SocGen: Gold summer rally - A closer look at the new drivers (09/05/2024)

US elections take poll position The stars remain aligned for a sustained gold rally. We argued in a paper published in May that Geopolitics should continue to drive the gold price ahead of the US election. After initially taking some time to materially impact the gold market, US election dynamics are now being reflected in money managers’ speculative futures positioning. As the election approaches, we think asset allocators should closely monitor the election polls to optimally time their entry into the gold market. New drivers on the scene Real interest rates and the US dollar remain the primary drivers of gold prices and are providing strong support. However, a new set of interrelated factors has entered the scene, adding complexity to gold pricing dynamics. These include rising central bank gold purchases, growing US public debt and US election developments. These new factors are interconnected, as we elaborate in this paper, making for an interesting interplay. Solo contender boosts prices: can this last? While the new factors are interrelated, indirectly influencing each other, the final driver we identify is more independent. Chinese investors, driven by limited domestic investment opportunities, have emerged as a significant force in the gold market. The longevity of this independent driver is uncertain, particularly given that the Chinese real estate market and broader economy have yet to receive sufficient stimulus to brighten the domestic investment outlook.

Summer gold rush: Fed cuts and US elections

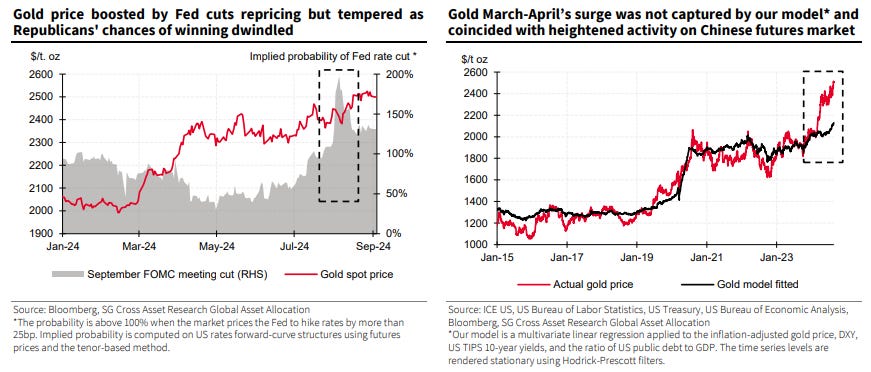

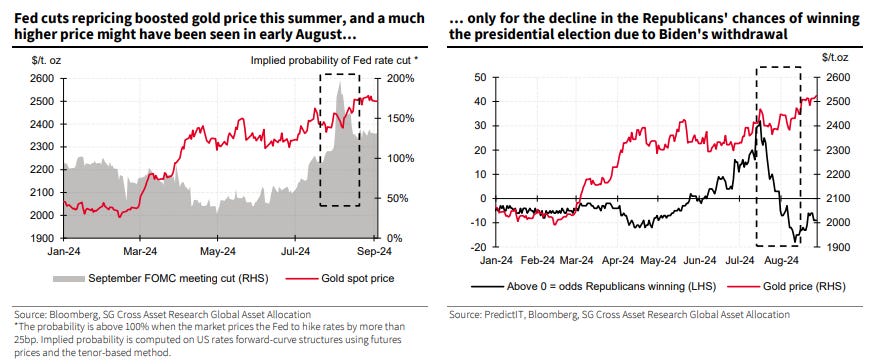

Following the unwinding of the yen carry trade that caused significant volatility in equity markets, the gold price surged to record levels, holding above the $2,500/oz mark. While gold’s safe-haven status was reaffirmed, the summer rally was driven by factors beyond the equity crash. In early July, the stars were aligned for gold to reach new highs amid aggressive repricing of Fed cuts and the rising prospect of a new Republican president1 . With the future market pricing in nearly two 25bp Fed cuts (representing 200% in the chart below), the gold price might have risen even further but failed to do so after Joe Biden's withdrawal from the race reduced the probability of a Donald Trump victory.

