US June FOMC Meeting

Starting with commentary BEFORE and then results

The US Fed Funds rate is at 5.50%, and the consensus is for the FOMC to hold. There’s nothing exceptionally important about this meeting at face value, so I will attach some charts and commentary from banks. I will add headlines from the press conference after it has concluded.

Outlook:

Firm - First Cut

Barclays - September

BofA - December

BNP Paribas - December

Citi - September

Deutsche Bank - December

Evercore - September

Goldman - September

HSBC - September

JP Morgan - November

Mizuho - 2025+

Morgan Stanley - September

MUFG - July

Nomura - September

RBC - December

SocGen - 2025+

TD - September

UBS - September

Wells Fargo - September

Effective Fed Funds:

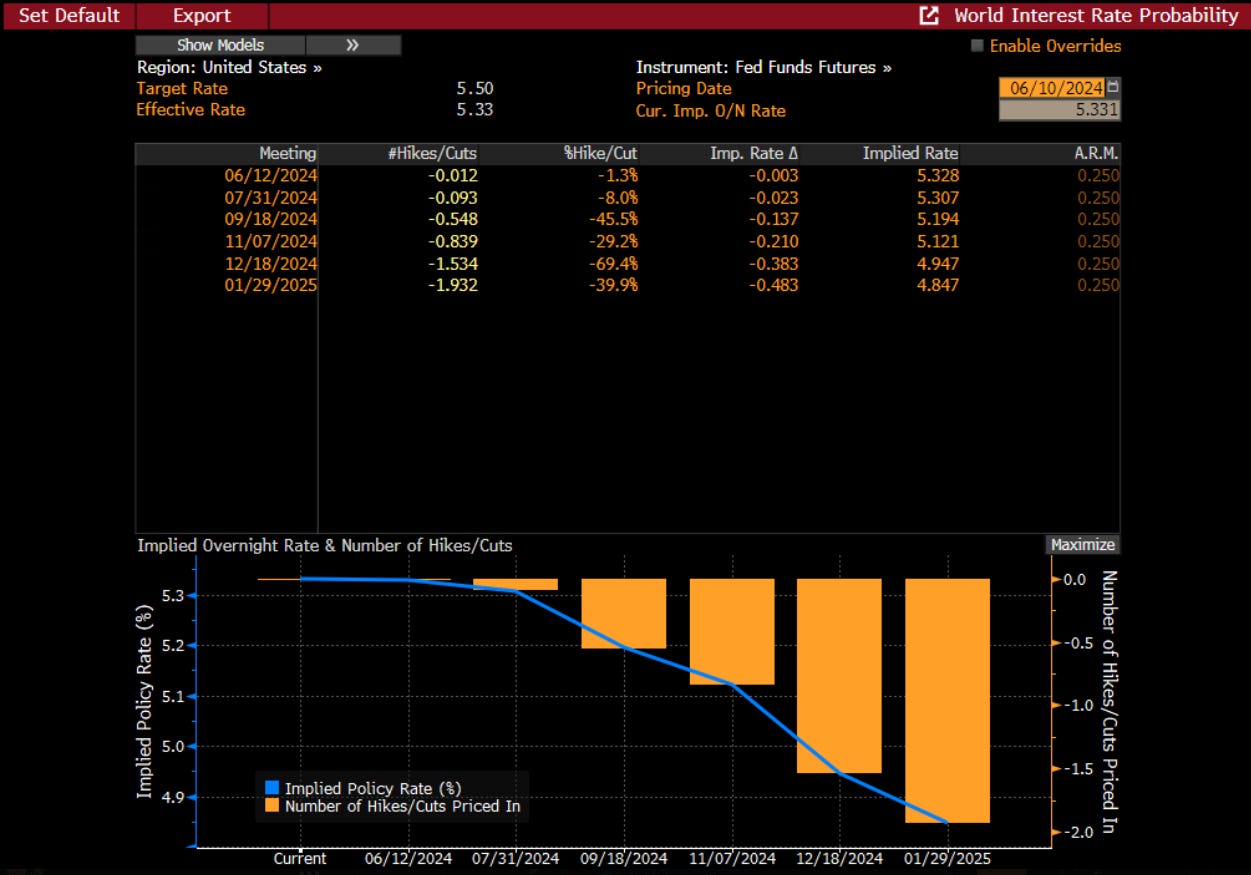

Market Implied Interest Rate Path:

