Goldman Sachs: Trading Desk 04/17/2024

Bank of Japan board member Asahi Noguchi said on Thursday that the pace of future rate hikes would likely be much slower than global peers in recent policy tightenings, as the impact of rising rates domestic wages has not yet been fully transferred to prices. RTRS

A US Congressional effort to force TikTok's Chinese owner to divest from the app has gained steam after House Speaker Mike Johnson unveiled a new package of legislation that could force the Senate to support the extent. FT

Berkshire Hathaway priced ¥263.3 billion ($1.71 billion) of bonds in the firm's largest yen debt offering since its debut sale in 2019. The surprisingly large offering raises speculation that Warren Buffett could be planning another foray into Japanese stocks. BBG

TSMC's recovery accelerated, with “extremely high” AI demand strengthening its prospects. The chipmaker expects revenue to grow as much as 30% this quarter following its first profit increase in a year. Chip stocks could see some relief in results. Nvidia rose before the market opened, as did ASML stock. BBG

European diplomats traveled to Israel on Wednesday to make a final call for restraint in response to the airstrike Iran launched this weekend, but Britain's foreign secretary acknowledged that an Israeli retaliation seemed inevitable. NYT

The Fed's Mester says the central bank will need additional time before deciding when to begin rate cuts, but expressed confidence that the disinflationary process will eventually resume. Barron's

Corporate pension funds are moving money into bonds. State and local funds are exchanging stocks for alternative investments. The nation's largest public pension fund, the California Public Employees' Retirement System, plans to move about $25 billion out of stocks and into private equity and private debt. WSJ

The Biden administration said Wednesday it would allow some U.S. and European oil companies to remain in Venezuela after U.S. efforts to persuade President Nicolás Maduro of democratic reforms by lifting economic sanctions ended in a tightening of his authoritarian regime. WSJ

Cash paid out by private equity funds has fallen to its lowest level in a decade, leaving investors less able, or willing, to allocate new money. As a result, the biggest backers want acquisition executives to put up more of their own assets, leading them to load up on debt and pledge personal possessions, including their homes. BBG

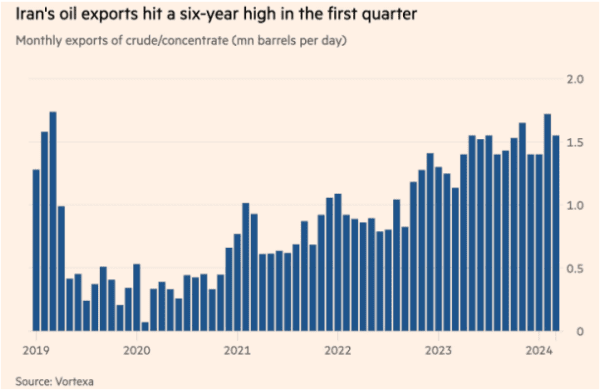

Iran is exporting more oil than at any time in the past six years, providing a $35 billion-a-year boost to its economy even as Western countries discuss stepping up sanctions in response to its attack on Israel. Tehran sold an average of 1.56 million barrels a day during the first three months of the year, almost all of it to China and its highest level since the third quarter of 2018. FT

S&P closed down 22 basis points, hitting 5,011, with a $1.5 billion market close order (MOC) to buy. The NDX declined 57 basis points to 17394, the R2K fell 26 basis points to 19142, and the Dow rose 6 basis points to 37775. 10.5 billion shares were traded across all US stock exchanges, compared to the daily average of 11.5 billion shares to date. The VIX decreased 115 basis points to 18.00, crude oil fell 22 basis points to 82.51, 10-year treasury bond yields rose 4 basis points to 4.64%, gold rose 74 basis points to 2378, the US dollar index rose 21 basis points to 106.17, and bitcoin rose 438 basis points to 63,523.

Stocks are now down for five consecutive sessions on a possible change in narrative by the Fed and an increase in interest rate volatility (the VIX is now near its six-month high). Trading duration increased sharply today due to stronger than expected data from the Philadelphia Fed Index and hawkish comments from the Fed: *WILLIAMS: RATE INCREASE NOT THE BASIS, BUT POSSIBLE IF THE DATA JUSTIFIES IT; *BOSTIC: WE WILL NOT BE IN A POSITION TO REDUCE RATES UNTIL THE END OF THE YEAR; *KASHKARI: COULD WAIT UNTIL 2025 TO LOWER RATES... 10-year treasury bond yields rose ~5 basis points to 4.64%.

More risk-on selling price action within tech, with weaker semiconductors following TSM -4.8% drop on 'within expected range' print (lacked 'wow factor' + some debate on outlook trajectory (FY, ASML was down another -2% following weaker top line results yesterday). Antennas are a little alert now with Semiconductors DOWN ~12% from highs (below the 50-day moving average for the first time since last fall). After the Close: NFLX -4% fell after the close on a strong EPS release and beat...again amid high expectations, competition, and the fact that the company will stop reporting quarterly membership numbers next year.

Our desk was a level 5 on a scale of 1-10 in terms of overall activity levels. The flow run on our desk ended with a buy bias of +75 basis points compared to the 30-day moving average of -104 basis points. It was a successful debut for Ibotta (IBTA), priced at $88, it opened at $117 with 485k shares, and closed at $103.25. Local operators ended with -6% as net sellers, driven by the offer in macro and rate-sensitive products. Hedge funds finished +2% as net buyers, driven by scattered demand in communication services, financial services, basic products against supply in discretionary and technology. At the top of the chart: Sensitive Bitcoin +2.6% (BTC halving event is scheduled for 4/20), Copper +1.6%, and Chinese ADRs +76 basis points. At the bottom: Casinos (LVS -8% missing in Macau), Renewables, Obesity Drugs and AI all down more than 1%. Watching AXP and PG reports for tomorrow morning.

DERIVATIVES: Today we saw a round trip in spot/volatility. During the morning rally, volatilities sold aggressively, and when the spot turned lower in the afternoon, volatilities gained interest as a couple of indices are close to the 100-day moving average. In general, the flows were inclined towards the sale of volatility in the medium and long terms. The slope leveled off as more than 49% of total options volume were puts, the fourth highest this year. Dealers have around ~1 billion SPX gamma in spot heading into tomorrow's OPEX, where we don't expect any surprises. Friday's straddle is at 76 basis points. (h/t Braden Burke)