Goldman Sachs: Hedge Fund Trend Monitor

PERFORMANCE: Hedge funds' most popular long and short positions have supported returns despite a deteriorating stock-picking environment. Our VIP list of the most popular long hedge funds (ticker: GSTHHVIP) has returned +31% so far this year, far outperforming the S&P 500 (+19%), the S&P 500 as well peso (+5%) and to the best-selling stocks (GSCBMSAL, +0%). This overweight has persisted despite market volatility in recent months, with popular long positions outperforming concentrated short positions in most sectors. However, the improvement in the alpha generation outlook that took place in early 2023 has reversed, with the “micro” share of equity gains declining in Q4.

LEVERAGE AND SHORT INTEREST: Hedge funds have modestly increased their net exposures while maintaining record levels of gross leverage. High gross exposures help explain the recent extreme volatility of heavily shorted stocks. However, short interest in typical stocks remains low as funds have increasingly used macro products like ETFs and futures instead of short positions in individual stocks.

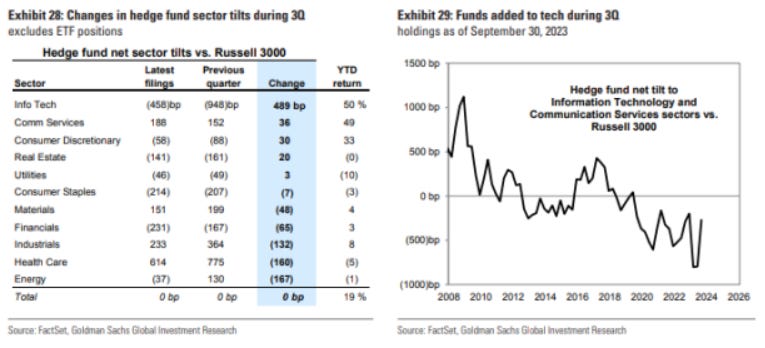

MAGNIFICENT 7: Funds bought mega-cap technology stocks during the third quarter, raising their exposures to the “Magnificent 7” to a new high. Mega-cap technology stocks represent 13% of hedge funds' aggregate long portfolio, double their weight at the start of 2023 but only half the weight of these stocks in the Russell 3000. With the exception of TSLA, every one of the seven is among the top ten members of our hedge fund VIP list. MSFT and AMZN have been the top two VIPs for nine consecutive quarters.

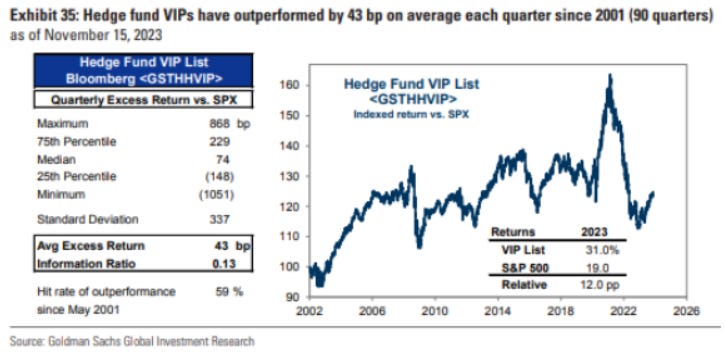

HEDGE FUND VIPS: Mega-caps remain the most popular long positions for hedge funds. This quarter's top six stocks (MSFT, AMZN, META, GOOGL, NVDA, UBER) also held the top six spots last quarter. The VIP list contains the 50 stocks that appear most frequently in the top ten holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 59% of quarters since 2001, with an average quarterly outperformance of 43 basis points. There are 14 new constituents: ABCM, AER, CPRI, CRH, DDOG, KKR, KVUE, LNG, MU, PGR, PXD, SPLK, TMUS and UNH.

SECTORS: Hedge funds sharply increased their technology exposure last quarter, with increases across industries. The funds sold stocks in the healthcare sector, but this sector remains the most overweight relative to the Russell 3000. They also sold stocks in the energy sector, where tilts are near the lowest levels since before the global financial crisis. (GFC). Consumer remains a point of debate, with consumer companies heavily represented on our list of “controversial” stocks with high ownership and high short interest. CZR, DLTR, HLT, SYF and WYNN joined our High Hedge Fund Concentration basket. Similarly, funds maintained an underweighting in the financial sector, with JPM and C dropping off our VIP list, but CMA, JEF, MKTX, WAL, and ZION were among the stocks with the biggest decline in short interest in recent months.