Goldman Sachs: Trading Desk 12/15/23

US GS Pension Rebalancing Update… SELLERS. We model pensions as SELLERS of $11 billion in US stocks heading into the end of the month/quarter/year. This ranks in the 67th percentile in terms of absolute value over the past 3 years. Funded Status: GSAM estimates that the funded status of the corporate defined benefit (DB) plan in November was 107.9%. Many plans have continued to gravitate toward higher fixed income allocations due to increased funding levels. This aligns with our current estimates for the December rebalancing.

TONY P MACRO… The first five points… please follow the link to see the remaining 15: LINK

I suspect there is still some gas left in the tank.

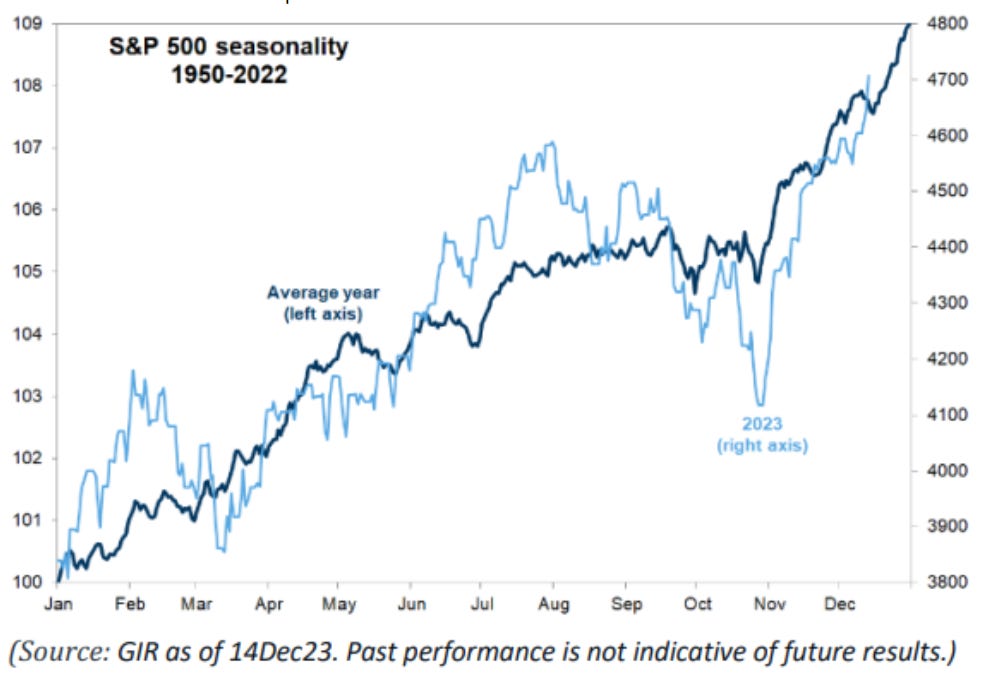

I say this for two reasons: (1) the macroeconomic outlook, primarily the interaction between the Federal Reserve and US growth, has reached a remarkably favorable place; (2) Short-term technical factors, such as seasonality and fund flow, continue to favor the bulls.

This is extraordinarily good news. The market has also noticed it. To be clear: the move from the October lows has been fiery. Consequently, the risk/reward has changed and the current setup is more demanding (I say this specifically with respect to sentiment and risk premium).

So, while I wouldn't limit my imagination at this time of year, I expect an extension of the rally from here to show less speed than what we've seen over the past two months.

What I mean is: from a leap... to a slow advance.

