Goldman Sachs: Trading Desk 02/04/2025

Indexes:

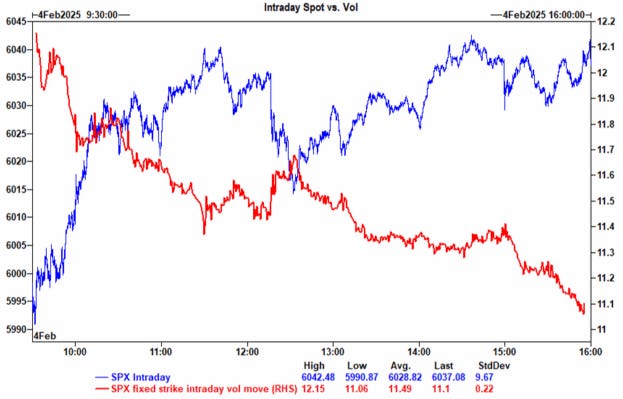

S&P 500 +72bps, close at 6037

Nasdaq 100 (NDX) +126bps, closing at 21566

Russell 2000 (R2K) +141bps, close at 2290

Dow Jones +30bps, closing at 44556

Volume and Volatility:

Trading volume: 13.35 billion shares across all U.S. equity markets (vs. year-ago daily average of 16 billion).

VIX: -822bps, closing at 17.09

Other Assets:

Crude oil: -78bps, closing at 72.59

10-year Treasury bonds: -4bps, close at 4.51%

Gold: +96bps, close at 2842

Dollar Index (DXY): -98bps, closing at 107.93

Bitcoin: -387bps, close at 98125

Sector and Stock Performance

Stocks rose broadly, with energy, consumer discretionary and technology outperforming .

PLTR +23% (beat expectations and improved forecasts)

SPOT +13% (better than expected Q1 guidance)

SMCI +7% (results publication date confirmed)

Results after closing:

GOOGL : Up +2.5% pre-earnings, but down -5% after the close due to a mixed quarter (better-than-expected advertising revenue, weaker cloud revenue).

SNAP : +10% after beating Q4 revenue and improving Q1 guidance.

AMD : -4% (up +4%) after beating general expectations, but with weakness in data centers.

AVGO : +4.5%.

GOOGL announced CapEx of $75 billion , above expectations.

Upcoming Results:

Tomorrow: UBER before opening.

After the closure: ARM, CTSH, QCOM.

Market Trends

The Nasdaq 100 has been performing erratically over the past two months, failing to make sustained gains since early December. The current dynamics of the technology market seem to be divided into two groups:

Favored stocks: GOOGL, AMZN and META continue to attract interest.

Troubled stocks:

NVDA , stuck below its 200-day moving average and with discussions about its February 26 results and outlook for 2026+.

AAPL , with few notable bullish gains, despite its catalyst calendar.

MSFT , also below its 200-day moving average and approaching its 7-year low relative to its P/E multiple.

Market Flow

Market activity on a scale of 1 to 10 : 5

There was an improvement of +130bps in favor of buying , with a net demand of more than $500 million .

Institutional investors (LOs) were net buyers in technology and healthcare , as well as in most sectors except industrials and consumer staples .

Hedge funds (HFs) closed with slight net selling, led by macro products and communication services. However, they bought technology and consumer discretionary stocks.

Results after closing:

ENPH +10% (high short interest) after beating expectations and offering optimistic guidance.

Macroeconomic Factors

Tariffs Mexico and Canada : both have been paused for one month.

Tariffs on China : The US imposed an additional 10% , while China responded with just 12% on $14 billion of US goods (versus 10% on $525 billion of Chinese goods).

JOLTS (job openings): fell more than expected, which eased 10-year Treasury yields (-4bps, close at 4.51%) .

Q4 2024 GDP estimate: reduced by 0.1pp to 2.2% .

Key data for Friday: US payrolls

Derivatives

Slow day for options , with skewed supply and volatility , which facilitated the gradual rise of the market.

Outside the US, there was a phenomenon of price increases and volatility in FXI, EWZ and VALE .

Volatility in emerging markets is considered to be low compared to the S&P 500.

CTAs are projected to be sellers in all scenarios next week.

Dealers remain long gamma.

Straddle for Friday afternoon: 1.30% .