Morgan Stanley: Tesla - 1st Positive Surprise of the Year

Tesla started its Independence Day celebration early with a positive 2Q delivery beat, 33k lower inventory and a large storage beat to remind investors it's not just an auto company.

Deliveries beat, but... 2Q deliveries came to 443,956 units vs. MS at 427,303 and cons at 437,812. While this is one of the first and only positive auto surprises of the year for Tesla, we still believe matching last year’s delivery number would be difficult to achieve. Tesla would have to grow 2H deliveries by around 6% YoY to hold volume flat.

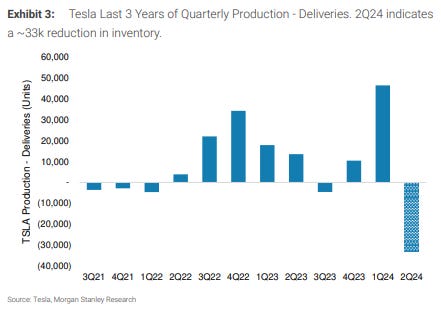

Inventory reduction, a $1.5bn boost to working capital. Tesla delivered 33k units more than it produced in 2Q, driving a 7-day reduction in days' supply of inventory (on a full calendar day basis) in the quarter. The 2Q inventory reduction substantially (but not fully) offsets the increase in inventory seen in 1Q (see chart). At an ATP of $45k/unit this, by itself, drives a $1.5bn working capital inflow during the quarter – higher than the $600mm tailwind we have expected. Our 2Q forecast for $0.9bn FCF burn looks incrementally more conservative following this print.

Energy storage deployments. A ‘show stealer’ from today’s update is the all-time record high stationary storage number (9.4 GWh) for 2Q which is nearly 2x our forecast. As Gen AI acceleration spurs a multigenerational increase in energy demand, electricity generation, and data center investment, we believe investors will begin to pay more attention to Tesla Energy which we value at $36 per Tesla share ($130bn) as the business uniquely positioned to benefit from investment in the US electric grid accelerated by the AI boom.

Tesla getting its mojo back? Little more than 2 weeks ago our clients were preparing for shareholders to reject Elon Musk’s 2018 comp package potentially setting up a change of management and strategy, compounding many months of negative newsflow. Fast forward to today, clients are beginning to ask us about positive catalysts into 2Q results and beyond. We’re getting asked for our proprietary Tesla Energy model and even our Humanoid robot TAM model. Is this the same Tesla from early June?

Our PT of $310 is comprised of 6 components: (1) $67/share for core Tesla Auto business on 6.1mm units in 2030, 9.0% WACC, 13x 2030 exit EBITDA multiple, exit EBITDA margin of 18.4%. (2) Tesla Mobility at $61 on DCF with ~158k cars at $1.8/mile by 2030. (3) Tesla as a 3rd party supplier at $40/share. 4) Energy at $36/share, 5) Insurance at $5/share, & 6) Network Services at $100, 15.4mm MAUs, $180 ARPU by 2030, 50% discount.

Risks to Upside

Disclosure on service revs

Increased FSD attach rate

Cost milestones on new battery

New model intro (Cybertruck, multivan, Semi)

3rd party battery win

Geographic penetration & new capacity

Risks to Downside

Competition: legacy OEMs/Chinese players/big tech

Execution risk: multiple factory ramps

Market does not recognize Dojo-enabled services op, lower than expected attach rate & RPU

China risk

Dilution

Valuation