Jefferies: Tail wags dog (10/03/2024)

Verbier

If anybody needed reminding that geopolitics remains the main risk to markets at present, events over the past week have served as a reminder of that fact. Israeli Prime Minister Benjamin Netanyahu has continued to take advantage of an effective power vacuum in Washington to advance his government’s agenda in a highly effective way, which is fast changing the balance of power in the Middle East. The flattening of Gaza and seeming decapitation of the Hezbollah leadership are historic developments, but they have nothing to do with “two-state solutions”. All this has happened while the Biden Administration has continued to call for cease fires while providing the Israeli Government with continuing funding. This is as dramatic example of the tail wagging the dog that GREED & fear has ever seen.

Meanwhile, Iran has been finally provoked into a response, which seems to have been the aim of the Israeli Prime Minister all along. This should lay the groundwork for further escalation in terms of another Israeli counter reaction. Still, given the supposedly relatively ineffective Iranian response thus far to Israel’s aggression, and given the severe weakening of its proxies, GREED & fear is beginning to wonder if the regime in Tehran risks losing credibility altogether, most particularly the reformist new president Masoud Pezeshkian. For the record, Iran has stated that 90% of its missiles hit their targets in Israel on Tuesday, though Israel states that most missiles were shot down.

The growing confidence of Netanyahu is clear from his public call to the Iran people on Monday to abandon the Islamic regime in place since 1979 and re-ally with Israel (see Politico article: “Netanyahu: Iran regime change will come a ‘lot sooner than people think’”, 30 September 2024). It is worth recalling that the Israeli Prime Minister hosted in April 2023 the 63-year-old son of the former Shah of Iran, Reza Pahlavi (see The Times of Israel article: “Son of last Iranian shah to visit Israel in bid to renew ‘ancient bond’”, 17 April 2023). Meanwhile, it is no surprise to hear that Netanyahu’s popularity is soaring in Israel, which is likely to give him further confidence to continue on his current path. A poll published Sunday for Channel 14 shows that Netanyahu now has much higher ratings than his two main rivals. In head-to-head matchups, he leads former

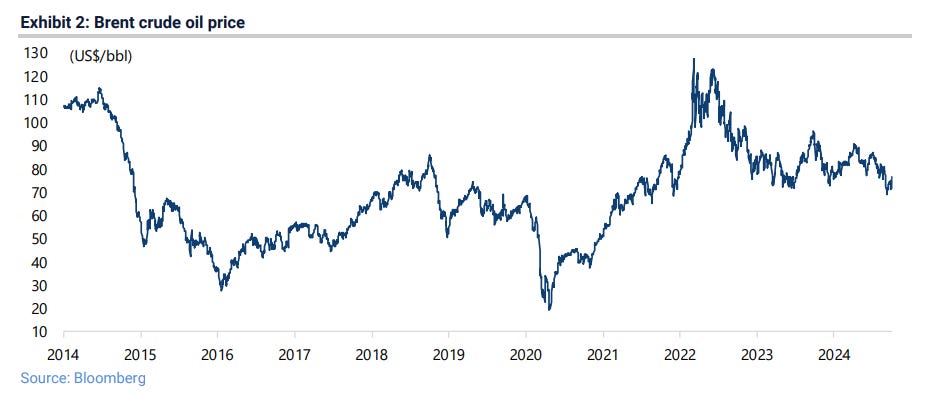

Still, the risk for markets is that Israel attacks Iran in a more direct fashion, that the Iranian leadership finally decides to respond in a more telling way, say by closing the Strait of Hormuz or attacking US military facilities in the Gulf. Iran has stated that should the country be attacked that they would consider attacking America’s military bases in the region.

These are clearly developments which financial markets could not ignore. None of this is the base case but it is certainly not impossible. It is also certainly a reason for investors to maintain energy and gold exposure in portfolios as well as cash, most particularly in the run up to the US presidential election in November, now only 33 days away.

