Goldman Sachs: Nvidia Earnings Preview (08/28/2024)

POSITIONING: Not feeling as crowded around ~$125 today as it did when it last hit this level in June… we think it's at 8.5 out of 10 (it was previously firmly at 9+ before previous posts).

LOGISTICS: Numbers typically come out around 4:20pm ET, followed by the conference call at 5pm ET (guidance is in the press release, but it’s all about Jensen on the call)… options are pricing in a nearly ~10% move (a stunning ~$300B market cap change)… the stock has finished anywhere from -2% to +25% the next day (T+1) in 9 consecutive releases (i.e. a positive tilt lately).

Toshiya/GIR reviewed the post last week - potential impacts of Blackwell's timing, a more favorable valuation (e.g., only a ~45% premium versus the average 151% premium over the past 3 years), rising earnings (GIR is at $4.16 in calendar year 2025), and ongoing demand trends (GIR believes CSP+Enterprise demand remains strong). For reference, NVDA's recent quarterly pace over the past few quarters has been a revenue surplus of around ~$1.5B +/- QoQ (for context, consensus is for ~$28.8B in July QoQ revenue) with Nvidia guiding next quarter's revenue to be up ~$2B QoQ (of course, there's still a lot of debate over expectations and/or how Blackwell's timing might impact it). (Credit to Peter Callahan)

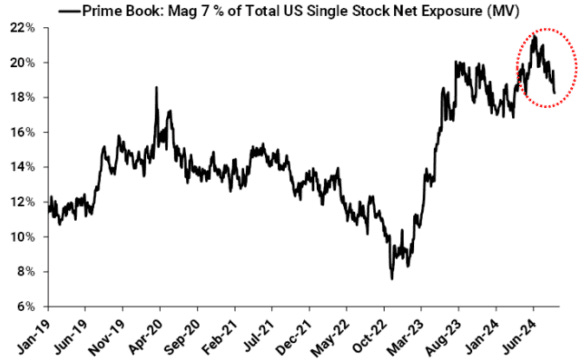

2 Notable GS PB Charts before release tomorrow night (I think today/tomorrow is the best time to buy the Mag 7 we've seen since early 2023).

Mag 7 currently accounts for 18.2% of Total Net Exposure to Individual U.S. Equities (compared to 20.5% at the end of June), ranking in the 30th percentile compared to last year…

Total net allocation in Semiconductors and Semiconductor Equipment, which is on track to be the top net-sold subsector in our book in August (driven by both long and short sales). The group now represents 1.5% of Total Net U.S. Exposure in our Prime book (compared to 3% at the end of June and 5.8% at the end of May), ranking in the 13th percentile compared to last year…