Goldman Sachs: S&P 6,500 price target (11/19/2024)

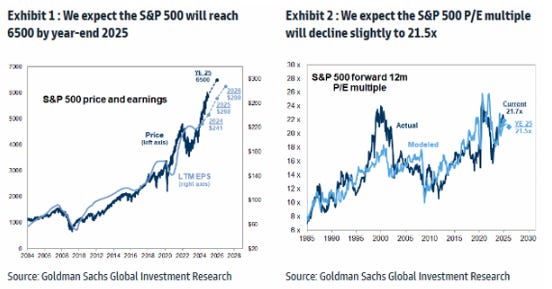

We forecast the S&P 500 to rise to 6,500 by the end of 2025. The projected gain of 11% would be in the 46th percentile of the historical distribution of S&P 500 12-month forward returns since 1980. Our forecast assumes continued U.S. economic expansion, earnings growth of 11% in 2025 and 7% in 2026, and a forward P/E multiple of 21.5x at the end of next year, representing a 1% compression from the current P/E of 21.7x.

5 Recommendations:

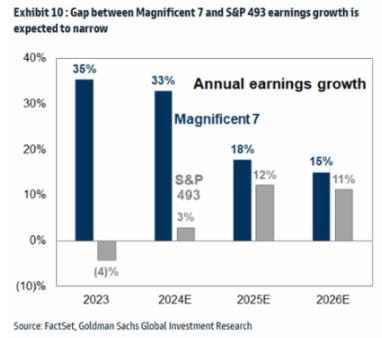

“Think big.” The Magnificent 7 stocks (AMZN, AAPL, GOOGL, META, MSFT, NVDA, and TSLA) will collectively outperform the rest of the S&P 493 in 2025, but only by about 7 percentage points — the narrowest margin in seven years and significantly smaller than the 63 percentage points in 2023 and 22 percentage points year-to-date. Slowing relative earnings per share (EPS) growth will be the primary factor driving this narrowing performance gap.

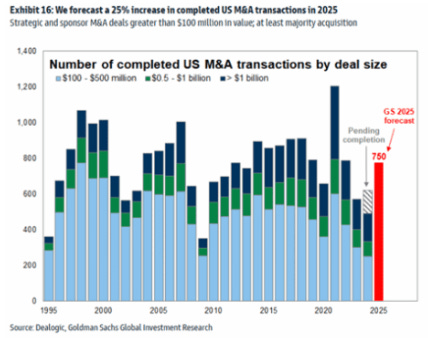

“Maximize your options.” Owns a basket of 62 potential U.S. M&A candidates that Goldman Sachs equity research analysts view as having a significant likelihood of being acquired (ticker: GSRHACQN). This basket outperformed during Trump’s first term. We forecast a 25% year-over-year increase in the number of completed mergers in 2025.

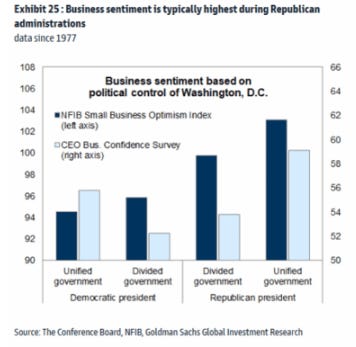

“Low income, big bets.” Owns a basket of 60 stocks with revenue exposure to small and midsize businesses (SMBs) in the U.S. (ticker: GSRHSMBX). A more favorable operating environment for small businesses will boost earnings and the valuation of stocks tied to that spending. We expect business optimism to increase significantly in the coming months.

“Delivers the results.” Owns 30 stocks in “Phase 3” of the AI evolution, with the potential to monetize artificial intelligence by generating incremental revenue (ticker: GSCBAIP3).

“Protect the downside and the upside will take care of itself.” The economic backdrop favors stocks with cyclical exposure, but the stock market has already adjusted its prices considerably based on this outlook. Among sectors and industries, we recommend overweighting Software & Services, Materials and Utilities.

…where to look: