Goldman Sachs

“NVDA” is the biggest stock on the planet from an index correlation, factor and retail momentum perspective. The bar is high, and by high I mean that a big surprise is expected. Implied options move is about 11% for tomorrow after the close.

Some observations from Goldman traders:

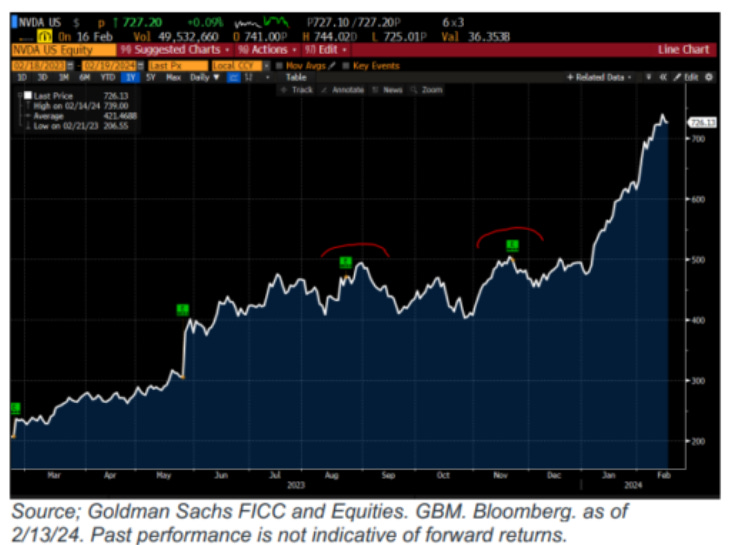

NVDA is now up >50% since last quarter's earnings, surpassing GOOGL and AMZN in market cap in the interim .

Investors are hoping that Nvidia will once again deliver a clear impression of outperforming and surging: for context, Nvidia has outperformed revenue by about $2 billion in recent quarters (vs. cons model, ~$20 billion in revenue January quarterly), which will likely serve as a measuring stick along with comments on the April quarter (remember, Nvidia had guided the January quarter +10% q/q) and the 2025+ roadmap (both visibility + product cadence).

Next catalyst = NVIDIA GTC 2024 | March 18 to 21.

In terms of consensus expectations, the image below summarizes the median estimates, as well as the company's own guidance:

The recent history of NVDA filings has suggested more local top moments than breakout moments...of course, past performance is not indicative of future returns.

Morgan Stanley

NVIDIA (OW, reporting after market close on Wednesday): See a strong quarter in line with recent increases to expectations; focus should shift to new products). We wrote extensively around near term issues at NVIDIA - Raising ests and price target as AI demand continues to surge. While data points are mixed, data points that are closest to end demand seem strongest, and more mixed supply chain data has more to do with non GPU bottlenecks, or the upcoming product cycle transitions from H100 to H200 and B100.

All of that points to a strong quarter; our top line estimate for January of $21 bn is $1 bn above guidance and $700 mm above consensus, and for April we are at $22.8bn vs consensus $22.1. We note that there are sell side previews in print suggesting guidance of $25+; while it's possible revenues could get there, we see the company guiding more conservatively than that at least initially.

With the stock up over 50% ytd already, we aren't looking for an immediate strong reaction to positive results, but we don't expect a selloff either. Our investor conversations are mostly with clients constructive on the stock but worried about near term expectations being too high, which usually creates a benign setup. Further, unlike prior quarters, we do have other catalysts beyond the quarter, with the graphics technology conference event in March where we should get insight into many of the new products. We remain OW the stock.

UBS

A downside surprise from Nvidia would likely trigger a correlated sell-off in the stock market.

An upside surprise, on the other hand, would create a dispersion with AI winners continuing to outperform the rest of the market.

UBS Trading has seen some tightening ahead of the release and the risk-reward seems slightly tilted to the downside considering the crowding.