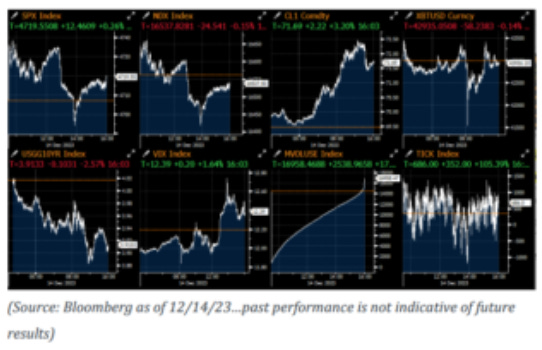

Flows on the US Desk… Overall, the flow executed on our desk ended with a buy bias of +182 basis points versus an average of -15 basis points over the last 30 days. Local operators (LO) recorded another notable buying tilt, adding $894 million in net demand, finishing 465 basis points better in buying. LOs were significant buyers of utilities and we continued to see strong demand in macroeconomic products. Hedge funds (HF) finished 558 basis points better in buying, with the highest demand in Communication Services, Information Technology and macroeconomic products. HFs were net sellers of utilities and were 9% higher in selling commodities, driven by short selling. Overall, volumes were explosive today compared to the 5- and 20-day moving average, but the top of the book was surprisingly light, according to Ari Contessa.

*ACROSS THE POND… Flows on the desk today were better for buying (1.7x). Both LO (60% of flow) and HF (30% of flow) ended with a buy bias (1.4x and 3x respectively). Thematically, there was demand in most sectors, with Industrials, Consumer Discretion and Technology as the 3 most in-demand sectors. On the other hand, there were moderate sales in Finance and Telecommunications.

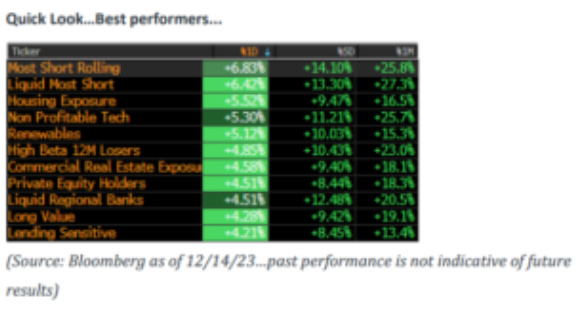

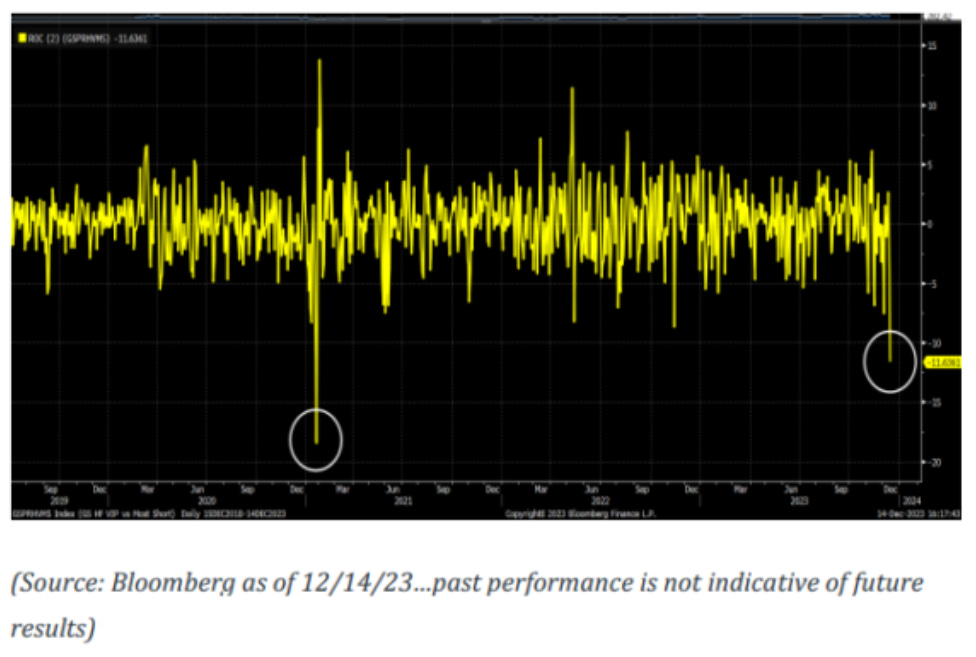

PB Update… Hedge Fund Performance (as of 10am today)… Systematic Long-Short (LS) Strategy Managers are down 2.2%, the worst single day since November 2020. Crowded trades (mainly short positions), momentum and volatility are the main negative factors. They are now down 1.5% month-to-date (MTD), but are still up 13.7% year-to-date (YTD).

