US February CPI

Starting with reports BEFORE then live commentary

Estimates by institution:

Firm - Headline Y/Y%, M/M%; Core Y/Y%, M/M%

Barclays - 3.2%, 0.5%; 3.7%, 0.3%

BNP Paribas - 3.1%, n/a%; n/a%, n/a%

BofA - 3.1%, 0.4%; 3.7%, 0.3%

Citi - 3.1%, 0.5%; 3.7%, 0.3%

Deutsche Bank - 3.1%, 0.4%; 3.7%, 0.3%

Goldman Sachs - 3.2%, 0.4%; 3.7%, 0.3%

JP Morgan - 3.1%, 0.4%; 3.7%, 0.3%

Morgan Stanley - 3.2%, 0.4%; 3.7%, 0.3%

Nomura - 3.2%, 0.5%; 3.7%, 0.4%

RBC - n/a%, n/a%; n/a%, n/a%

SocGen - 3.1%, n/a%; n/a%, n/a%

TD - 3.1%, 0.4%; 3.7%, 0.3%

UBS - 3.2%, 0.5%; 3.8%, 0.4%

Wells Fargo - 3.1%, n/a%; n/a%, n/a%

BofA

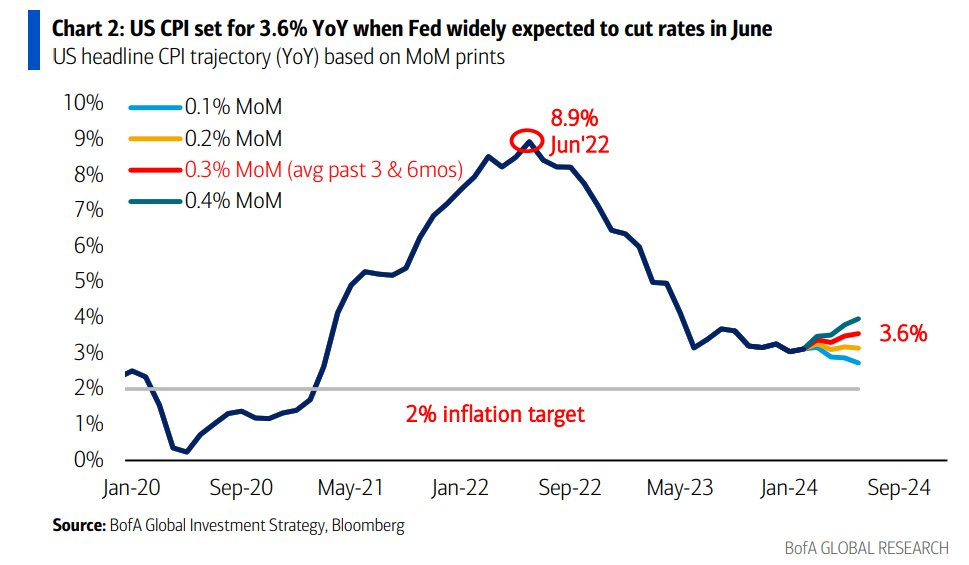

February print should keep June cut on the table

We expect core and headline SA CPI to print at 0.3% and 0.4%, respectively. This is in line with Bloomberg consensus but below market pricing. The Fed will likely be playing close attention to the composition, particularly services, to gauge confidence on the disinflation trend persisting. A print as we forecast should keep a June cut on the table. Clients who think that there is upside risk to a firmer print may prefer expressions in nominal rates versus inflation markets.

