Goldman Sachs: Trading Desk 12/12/23

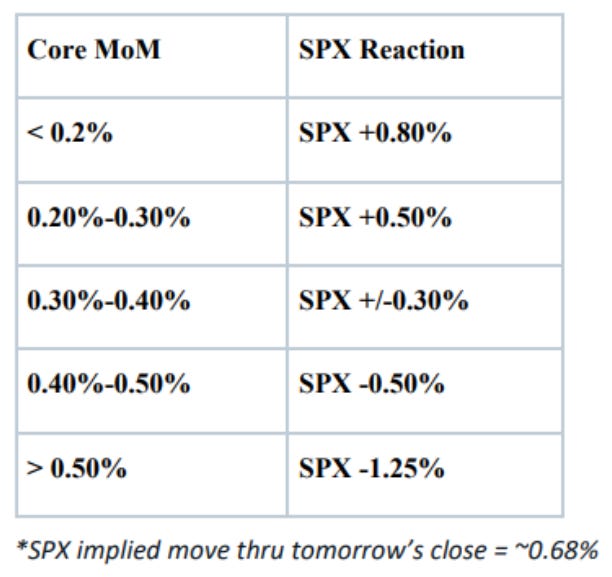

For the CPI

“We estimate a 0.27% increase in the November core CPI (month-over-month, seasonally adjusted), which would leave the year-on-year rate unchanged at 4.0%. Our projection reflects a 0.5% decline in apparel prices due to an earlier start to holiday sales and weakness in online pricing indicated by Adobe's customer base. We also assume a drop in car prices (new -0.3%, used -0.9%), as dealer incentives fully recovered after the UAW strike and used car prices “They have continued to decline.”

Goldman Asset Baskets

A quote from Schiffrin: “My strongest opinion is that disinflation will continue to surprise people by its depth and magnitude; I really feel this strongly. It is difficult to predict a data point, but everything points to ongoing disinflation and I think this creates a very favorable environment for emerging markets.”

Trading Desk

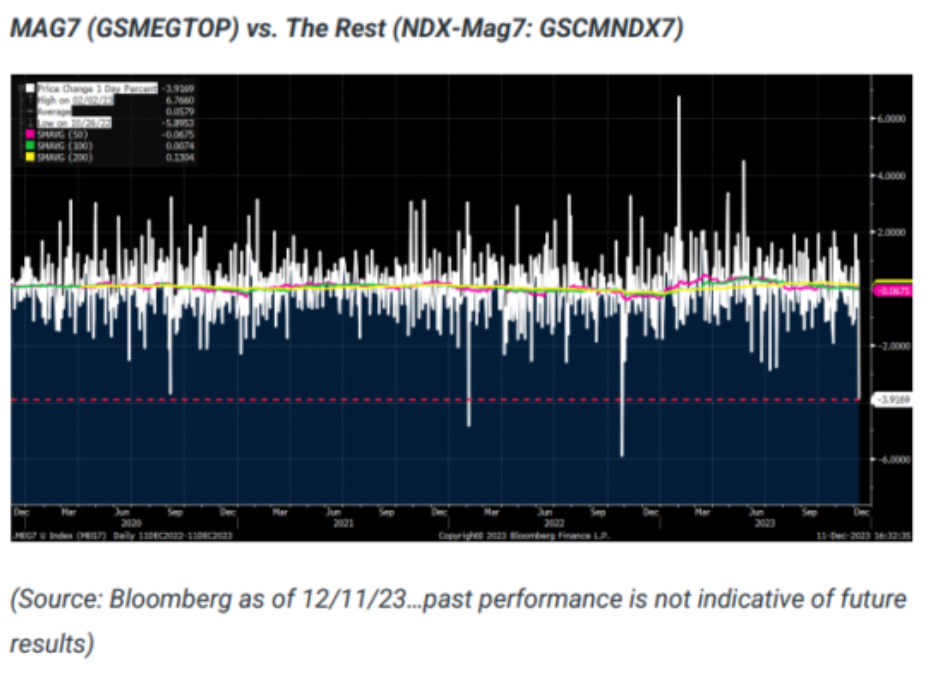

The underperformance of tech megacaps appeared to be a continuation of last week's flow picture, with capital deployed towards the end of the year in lower quality assets, with growth, software and internet being the biggest beneficiaries. Today there was a difference of over 3% between our Profitable Secular Growth Basket (GSCBOSQT) and our Large Cap Technology Basket (GSTMTMEG). Last week, we saw demand from institutional traders (LOs) in names like PINS, LYFT, U, and INTC, with a notable increase in demand for semiconductors on Friday. Today we saw demand tracking in these names. Semiconductor strength was also highlighted, with multiple entries in AVGO +9%, MU +4% and AMAT +5% (appears to be a combination of idiosyncratic news and broader tracking from Friday).

