January CPI

Starting with commentary BEFORE and then initial reactions

Firm — Headline: y/y%, m/m%, Core: y/y%, m/m%

Barclays — Headline: 2.9%

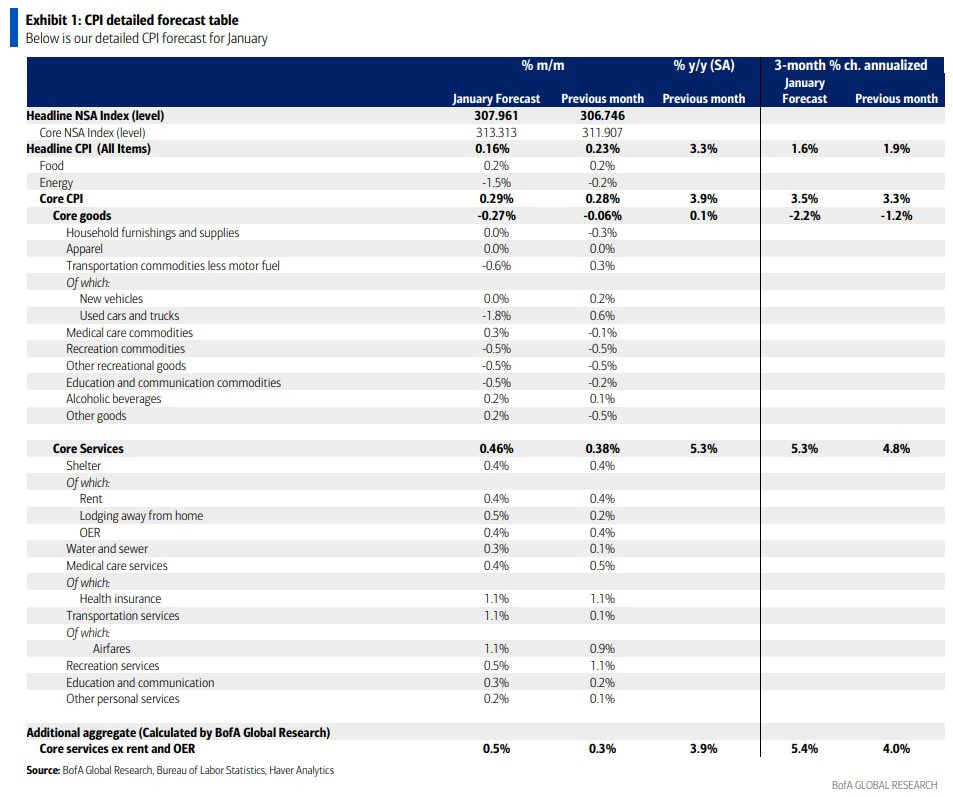

BofA — Headline: 3.3%, 0.2%, Core: 3.9%, 0.3%

BNP Paribas — Headline: 2.9%

Citi — Headline: 2.9%, 0.1%, Core: 3.7%, 0.2%

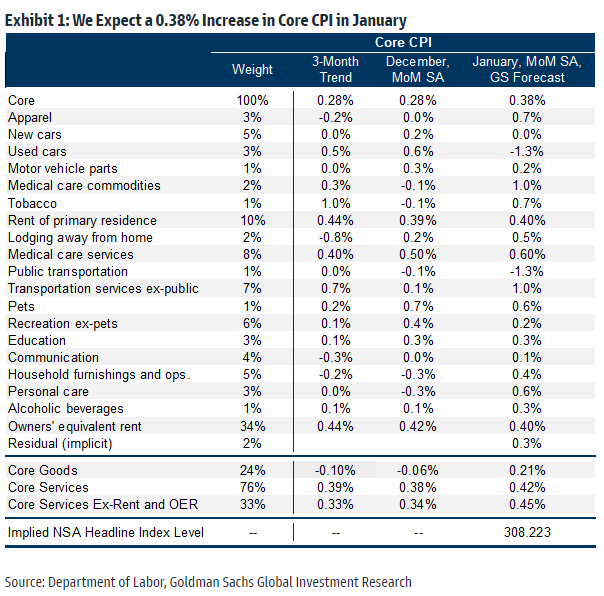

Goldman — Headline: 3.0%, 0.2%, Core: 3.9%, 0.4%

JP Morgan — Headline: 2.9%, 0.1%, Core: 3.7%, 0.2%

Morgan Stanley — Headline: 2.9%, 0.1%, Core: 3.7%, 0.3%

Nomura — Headline: 2.9%

SocGen - Headline: 2.9%

UBS — Headline: 2.9%, 0.1%, Core: 3.7%, 0.2%

Wells Fargo - Headline: 3.0%, 0.2%, Core: 3.7%, 0.3%

Consumer Inflation Expectations:

Barclays

BofA

The inflation outlook is mixed: we see downside risks to housing and used cars in the coming months, but upside risks to growth could mean slower disinflation.