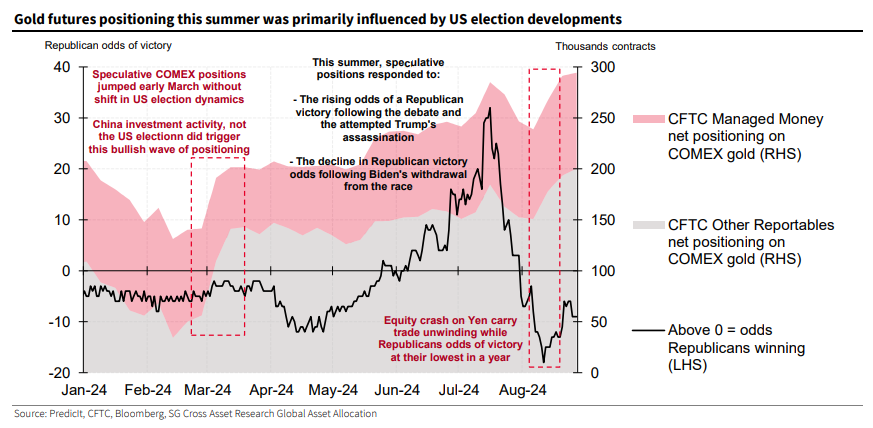

Gold flows sensitive to US election outcome In theory, a potential Trump victory could see the US fiscal deficit widen and uncertainty increase, potentially driving more safe-haven flows toward gold. Although we believe there won't be a significant difference in the deficit whichever candidate wins (unless in the event of an electoral clean sweep), speculative futures markets have been aligned with the above narrative since May. Managed money long positions were opened and closed as the odds of a Republican victory fluctuated, particularly after the first televised debate, the attempted assassination of Trump and when Biden withdrew from the race. Monetary easing, as signalled by Chair Powell at Jackson Hole, looks set to bolster gold in the near to medium term. PredicIt, the online prediction market, along with The Economist’s prediction model, currently favour a Democrat win in the presidential election. A shift back towards a Trump win could lift the gold price ceiling, potentially to record levels. In the event of a red sweep, to which our US economists give a 25% probability, the bolstering effect on gold would accrue, as the new Republican president would have Congressional support to deepen the deficit, increasing the US debt-to-GDP ratio at a faster rate.

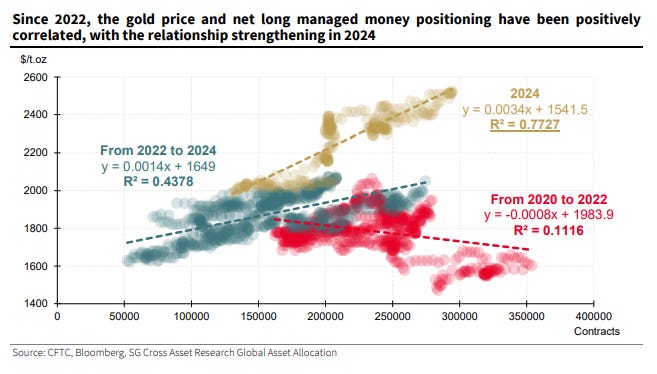

Given the increasing correlation between gold prices and CFTC managed money positioning, tracking gold flows and their underlying drivers is essential.

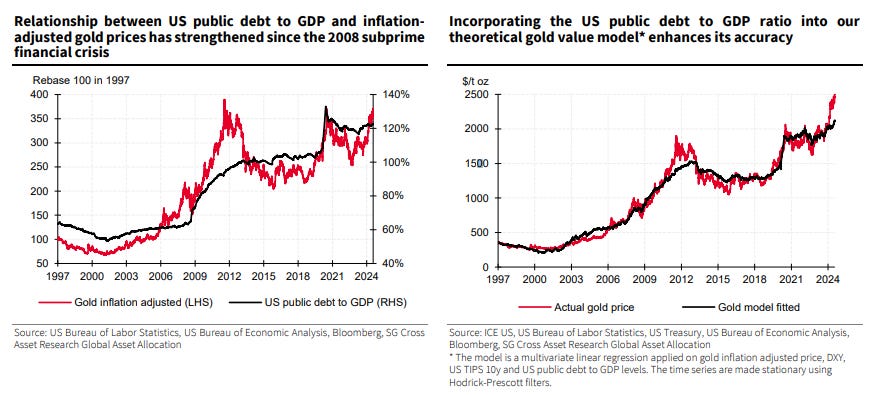

US public debt significantly influences gold valuation Our traditional model, which factors in the DXY and 10y TIPS real interest rates, currently suggests a much lower theoretical value for gold compared to its market price. This points to two potential scenarios: 1) gold is presently overvalued or 2) new drivers are influencing its price. We have consistently maintained that gold purchases by non-Western-aligned central banks represent an emerging bullish driver for gold (Revisiting the drivers of gold – What if non-OECD central banks start buying again?). These purchases, initiated in the aftermath of the 2008 GFC, are largely fuelled by growing doubts regarding the stability of the US-centric global financial system. Therefore, it is logical for us to include a long-term measure of US financial stability such as the ratio of US public debt to GDP.

