Nomura: The road goes on forever... and the party never ends (10/02/2024)

Nomura Securities Intl Inc, Charlie McElligott, Equity Derivatives Sales / Strategy, 212 667 2210

This sales note is produced by Nomura Equities and is not a product of the Nomura Research Department

Paying in Rates again, with the market starting to get its arms around the fact that we’d need to see a powerful downshift in Data to get a new leg of Upside in STIRS / USTs / new Steepening in Curves…

But in the meantime, the Powell confidence when highlighting the upward revisions of GDI (“removes a downside risk to the economy”) in addition to the upward revisions to the Savings Rate has given him increased confidence in achieving the “Soft Landing,” which then risks these occasional blasts of repricing the Fed path with less urgency / less ultimate depth

And when you add-in my prior observation that regardless of the immediate depth or urgency of the global cutting cycle commencement—that 1) we are seeing a universal easing in FCI, with 2) Credit / Spreads at tights and 3) Equities at highs--with 4) China stimulating hard--and 5) into a forward fiscal future of “economic populism” with deep deficit spending from the US government, regardless of who wins the election…the fact-pattern is there to see at least see a path to a “resumption of economic animal spirits / reflation” phenomenon –risk at some point next year versus what remains priced-in….hence, the Paying interest, even though the “Left Tail” of a harder Labor slowdown and resumption of “Deep Fed Cuts” -pricing remains “fat”

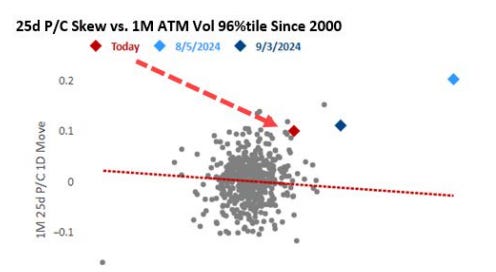

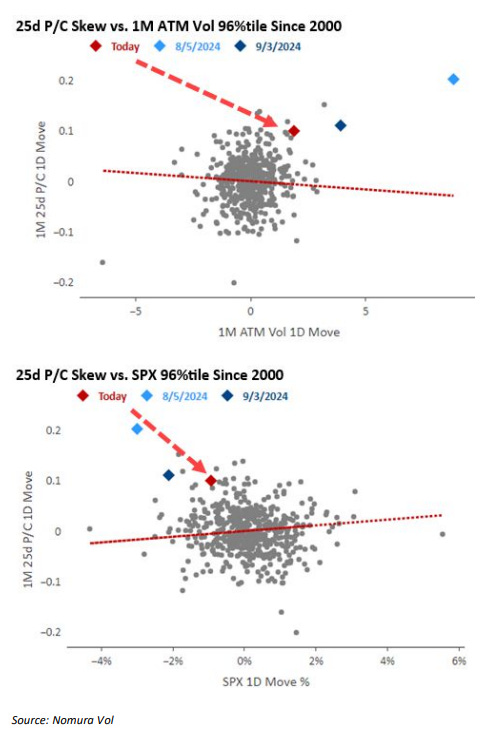

Separately and as alluded to in the quick image drop email y’day morning before I ran into meetings—Equities Index Vol metrics continue to signal real tension, with Skew “skewing” like bonkers across US Equities Indices on a rather impulsive “bid” into Downside Optionality and back to relative rank levels near the Aug / Sep shocks, UX1 Beta to SPX back at extremes, and “Vol of Vol” indicating real “puckering” yet again if Short Vega / short VIX Convexity off fresh demand for Tails

Put Skew bid (OTM Puts over ATM) in SPX QQQ IWM SMH SLV XLY XLI TLT KRE IYR

SKEW RANKS PUSHING BACK TOWARDS THE EXTREMES OF THE AUG / SEP SHOCKS:

Source: Nomura Vol

And yes, OF COURSE there is macro “event-risk” out there with 1) extreme market sensitivity to each-and-every US labor- and global growth- data release as it relates to Central Bank easing path trajectories (particular with Fed back to “data dependency” mode again with their one-trick-pony of “Labor Market” as the singular FOMC reaction function) and now in much-more “real-time” fashion 2) the risk of transitioning from “proxy war” to full-blown “hot war” btwn Israel and Iran…. all that before 3) the standard US Presidential Election “October Surprise” risk in a margin-of-error coin flip race, and running concurrent to 4) a US Port strike with all sorts of implications back into Consumer Sentiment / Inflation data / Election –impact potentials