Our analysis suggests that most of the recent strength in consumer spending has been due to supply expansion.

Goldman Sachs

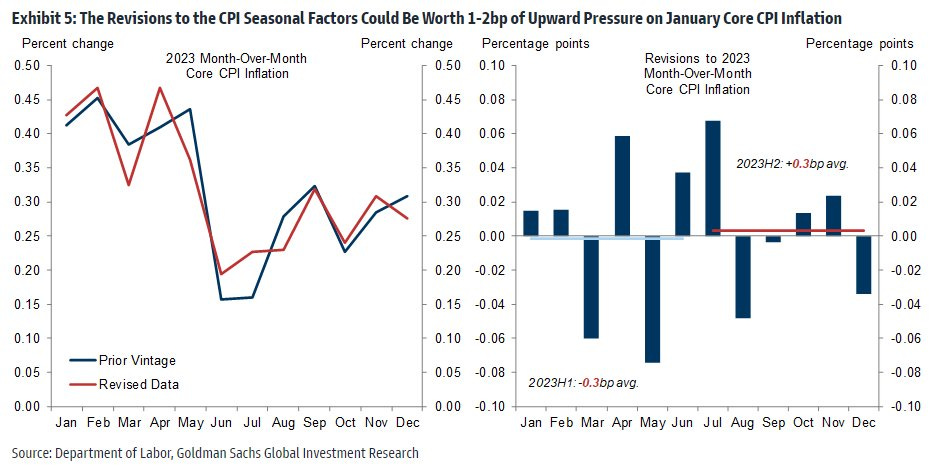

We forecast that core CPI rose an above-consensus 0.38% in January. (vs. consensus 0.3%) and headline rose 0.20%.

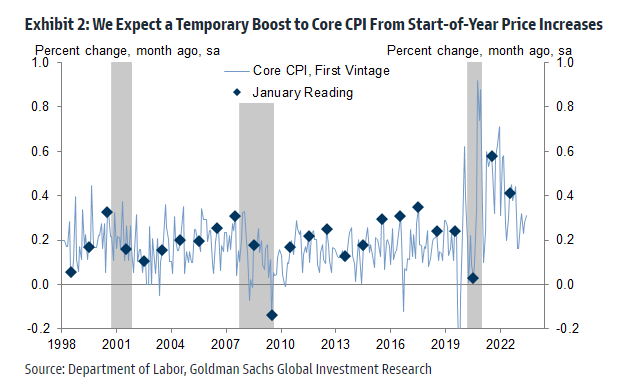

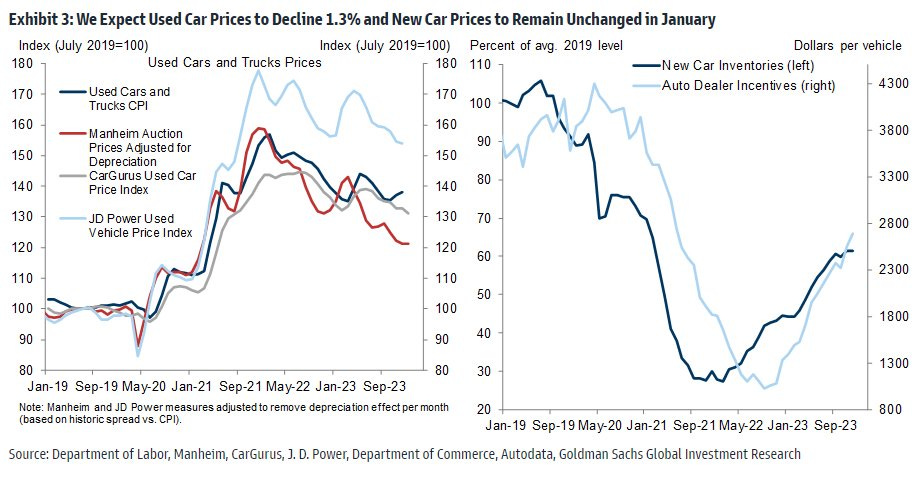

Our core forecast reflects a 0.1-0.15% temporary boost from above-normal start-of-year price increases, including for prescription drugs, car insurance, tobacco, and medical services. We also expect a 0.7% rebound in apparel prices as outsized holiday promotions reverse. On the negative side, we expect a 2% pullback in airfares and a 1.3% drop in used car prices. We are forecasting +0.40% for both rent and OER.

