Goldman Sachs: DOGE Impact on Defense Sector

DOGE Reshapes Federal Spending and Market Sentiment

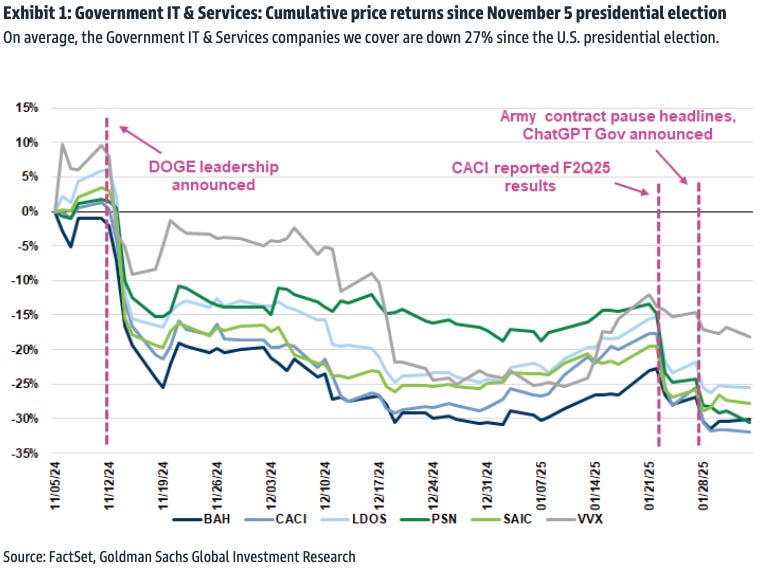

The Department of Government Efficiency (DOGE), spearheaded by Elon Musk, has begun restructuring U.S. federal agencies, unsettling investors in Government IT & Services and large-cap Defense stocks. The dismantling of USAID and the freeze on foreign assistance spending under Secretary of State Marco Rubio signal a broader shift toward cost-cutting and restructuring.

Goldman analysts Noah Poponak and Connor Dessert provided insights into how these changes impact market dynamics, citing management commentary, trader insights, and valuation shifts across affected sectors.

Sector Views: Caution on Government IT & Defense

Government IT & Services

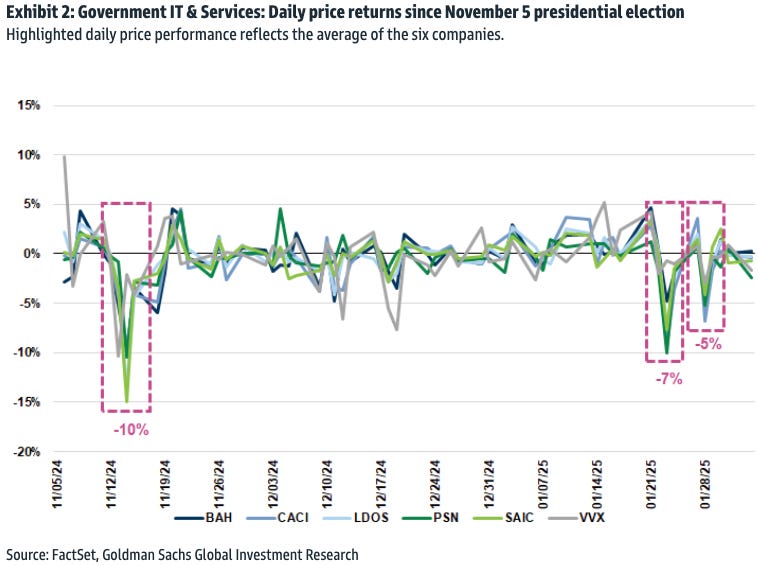

Uncertainty surrounding government budgets and spending priorities has driven stock selloffs.

Selloffs have been triggered by key events, including DOGE’s formation, earnings results indicating slower bookings, and Army contracting shifts.

OpenAI’s ChatGPT Gov raises concerns about AI replacing outsourced federal work.

