Goldman Sachs: TMT Sector Specialist - Final Push (09/02/2024)

Goldman Sachs FICC and Equities

GS SECTOR SPECIALISTS: TMT

GS US TMT: .. final push ..

NDX up 16% on the year as we head into the post Labor Day push .. though .. NDX is tracking down ~1% through the first 2 months of 3Q (vs REITs, Utes, Fins all up 10%+ thus far in 3Q), indicative of the less directional TMT tape we’ve been in lately.

Last week was indeed a big one for Tech investors, even if volumes didn’t muster up to the story lines, with all eyes on NVDA. Nvidia earnings and price action largely supported the local view here that the GenAI theme has become a bit more two sided -- the good was Nvidia’s Datacenter revenues growing +155% y/y on a ~$100+ bn run-rate base ... the less good was the skinnier EPS beat on quarter / guide (GMs normalizing + OpEx ramping), arguably muting the “wow” factor for the first time since this GenAI saga began. To be clear, the story is far from derailed (bulls are training their focus on the upcoming “Blackwell” product ramp into CY25) and Jensen left plenty of breadcrumbs on the earnings call re: generative AI usage and engagement expanding to sovereigns, enterprises and start-ups (not to mention reports this week (link) that 200 million people now use ChatGPT each week, a double since last Nov) … there is just less ‘one way’ momentum on the theme these days as investors look for AI monetization clues to balance the growing D&A/Capex burden that the cloud vendors are facing. Next up: CEO Jensen Huang speaking at the GS Tech Conference on Sept 11th.

Down the stretch of the year, what are the big storylines that TMT investors are set to wrestle with?

IT Spending .. a handful of datapoints to support the “things are stabilizing” view out there (DELL / CSCO / CRM all sported relatively upbeat tones / results), which lines up with price action as Enterprise Tech / Services > Semis over the last ~2-months .. decent debate on linearity down the stretch of 2024 (esp with the Election) as investors look for stable / accelerating growth into 2025. Not to mention, a huge wave of Software user conferences & events in the coming weeks (CRM, WDAY, INTU, ORCL, HUBS, CRWD & more).

GenAI: how to think about the NVDA bull case for 2025+ DC revs vs where cons ests sit for hyperscaler capex? …

GenAI: how does the market think about the (potentially) burgeoning cost of frontier models / LLMs (even if one believes in the upside outcomes and the long-term ROIs, what is the “path” for stocks to get there?)

Does the U.S. Election end up mattering for TMT risk? Or just a sector / factor tilt impact as we get closer to November? (my gut is more the latter)

Internet .. as we get into conference season, cute the debate about how to think about the “strong” 3Q topline guides / prints (UBER, AMZN, DASH, META types) vs the ‘softer’ guides (EXPE, BKNG, ABNB, PINS, SNAP) .. prefer the co’s executing well or the ones that may have guided “conservatively”. Yes, this is a very tactical thought.

GenAI: do we get more signs of engagement & monetization – Meta AI Assistant or CRM’s Agentforce (Benioff goal = 1 billion agents by end of FY26) or MSFT Co-Pilot

Is the software issue cyclical (AI spending crowding out core spending) or secular (GenAI pressures / platform shift) ? Despite the prevailing ‘dialogue’ out there, feels like most investors ‘want’ to believe it is the former.

GenAI: any signs of “AI at the Edge” becoming a trend (iPhone launch + HP Inc forecasting AI PCs to be 50% of shipments in '27) – and if so, does this change app / workflow usage? ..

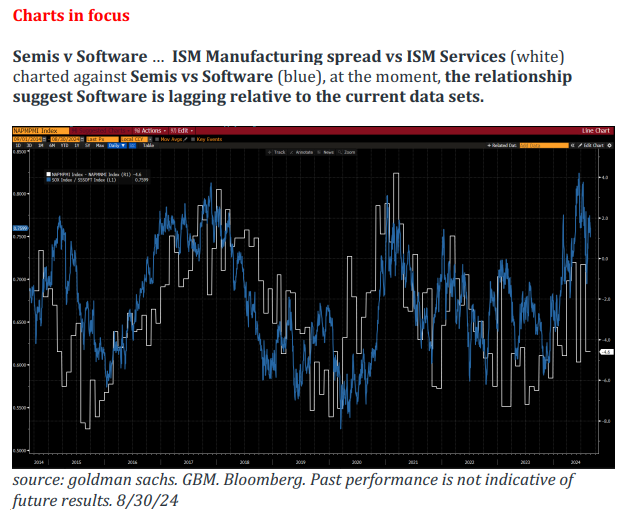

Semis .. into 2Q earning season (with the SOX at the highs), the Semiconductor bull case was increasingly about a potential ‘supercycle’ (e.g. tight pricing / capacity driven by broad-based end-mrkt recovery + ongoing A.I. demand pull) .. while 2Q earnings may have put that view on hold (Autos down-ticked, PCs / ‘Phones just ‘ok’, Industrials choppy), imagine as rate cuts get underway (with ISM data humming around trough / sub-50), it may not take long for investors to “dream the dream” again.. ?

other events & debate to watch … are Robotaxis a thing or not (TSLA event on 10/10) .. GOOG regulatory proceedings (bank-shots to AAPL + broader SMID Internet) ..

