Goldman Sachs: Trading Desk 02/21/2024

Futures are once again weaker (continuation of yesterday's action) as market continues to digest last week's higher inflation readings + extended positioning + nervousness ahead of NVDA results tonight where implied volatility is 10.5%, etc. Macroeconomic news overnight was very quiet, except for the Axios report reporting that some House Republicans are now privately hoping for a US government shutdown.

In the US, we'll have Fed Chairman Bostic at 8am, Fed Chairman Barkin at 9:10am and FOMC Minutes at 2pm...among the main pre-release results. opening are ADI, EXC and NI… after closing, results include ETSY, HST, MOS, MRO, NVDA and RRC.

Europe is mixed, with consumer discretionary leading and materials lagging. EU Consumer Confidence in February was slightly better month on month (-15.5 vs -16.1 previously). As for individual stocks, Carrefour (+3%) is trading higher after the results, while HSBC (-7%), Glencore (-3%) and Rio Tinto (-1.5%) are trading lower. Asia closed mixed, with mainland China rising once again after yesterday's LPR cut (mainland has closed higher for 6 sessions in a row), with real estate and technology standing out. China's housing authority approved $17 billion in development loans aimed at helping developers complete projects. Japan's trade data in January was mixed (exports better, imports worse).

*NVDA EPS PREVIEW… (numbers typically released at 4:20pm, conference call at 5pm) from Pete Callahan: NVDA is up ~37% since last quarter's results, at one point surpassing both GOOGL and AMZN in market capitalization (before yesterday's sale).

Options are pricing in a ~10.5% move on results.

Notable given that over the past two quarters, NVDA has not moved Q+1 ('consolidation events'), despite outperforming EPS by 20-30% in both reports.

There is a lot of tactical debate about whether this report will be a local high or a 'breakout' moment for the stock and for AI trading (in my view, it seems the consensus leans more towards the former).

Investors expect Nvidia to once again deliver a clear positive result and revise upwards.

Nvidia has beaten revenue by ~$2 billion over the last two quarters (compared to a consensus model of ~$20 billion in revenue in the January quarter).

This will likely serve as a metric along with comments on the April quarter (remember, Nvidia had guided for 10% growth in the January-January quarter) and the 2025+ roadmap (both visibility and product cadence ).

FOCUS ON FACTORS… -US DESK ACTIVITY…. The total flow executed on our desk ended with a selling slope of -260 basis points versus the 30-day average of -3 basis points. Limit orders (L/Os) ended with 10% of net sales, driven by broad offerings in Technology, Healthcare, Industrials and Communication Services (in that order). Hedge funds (HFs) finished balanced, driven by supply (short > long) in communication services, macroeconomic products and energy versus demand in Healthcare and select technology sectors. -PRESSURE ON AI… NVDA on the move (~20% of total NDX movement yesterday)… ahead of today's release. A lot of concern around positioning and sustained upward momentum. We are seeing supply across the group, although generally passive in nature… this dynamic is also affecting our Momentum Winners basket, which had one of its worst sessions of the year. -STOCK BUY BACKS ARE ACTIVE… But they did not provide the necessary support yesterday. Last week finished 1.2 times the FY23 average. Currently, 81% of the SPX is in an open window. That will increase over the next two weeks before the next closing window beginning 3/11. -KEEP YOUR SEASONS IN MIND... Yesterday began the worst two-week period of the year for the S&P since 1928.

HF TREND MONITORING… 5 key takeaways from Goldman Sachs Hedge Fund Trend Monitoring:

PERFORMANCE: US long/short equity hedge funds have generated a strong +4% YTD return, driven by alpha from popular long positions and concentrated short positions. Our Hedge Fund VIP list of the most popular long positions (ticker: GSTHHVIP) has returned +9% YTD, outperforming the S&P 500 (+5%), the equally weighted S&P 500 (+1%) and the best-selling shares (GSCBMSAL, -1%). The outperformance of the “Magnificent 7”, which have generated a return of +8% YTD in aggregate, has supported the performance of the VIP Hedge Funds. Popular long positions have outperformed concentrated short positions in all sectors except Healthcare.

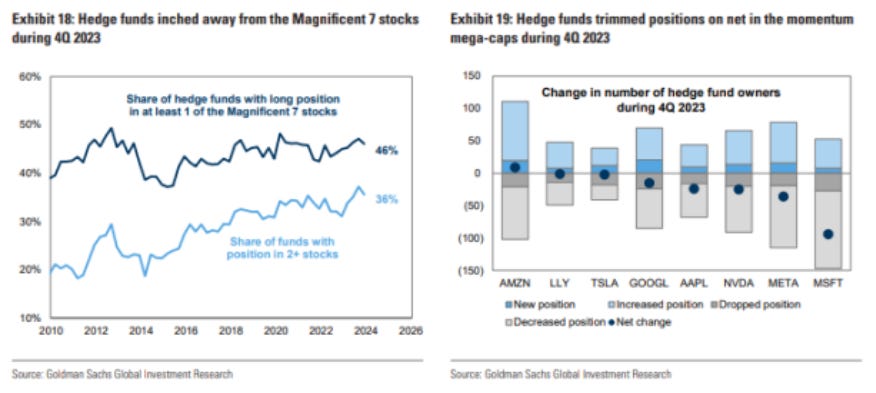

THE “MAGNIFICENT 7”: The weight of the “Magnificent 7” in hedge fund portfolios continued to increase alongside a record tilt toward Momentum and extreme crowding. These stocks represent 13% of the total long hedge fund portfolio, an all-time high but only half of their collective weight in the Russell 3000. All members of the “Magnificent 7” except TSLA are in the top 10 members of our hedge fund VIP list. However, hedge funds decreased net ownership in these stocks during the fourth quarter. AMZN was the exception and is the top VIP this quarter.

