend for the owners’ equivalent rent category.

Continue reading:

US February CPI

Starting with reports BEFORE then live commentary Estimates by institution: Firm - Headline Y/Y%, M/M%; Core Y/Y%, M/M% Barclays - 3.2%, 0.5%; 3.7%, 0.3% BNP Paribas - 3.1%, n/a%; n/a%, n/a% BofA - 3.1%, 0.4%; 3.7%, 0.3% Citi - 3.1%, 0.5%; 3.7%, 0.3%

Morgan Stanley Weekly Equity Strategy

Top Charts

Looking Forward

This week, the top event on the calendar will be the FOMC rate decision on Wednesday. While it’s undoubted that the Fed won’t likely change rates (14:00ET), we’ll be listening in to commentary from chairmen Powell at 14:30ET.

Outside of this for the US, the next big catalyst to watch is PCE inflation next Thursday. PCE is the Fed’s primary gauge of inflation, even more than CPI. I will follow up with more research sometime next week.

If you’ve made it this far, thanks for tuning in to this weeks weekly update. Reminder you can read these stories as they come out on the Sell Side Research website.

Feedback and comments always welcome