Zooming out on the sector, to level-set on the TMT framework … BULLS underwrite a “nothing has changed” view (positioning has really cleaned out in TMT … GenAI upside is more ahead of us than behind us and the recovery in IT / Enterprise / SW spending is around the corner .. not to mention steady economic growth + the Fed put helping anchor the broad market) while BEARS argue its times to “hold the reigns tight” (GenAI sentiment is clearly hitting an air-pocket, EPS revisions are flattening out across Big Tech, valuations are ‘meh’ and the world is complicated – think Sept seasonality, geopolitical, Election, regulation & more) … what side are you on?

***

Top inbounds last week .. why the fade in CRM post a strong print? .. does MRVL break-out from here? .. what do you do with NVDA? Can you trade the Blackwell cycle or is it just range-bound? .. is Software catching some wind? ..

FAAMG+ … what’s the mood on the biggest stocks in the world down the stretch? .. I would say, there is healthy 2- debate on AMZN, GOOGL, MSFT & even NVDA these days the market appears to be transitioning from a world where there was a 1-way, singular theme and revision cycle driven by the big 6 (chart below), not to mention GenAI optimism … to … a more “diverse” thematic backdrop (rate cuts, elections) and arguably a flattening out of the “slope” of the Big Tech revision line the last few months. Said another way, as the cash flow statement cost (capex) of AI has turned into a headwind on EPS / margins into 2025-2027, the market has started to debate how long it will take to underwrite an inflecting revenue curve to make the math work.

GS Communacopia + Tech Conference .. Sept 9-12 in SF .. I’ll be out with a full preview later in the week, but should be an amazing event headlined by CEOs from: AMD, NVDA, Amazon’s AWS, PANW, UBER, ARM, Anthropic, NOW, CRM, Adyen, VRT, WBD, T, VZ, Databricks, CRWD, INTU and much, much more. Cant wait!. Hope to see many of you out there.

Charts .. handful of charts that really Impress (& surprise) me — most of which are stocks that are rarely talked about … IRM .. CHKP .. ADP .. GDDY .. ZETA .. QTWO .. ACIW .. MPWR … GRMN .. TRU .. TYL … FOXA .. CTAS … GWRE .. and maybe the G.O.A.T. chart = MSI ….

3Q thus far .. NDX down ~1% through the first 2-months of the quarter ... notable leaders – a bit of 'reversion' quarter: FTNT, PYPL, MELI, DASH, WDAY, CHTR, ADP, MDB, CTSH up 15%+ .. notable laggards: SMCI, INTC, CRWD, PDD, MU, LRCX, ABNB, ARM, AMAT, QCOM, GOOGL down 10%+

Listen in .. thought this 20vc podcast with Princeton’s Arvind Narayanan re: AI Scaling Myths, The Core Bottlenecks in AI Today & The Future of Models was a interesting / balanced take on GenAI – link to pod.

Most debated stocks… where is the debate (& therefore, opportunity?) down the stretch of 2024… MRVL, DELL, Memory (incl SPE), SNOW, ON, TEAM, PCOR, CRM, INTU, CRWD, PYPL, MSFT, GOOGL, AMZN, UBER, ACN, ADBE

Notes from the road .. last week, GIR hosted meetings / calls with …. DOCN, XP, Advantest, Ulvac, HOYA, Tokyo Electron, AAC (2018.HK), Taiwan AI Tour (Auras liquid cooling lab, AVC (3018.TW), Hon Hai], BZ, Meiutan, Tokyo Seimitsu (7729.T), HG Tech (000988.SZ) and two interesting calls - an expert call on Chinese competition in Analog (ex-NXPI) and a call with SB Intuitions Corp re: sovereign AI.

… last, but not least .... Monday. 9/2. 3pm ET. Netflix hosting live hot dog eating competition b/t J Chestnut x Kobayashi (the former is the heavy favorite). As you digest your lunch, consider this: Joey Chestnut's current record = 76 hot dogs (& buns) in 10 minutes [this record is maybe more impressive / grosser ... 141 Hard Boiled Eggs in 8 Minutes]