Goldman Sachs: Trading Desk (01/15/2025)

S&P : +183 basis points closing at 5,949 on closing order volume (MOC) of $3.8 billion in sales. NDX : +231 basis points at 21,237, R2K : +199 basis points at 2,263 and Dow : +165 basis points at 43,221. 14.29 billion shares were traded across all US equity markets, versus the year-to-date (YTD) daily average of 16 billion. VIX : -1384 basis points at 16.12, Crude Oil : +383 basis points at 80.46, US 10-Year Bond Yield : -14 basis points at 4.65%, Gold : +69 basis points at 2.695, DXY : -19 basis points at 109.07 and Bitcoin : +346 basis points at 99.789.

“Risk on” sentiment today as the market digested a more subdued CPI report (core up +23bps unrounded vs +30bps expected, and yoy rate down to 3.24% ) combined with solid results in financials (net interest income beat expectations across the board and fear-inducing expenses came fully in line… Better net interest income translated directly into operating leverage. The tone on buybacks at C and JPM was especially positive). Finally, some relief on rates, with the US 10-year bond yield retreating 14bps to 4.65%. Market breadth improved with over 369 stocks up on the day. Reminder: balance points indicate contrarian (excessively short) positions. Entering this week, the pace of net leverage reduction over the past month was the fastest since mid-2022. Individual U.S. stock shorts have risen for 12 consecutive weeks (22 of the past 24). We have not experienced a significant episode of short covering since last July… Most compressed shorts are up +380 basis points, and compressed technology, media and telecom (TMT) shorts are up +750 basis points.

Some of the goods components that serve as the data source for the core PCE index fell sharply this month, possibly reflecting stronger-than-usual holiday sales. Our economists now believe core PCE inflation rose just 0.15% month-over-month in December. Tomorrow, we’ll be keeping an eye on US retail sales, Trump confirmation hearings, US import/export data, and pre-open earnings ( BAC, FHN, INFY, MS, MTB, PNC, TSMC, UNH, USB ). Our overall activity level was a 7 on a scale of 1-10. Overall, executed flow ended +430 basis points versus -34 basis points, 30-day average. Limit orders (LOs) ended as net buyers of $2 billion, driven by demand for macro, financials, and discretionary products. Hedge funds ended as net sellers of -$1.5 billion, with broad supply dispersed across all sectors for the second consecutive session.

Update on buybacks:

2024 ended as the second-highest year for authorizations, closing at $1.26T

We expect executions in 2024 to end up as the second most active year, around $1.00T

Looking ahead, we estimate 2025 will be the busiest year for buybacks, with an estimated increase of +15% to $1.45T in authorizations and $1.16T in executions

We are now within our estimated blackout window for the S&P 500 until 1/24 ; after that date, we expect approximately 45% of the S&P 500 to be in its open window period

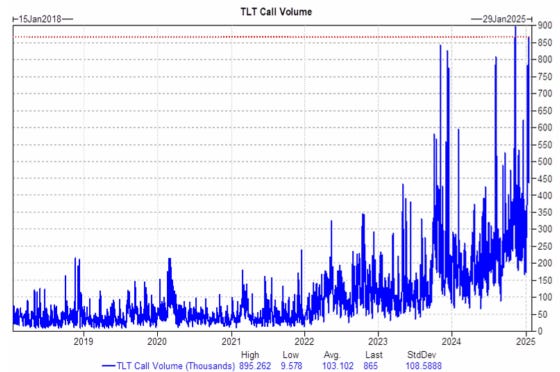

DERIVATIVES: Ahead of the CPI report this morning, the market was pricing in a 1.10% move, the highest for an inflation print since March 2023. This was easily met, and we saw volatility and skew narrow on the day, while the UX1 contract underperformed the spot move by almost a full point of volatility. In terms of flows, we saw short-dated call buying on SPY as well as demand for VIX calls as some clients took advantage of the drop in volatility to add to positions. Call volumes on TLT spiked, with 865k contracts traded today, the second highest ever. This materialized on the table primarily as monetization of already existing long positions. Coming into today, traders were short -$700M of gamma on SPX and our model shows the position remains short/flat on any rallies. With the week’s major macroeconomic event now behind us, the SPX straddle for Friday’s close is now just 0.90%. (h/t Pat Grahling)