If the Biden Administration has proved extremely ineffective as regards the Middle East, despite ten trips to the region by the hapless Secretary of State Antony Blinken since events on 7 October last year, Joe Biden appears at least for now to have pulled back from the brink in the Russian-Ukraine conflict, in terms of not authorizing Ukraine to employ US, British and French supplied long-range missiles for use deep inside Russia.

Such was the message of an interesting article in the New York Times published at the end of last week (“US Intelligence Stresses Risks in Allowing Long-Range Strikes by Ukraine”, 26 September 2024). The article quoted US intelligence sources as saying that, even if the Ukrainians were permitted to use the long-range missiles, it was doubted that they would have enough of them to alter the course of the conflict in a fundamental way, in part because the US only had a limited supply of such missiles and needed to keep a reserve for its own use. That is beyond the other risk sensibly deterring Biden, namely that Moscow has made it clear that such an authorization would be interpreted as a signal by Moscow that NATO had entered the war directly on Russian soil, risking further escalation that could even turn nuclear.

Meanwhile, an article in the pinko paper the same day on Ukraine was interesting because it all but admitted what has been clear for many months but has too often not been reported by mainstream media. That is that Ukraine is losing the war (see Financial Times article: “Ukraine faces its darkest hour”, 1 October 2024). The article also reported on Ukrainian President Volodymyr Zelenskyy’s increasingly desperate but failed efforts in a trip to Washington last week, both to get permission to use Western missiles for long-range strikes into Russia and to try and achieve concrete progress on Ukraine’s hopes to join NATO.

This trip included an impromptu 40-minute meeting with Donald Trump in Trump Tower. The interchange does not appear to have changed the Republican presidential candidate’s mind on the Ukraine issue. Still, this is a reminder that a Trump victory has a much better chance of resolving one of the two key simmering geopolitical risks, namely Russian-Ukraine. This is also a reason for Putin not to escalate ahead of the November poll beyond the slow but steady progress being made by his forces advancing West. This week the city of Vuhledar in Ukraine's Donetsk region was taken. The other reason for the Russian president to seek to avoid near-term escalation is the BRICS Summit due to be held in Kazan on 22-24 October.

As for Trump’s view on current goings on in the Middle East, he has always been solidly pro-Israel. Still, he does not like wars and he is intrinsically unpredictable. This is a further reason for Netanyahu to use the current power vacuum in Washington to advance his agenda as much as possible, which is what he is clearly doing. Meanwhile, in an outright confrontation between Israel and Iran, the Israeli leader’s calculation will be that America will join in openly on Israel’s side whoever becomes president. This is why attacks on US military bases in the Gulf cannot be ruled out.

Still, in the absence of such extreme outcomes, a Trump victory would likely be risk on for equities given the likelihood of an extension of tax cuts, a deregulation drive and at least a defusing of one of the geopolitical conflicts. But the question right now is what happens in the interim. Meanwhile, if the national polls continue to favour Kamala Harris, the battleground states send the opposite message. And winning the presidency is all about winning the Electoral College. RealClearPolitics’ polling average shows that Trump leads Harris in North Carolina, Georgia and Arizona, while the candidates are tied in Pennsylvania. Trump leads 49.1% to 48.5% over Harris in North Carolina, 49.3% to 47.8% in Georgia and 49.2% to 47.5% in Arizona. In Pennsylvania Trump and Harris are tied at 48.2% (see Exhibit 3). As for national polls, Harris still leads 49.3% to 47.1% over Trump (see Exhibit 4).

The unpredictability of Trump, as well as his instinctive suspicion of the national security lobby, is a reason why GREED & fear continues to view it as wrong to assume a further deterioration in US-China relations if Trump wins. In GREED & fear’s view it could go either way given that relations are already bad.

