Goldman Sachs: NFP report preview

“What you think about day and night shapes your character and personality.” – Masami Saionji

The US stock market will be closed tomorrow (although the bond market will be open… it seems to be the first time this has happened), followed by Friday’s jobs report (NFP). This creates a rather awkward scenario. We have not seen any significant moves by equity traders this week in anticipation of the jobs report. Yesterday’s economic data was restrictive (JOLTS and ISM) and 10-year bond yields, now at 4.7%, are clearly weighing on stocks. The market is currently only pricing in 40 basis points of Fed rate cuts this year.

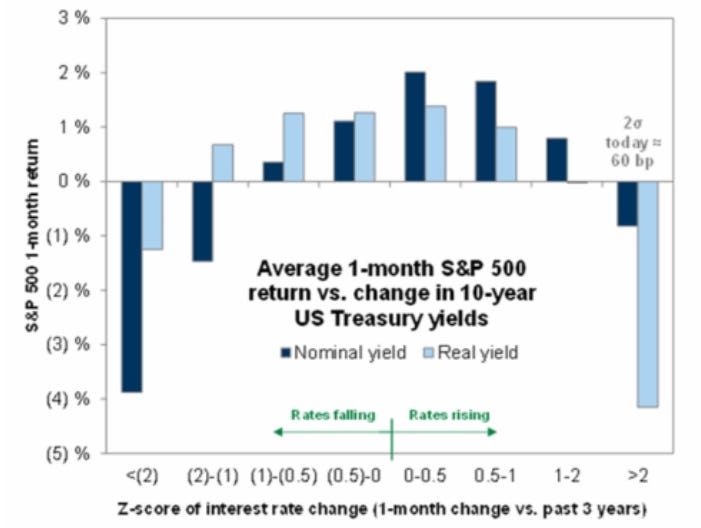

According to Ryan Hammond of GIR, US stocks can generally digest gradual increases in bond yields. However, when bond yields rise sharply, say, more than 2 standard deviations in a month, stocks tend to fall (2 standard deviations today = 60 basis points). This is especially true when the move is led by real yields.

In addition, U.S. stocks typically continue to rise if the market is pricing in improved economic growth coupled with higher bond yields. However, if other factors, such as high inflation or tight Fed policy, push yields higher, stocks typically fall.

Over the past month, real and nominal yields have risen sharply while the market's assessment of economic growth has remained roughly flat (cyclical vs. defensive sectors). We crossed the 2 standard deviation threshold over a 5- and 10-day period in December and are basically at the 2 standard deviation threshold over a one-month period.

The S&P 500 (SPX) is 3% below its all-time high, but (as of yesterday) has been supported by mega-cap tech stocks. The SPW is 6% below its all-time high and the Russell 2000 (RUT) is 8% below its all-time high.

Specifically for Friday’s report, GIR expects a headline figure of +125k (vs. +160k consensus and +227k prior), average hourly earnings (AHE) growth of +0.3% MoM (in line with consensus of +0.3% and down from +0.4% prior), and an unemployment rate of 4.3% (vs. consensus of 4.2% and prior of 4.2% ).

I think the sweet spot for stocks is between 100k and 125k. If the number is too high, rates will go higher (which the market clearly doesn't want). If it is too low, concerns will quickly shift from rates to growth.

The volatility market is pricing in a 107 basis point move for the S&P through Friday's close.

Expected S&P reaction to the headline data in an isolated scenario:

>200k: S&P drops at least 100bps

175k – 200k: The S&P falls between 50 and 100bps

150k – 175k: The S&P fluctuates in a range of ±50bps

125k – 150k: S&P up between 0 and 50bps

100k – 125k: S&P up 50-100bps

<100k: S&P falls between 0 and 50bps

Official GIR Outlook: We estimate nonfarm payrolls increased by 125k in December. Big data indicators show a more moderate pace of job creation sequentially, and we estimate that an unfavorable calendar configuration could reduce job growth by 50k.

On the positive side, we assume above-trend (albeit moderate) contributions from the recent surge in immigration and lagged hiring. We estimate that the unemployment rate rose to 4.3% on a rounded basis (a low threshold from the unrounded 4.246% ), reflecting a rebound in the labor force participation rate and moderate household employment growth amid more challenging job prospects.

That said, annual revisions to the seasonal factors for the household survey will be released with this report, and we suspect they will put moderate downward pressure on fourth-quarter unemployment rate readings.

We estimate that average hourly earnings increased 0.3 % (monthly, seasonally adjusted), which would keep the year-over-year rate unchanged at 4.0%, reflecting modest positive calendar effects but declining wage pressures.