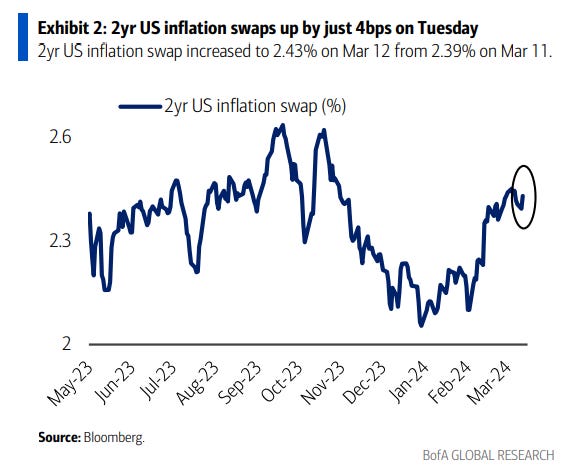

Reduce risk in 2y inflation long

We recommend that clients who have been long front-end inflation reduce exposure ahead of the CPI print (for details, see inside). The market is pricing a firmer print than we and Bloomberg consensus expect, and we see risks that a disappointment could drive market pricing materially lower. Technical factors also support a topping out of our 2-year (2y) inflation swap around current levels. However, our conviction that services inflation will be slower to moderate versus market pricing and upside commodity risks suggest maintaining long positions without hedging energy exposure for a longer time horizon.

Commodity upside risk

Fundamental and technical factors suggest that inflation longs should be expressed without an energy hedge. Besides geopolitical risks, we see three factors that could strengthen gasoline and diesel cracks and prices into 2Q24: 1- inventories are at seasonal lows, 2-gasoline may become more expensive due to blending components, 3- global manufacturing is moving back into expansion territory. From a technical perspective, broad market commodities double bottomed in February, and the move higher broke away from the downtrend. The Bloomberg Commodity Index may be a leading indication that oil and/or copper could break higher soon.

Goldman Sachs

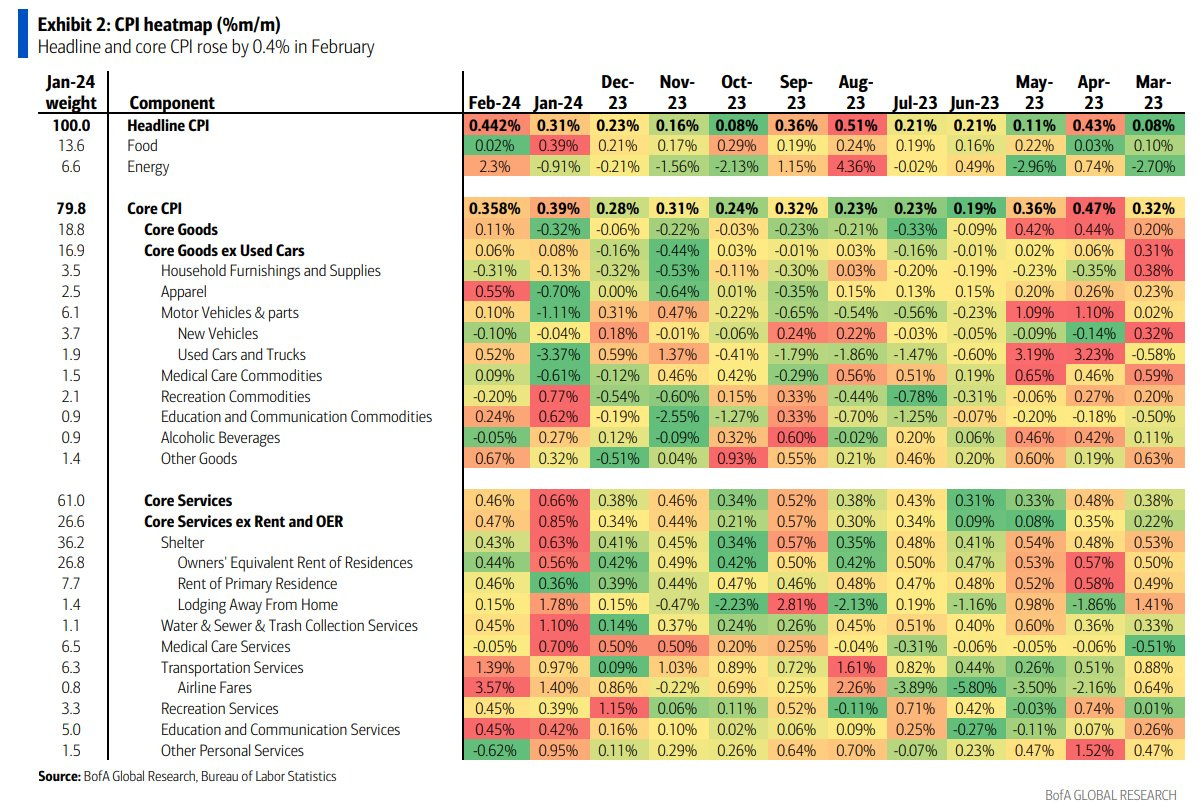

We expect a 0.32% rise (vs. 0.3% consensus) in the core CPI in February.