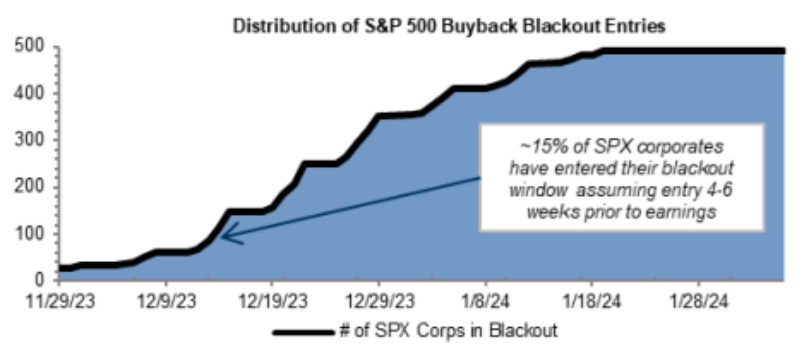

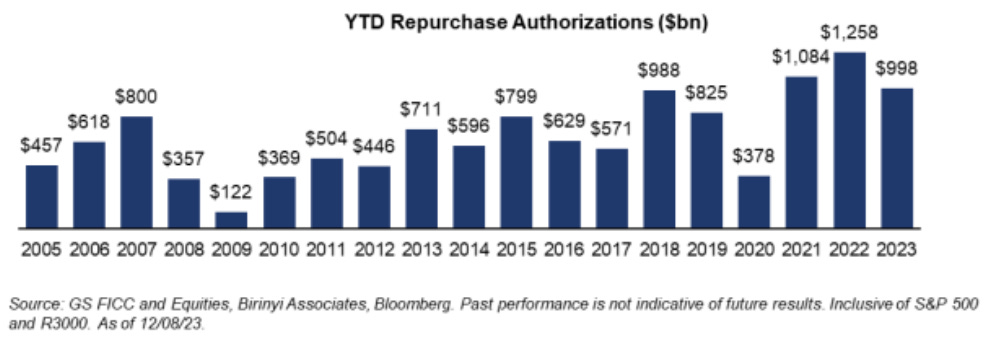

The flow executed on our desk generally ended with a buy bias of +330 basis points. Institutional traders (LO) finished as net buyers +6%, with the majority leaning towards Information Technology, Healthcare and Energy. Hedge funds (HFs) finished +420 basis points better to buy, led by the Consumer Discretionary and Information Technology sectors. We are also in the first week of the estimated buyback lock-in period. We estimate that this blackout period will extend through January 19, 2024. As a reminder, we estimate that companies enter the blackout period approximately 4-6 weeks before earnings reports. Currently, we estimate that around 15% of the S&P 500 is in the lockup window, and around 30% is expected to be in lockup by the end of the week. During the lockdown period, our corporate desktop runs typically decrease by approximately 30%. In terms of authorizations, authorizations to date in 2023 amount to $998 billion, making it the third most active year to date. Greetings to Ari Contessa.”

*ACROSS THE POND… To close the session, the HT desktop finished 1.1 times better for sale. As for clients, institutional traders (LOs), representing 70% of the flow, were 1.3 times better inclined to sell, while hedge funds (HFs), representing 30% of the flow, were 1.5 times better to buy. Thematically, we see net supply in Finance, Telecommunications and Staples (with sales in Supermarkets) versus demand in Materials (buying Chemicals), Healthcare and Energy.

