Goldman Sachs: Trading desk pre-CPI (11/13/2024)

S&P -29bps closing at 5983 with a $1.2bn market order on close (MOC) to buy. NDX -17bps at 21070, R2K -183bps at 2390 and Dow -86bps at 43910. 14.9bn shares were traded across all US equity markets vs. the full year daily average of 11.5bn shares. VIX -167bps at 14.73. Crude Oil +3bps at 68.01, US 10Y Treasury Bond +12bps at 4.42%, Gold -78bps at 2598, DXY Index +36bps at 105.93 and Bitcoin +111bps at 88993.

Bond markets reopened with a sharp 12 basis point jump in the US 10-year bond yield (now at 4.43%), as investors weigh up the potential upside risk in tomorrow’s CPI, corporate issuance and the implications of the new Trump administration (Trump cabinet appointments Marco Rubio and Mike Waltz, both seen as protectionists and critics of China… widespread weakness seen in Chinese ADRs down 5% and semiconductors down -2%).

The main conversations revolved around the debate on whether higher rates are positive or negative for banks: optimists argue that fixed rate repricing is positive for growth if the slope of the curve is not inflationary, while pessimists point to capital problems and, to a lesser extent, commercial real estate, but focus mainly on the inflationary component and how the Fed's reaction could affect margin recovery.

Beyond rates, equity stance was tilted towards ‘new defensives’ like tech and communication services, and ‘old defensives’ like commodities. There was some reversal in the mag7, outperforming the Russell by ~2.5% and some idiosyncratic moves: HON +4% (crowded short position) on Elliot’s part (getting a lot of flak from the hedge fund community), GEV -6% (other names also weak like VST, CEG, TLN, OKLO, SMR, FLR, article on nuclear capacity in 2050?) and in healthcare more broadly with EPS reactions getting harder to pin down (SWTX, AVDL, SGRY), clinical/safety updates driving some bigger declines (SNDX, NGNE, ELV, EXAS) and GLP-1 complex down after a competitive note on AMGN fell 7%.

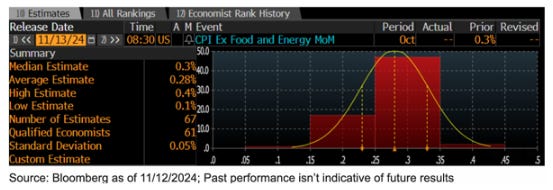

For tomorrow, GIR expects a 0.31% increase in core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.30% (vs. 3.3% consensus), and a 0.19% increase in October headline CPI (vs. 0.2% consensus), reflecting higher food prices but lower energy prices. Overall, we expect monthly core CPI inflation to remain around 0.2% for the remainder of the year, with year-over-year core CPI inflation of 3.1% and core PCE inflation of 2.7% in December 2024.

Our overall activity level was a 4 on a scale of 1-10. Total executed flow ended with a sell bias of -700 million. Flow biases were benign overall as clients remain in digestion mode. Final buy orders were slightly net sellers with supply in macro, materials and healthcare versus demand in discretionary and communication services. Hedge funds also ended slightly net sellers driven by supply (short > long) in financials, macro and discretionary.

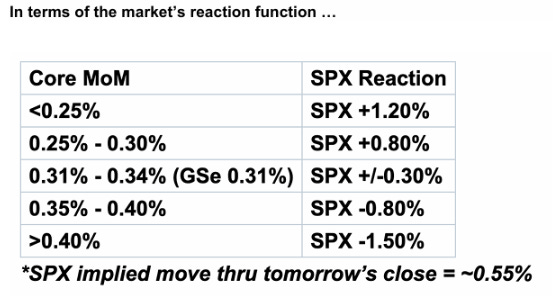

Derivatives : Quieter day on the volatility desk, and despite the drop, call options still accounted for a large percentage of activity (62% vs. 2-year average of 54%). Flow-wise, we continue to see demand in the more cyclical parts of the market, with clients taking advantage of the dip to add to positions in small-caps and financials. XLF traded close to 500k call options today, the second-highest amount in the past three years. Dealers are longing gamma on SPX (now ~$8B), however, length turns short with a 2% increase from here. The straddle for tomorrow is down to 0.55%, the smallest implied move ahead of a CPI report this year.

