Goldman Sachs: Trading Desk 03/27/2024

S&P +86 basis points to close at 5248 with an Order to Close (MOC) of $470 million to buy. NDX +39 basis points at 18280, R2K +213 basis points at 2114 and Dow +122 basis points at 39760. 10.6 billion shares were traded across all US stock exchanges, versus the daily average for the year to the date of 11.7 billion shares. VIX -347 basis points at 12.78, Crude +6 basis points at 81.67, 10-year bond yields -4 basis points at 4.18, gold +74 basis points at 2194, dxy unchanged at 104.29 and bitcoin -128 basis points at 68935 .

Today reflected an advance for Short Mo' (GSCBLMOM) +3.8% versus Long Mo' only going down slightly. RTY outperformed SPX by 146 basis points. 10-year yields fell 4 basis points. The tape continued to be tight with our shortest basket increasing +2.9%. There were a lot of exaggerated moves to the upside that exceeded 2 sigma. To name a few: Expensive Defensives +1.5%, Short Mo' +3.8%, Long Value +2.8%, Renewables +4%, Commercial Real Estate +2.6%, Regional Banks +3.7%. The market exploded higher during the last 20 minutes of the session (Reminder: the last few days have had big SELL MOCs that were probably driven by the End of Quarter/Pension Relocation).

Our desk had an overall activity of 4 on a scale of 1 to 10. The flow executed on our desk ended with a buying bias of +128 basis points versus the 30-day average of -43 basis points. Limit orders were once again in selling mode before the end of the month, ending as net sellers -7% with -1.2 billion in net supply. Supply was broad across all sectors, although most notably concentrated in defensives moving higher as yields fell. Utilities, Real Estate and Healthcare all rose more than 1% today. Communication services were the only sector that ended with a net purchase by this type of customer. Hedge funds ended up being net sellers -130 basis points and mostly traded around their short book. Hedge fund hedging trades were small in nominal but were done at a very rapid pace. Very quiet on the ECM front…. $15 billion supply last week digested by the market with relative ease.

Interesting dynamic that the end of the quarter falls on a Thursday of a long weekend. Despite the 3-day weekend starting tomorrow (fixed income has a half day), volumes will be explosive especially at the close. So far this year, asset managers have been using month-ends and index relocations as opportunities to move volume in the closing auction (more than usual). Our live estimate for quarter-end pension relocation is -$29 billion of shares for sale, which is the 86th percentile in terms of absolute value over the past 3 years. And after all the volatility this morning on cruise lines, we ended up back in the green for the entire space after the CCL call (very positive tone, as expected). I would highlight that there are some clear positioning dynamics, to state the obvious. I don't think NCLH is as short as it was 1-2 quarters ago, but it's still the name we get the least positive feedback on in the group and today it's up more than double CCL/RCL.

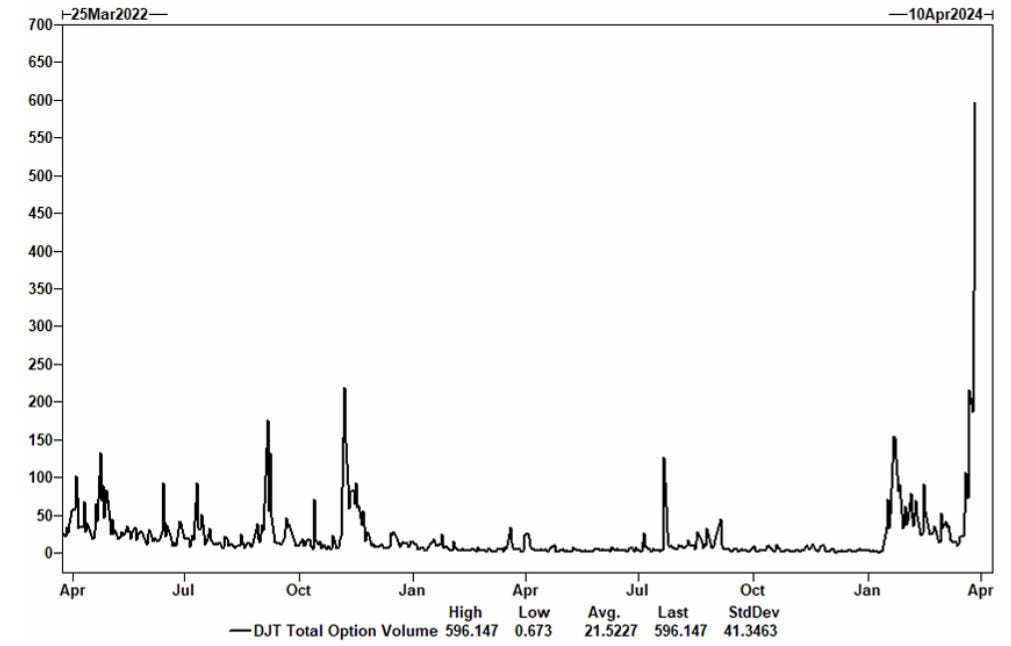

DERIVATIVES: Another suppressed move in the spot today until the last 30 minutes where we saw SPX close up 0.86%. Daily straddles continue to break out around $2022, due to the fact that intraday ranges have narrowed significantly and the current dealer long gamma momentum (which we don't expect to go away anytime soon). Notable reduction in volatility in the terms, with SPX April up trading below 10v and showing itself as an attractive option. The desk also likes to sell volatility in December, particularly if vols continue to pull back. Currently, the implied movement from the elections is 3% while the year-end straddle is 10%. In the individual space we saw record volume in DJT options, with ~600k total options traded. (credit to Braden Burke)