*POSITIONING… Observations from Peter Callahan (TMT Desk Specialist): “Incessant questions about the poor performance of FAAMG (especially META, NVDA) compared to the good performance of everything else (especially semicap and semiconductors). In fact, the Big 7 underperformed the NDX by ~225 basis points today, one of the worst 7 days since 2015. As highlighted in yesterday's note, the growing stream of questions about the stocks' sustainability, that are not from FAAMG, and that have already gone up a lot, just keep coming: think names like AMD, UBER, SNAP, ANET, PINS, NOW, CRWD, IT, CDNS/SNPS, SNOW, KLAC, etc. These types of names underscore a growing debate (and tension) regarding the lack of perceived upside potential in many of the “clean stocks” that are performing, at least in traditional valuation frameworks; However, there is equally not much conviction elsewhere. In summary, it appears we are still in the POSITIONING/FLOWS stage of this “amplitude” correction, and December tends to be a volatile time in price action (see Momentum performance, seasonally weaker in November periods /December January)."

About buybacks

We are in the first week of the estimated buyback lockout period. We estimate that this blackout period will extend through January 19, 2024. As a reminder, we estimate that companies enter the blackout period approximately 4 to 6 weeks before their earnings reports. Currently, we estimate that about 15% of the companies that make up the S&P 500 are in the lockup window, and approximately 30% are expected to be in lockup by the end of the week. Credits to Vani Ranganath for this information.

On the authorizations front, year-to-date (YTD) share buyback authorizations in 2023 total $998 billion, making it the third busiest year to date in terms of share buybacks.

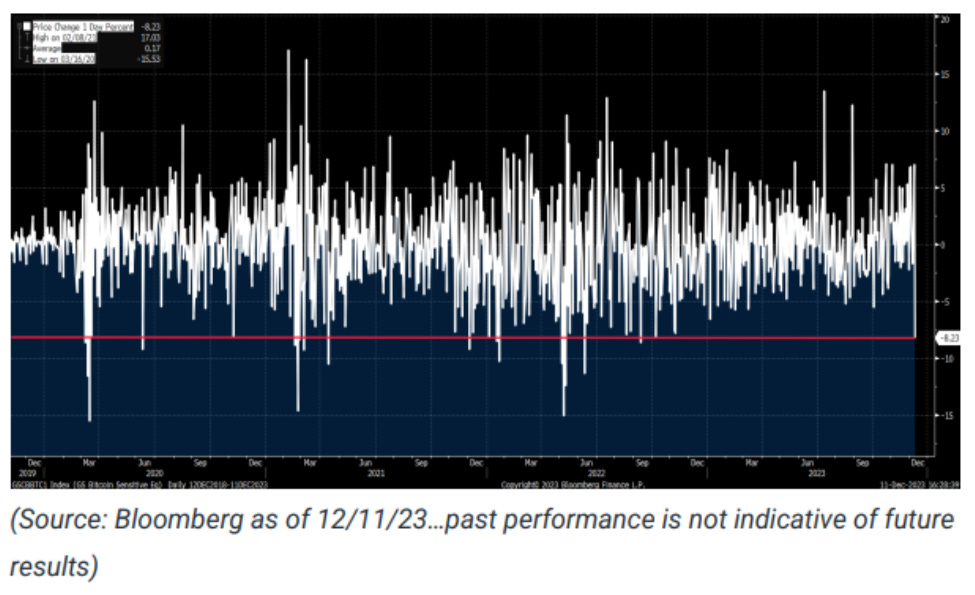

Bitcoin

For a group that has experienced its fair share of volatility, today was one of the biggest single-day moves we've seen in a while.