From GS Research:

We expect core CPI for October to rise by 0.31% (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.30% (vs. 3.3% consensus); link.

Our forecast for October’s core CPI is in line with the pace of the August and September readings, but above the +0.14% average of the previous three readings. Those softer readings were helped by large declines in the airfare component—which declined 3.4% on average—and in the used-car component—which fell 1.1% on average. In October, we expect increases in airfares (+1.0%)—reflecting a modest boost from residual seasonality and strong price trends—and in used-car prices (+2.5%)—reflecting a recovery in auction prices.

We highlight two key component-level trends that we expect to see in this month's report:

We expect another significant increase in auto insurance prices, reflecting continued, albeit slowing, increases in premiums.

We expect the health insurance component to remain broadly unchanged this month as the BLS incorporates updated data on insurance premiums.

Looking ahead, we expect monthly core CPI inflation to remain around 0.2% for the remainder of the year.

As for the market reaction…

Perspectives from GS:

Dom Wilson (Senior Markets Advisor):

The market is focused on the post-election shift, which is the main source of volatility. The FOMC meeting in November offered a “stay the course” message, so significant surprises would be needed to move markets significantly. Our 31 basis point forecast for core CPI is broadly in line, and we expect it to translate into a lower core PCE result (24 basis points). A higher than expected number could fuel the narrative that the fight against inflation is not over yet, especially given the positive cyclical picture the market has priced in since the election. This could lead markets to question expectations for cuts in December and perhaps put some downward pressure on stocks after the rally. While many of the easing expectations for 2025 have already been reduced, a really low number could allow for some relief and upside in stocks. We think asset trends will be influenced by other factors, but we continue to favor upside exposure to US equities (via call options or spreads) along with long USD positions to capture the risk of US rate increases and tariff risks.

Shawn Tuteja (ETF Volatility/Basket Trading):

CPIs have had little impact on broader markets for months as the focus has been on economic growth and, more recently, the election. One post-election factor that has supported equity markets, especially cyclical ones, is the stability of long-term bonds. 10-year yields declined by over 70 basis points from the September FOMC meeting to the election, and many expected a Republican sweep to add another 25-35 basis points to yields. Since the day after the election, implied volatility in rates and equities has declined (the VIX fell from over 23 to under 15). A high CPI could reintroduce volatility into the rates market, and it is hard to imagine an explosive rally toward year-end if 10-year yields cross 4.5-4.55%. As we saw in October 2023, yields above 4.5% on 10-year bonds sparked fears in the equity market. Our trading over the past few weeks has shown consistent buying in financials (KRE, XLF), ARKK, and IWM as the market continues to expect the “Trump trade” to hold for months like in 2016. If the market begins to take a risk-off stance on fears of yields, we imagine large-cap tech will act more defensively against these newly favored sectors. One upside trade we like and believe remains underinvested is a call spread in our AI software basket, GSTMTAIS. The 31Dec 105-115% call spread costs 1.5%.

Joe Clyne (Index Volatility Trading):

Given the Street's positioning for tomorrow's CPI, we don't expect a dramatic reaction in equity markets in either direction. Dealers have plenty of gamma, especially to the downside, as we've rallied through many consistently sold option strikes. This is reflected in a day like today, where on spot downside moves, volatility is sold more aggressively than on rallies or even flat days. On the desk we continue to prefer calls over puts as a hedge, even in a dramatically flat skew scenario we see post-election. We also think the wing may continue to decline in terms of vol/price as the Street receives even more optionality during the week.