Still, that is not the issue regarding China which is currently preoccupying investors. As highlighted in the GREED & fear flash published on Tuesday, the China rally discussed here last week has continued, with the CSI 300 Index up 25.1% as of Monday in five trading days before the mainland market closed for a week-long holiday on Tuesday with the next day of trading not until 8 October. Still, the action has continued in Hong Kong this week with China-related stocks, represented by the Hang Seng China Enterprises Index, rallying a further 7.1% on Wednesday following a 17.5% rise in the last five trading days of September, though it corrected by 1.6% today (see Exhibit 5).

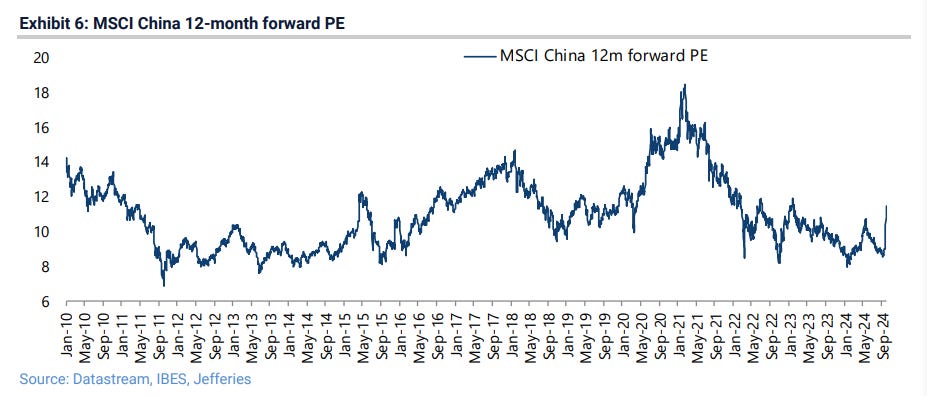

The result is that MSCI China, as of Wednesday’s peak, is now trading at 11.5x 12-month forward earnings, up from 8.5x forward earnings at the recent bottom on 9 September and 8x on 22 January (see Exhibit 6). As a result, the market is now vulnerable again if the recent easing measures do not succeed in triggering a reacceleration in nominal GDP growth, which was only 4% YoY in 2Q23 (see Exhibit 7). Still, in the short-term the market should be underwritten by expectations of a Rmb2tn or higher fiscal stimulus, which will likely be approved by the end of October.

Of the various measures announced last week, GREED & fear hears from Jefferies China economist Shujin Chen that the one which has triggered the greatest excitement among mainland investors is, as discussed here last week, the PBOC’s announcement of its intention for the first time ever to provide a Rmb500bn swap facility where institutions can borrow money to buy stocks and another Rmb300bn facility where companies can borrow to buy back their shares, assuming they want to (see GREED & fear – Reaction functions, 26 September 2024). While the details of the scheme have not even been published yet, the announcement effect has been powerful. This is because mainland investors now assume that a rising stock market has become part of the PBOC’s KPI whereas before this was strictly the responsibility of the CSRC, China’s securities regulator.