Fundamental long-short strategy managers are up 0.2%, now up 1.2% on the MTD and up 8.3% on the YTD.

But the GS VIP Hedge Fund Performance Gauge vs. Shorters (GSPRHVMS… HF Performance Barometer) just completed its worst 2-day streak (-11.6%) since January 2021 (crazy times of memes)…

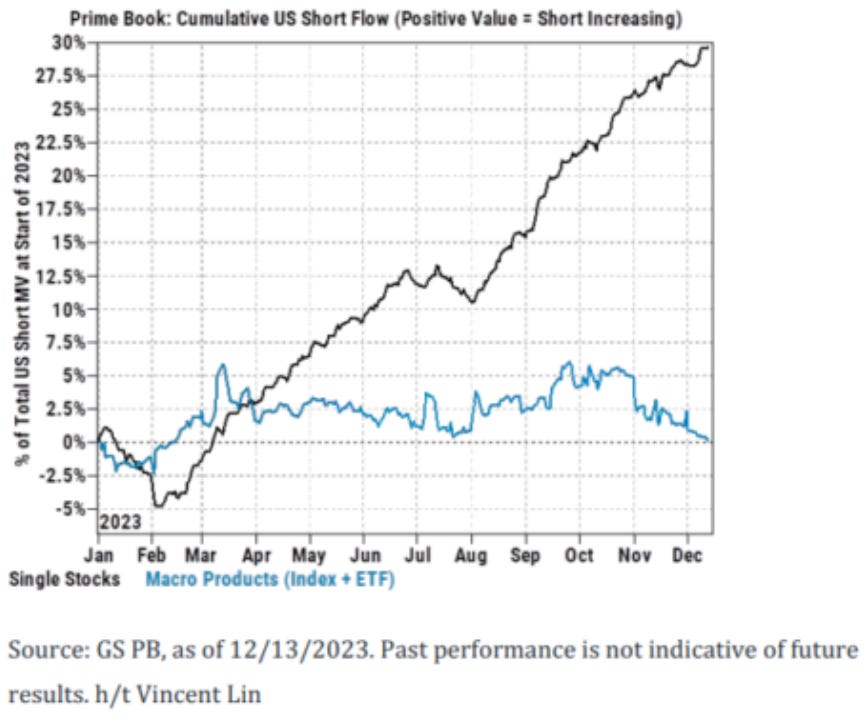

…and short positions remain elevated… According to GS PB data, the cumulative flow of short positions in individual stocks in the US remains near year-to-date highs (i.e., there are still a LOT of short positions in individual stocks that need to be covered), while short positions in macro commodities saw heavy covering and buying last week (the largest in 5 months). Investors continue to make the case for holding longer duration assets in a shortening cycle, and we have seen continued LO demand in names further out on the duration curve into 2024.