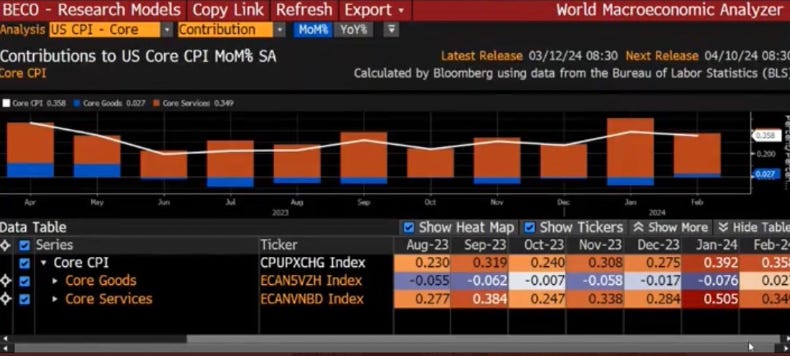

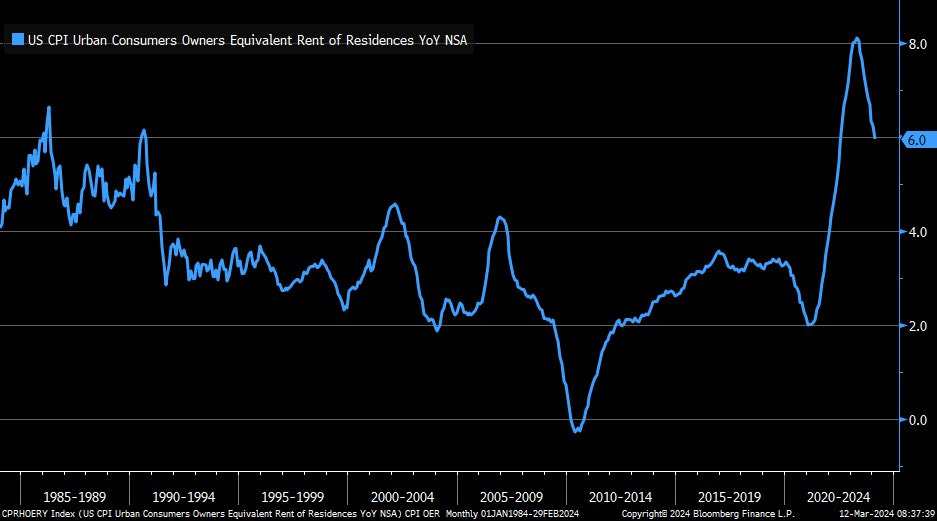

We expect a step down in February because we think that the January print was boosted by the January effect and noise in OER. We expect OER to slow to 0.47% in February, 5bp above rent at 0.42%, and we see this as a more reasonable gap going forward than the large 20bp January gap.

