Goldman Sachs: Trading Desk 04/03/2024

Taiwan was hit by its strongest earthquake in 25 years, toppling dozens of buildings on the island's eastern side. At least nine people died, according to Taiwan's emergency services. TSMC halted some chip manufacturing and evacuated plants. (BBG)

NATO is drawing up plans to secure a military aid package of up to $100 billion over five years, in a bid to protect Ukraine from the “winds of political change” that could bring a second Trump presidency. (FT)

In meetings in Guangzhou and Beijing, Yellen is expected to tell her Chinese counterparts to stop relying on exports to sustain their underperforming economy and instead boost their own consumer market. Yellen's warning is a sign that the Biden administration is moving toward increasing Trump-era tariffs on some Chinese goods, including electric vehicles. Such a move could reignite tensions between the world's two largest economies, which have attempted to stabilize relations in recent months. (WSJ)

Eurozone CPI for March falls slightly below expectations, registering +2.4% in the headline indicator (down from +2.6% in February and below the market forecast of +2.5%) and +2.9 % in core (down from +3.1% in February and below the market forecast of +3%). (BBG)

Joe Biden chided Israel for not doing enough to protect civilians and aid workers in Gaza, some of his harshest criticism yet of the country's conduct. The comments echo rebukes from the United Kingdom and Australia as Israel's global isolation grows. (BBG)

U.S. auto sales in March stood at an annualized rate of 15.5 million last month, down from 15.8 million in February and below the consensus forecast of 15.9 million, while average sales prices fell 3.6% year-on-year (the largest drop recorded in the month of March) and discounts increased by ~66%. (Marketwatch)

The rebound in crude oil led the United States to cancel plans to buy up to 3 million barrels for its strategic reserve. Separately, US stockpiles are said to have fallen by 2.3 million barrels last week, API reported, and OPEC+ could today confirm its current supply cuts. (BBG)

Loretta Mester, president of the Cleveland Federal Reserve and a voting member of the Federal Open Market Committee, revealed in a speech Tuesday that she has raised her estimate of the long-term federal funds rate from 2.5% to 3%. (FT)

Disney secured enough votes ahead of today's shareholder meeting to defeat a challenge to its board from Nelson Peltz's Trian, Reuters reported. (BBG)

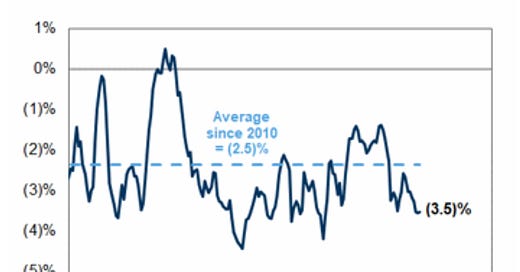

Outflows from active mutual funds have accelerated…

The S&P rose 11 basis points, closing at 5211 with a $1.6 billion Market Order (MOC) to SELL. The NDX was up 21 basis points at 18160, the R2K was up 54 basis points at 2076 and the Dow was down 11 basis points at 39127. 10.9 billion shares were traded across all US stock exchanges, versus the daily average year-to-date of 11.6 billion shares. VIX down 192 basis points to 14.33, crude oil up 52 basis points to 85.59, 10-year Treasury yields down 2 basis points to 4.34, gold up 76 basis points to 2,298, dollar down 52 basis points to 104.27 and bitcoin rose 14 basis points to 65796.

Stocks appreciated the more dovish ISM Services reading, which neutralized returns from pre-market highs after the hot ADP reading (+184k vs. +150k consensus). Clearly, we are still in a market where bad data equals good market. Yes, the ADP is noisy, but it adds evidence that the hiring pace was solid. GIR increased our NFP forecast by 25k to +240k ahead of Friday's report (not seasonally adjusted). Despite “Reflationary” price action across the board (rates, copper, energy, reflation basket, etc.), big tech traded well…it looks like the macro temperature is still “good enough.”

Headlines that grabbed attention: GOOGL up 2.5% in the aftermarket… “Google considers charging for AI-powered search in big business model shift” + “Apple explores home robots as the 'next big thing' after that the automobile fails.” Powell = status quo. *POWELL: DON'T EXPECT CUTS UNTIL YOU HAVE MORE CONFIDENCE IN INFLATION. *POWELL: I DON'T THINK INFLATION IS RETURNING UPWARDS...

Mike Cahill (GS FX Strategy) on ISM: Some comforting news from the ISM supply side. Two things to note in the details: 1) 75% of the drop in the headline came from faster delivery times from suppliers, so I'd discount that a bit, especially given that ISM had been running a slightly above other non-manufacturing surveys. 2) both the drop in prices paid and the improvement in supplier delivery times came from an increase in the % of companies reporting faster deliveries + lower prices (around 12-13%). So, not only is there a shift towards more companies reporting that things are the same, but that they are actually getting better.

Our desk was a 4 on a scale of 1 to 10 in terms of overall activity levels. The flow executed on our desk ended with a selling bias of -90 basis points versus the 30-day average of -43 basis points. Limited Orders (L/Os) ended up 5% as net buyers, driven by demand in technology, communication and financial services. In smaller notations, L/Os ended up being net sellers in industrials, discretionary and energy. Hedge Funds finished 3.7% as net sellers, driven by scattered supply in almost all sectors. Short ratios remained elevated in staples, discretionary items and healthcare.

Changing consumer sentiment: Over the past few weeks, there have been a number of companies talking about a slowdown. However, it was mainly explained as idiosyncratic competitive problems or brand-specific factors. That seemed to change today, based on our conversations. Maybe ULTA has some share issues in its Prestige business, but pointing out a slowdown across the board and across all products feels different.

We think investors largely explained NKE (market share), LULU (market share), and PVH (proactive wholesale reduction), but MCD, DRI, and ULTA feel more like an indictment of the consumer spending, and our conversations and flows reflect that today. (thanks to Scott Feiler)

DERIVATIVES: Slow day in volatility after the ISM print this morning. There is no specific theme to the flows, but we saw clients unwinding bullish positions in XLE and overwriting some individual names in energy as the space continues to rise. In indices, despite intraday movements, SPX volatility ended slightly lower on the day. We believe NDX volatility is reaching an attractive level, especially in May which captures tech gains. We have been closely following the dealer gamma and after yesterday's move we saw the length halved to ~3.5bn... this should continue to decline on any move lower. Friday's straddle for the NFP came out at 0.85%. (thanks to Pat Grahling)