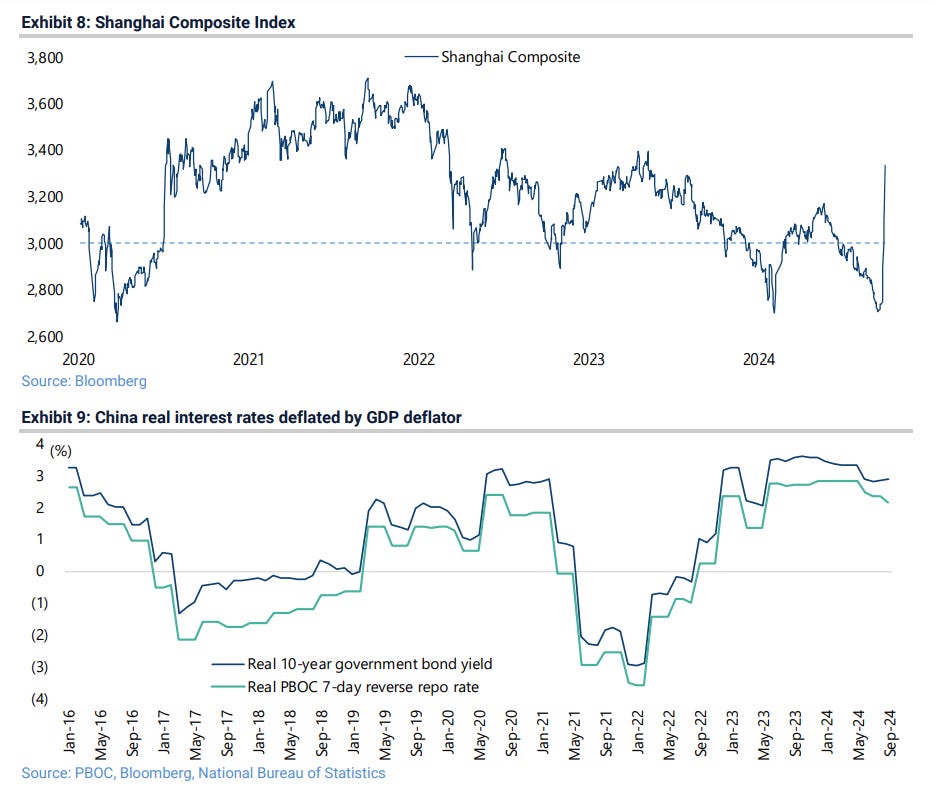

While this may well be the case, with the Shanghai Composite back above the 3,000 level formerly perceived to be the support level for the so-called national team (see Exhibit 8), the same national team may no longer be in a hurry to buy more stock. Meanwhile, the interest rate cuts and the refinancing of existing mortgages announced last week are not by themselves that powerful a stimulus given that real rates, deflated by the GDP deflator, are still 2.18% on the policy 7-day reverse repo rate (see Exhibit 9). It is also the case that refinancing of existing mortgages does nothing to incentivise new buyers of property. The mortgage rate for buying a new house is now 3.5%, which is the level existing mortgages will be refinanced based on current market rates. Meanwhile, the latest property data for September shows no clear sign of a stabilisation in residential housing.

In GREED & fear’s view, what would really excite the market and give further momentum to this rally would be the announcement of policies where government money is used to recapitalize over leveraged private sector players complemented by related bank recapitalisations. GREED & fear hears there is speculation about a government fund being set up to buy up unsold property inventory. Still, if such a development does occur, GREED & fear would be amazed if public money was used to bail out the overleveraged. That would be contrary to everything President Xi Jinping has stood for. Much more likely is that the upcoming fiscal stimulus will comprise transfer payments for poorer households to boost consumption.

Finally, the recent easing package and the market’s dramatic reaction is a further reminder, as noted in this week’s flash, that policy is essentially now made by one man in China and this, in practice, can delay the central government’s policy response. This was a point also made in a recommended article in the Wall Street Journal on Tuesday (see WSJ China article: “And Just Like That, China Did a Policy U-Turn (Again)” by Lingling Wei, 1 October 2024), with the analogy made to the situation in 2022 when the abolition of the zero-Covid policy was delayed until December 2022 after Xi had been reappointed for a third term in October, a delay which undoubtedly served as a catalyst for the intensification of the downturn in residential property from which the mainland economy is still suffering.

Meanwhile, the start of a new quarter is the appropriate time to record the performance of all GREED & fear’s long-only portfolios. It should be noted that none of the portfolios can own cash. All performances recorded are as of the end of last quarter.

The Asia ex-Japan long-only thematic portfolio has now risen on a total-return basis by 3,958% in US-dollar terms since its inception at the end of 3Q02, compared with a 691% increase in the MSCI AC Asia ex-Japan Index and a 984% increase in the S&P500 (see Exhibit 11). This means the portfolio has risen by an annualised 18.3% since inception, compared with an annualised 9.9% increase in the MSCI AC Asia ex-Japan Index and an annualised 11.4% gain in the S&P500.