Our core forecast implies a roughly stable year-on-year rate of 3.90% and our headline forecast implies a decline in the year-on-year rate to 3.03%.

A 0.38% increase in January's core CPI (monthly, seasonally adjusted) is estimated, which would leave the year-over-year rate unchanged at 3.9%. The team estimates a 0.20% increase in the headline CPI, reflecting lower energy prices (-2.0%) but higher food prices (+0.3%). The January Effect: The prediction reflects a temporary boost from above-normal price increases at the start of the year, including prescription drugs, auto insurance, tobacco, and medical services.

Mike Cahill (FX Senior Strategist): I think after payroll, the risks are pretty asymmetric for the next CPI data. Even a decent mistake probably won't make the Fed much more confident that inflation is heading sustainably toward 2%, which is the threshold they've set. On the other hand, firmer data combined with much more resilient activity data than they anticipated should have a more significant impact, especially with the position at the front end of the yield curve and the lack of enthusiasm for FX at the moment.

Alan Stewart (FX Trading): The market's reaction would be more significant to a substantial error than to a better-than-expected outcome. In fact, we suspect that the magnitude of the reaction would be significant and relatively symmetrical in either direction. Our expectation is that a substantially better CPI result (which we would rate > 0.2 from consensus) would break the year-to-date highs in the dollar and trigger an upward capitulation move. EURUSD should lead the advance, with a break of the year-to-date lows at 1.0720, precipitating a move back to the October consolidation zone around 1.0600. At G10, we would play this through a long position in NZD, but we believe the best performance would likely come from emerging market currencies such as ZAR and BRL.

Rich Privorotsky (Equity Trading): Stocks have been somewhat disconnected from the interest rate market, as some very strong idiosyncratic returns from the first-quarter numbers have propelled tech/AI/SPX to all-time highs even as the rates market has revalued. Small caps and leverage have been underperforming and I think a bullish outcome for the CPI will be hard to ignore for the market as a whole. On the other hand, a weak result could drive a rotational move given the aforementioned relative underperformance in recent weeks.

Dom Wilson (Senior Macro Advisor): The basic story for us remains that the main challenge is how to remain long equities/risk, which remains the central issue for us given our benign macro view. This week's CPI is exactly the type of risk event for which short-term protection is appropriate. Our 0.4% core forecast would likely further fuel fears that the Fed won't intervene soon, and after the hike, we could see some selling on that. Given we think it's a short-lived issue (and subsequent months' inflation readings will be lower again), that would be a dip to buy in our view, but there is a genuine near-term risk. Likewise, if we end up below (or near) the consensus, there could still be some relief, although I think the downside moves could be larger than the upside moves. Recent realized SPX volatility is a bit above the short-term implied fixation and in recent days of events (FOMC, megacap earnings, CPI revisions) we have been able to overcome that implied fixation. I prefer a long position with short-term options instead of calls, since the slope is still very low and, as we saw on FOMC day, the market has room to realize sharply to the downside. January effects and seasonal quirks mean the variance of this release is probably higher than usual and the tails a little fatter on both sides, which is another reason to have some long gamma. For me, protection is largely about creating the ability to add the delta back if we have a dip.

Joe Clyne (US Indices Volatility Trading): Ahead of the CPI, the situation in stocks and stock volatility is broadly similar to how we have been positioned in recent months. Stock volatility and implied correlation are dramatically low as dealers have been fairly well supplied by systematic volatility sellers and are long volatility and slope. The straddle for the CPI is currently just below 70 basis points. We haven't done much of a close look at the CPI in the last two posts, but we had a nearly 2% rally in November. The desk prefers to have short term option on SPX, but would still have 1 month of delta neutral upside rather than longer expiration or tilt options. The desktop also prefers to have the negative side of Mar QQQ to cover a hot impression. The spread has normalized to SPX after megacap gains, and Mar 420 puts are priced at 2.7 from 436.5. We closed below 420 on January 31st.