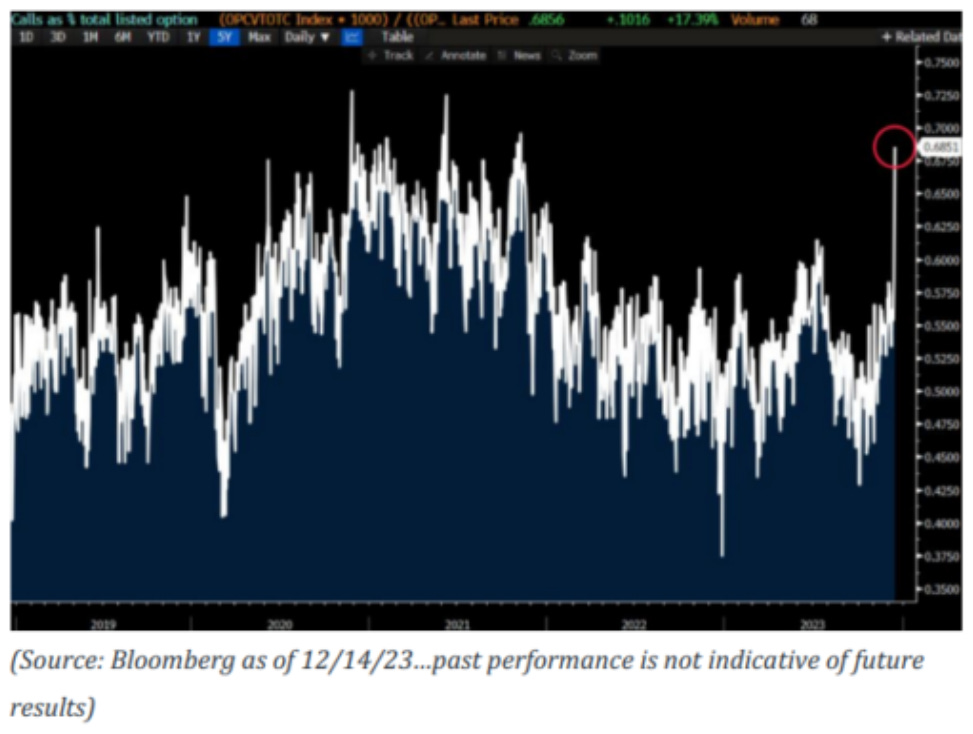

OPTIONS ACTIVITY… This morning, calls represent 68% of total trading volume… These levels are similar to 2021 “yolo” levels. Are retail investors returning for the holidays?

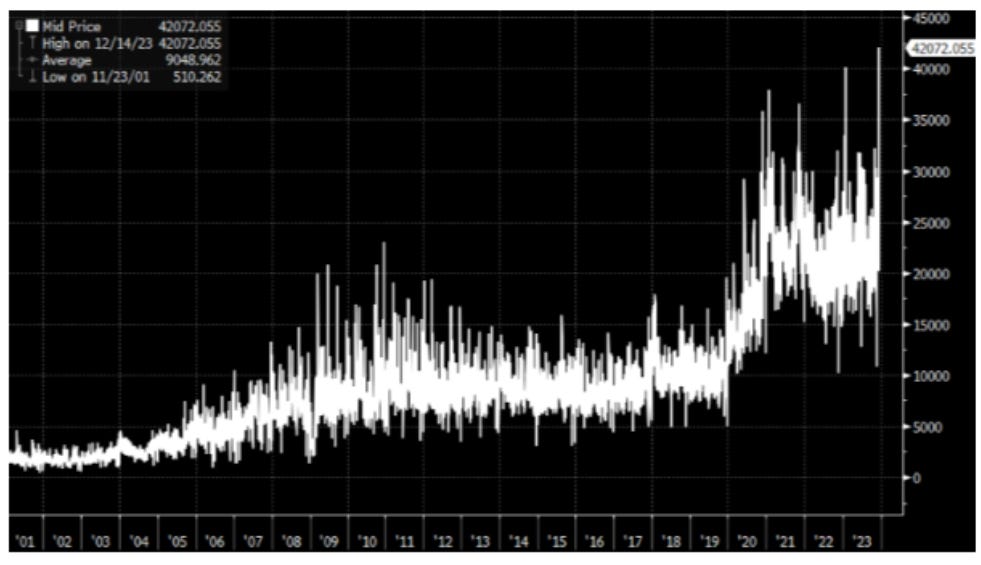

…There were 42 million call options traded across all exchanges today, the most ever, that's a long time.

