Goldman Sachs: The last two weeks of the year - Wasn't what was expected (01/02/2024)

The last two weeks of this year have not been what was expected. On December 16, the SPX 2-week straddle was valued at 1.25%, but the average intraday trading range since December 16 has been 1.35% (i.e. the daily average between the high and low has exceeded the 2-week breakeven point).

For those who have been away from screens:

The bears have increased the volume.

Technical aspects are dominating the narrative.

Liquidity is proving a challenge.

A healthy dose of risk-on prudence has only just begun (shorts are increasing, net positions are decreasing, etc.).

Here are some observations from the desk on how we ended up and what we think lies ahead:

While the first year of the Trump presidency (1.0) marked one of the least volatile calendar years in decades (6.9% realized volatility as of December 31, 2017), it seems unlikely that version 2.0 will be the same.

Recommendations:

Favor equal weighting over market capitalization weighting.

Favor mid-cap companies over large-cap ones.

Allocate some assets to gold.

Allocate some assets to 6-month bearish options.

Keep an eye on VVIX (alert triggered above 110).

Analyze M&A targets (especially outside the US, given the strength of the dollar).

Read this post to learn about some of the official GS favorite ideas. It's a great new post from the GS industry specialists, with a lot of work behind it.

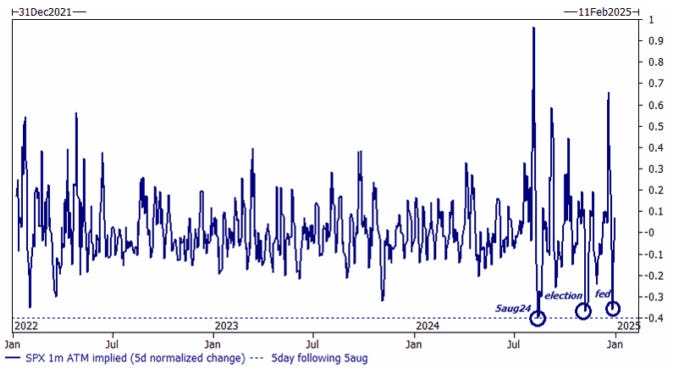

1/The biggest volatility lesson I take away from 2024 is the speed with which the SPX surface is learning to “compartmentalize.” The rapid rise and even faster fall following bouts of risk aversion are unprecedented in the past 3+ years. The structural gamma supply in the indices is very likely the main reason for this. If we enter a prolonged period of weakness, these short-duration options are likely to pull back “too fast” and offer great buying opportunities.

2/ On the topic of structural gamma supply… For every participant who says “gamma doesn’t matter,” I would simply point to the last few days of December as a reminder that it does matter.

The correlation between these two factors was never a big deal until about 2 years ago, but now it is part of the daily morning ritual.

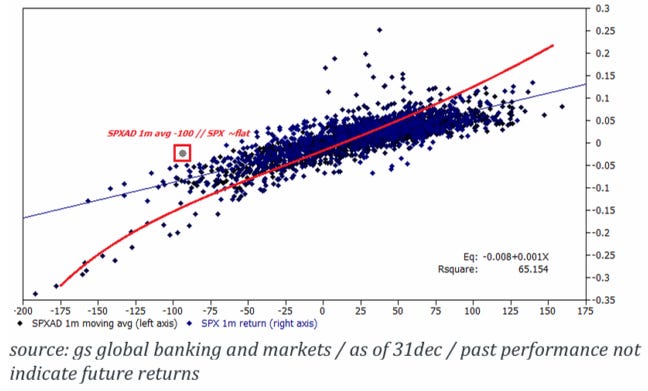

3/ The month of December has seen a significant decrease in market breadth.

Approximately 70% of trading sessions in December had more SPX names declining than advancing (SPXAD 1-month average: -100).

Negative market breadth of this magnitude has extremely fat tails, and yet the SPX index has shown remarkable resilience in the face of the expected pullback.

A 1-month SPXAD average of -100 suggests a SPX decline in the 10-15% range.

4/ Another way to analyze market breadth is by comparing the performance of the equal-weighted SPX versus the market-cap-weighted SPX index.

In 2024, the largest underperformance of “stocks” relative to the “stock market” was recorded, with a spread of -6%.

5/ Although there were occasional periods of retail frenzy during 2024, I would highlight that speculative buying of call options on “mega cap tech” has decreased significantly, falling 75% from its peak.

It's not so fun when these names "rise slowly" instead of "rise explosively."

6/ You cannot close a year-end note without referring to the cost of 1-year ATM put/call options.

Given where rates and dividends are, the breakeven point for the call is quite high. Using GS’s target price of 6500, it would only offer about a 20% yield on your premium to expiration (i.e. the 5900 call for December 31, 2025 costs 500 points).

7/ Volatility Stress Index… It is increasing towards the end of the year.

Reminder: This is a custom index based on the 2-year moving average percentile combining VIX, ATM volatility, skew and term structure (last value: 7.5).

8/ Systematic … Given the price action, there is renewed interest in how the systematic community is positioned.

The Russell and SPX have fallen below their short-term momentum thresholds (the NDX is right on the border).

According to GS's calculations, this group has already sold approximately $28 billion worth of global equities over the past week and is poised to sell another $28 billion in the coming week (if the market remains flat).

I can send a full breakdown if you are interested; this will be a prominent topic during the first sessions in 2025.