HEDGE FUND VIP: Mega-cap stocks continue to top the list of hedge funds' most popular long positions, but these funds increasingly favor manufacturing-related stocks. The Industrials sector now constitutes 18% of the VIP basket, only behind Financials (20%) and Information Technology (22%). The VIP list contains the 50 stocks that appear most often in the top 10 holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 59% of quarters since 2001, with an average quarterly excess return of 47 basis points. 15 new constituents: APG, AYX, BLDR, BSX, C, DHR, GE, HES, KRTX, NOW, TPX, TSM, UNP, WDAY and WSC.

LEVERAGE AND SHORT INTEREST: Hedge fund net leverage has recently increased along with the market rally, while gross exposures remain extremely high. Short interest for the median S&P 500 stock remains very low, at 1.7% of the float. Funds have increasingly used macro products on both sides of their portfolios; Short positions in hedge fund stock futures and long positions in ETFs are large relative to history.

SECTORS: Hedge funds rotated selectively within growth sectors and into cyclical industries. The funds reduced their net tilt toward the Information Technology sector and the sector remains the largest “underweight” relative to the Russell 3000. At the stock level, MSFT, AAPL and NVDA were among the Information Technology stocks. Information with the largest net declines in popularity among hedge funds. In contrast, hedge funds added exposure to Communication Services in most subsectors, led by DIS, SNAP and RBLX. Hedge funds also increased duration in cyclical industries, including Financials; PGR, ACGL, KMPR, OWL and MORN stood out among this quarter's “Rising Stars.”

Ten things to know:

Beijing is reviewing how China's fast-growing quantitative trading industry is regulated after one of the sector's largest operators was hit with a trading ban this week for stock dumping. Stock exchanges in Shanghai and Shenzhen announced late on Tuesday that all market activity carried out by computer-driven quantitative funds, which rely on complex automated trading strategies, would be closely scrutinized under a new monitoring scheme jointly managed by both exchanges. and the China Securities Regulatory Commission (CSRC). FT

HSBC fell as its profits plunged 80% after incurring unexpected charges over holdings at a Chinese bank. CEO Noel Quinn said they have de-risked their exposure to the US commercial real estate sector and that China's moves to shore up its real estate sector will lead to a longer-lasting recovery. The bank announced share buybacks worth $2 billion. BBG

Honda and Mazda agree to union wage demands, the latest sign that compensation is rising enough for the Bank of Japan to begin tightening policy. BBG

Japan's exports for January are slightly ahead of plan at +11.9% (versus +9.5% on the street), although the Reuters Tankan survey revealed a deterioration in sentiment as the Japanese government lowered its economic assessment for the first time In 3 months. RTRS

Boaz Weinstein is accumulating positions in U.K. investment trusts that now account for about a quarter of his $5.4 billion bet on closed-end funds that trade near historic discounts. His targets include funds managed by JPMorgan, BlackRock, Schroders and Baillie Gifford. BBG

As Russia's war in Ukraine enters its third year, President Vladimir Putin's forces have gone on the offensive, capturing the eastern town of Avdiivka after months of fighting. In a conflict where momentum has fluctuated, the mood is now noticeably bleaker in kyiv. BBG

Private equity firms are increasingly raising money to buy individual companies on a case-by-case basis as they struggle with a slowdown in the market and investors look for ways to reduce management fees. A record $31 billion was deployed by investors “on a case-by-case basis” last year, according to data provided by private equity advisory firm Triago, defying a broader slowdown in deal making and fundraising in the industry. FT

Donald Trump entered the 2024 election year with about 200,000 fewer donors than in the previous presidential campaign four years ago, raising questions about his fundraising machinery just as legal bills are depleting his war treasury. FT

Bank reserve balances remain ample, suggesting that liquidity levels remain ample despite the decline in reverse trading balances (meaning the Fed may not need to reduce the pace of QT). BBG

GS HF TREND MONITORING: Continuing its strength in 2023, the most popular hedge fund positions have generated strong alpha to start 2024. Our VIP basket of most popular long position hedge funds (ticker: GSTHHVIP) returned +39% in 2023 and has returned +9% YTD in 2024. This compares to a YTD return of just +1% for the equally weighted S&P 500 and -1% for a basket of stocks with the highest concentration of interest short relative to float (GSCBMSAL). According to GS Prime Services estimates, US equity long/short funds have returned +4% YTD.