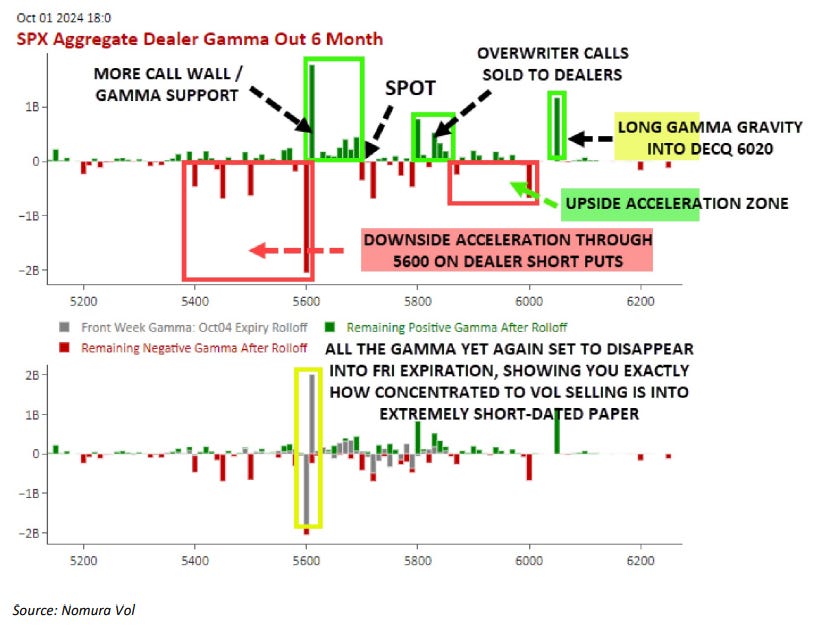

But the end of the day, Eq Index Vol stays “wound so tight” and hyper-sensitive to disruptions for both “mechanical” and “structural” reasons: Namely, because we’ve had two separate VaR events in the Vol –space over the past two months—which not only means 1) ever-tighter “tight stops” and smaller risk-budges on buyside books particularly at the multi mgr / macro VRP pods (ESPECIALLY with crowded “Dispersion” increasingly struggling)…and equally if not moreso important, 2) sellside Options Dealers / MMs simply have been risk-managed into sharply reduced tolerance for PNL events right now into these nascent market disruptions, which is a function of said prior “Vol Events,” which has then meant meaningful cuts to their risk stack / VaR by a “real amount” from what it was just a few months earlier

…and in-turn, this is making the market continue to act so “fragile,” as per Skew / Put Skew / VIX Beta to SPX / vVol which then ripples out into a multi-month bout of performance struggles from Vol space

DISPERSION (VEGA NEUTRAL) PROFITABILITY:

SHORT GAMMA / VOL SELLING BEEN A TOUGH TRADE THE PAST 3M:

Like I’ve said time-and-time-again, in the post- GFC / pos- COVID / post- rolling “Vol Shocks” of the global Central Bank tightening cycle’s collective risk-management and regulatory -regime, it is a non-starter to run a consistently “Short Vega / Short Gamma / Short Convexity” –tilt on these desks beyond tactically…and where most Dealer desks have to “Pay Decay” the majority of time

That said, you have to find ways to tactically trade around that and reduce your PNL drag in certain risk environments…and by-and-large, “Short Skew” is how most of that has occurred in the recent multi-year Vol regime, to try and offset against the Theta bleed

Accordingly, Skew is where we continue to see the pain from STEEPENING whenever Buyside gets motivated to “impulse hedge,” which is exactly where we have been since last Friday

You can see where this is going: You get through Election / “Data Dependency” risk-events, but still with Global Easing / China Stimulus / Bipartisan “Economic Populism” i.e. Fiscal Deficit Spending trajectory to the moon, regardless of Election outcome….you may then get that perverse “Capitulation / Tap-Out” of FORCED HEDGES thereafter which can then spring-board you into the Year-End, hence SPX 6000 -type Calls into the massive Gamma at that DecQ strike…especially as yet again, backtest after backtest shows these “Skew / VVIX –type shocks” shows forward returns with Equities HIGHER and iVol LOWER

Charlie McElligott

Managing Director

Cross-Asset Strategy

Global Equity Derivatives

Nomura Securities International, Inc.

Worldwide Plaza 309 West 49th St. New York, NY 10019

Charlie.McElligott@Nomura.com

O: 212-667-2210

M: 917-297-6468

* THIS IS A PRODUCT OF THE SALES AND TRADING DESK AND NOT RESEARCH MATERIAL *

For Institutional Investors Only