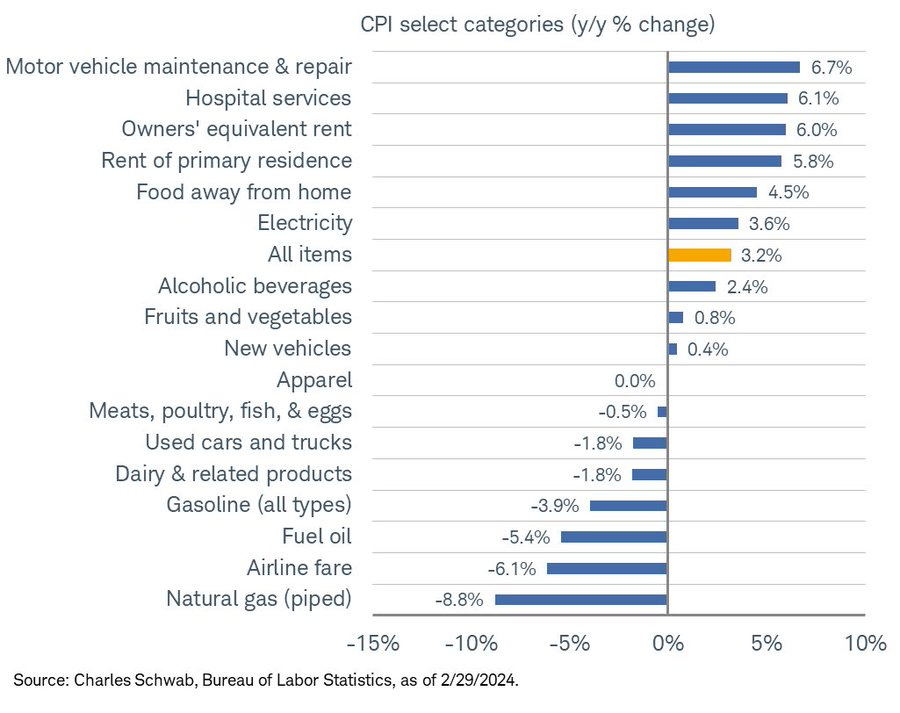

At the category level, we expect small declines in new (-0.3%) and used (-0.4%) car prices, but a 1.5% rise in airfares and another strong gain in car insurance (+1.6%).

Our forecast implies a step down in core services ex-rent and OER from 0.85% in January to 0.4% in February. It also implies a decline in year-on-year core CPI to 3.71%.

A BLS presentation strengthened our confidence that the strong January OER print was mostly noise.

We argued last month that only a fraction of the 20bp OER vs. rent gap in January reflected genuinely greater tightness in the single-family home market vs. the apartment rental market. As a result, our inflation forecast assumes that OER will outpace rent by 4bp a month in 2024.

A BLS seminar last week suggested that stronger single-family rent growth accounted for about 5bp of the OER-rent gap, while utilities accounted for another 5bp. This reinforced our view that the January strength in OER was mostly temporary and is unlikely to persist.

Wells Fargo

We forecast headline CPI to rise 0.4% in February, fueled in part by a jump in gasoline prices, which would keep the year-over-year rate at 3.1%.

Core CPI, however, likely moderated in February; we look for a 0.3% monthly gain and for the year-over-year rate to edge down to 3.7%.

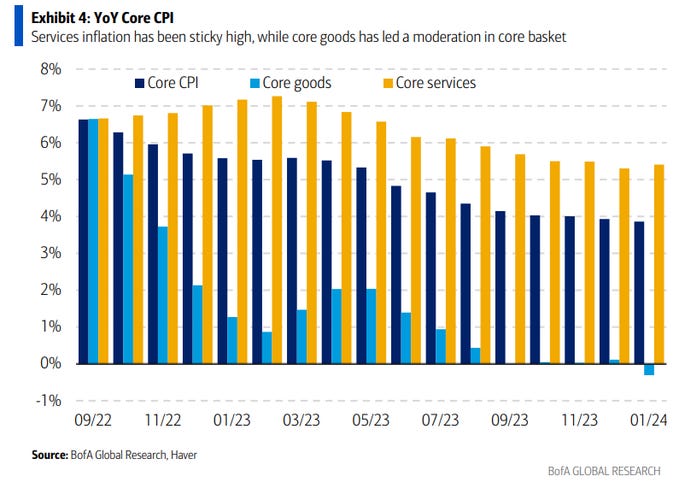

While goods deflation was likely less pronounced in February, we expect to see a smaller increase in core services relative to January.

Owners’ equivalent rent growth should continue to trend lower despite January’s pop, while we see less chance of residual seasonality boosting services in February.

