Goldman Sachs: Opportunities in low volatility market

Volatility Collapse

EUR/USD experienced the largest single-day decline in volatility since the onset of the COVID-19 pandemic on Tuesday. As volatility continues to subside, traditional macro trades—long USD, short CNH, short GBP, short equities, and short long-end bonds—are no longer delivering results.

Shift in Focus: Identifying Bull Markets

With SPX seasonality in mind, it is time to pivot toward identifying new bull markets and the "fastest horses" in the current environment. Top picks include:

Copper

Uranium

Bitcoin (BTC)

Oracle (ORCL)

Brazilian Equities

UK Markets

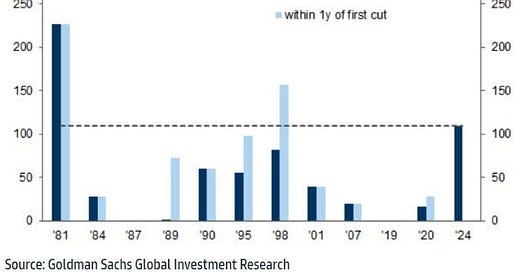

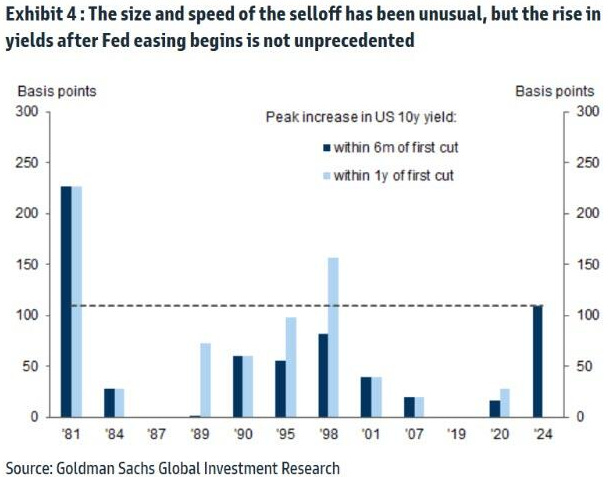

The adage "this time is different" remains a cautionary tale in investing. While the current cycle is undoubtedly unique due to the pandemic and fiscal interventions, historical parallels—such as 1981, 1995, and 1998—offer valuable insights.

The recent rapid selloff in yields, though swift, is not without precedent. While unusual, the current yield environment is not cause for panic—yet.

Opportunity Over Crisis

There is always a bull market to be found. Concentrating on shorting bubbles and bear markets is unproductive. Instead, the focus should remain on identifying and participating in emerging opportunities. When a bubble forms, fueling it with strategic participation can often yield favorable outcomes.

Equities remain a particularly compelling asset class. Post-CPI data has driven an eight-day winning streak for SPX, emphasizing the value of real returns. The cleanest trade this year has been to buy the equity market dip and de-emphasize rates, FX, and oil.

Macro Considerations: BOJ and Central Banks

For carry traders, the Bank of Japan’s (BOJ) policy remains critical. A dovish hike, coupled with data-dependent communication, is expected to minimize market pushback and maintain a gradual pace of rate increases. As we look to the coming week, central banks are likely to remain dovish, with global sentiment aligning toward rate cuts. This environment could support a rally in SPX toward 6350.

Two Potential Outcomes for the Fed

The Federal Reserve’s path forward presents a binary scenario:

Soft Landing: The Fed eases policy into a non-recessionary economy, supporting or improving growth pricing—a favorable outcome for risk assets.

Inflation Persistence: The Fed eases prematurely, inflationary pressures persist, and policy re-tightens, resulting in a hawkish policy shock and a negative growth environment.

Given this uncertainty, the Fed is likely to adopt a cautious approach in H1 2025. With interest rates forming the backbone of financial markets, the direction of long-end bonds will be pivotal in determining the trajectory of risk assets.

Key Asset Classes and Trades

Looking ahead, not much has changed since the early part of 2024. The assets and trades that thrived during H1 2024—SPX, copper, SFRZ4, gold (XAU), and AI-related investments—are poised to remain critical components of a balanced portfolio strategy.

Outlook: Low Volatility, Gradual Gains

With volatility subdued, markets are likely to grind higher. Carry traders should stay the course, leveraging opportunities from dovish central bank policies and the supportive macro environment. Month-end rallies remain a possibility, reinforcing the need to maintain a focus on risk and carry trades.

Conclusion

As we navigate this unique market cycle, adaptability and focus on emerging bull markets remain key. Strategic positioning in leading assets and sectors will enable investors to capitalize on opportunities in an evolving economic landscape.