Goldman Sachs: Year-end commentary (12/27/2024)

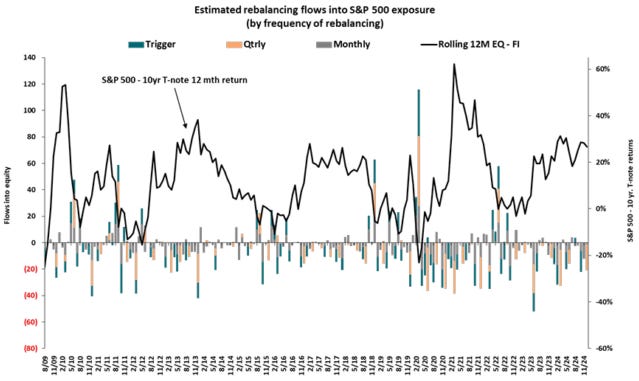

US pension funds to sell $21 billion in stocks

Looking ahead to the end of the month, the trading desk model estimates that US pension funds will sell $21 billion of US equities due to moves in the stock and bond markets. An equivalent amount of bonds is expected to be purchased by the end of the month.

Rebalancing peaked at ~$30B before the market sell-off on Wednesday and is now fluctuating in the ~$20B range.

The $21 billion sales figure ranks in the 86th percentile among all buy-sell estimates in absolute dollar value terms over the past three years, and in the 87th percentile since January 2000.

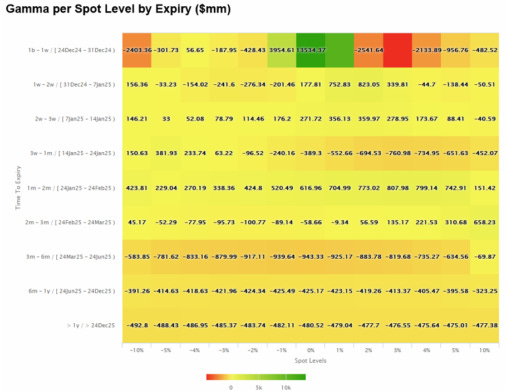

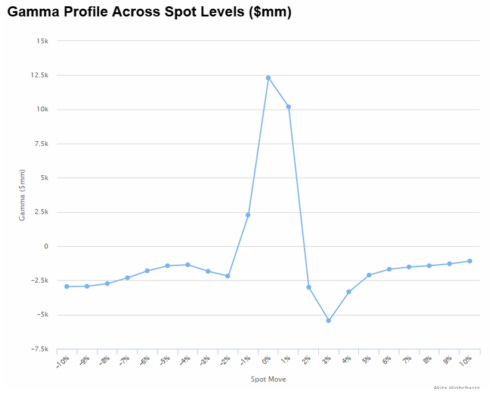

Significant Increase in Gamma

Following the 3% rally in the S&P over the past three sessions, closing near the ~6050 level, our current gamma estimate has risen dramatically: from $1 billion on Monday, to $4 billion on Tuesday, and now stands at $12.5 billion. This level is historically very high!

Historical Gamma at Current Level:

Our “heat map” shows that most of the gamma is concentrated around the current index level and will expire within 1-5 days.

In fact, if the rally continues, that gamma could turn negative very quickly… A 2% move up or down would be enough to send gamma into the negative $2.5 billion range.

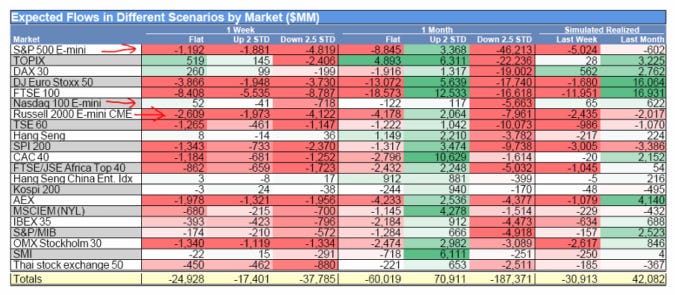

CTA sales are practically over

On Monday I mentioned how the S&P drop following last Wednesday’s FOMC meeting triggered CTA selling… well, that’s pretty much over now. We estimate that CTAs have sold about $7.5 billion worth of US equities in the past 5 days and will sell another $4 billion in the next 5 days.

This amount is small and, considering the high gamma mentioned above, I do not think it will have a significant impact on the market.

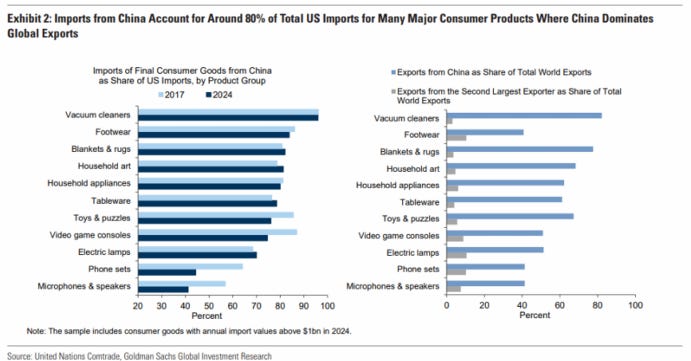

Which sectors of the US economy are most sensitive to tariffs on China?

A second Trump administration is expected to raise tariffs on imports from China by about 20 percentage points on average, with larger increases on nonconsumer goods than on consumer goods.

The United States is heavily dependent on China for certain consumer goods, including:

Durable household goods, such as appliances (10-24% of producer value, adjusted for prices).

Footwear and clothing (10-30%).

Consumer electronics (10-39%), especially phones (39%).

For these products, tariffs in our baseline scenario would increase prices of Chinese-origin goods by 2-10% if fully passed on to consumers, although the impact on average prices of these products (considering all origins) would be only 1-2%.

From a production perspective, tariffs could affect output and profits in three ways:

Increase in the costs of imported inputs:

Exposure is moderate: only in a few industries do Chinese-sourced inputs account for more than 3% of the total value of inputs used by US producers.

The cost of tariffs would represent only 0.5% of the final cost of production even in the most exposed industries, although this could amount to 10-30% of operating surplus in sectors such as machine tools, car bodies, furniture and textile manufacturing.

China's retaliatory tariffs:

These could negatively impact US exporters.

More than 80% of U.S. exports of lumber, grain and animal products go to China, as do more than 50% of soybeans (China's largest export) and nearly 20% of automobiles.

Export restrictions by China:

They could limit American producers' access to critical materials.

More than 70% of imported natural graphite, rare earth compounds and antimony come from China.

Some of these materials cannot be easily substituted or obtained from other sources in sufficient quantities.

These materials are key inputs for batteries, magnets and electronics used in industries such as automotive, smartphones, computer hardware and defense technologies.