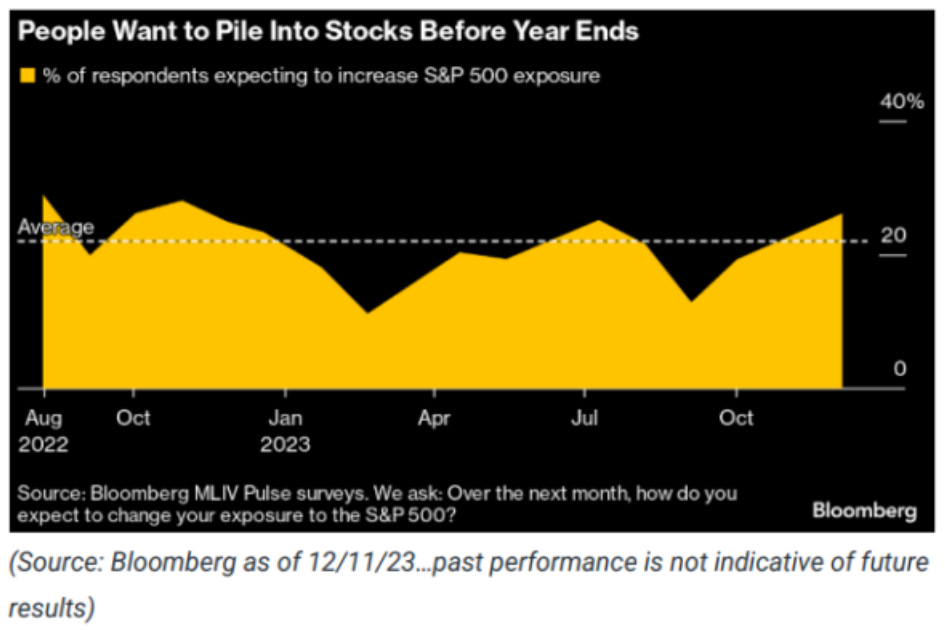

Positioning for the end of the year

According to the latest MLIV Pulse Survey by Bloomberg, about 26% of the 518 respondents in the latest survey said they plan to increase their exposure in the next month, which is above the average of about 22% on a question that asked survey began in August 2022.

China's top leaders began a meeting on Monday to discuss 2024 economic priorities (media reports suggest the government would adopt a GDP growth target of around 5% for next year, the same as in 2023). RTRS

According to U.S. officials and industry security officials, the Chinese military is ramping up its ability to disrupt key American infrastructure, including energy and water utilities, as well as communications and transportation systems. WaPo

Country Garden will avoid its first default on yuan bonds after holders of one security agreed not to demand payment this week, according to people familiar. BBG

The Bank of Japan (BOJ) may not raise rates next week, but such a move is coming relatively soon, and Ueda is keen to prepare markets to avoid surprises. RTRS

UK wage growth slowed to +7.2% year-on-year in October, 80 basis points lower than September and in line with street expectations (wages excluding bonuses cooled to +7.3% from +7.4%) . RTRS

Washington is stepping up its face-to-face military advice to Ukraine and pressuring Kiev to pursue a conservative strategy focused on holding existing territory and increasing domestic weapons production capacity, hoping this will force Putin into negotiations. at the end of 2024 or in 2025. NYT

Netflix (NFLX) has shown interest in purchasing PARA's Paramount movie studio, but talks have "cooled" (Shari Redstone insists the Paramount studio won't be sold separately; if anyone wants it, they'll have to acquire the entire company). WSJ

ORCL (Oracle) (-9% pre-market) reported FQ2 EPS that is essentially in line with 1.34 (consensus was modeling 1.33), but total revenue was lower (FXN revenue growth was 4% vs. Street forecast of 4.75%), while revenue guidance also fell short. RTRS

Google lost an antitrust battle against Epic Games, threatening an app store duopoly with Apple that generates $200 billion a year. A federal jury said Google exercised monopoly power through anticompetitive conduct. BBG

The tenth is the CPI data, which you can see what happened here:

Economic highlights released overnight…

German wholesale prices for November came in at -3.6% year-on-year, a slight improvement from -4.2% in October (Reuters).

Germany's ZEW Expectations Index rose to 12.8 in December, up from 9.8 in November and beating the market forecast of 9.5 (Bloomberg).

Japan's PPI (Producer Price Index) for November cooled to +0.3% year-on-year (down from +0.9% in October), but was slightly stronger than the market forecast of +0.1% (Bloomberg).

UK wage growth slowed to +7.2% year-on-year in October, 80 basis points lower than September and in line with market expectations (wages excluding bonus payments cooled to +7.3% from +7.4% ) (Reuters).

Stay tuned for the following events today…

ANALYST ACTIONS:

AZEK: AZEK rated “Outperform” at Wolfe; PT $43.

ACAD: Acadia Pharma rated “Buy” at Deutsche Bank; PT $25.

ABOS: Acumen Pharma rated “Buy” at Deutsche Bank; PT $8.

ALEC: Alector rated “Buy” at Deutsche Bank; PT $12.

AMAL: Amalgamated Financial elevated to “Overweight” at JPMorgan; PT $29.

AMLX: Amylyx Pharma named as a “Top Pick” at Deutsche Bank for its ALS drug.