Lou Miller (Macro Thematic Structuring): A core CPI print of 0.2 or less would be very good for lagging areas of the market, while a firmer print will make the market more selective as it has been YTD (in line with cuts and the market trading that). There are unique aspects of the market that performed extremely well YTD (AI basket is up >3x QQQ, for example). This is supported by extremely strong earnings results and very strong multi-year themes that are simply not worth fighting for yet. Rather than betting against AI, I like to supplement it with tactical exposure in lagging areas of the market with the view that the macro and monetary environment is quite benign. This is an innocent until proven guilty market with the Fed tapering cycle potentially on the horizon. This makes shorting difficult, and we believe the risk of bullish pressure is high in this environment, and I would quantify factor exposures through Marquee or your preferred risk visualization tool and manage the raw exposure. All moves should be somewhat offset by the market pre-trading a benign print today.

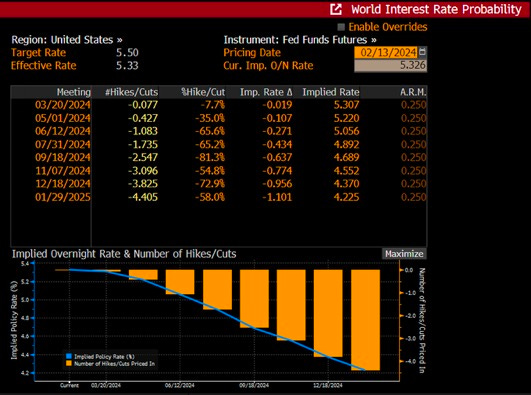

Brandon Brown (Short Macro Trading): Heading into 2024, the consensus among the macro community was that the Fed would likely begin cutting in March and proceed to cut 4-7 times throughout the year. Strong data through 2024 has challenged this consensus: the Atlanta Fed projects 3.4% growth this quarter, unemployment remains at 3.7%, and there is a risk that the CPI MoM rounds to 0.4% on Tuesday (analyst consensus 0.3%, GIR 0.38%). Furthermore, Powell's press conference has worked against consensus; namely, “I do not think it is likely that the Committee will reach a level of confidence by the time of the March meeting to identify March as the time to [cut].” The market is currently pricing in 112 basis points of cuts by 2024. The position is still long short-term interest rates, but has narrowed modestly since the January FOMC. Steepeners are still very popular. In our estimate, a central MoM print that rounds to 0.4 will further deleverage short-term long positions, and allow the curve to flatten. We think this move could be quite painful for the market, and would allow the 2024 fix to move to less than 100 basis points of cuts for the year. Conversely, a downside surprise at a core MoM of 0.2 will allow for a notable rally as confidence in inflation sustainably returning to 2% strengthens. We expect a muted market reaction with a small relief rally of 2-5 basis points on a print of 0.3.

JP Morgan

CPI SCENARIO ANALYSIS

[2.5%] Above 0.40%. The first tail-risk scenario would likely reflect a stronger than expected gain in housing prices and a lower than expected drag from commodity prices. This outcome would trigger a large response in Treasuries with March rate cut expectations going to zero and would likely see a significant decline in May cut expectations (currently ~54%). Further, you would see a material amount of investors questioning rate hikes this year rather than rate cuts. While the bar to rate hikes is likely too high to see the Fed resume its hiking cycle, the uncertainty would induce some large moves. That spike in bond vol would be negative for Equities and Credit. SPX loses 1.75% -2.25%.

[22.5%] Between 0.30% -0.40%, inclusive. Similar to the above tail-risk scenario, the worry here would be clear signs of core inflation accelerating, with headline inflation unable to break below 3%. The market will care about the mix between Core Goods and Core Services. If the hawkish surprise was driven by an acceleration in Core Goods, this may put a greater lens on the supply chain/shipping costs spike induced by events in the Red Sea, potentially adding more weight to future headline risk. SPX loses 1% -1.5%.

[45%] Between 0.20% -0.30%, inclusive. With disinflation firmly entrenched and with virtually all media outlets revealing a 6-month core PCE trend that has already reached the Fed's target, this outcome is aligned with Powell's statement of wanting to see more 'good data' points but not necessarily 'better data' points, relative to the last six months. In this scenario, look for more positive momentum for Equities. SPX adds 50bps - 1%.