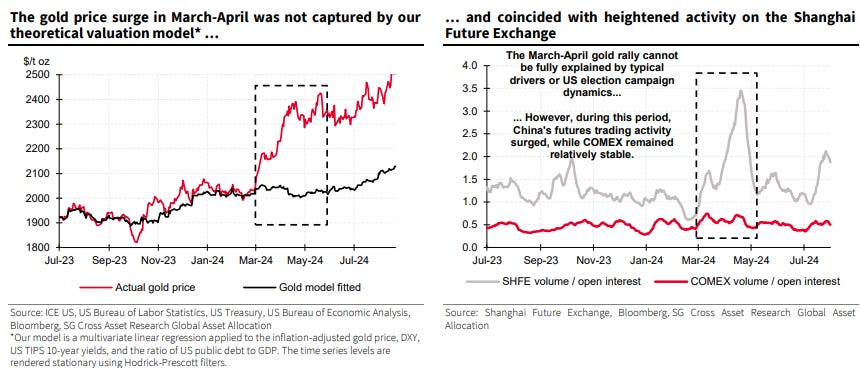

Including US public debt levels in the explanatory model significantly narrows the gap between the theoretical gold value and the actual price. However, the impressive gold rally in March-April remains unexplained. Is there another new driver in town? Chinese investors drove March-April gold rally Speculative COMEX flows show a strong correlation with recent developments in the US election campaign. However, the substantial build-up of long speculative positions in early March cannot be fully explained by these developments. Neither does it align with Fed cuts repricing or a weakening dollar. Although US real rates did not plunge and the US debt to GDP ratio did not rise, the gold price jumped 17.6% in less than two months. A surge in trading activity2 on the Shanghai Gold Futures Exchange (SHFE) coincides with the March-April rally, which our model’s traditional drivers fail to capture. This could help account for the $320/oz divergence recorded on average since the end of the unexplained rally.

Chinese investors, both retail and institutional, have become an increasingly prominent force in the gold market due to limited attractive investment alternatives. With capital tightly controlled, domestic investment opportunities hampered by the real estate crisis, the Shanghai Composite in a two-and-a-half-year decline, and the 10y government bond yield at record lows (now close to 2%), gold has emerged as a viable alternative in China. No indication that central bank gold purchases will ease Central banks set a new record for gold purchases in 1H243 , surpassing the previous half-year record. We expect this trend to persist, driven by consistent underlying factors. A Trump presidency might exacerbate the trend, increasing global uncertainties and, in the event of an electoral clean sweep, further accelerating the growth of US public debt.

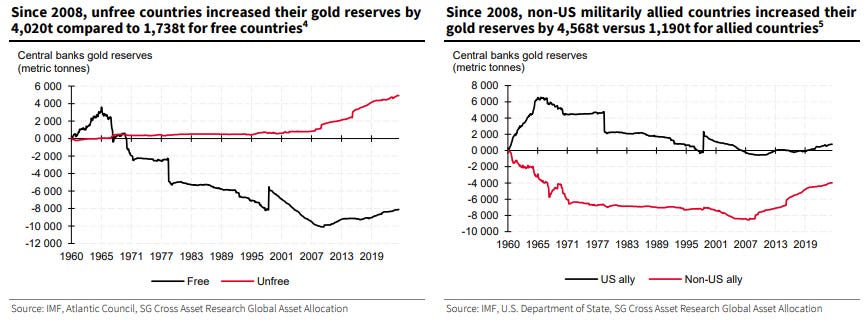

Since the 2008 financial crisis, 70% of central bank gold purchases have come from non-Westernaligned countries, categorised by the Atlantic Council's as ‘unfree’ and without military ties to the US. We attribute this trend to two factors that have gained prominence in the World Gold Council’s 2024 Central Bank Gold Reserves Survey – (1) growing concerns about the sustainability of the US-centric global financial system and (2) increasing apprehension about sanctions. According to our latest Commodities Outlook, non-Western-aligned central banks see gold as a valuable tool for risk diversification, being both credit risk-free and immune to sanctions. Conclusion The gold market rally has recently expanded its list of participants, welcoming some intriguing yet not entirely unexpected drivers – central banks on a gold buying spree, shifting US election dynamics and surging interest from Chinese investors. While traditional drivers such as real interest rates, the strength of the dollar and expected shifts in US monetary policy continue to set the rhythm, these new guests are increasingly shaping the tempo and direction of the gold market. In this evolving environment, we think it is crucial to assess both the potential upside and downside risks to the gold price. In the medium and long term, we see the outlook as remaining firmly bullish, buoyed by US monetary easing and continued central bank gold purchases. In the short term, as the polls currently favour Kamala Harris, any rise in the odds of a Trump victory could potentially inject further momentum into gold’s performance. On the downside, the premium built by Chinese speculative activity may quickly fade if more attractive domestic investment opportunities emerge, particularly with the aid of large stimulus packages, though these are unlikely to materialise until the next US president’s agenda is clearly defined. As our China economists suggest, Beijing may be holding back on deploying major stimulus in order to keep some dry powder to better adapt to the upcoming US foreign policy.