BLCO CN: Bausch + Lomb rated “Hold” at Stifel; PT C$21.72.

BLK: BlackRock elevated to “Outperform” on BNPP Exane; PT $885.

BA: Boeing rated “Outperform” by William Blair.

BYD CN: Boyd Group Services elevated to “Sector Outperform” at Scotiabank.

CDW: CDW downgraded to “Equal-Weight” at Morgan Stanley; PT $216.

CPT: Camden Property rated “Equal-Weight” at Morgan Stanley; PT $95.

CPB: Campbell Soup rated “Equal-Weight” at Wells Fargo; PT $47.

CMA: Comerica downgraded to “Neutral” at JPMorgan; PT $57.

CMPS: Compass Pathways ADRs rated “Buy” at Deutsche Bank; PT $16.

CAG: Conagra rated “Equal-Weight” at Wells Fargo; PT $31.

EXP: Eagle Materials raised to “Neutral” at JPMorgan; PT $200.

ECL: Ecolab downgraded to “Hold” in CFRA; PT $193.

EA: Electronic Arts rated as “Peerperform” in Wolfe.

EMA CN: Emera downgraded to “Underweight” at JPMorgan; PT C$50.

FTS CN: Fortis downgraded to “Underweight” at JPMorgan; PT C$53.

FRPT: Freshpet rated “Overweight” at Wells Fargo; PT $90.

GPRO: GoPro downgraded to “Underweight” at Morgan Stanley; PT $3.

GOLL4 BZ: Gol ADRs downgraded to “Sell” at Deutsche Bank; PT $3.

GO: Grocery Outlet downgraded to “Sell” at Goldman; PT $24.

HPQ: HP Inc elevated to “Overweight” at Morgan Stanley; PT $35.

HEI: Heico qualified as “Outperform” in William Blair.

HSIC: Henry Schein elevated to “Overweight” at JPMorgan; PT $82.

HUBS: HubSpot elevated to “Overweight” in Piper Sandler; PT $610.

IMVT: Immunovant rated “Buy” at Deutsche Bank; PT $50.

ITRI: Itron raised to “Neutral” at JPMorgan; PT $68.

SJM: JM Smucker rated “Overweight” at Wells Fargo; PT $140.

KRTX: Karuna Therapeutics rated “Buy” at Deutsche Bank; PT $227.

K: Kellanova rated “Equal-Weight” at Wells Fargo; PT $56.

LRCX: Lam Research downgraded to “Hold” at Deutsche Bank; PT $725.

LW: Lamb Weston rated “Overweight” at Wells Fargo; PT $120.

MON CN: Lundin Mining upgraded to “Neutral” at JPMorgan; PT C$8.90.

MFC CN: Manulife Financial elevated to “Outperform” at RBC; PT C$34.

MLM: Martin Marietta elevated to “Overweight” at JPMorgan; PT $530.

MAA: Mid-America rated “Equal-Weight” at Morgan Stanley; PT $128.

NMRA: Neumora Therapeutics rated “Hold” at Deutsche Bank; PT $13.

NBIX: Neurocrine Bio rated “Buy” at Deutsche Bank; PT $136.

NKE: Nike elevated to “Buy” at DZ Bank; PT $130.

ORCL: Oracle Falls on Unsatisfactory Cloud Sales: Wall Street Roundup.

PVH: PVH raised to “Buy” at Goldman; PT $126.

POST: Post Holdings Rated “Equal-Weight” at Wells Fargo; PT $92.

PRTA: Prothena rated “Buy” at Deutsche Bank; PT $62.

RL: Ralph Lauren elevated to “Neutral” at Goldman; PT $132.

RNG: RingCentral downgraded to “Hold” at Jefferies; PT $35.

ROIV: Roivant Sciences rated “Buy” at Deutsche Bank; PT $14.

RXST: RxSight rated “Buy” at Stifel; PT $40.

SAGE: Sage Therapeutics rated “Hold” at Deutsche Bank; PT $21.

SRPT: Sarepta rated “Buy” at Deutsche Bank; PT $109.

SRE: Sempra elevated to “Overweight” at JPMorgan; PT $86.

SHOP CN: Shopify downgraded to “Sell” at DZ Bank; PT C$88.25.

SKWD: Skyward Specialty Insurance Group rated “Buy” on Jefferies.