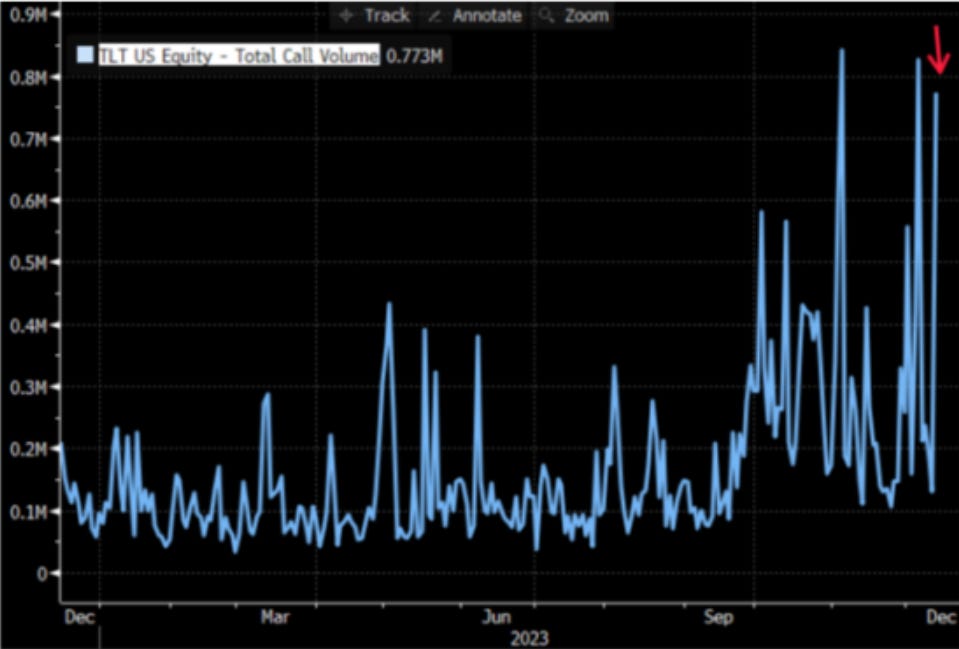

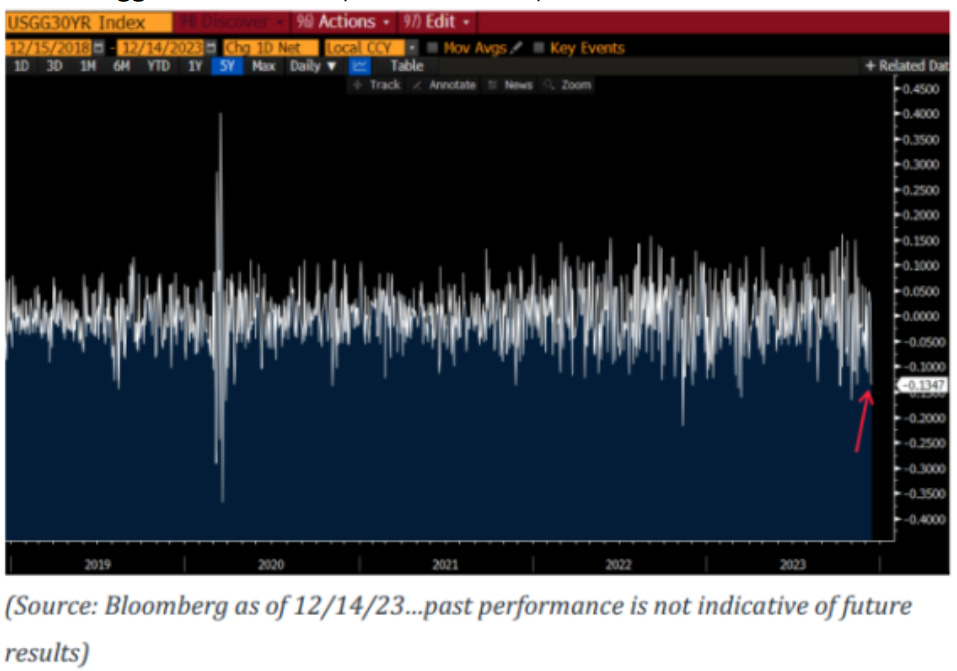

BACK TO THE BONDS: TLT… Options activity on TLT exploded yesterday.

One of the biggest rallies in 30-year bonds today…