Apollo Global: Update on Credit

Key topics for credit investors:

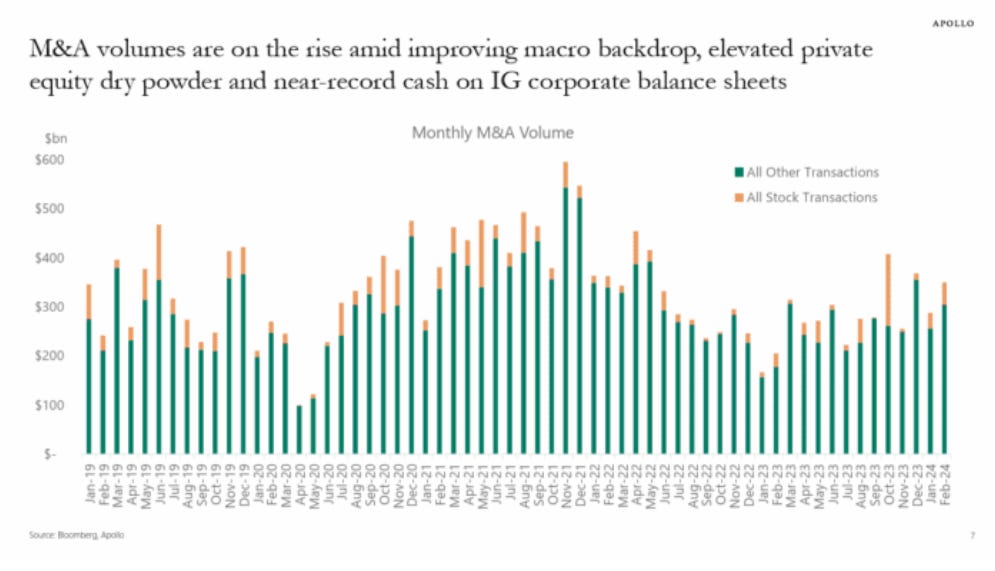

M&A volumes increased in February, a trend we expect to continue amid an improving macroeconomic outlook, with dry powder high in private equity and cash near record highs on U.S. corporate balance sheets.

M&A-driven issuance weighed on US investment grade valuations as spreads remained unchanged in February, lagging US high yield spreads and US investment grade spreads. Europe's investment/high-yield markets that narrowed. Beta compression remains a key issue across credit, with the exception of CCC ratings. Asset-backed credit has risen markedly relative to corporates so far this year.

Total returns remain attractive and should continue to attract retail, insurance and pension investment flows. Strong technical fundamentals and a solid macroeconomic outlook should support valuations, even if credit spreads are near the tight end of recent trading ranges.

Credit spreads should not react negatively if market expectations for Fed cuts this year decline further. However, higher rates for longer could pose a risk to companies with low interest coverage ratios, especially those with capital structures with lots of debt and/or short-term maturities.