Nevertheless, with the core CPI likely to be running at a 3.9% annualized pace in the three months through February, the Fed is likely to be searching for more confidence that inflation is on course to return to target on a sustained basis for a little while longer before easing policy.

Print & Initial Reaction

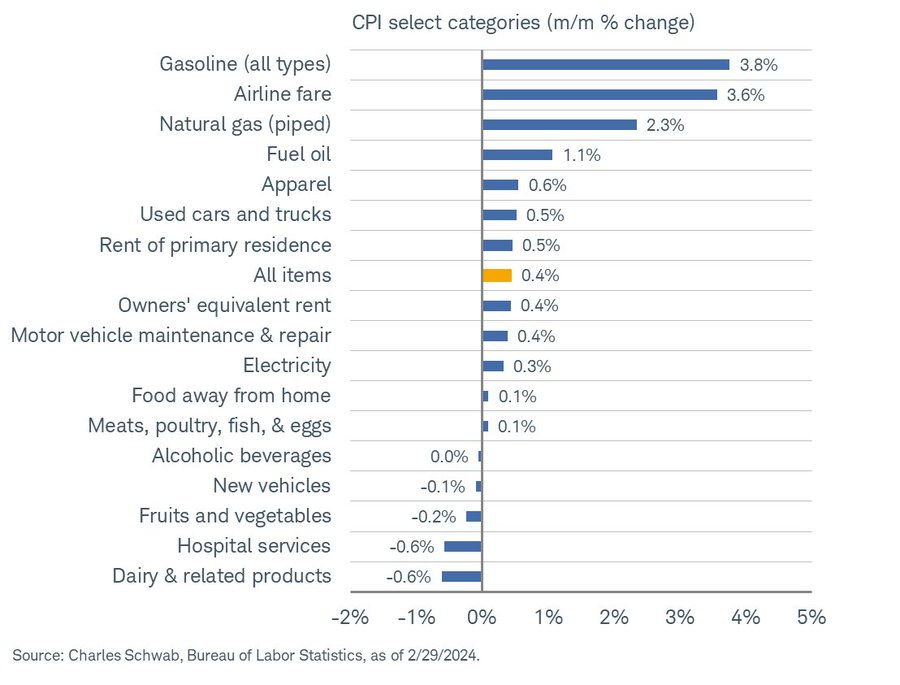

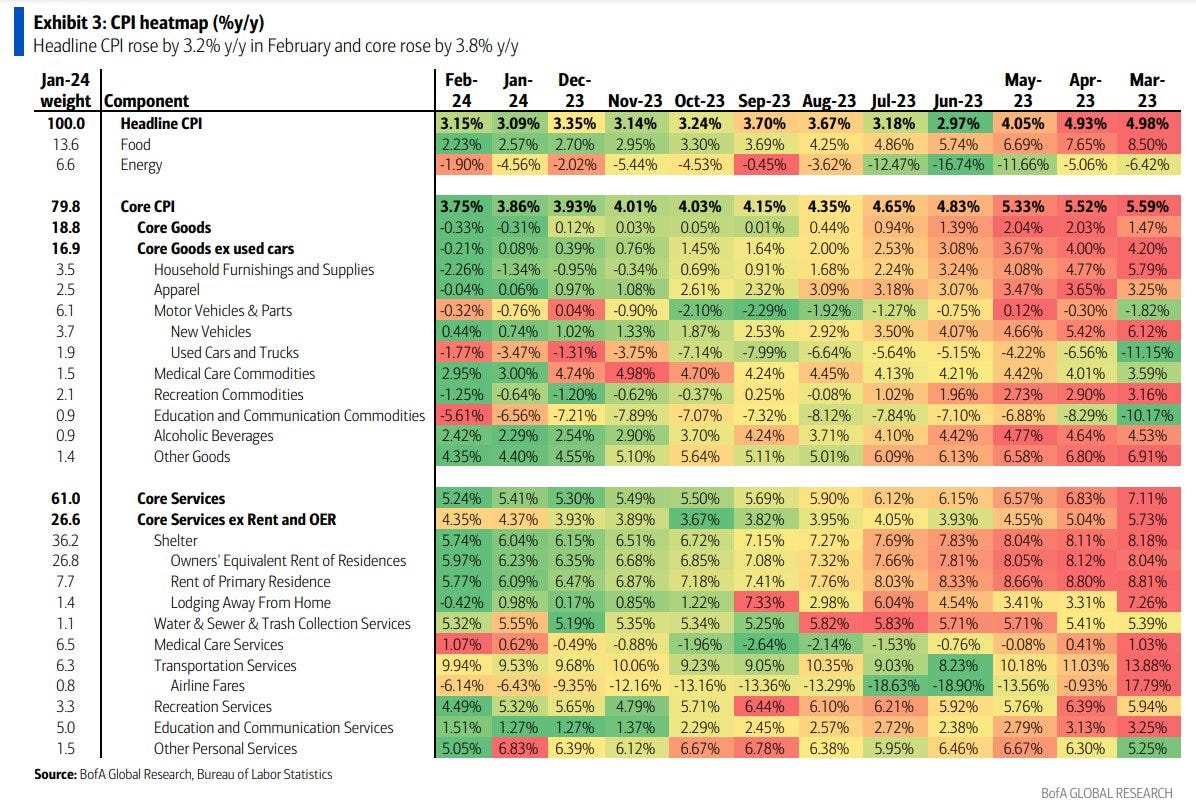

Inflation came in below expectations. Note how shelter costs, the biggest driver in January, cooled meaningfully. This proves the "January Effect" was likely the correct approach to the January surprise on OER.

While the appropriate time for Fed cuts is still not agreed upon or determined, this is unlikely to change estimates in a relative way considering it was mostly in line.

CPI biggest accelerators/decelerators

Fitch

"…a sober reminder of the tendency for inflation to perpetuate itself…[Three-month annualized core CPI] has risen to 3.8% in February, up from 3.0% last October. That is not the direction the Fed wants to see."

Goldman Sachs

Core CPI Beats Again but OER and Non-Housing Services Both Normalize

February core CPI rose 0.36%, 6bp above consensus expectations, and the year-on-year rate fell by less than expected to 3.8%.

The composition was disinflationary however, with a sharp normalization in non-housing services inflation and a return to the Q4 trend for the owners’ equivalent rent category.

Today’s CPI was disinflationary…with a sharp normalization in non-housing services inflation and a return to the Q4 trend for the owners’ equivalent rent category. We also expect the rise in used car prices to more than reverse this spring. We continue to expect the FOMC to leave the Fed funds rate unchanged at the March meeting and to begin the easing cycle in June.”

BofA