The portfolio rose by 9.2% last quarter on a total-return basis compared with a 10.6% rise in the MSCI AC Asia ex-Japan Index, reflecting its relatively low China weighting. Still, it remains an outperformer year to date rising by 29.7% compared with a 21.5% gain in the benchmark.

The portfolio remains 49% invested in India, with 10% exposure to China and another 17% allocated to Taiwan and Korean technology. There is also a 9% allocation to Indonesian banks. The portfolio remains primarily geared to the long-term domestic demand story in India.

The Japan long-only thematic portfolio, introduced on 17 March 2005, declined on a total-return basis last quarter by 6.3% in yen terms compared with a 4.9% decline in the Topix. However, in US dollar terms it rose by 5.4% compared with a 6.9% gain in the Topix reflecting yen strength. As a result, it underperformed last quarter in US dollar terms though it is still an outperformer year to date rising by 20.3% in US dollar terms compared with a 12.6% gain in the Topix. In yen terms, it has risen by 22% year-to-date compared with a 14.2% gain in the Topix.

From a longer-term perspective, the Japan portfolio is now up 526% in yen terms and 357% in US dollar terms on a total-return basis since inception, while the Topix has risen by 233% in yen terms and 144% in US-dollar terms over the same period (see Exhibit 12). This translates into an annualised gain of 8.1% in US dollar terms since inception, compared with a 4.7% annualised gain for the Topix. The Japan portfolio remains a combination of domestic demand names and exporters.

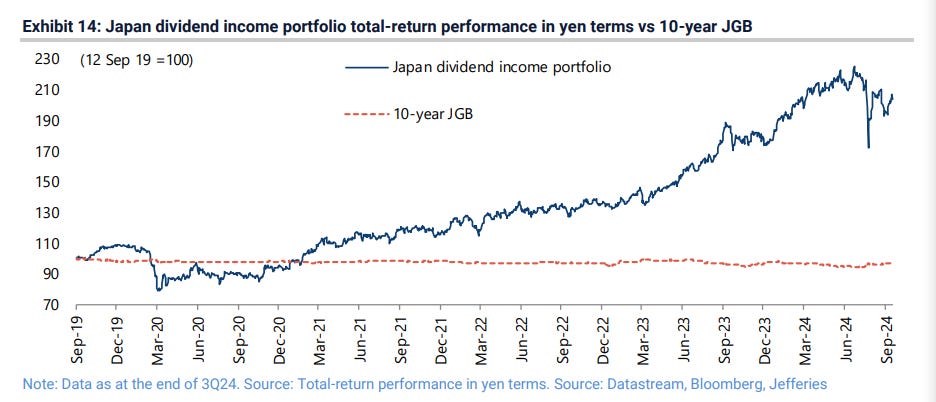

A Japanese equity dividend income portfolio was launched on 12 September 2019 with an average forecast dividend yield of 4.8% to highlight the superior yields to be obtained from Japanese equities relative to Japanese government bonds for yen income orientated investors. It is shown in the table below (see Exhibit 13). The portfolio declined by 6% in yen terms last quarter and is now up 14.9% year to date.

Given this is a dividend portfolio geared to income, the most appropriate relevant performance measure is against the 10-year JGB in yen terms. By this measure, the portfolio has outperformed significantly since inception. The 10-year JGB has declined by 3.3% on a total-return basis since 12 September 2019 compared with a 103.6% gain in the dividend portfolio on a total-return basis in yen terms (see Exhibit 14). The portfolio’s average 12-month forward dividend yield is now 4.0%. It also should be noted, by way of comparison, that the Topix is up 88.9% in yen terms over the comparable period since inception.