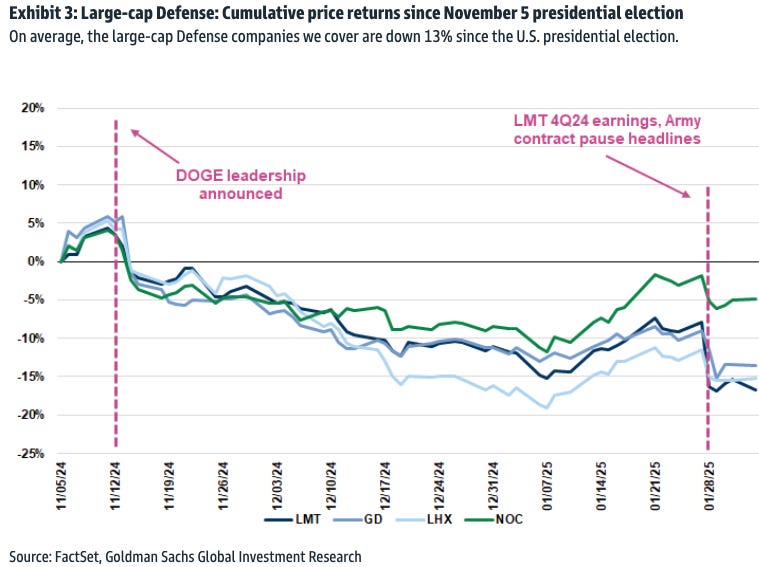

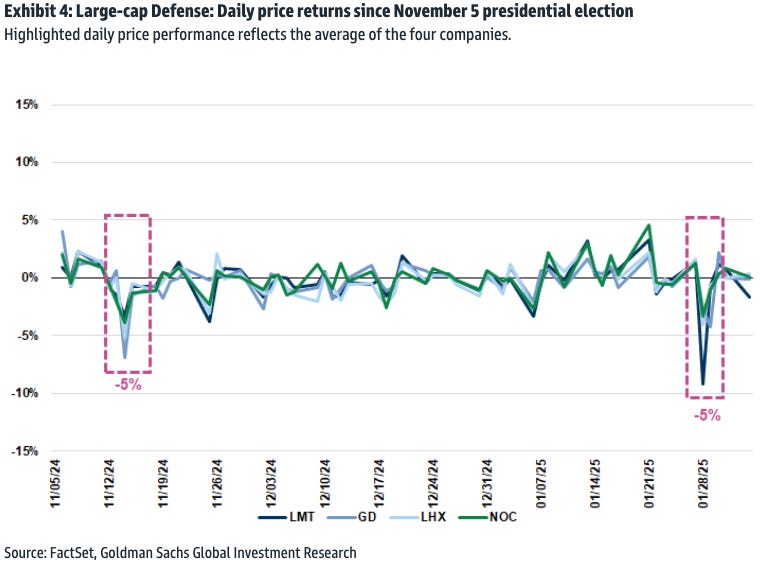

Large-Cap Defense

The Pentagon is shifting contract risk onto companies.

Fixed-price contracts could hurt margins and top-line growth.

Management teams acknowledge efficiency-driven spending reductions but express concerns about slower bookings.

Key Market Events Driving Selloffs

November 12, 2024 – DOGE Formation Announced

Elon Musk & Vivek Ramaswamy appointed to lead DOGE.

Government IT stocks sold off 15-20%.

January 22, 2025 – CACI Earnings Report

Strong results, but soft bookings led to a 10% decline in CACI, with the broader Government IT sector down 7%.

January 27-28, 2025 – Army Contracting & OpenAI’s ChatGPT Gov

Reports suggested Army contracts were paused, later clarified by the DoD.

Government IT stocks fell 5% on 1/28 due to confusion over contracting changes and AI-driven disruption fears.

Earnings & Stock Performance – Large-Cap Defense

Lockheed Martin (LMT) – January 28

Shares down 9% after taking incremental charges on classified Aeronautics and MFC programs.

Management emphasized the need for disciplined bidding amid DOGE’s focus on fixed-price contracts.

General Dynamics (GD) – January 29

Shares down 4% due to an Aerospace revenue miss and weak 2025 guidance.

Company supports efficiency measures under DOGE but faces revenue headwinds.

Northrop Grumman (NOC) – January 30

Shares flat after missing segment EBIT expectations and guiding 2025 below consensus.

Management sees an opportunity to collaborate on efficiency improvements.

L3Harris (LHX) – January 30

Shares flat despite a mixed earnings report.

Expressed willingness to work with DOGE, submitting policy recommendations.

Conclusion: The DOGE Era Reshapes Market Expectations

Government IT & Defense sectors face headwinds from restructuring and spending shifts.

DOGE’s push for efficiency is reducing contract certainty, pressuring valuations.

Short-term volatility is likely, with long-term structural risks emerging in federal contracting.

Updated Stock Ratings & Price Targets

Government IT & Services

BAH (Buy) – $150 PT | Valuation: 16.3X EV/EBITDA

CACI (Sell) – $362 PT | Valuation: 10.3X EV/EBITDA

LDOS (Neutral) – $148 PT | Valuation: 10.6X EV/EBITDA

PSN (Buy) – $109 PT | Valuation: 15.9X EV/EBITDA

SAIC (Sell) – $101 PT | Valuation: 8.8X EV/EBITDA

VVX (Sell) – $52 PT | Valuation: 7.7X EV/EBITDA

Large-Cap Defense

GD (Sell) – $231 PT | Risks: Jet demand, DoD spending, capital deployment

LHX (Sell) – $198 PT | Risks: DoD priorities, program execution, capital deployment

LMT (Sell) – $418 PT | Risks: Geopolitics, DoD spending, capital deployment

NOC (Sell) – $424 PT | Risks: Geopolitics, DoD spending, program margins