Goldman Sachs: Trading Desk 03/06/2024

Chinese policymakers held a rare joint news conference to defend new economic targets for 2024 and ensure additional tools are in place to boost growth. Nikkei

China set an optimistic target of around 5% growth this year as top leaders try to boost confidence in the world's second-largest economy. But to analysts, Premier Li Qiang's lack of detail on how to achieve this was out of sync with the nation's profound challenges. BBG

The PBOC has room for further cuts in the reserve requirement ratio and will push for lower financing costs, Governor Pan Gongsheng said. That suggests the PBOC will be more active in easing to boost demand, Mizuho said. China's 10-year yield fell. BBG

South Korea's core CPI rises to +3.1% in February (rising from +2.8% in January and ahead of the +3% street forecast) while core remains unchanged and in line at +2.5%. WSJ

Some Bank of Japan (BOJ) board members will likely say that raising negative interest rates is reasonable at a policy meeting this month, Jiji Press reported on Wednesday without citing sources. If a majority of the nine board members votes to end negative rates, it would pave the way for the first rate increase since 2007. RTRS

Biden urges Hamas to accept a ceasefire, warning of a “very, very dangerous” situation if one is not reached by the start of Ramadan on 3/10. SCMP

“Super Tuesday” saw Trump and Biden dominate their respective parties (although each lost once, Trump in Vermont and Biden in American Samoa), but with some big warning signs for each (Trump continues to perform poorly with suburban voters and educated while Biden's “unengaged” and third-party problem is very real in certain critical states). Political

Trump met with Elon Musk and some wealthy Republican donors on Sunday as the former president seeks a big influx of money to bolster his campaign (Musk apparently sees it as essential that Biden be defeated in November). NYT

Nikki Haley plans to suspend her Republican presidential bid in a speech Wednesday morning. Her decision came the day after Super Tuesday, when she only won Vermont among the 15 states that held Republican contests. Haley will not announce an endorsement on Wednesday, the people said. She will urge Donald Trump, who is close to having the delegates needed to win the Republican nomination, to win the support of the Republican and independent voters who backed her. WSJ

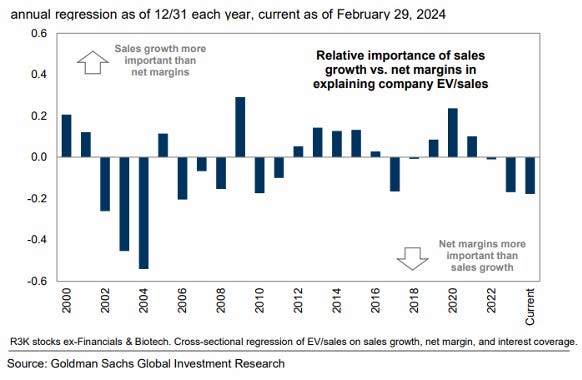

Margins have become highly important for valuations…

S&P closed at -51 basis points @ 5104 / MOC: $1.6 billion to SELL. NDX +67 basis points @ 18017, R2K +70 basis points @ 2068 and Dow +20 basis points @ 38661. 12.5 billion shares were traded across all US stock exchanges versus the daily year-to-date average. date of 11.6 billion shares. VIX +28 basis points @ 14.5, crude oil +123 basis points @ 79.11, 10-year yields -5 basis points @ 4.10, gold +95 basis points @ 2148, dxy -40 basis points @ 103.38 and bitcoin +508 basis points @ 66544 .

Recovery session after strong selling pressure yesterday, tech came back to the fore with better gains from CRWD +11% and JD +16%, which seemed to boost risk appetite and recovery in yesterday's losers : Bitcoin Sensitives +9%, Meme Stocks +2.5%, Long Momentum 2.5%, China ADR +1.9% and Software +1.9%. Banks are back in the spotlight with today's focus on NYCB's $1 billion equity capital raise, we think overall the risk is positive for banks (our desk saw 1 million shares in NYCB to meet demand) …Sarah Chah, Finance Specialist, “Many ask if $1 billion is enough. The new CEO (former OCC) and $1 billion of equity capital increase his CET1 by 110 basis points or 10.2% of total CET1 and reaching over $6 TBV roughly just pro forma for the increase. We believe that the group can revalue itself with a resolution here (and it is doing so).”

On the other hand, there is a lot of focus on Mag 7 dispersion. Last year, Mag 7 basically moved in unison and was the determining trade for investor performance in US stocks in 2023. Two months into 2024, we are seeing dispersion in the group, which has been VERY WELL received by the majority of active investors. We continue to see long HF supply on Mag 7 stragglers with cash raised going into certain cyclical sectors (mainly industrials) – given this dynamic, we continue to see quality semiconductor and hardware stocks as potential beneficiaries if this cyclical rotation continues (think in ADI / Analog Semiconductors, types of JBL, FLEX). Our desk was a 5 on a scale of 1 to 10 in terms of overall activity levels. The flow executed on our desk ended with a buying trend of +7% versus the 30-day average of -10 basis points. L/O ended up being net buyers at +5.7% (in almost all sectors), with demand in Info Tech, Industrials (today we saw the highest buying trend for the sector since January 15, ranking in the 91st percentile at a 52-week look) and Discretionary. HFs ended up being net buyers by +3%, also driven by overlapping demand in Info Tech and Industrials.

On the macro front, ADP private payrolls for February came in slightly softer than expected (140k vs consensus 150k) and JOLTs were roughly in line (declining 26k to 8,863k in January). Our economists believe the gap between employment and workers now sits slightly above the 2 million level needed to bring the U.S. labor market back to equilibrium. 10-year yields are down to 4.10% (vs BEs which continue to rise, keep an eye on this). There were no fireworks from Powell in front of the House Financial Services Committee: POWELL REITERATES THAT FED NEEDS MORE CONFIDENCE IN INFLATION TO TRIM POWELL: IT IS PROBABLY APPROPRIATE TO CUT RATES SOMETIME THIS YEAR POWELL: INFLATION HAS NOTICEDLY DECREASED BUT STILL ABOVE 2% TARGET February 5 Reminder said “the danger of acting too soon is that the work is not completely done and the really good readings we've had over the last six months somehow turn out not be a true indicator of where inflation is headed.”

DERIVATIVES: Today's rally brought a slight bid to volatility. Flows were relatively subdued ahead of the NFP on Friday, but we saw clients extending puts up and out ahead of print. Our internal gamma model estimates four yards of gamma unwinding after yesterday's selling, but we continue to believe the overall street position is saturated by volatility selling. As a desk, we think short-term call spreads on S&P look attractive (especially the SPY 22Mar24 515/525 call spread, which captures NFP, CPI and FOMC). Given the recent outperformance of our momentum basket, we like the put spreads on MTUM (Momentum Factor ETF) or GSTMTAIP (AI basket). The straddle strategy for the rest of the week is set at 0.95%. (courtesy of Elana Kopelman)