[25%] Between 0.10% -0.20%, inclusive. In Jay Barry & team's most recent Treasury Client Survey (here), we saw the fewest net longs since Oct 2, 2023, when the 10Y yield was about 50bps higher than where we closed on Friday (4.175% vs. 4.678%). This outcome could spark demand for longer duration bonds (Jay likes owning 5Y bonds), which could push some of the lagging sectors toward outperformance, especially if we saw a bull steepening of the yield curve. SPX adds 1% - 1.5%.

[5%] Below 0.10%. The other tail-risk scenario, likely driven by lesser than expected gain in housing prices. Similar to the previous scenario, expected a collapse in bond yields triggering an 'everything rally' within Equities. This would likely coincide with the bond market bringing March rate cut expectations back above 50%. SPX adds 2% -2.25%.

Morgan Stanley

We think that core CPI decelerated to 0.26% MoM in January (versus 0.31% MoM in December and 0.3% MoM consensus), bringing the annual rate to 3.7% YoY.

Core services Inflation moves sideways, and goods decelerate due to weak used cars.

Energy prices drop, bringing the headline to 0.14% MoM (2.9% YoY).

Nomura

US core CPI inflation is expected to show a +0.3% MoM increase based on the consensus, the same pace as in December.

Meanwhile, a steady decline from +3.9% in December to +3.7% is likely in terms of yearly inflation, though it is unlikely to significantly alter the market’s expectations about the timing of the first rate cut.

Wells Fargo

We expect inflation to continue to recede and forecast the headline CPI to rise 0.2% in January, which would push the year-ago pace down to 3.0%.

Falling gasoline prices and moderating price increases at the grocery store should keep the headline gain in check.

Core inflation likely continued to cool more slowly last month, and we anticipate the core CPI rose 0.3%, translating to a 3.7% year-ago pace.

We ultimately look for inflation to cool further this year, albeit at a slower rate than in 2023, and believe price growth is still more likely to modestly overshoot rather than undershoot the Fed’s target.

The inflation data will continue to garner most of the Fed’s attention this year as it tries to fine-tune the precise timing of rate cuts.

We continue to believe the first cut will come in May, though risks look tilted more toward June than March based on recent data.

Initial Print

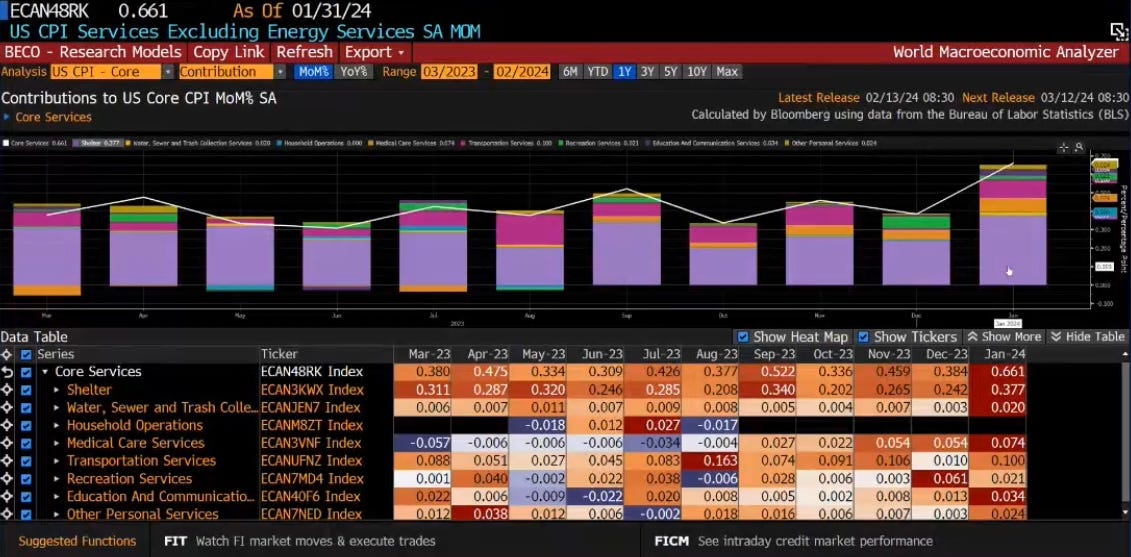

Headline: 3.1%, 0.3%

Core: 3.9%, 0.4%

Fed cuts now seen in June instead of May (prev):

Commentary

Fitch: “This is not a very good number. And it’s not just about rents – medical and transport services inflation also picked up. The Fed was right to sound cautious about the potential for inflation data to deliver some awkward surprises about inflation persistence.”