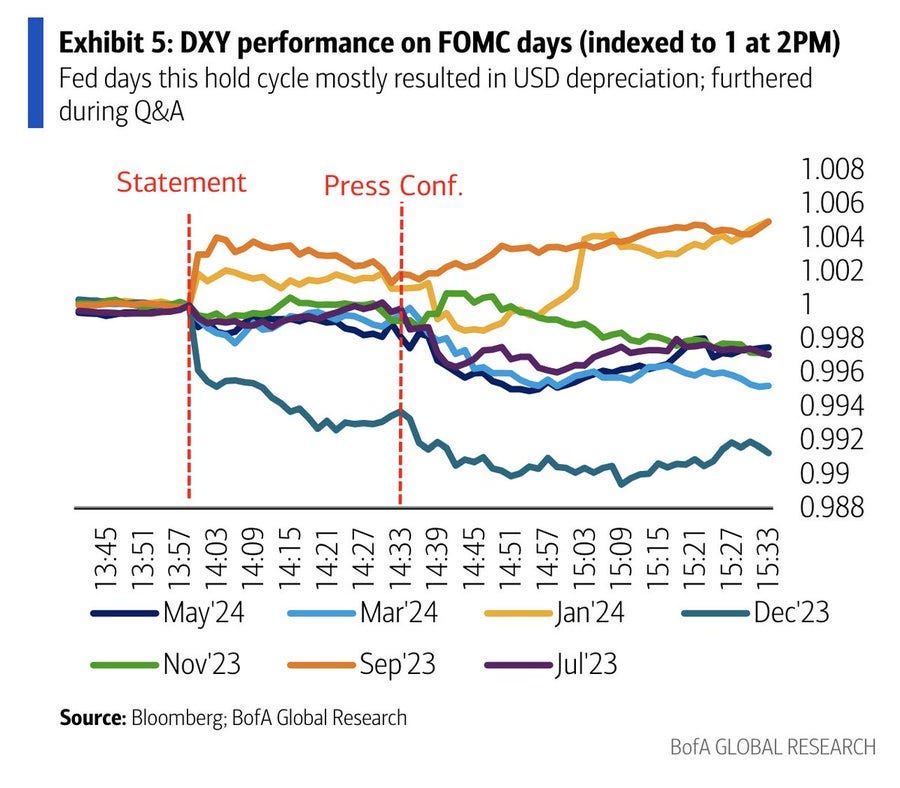

BofA

At the June FOMC meeting, we see the Fed revising its outlook in favor of slower growth and firmer inflation. We think the median Fed member will project two rate cuts this year, down from three rate cuts in March, which would imply a cutting cycle that begins in September.

We think a narrow majority prefers to keep optionality for September alive should inflation cooperate. Our view is the Fed cuts once this year in December.

Recent data should give the Fed confidence that the economy is cooling, but the Fed needs more evidence of disinflation before easing.

What it needs now is time. In the press conference, Chair Powell is likely to say the committee is confident that activity and labor markets are cooling and not overheating.

The Fed has not changed its view of the fundamentals and the main message should be cuts are coming, though exactly when remains uncertain.

Powell is likely to preach patience and will emphasize the Fed is prepared to keep policy where it is for as long as needed to bring inflation down. We still think the bar for hikes – or rapid cuts – remains high.

Wells Fargo

FOMC members will hold their next meeting on June 11-12.

The committee is widely expected to keep the federal funds rate bound between 5.25% and 5.50%, a level at which it’s been held for nearly one year.

Our focus therefore will be on the June Summary of Economic Projections (SEP).

Most members expected 50 bps of cuts or less; however, a dovish outlier pushed the median expectation up to 75 bps.

Meanwhile, longer-run interest rate estimates inched higher, surpassing 2.5% for the first time since March 2019.

Our call is for the median 2024 dot to lift to 4.875%, reflecting expectations for two 25 bps cuts this year instead of three.

That said, we would not be surprised if the median projection calls for just one rate cut.

This morning’s employment release was chock-full of mixed messages that are unlikely to sway the committee one way or another.

The May CPI is set for release the morning of June 12, but FOMC members will probably not have enough time to incorporate it into their forecasts.

Nevertheless, any new inflation data will be instructive on the trend direction of price pressures.

We look for an incremental improvement in core CPI consistent with a return to gradual descent, but doubt it will convince the committee that inflation is sustainably headed back toward 2%.

Our base case remains for the first rate cut to occur in September.