The China long-only portfolio, launched on 3 September 2020, rose by 20.7% in US dollar terms last quarter on a total-return basis compared with a 23.6% rise in the MSCI China Index and a 22.1% rise in the CSI 300 Index. Still, it remains an outperformer year to date rising by 32.6% compared with a 29.6% gain in the MSCI benchmark; and also since inception, rising by 9.3% compared with a 23.4% decline in the MSCI China benchmark and a 10.8% decline in the CSI 300 Index (see Exhibit 15).

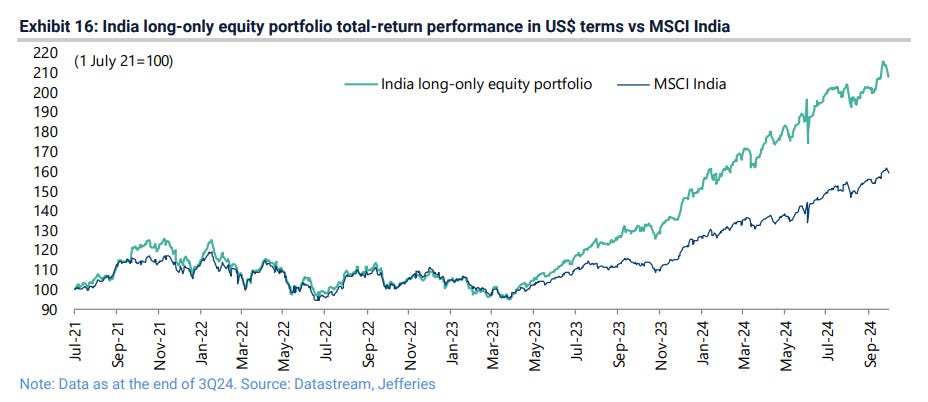

The India long-only portfolio, launched on 1 July 2021, rose by 4.8% in US dollar terms last quarter on a totalreturn basis, compared with a 7.4% gain in the MSCI India benchmark. Still, it remains an outperformer year to date, rising by 38% compared with a 25.8% gain in the benchmark. As a result, the portfolio is up 108.1% since inception compared with a 59.6% increase in the MSCI India Index and a 52.2% gain in the Nifty (see Exhibit 16).

Moving away from regionally orientated equity portfolios, a global long-only equity portfolio was introduced on 19 January 2023 or four days before the announcement of the Microsoft investment in ChatGPT-maker OpenAI served as the catalyst for the AI narrative to drive Wall Street-correlated world stock markets.

This timing proved an initial negative for a portfolio which began with a 66% weighting in Asia Pacific of which 23% comprised India. Still the portfolio is now up 50.3% since inception in US dollar terms on a total-return basis, compared with a 41% gain in MSCI AC World. The portfolio marginally underperformed last quarter rising by 5.9% in US dollar terms compared with a 6.7% gain in MSCI AC World (see Exhibit 17). The portfolio has still outperformed year to date rising by 31.7% compared with a 19.1% gain in MSCI AC World. The portfolio is now 60% invested in Asia Pacific with a 26% exposure to India.

GREED & fear’s global sovereign bond portfolio was launched on 26 March 2020, consisting initially only of Asian government bonds, to highlight the point that Asian and other emerging market local currency government bonds made a better long-term investment than G7 government bonds given the ultra-low, if not negative, bond yields prevailing in the G7 universe at that time. The portfolio is shown below (see Exhibit 18). It now has an average yield to maturity of 6.34%. By contrast, the Bloomberg Barclays G7 government bond index now yields 2.84%, up from 0.35% at the time of the portfolio’s inception.

The portfolio has risen by 28.1% in US dollar terms on a total-return basis since inception, compared with a 15% decline in the G7 government bond index (see Exhibit 19). It has, therefore, outperformed by 50.6% since inception. Last quarter it performed almost in line with the G7 benchmark, rising by 8.1% compared with a 8.0% gain in the G7 benchmark. The portfolio is up 3.3% year-to-date, compared with a 1.7% gain in the G7 government bond index.