Based on today's CPI release, we currently estimate core PCE inflation to print at 0.3% m/m in February. This is a preliminary estimate that assumes categories where we do not have information on yet will see prices persist at recent trends. We will have more complete estimate after Thursday's PPI report.

Fed implications: June remains a reasonable base case On net, we think this CPI is a favorable report with respect to our outlook for monetary policy. We find good news in the deceleration in services inflation and the February data suggest the OER-rent deviation from January is a one-off event. Both rose at a similar pace in February. The deceleration in services inflation - against the backdrop of resilient growth and solid employment gains - should give the Fed some additional confidence that the economy is not overheating.

We temper this good news with the uncertainty raised by the surprise increase in core goods prices. This could leave some on the FOMC wondering whether goods deflation has run its course. If so, then there is a risk that the median FOMC member only forecasts two rate cuts this year in the forthcoming March Summary of Economic Projections, as opposed to three currently.

That said, the Fed has said they need services inflation to moderate further in case goods deflation has ended. The February CPI report has this flavor. Hence, while it would have been an unambiguously favorable report had goods prices met our expectation for a decline, we read developments on February inflation as continuing to support out outlook for a rate cut cycle that starts in June.

JP Morgan

Today’s CPI should assuage fears that January’s jump in core signaled a more significant re-acceleration, but inflation remains firm. …core goods broke an eight-month deflation streak…brings the overall core three-month run rate to 4.2%ar, the highest level since June…highlights the need for a further slowing in services as core goods returns to positive (albeit modest) monthly gains.