Goldman Sachs: DeepSeek Risks and Upside

In mid-2023 we laid out the case for an AI investment cycle reaching 2% of annual GDP, where 1) an initial surge in hardware investment necessary to train AI models and run AI queries would ultimately fade as compute costs decline while 2) AI software investment increases steadily over time as end-user adoption increases. This thesis has largely borne out so far, albeit in a more frontloaded manner than we expected.

This weekend’s reports that DeepSeek obtained similar AI model performance at a fraction of the cost of existing models raises questions around whether the cost disinflation stage of the AI investment cycle is also arriving sooner than expected, whether large AI investments are sustainable, and whether AI infrastructure companies will be able to capture an outsized revenue share. These are valid questions regarding the distribution of profits, but the macro implications of DeepSeek’s breakthrough are more limited and most likely positive.

The main near-term risk to GDP is that more efficient model training and declining compute costs could lower AI-related capex. We are less concerned from a macro perspective since AI-related investment has so far had little impact on official GDP measures, thereby limiting downside even if investment does slow. Furthermore, our equity analysts note that DeepSeek could catalyze higher levels of real hardware spending if it pushes incumbents to invest more to maintain their lead.

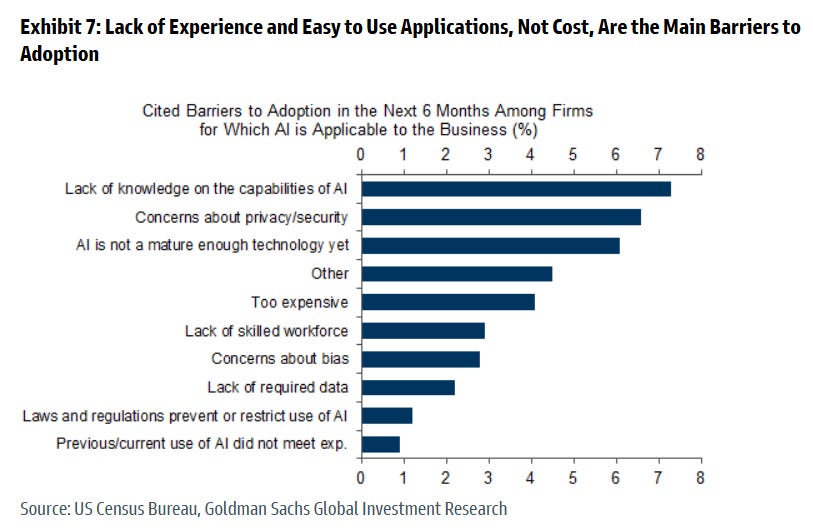

DeepSeek’s breakthrough could raise macroeconomic upside over the medium-term if its cost reductions help increase competition around the development of platforms and applications. Limited adoption is still the main bottleneck to unlocking AI-related productivity gains, and adoption would benefit from competition-induced acceleration in the buildout of AI platforms and applications. That said, the near-term adoption impact is probably limited since cost itself is not currently the main barrier to adoption.

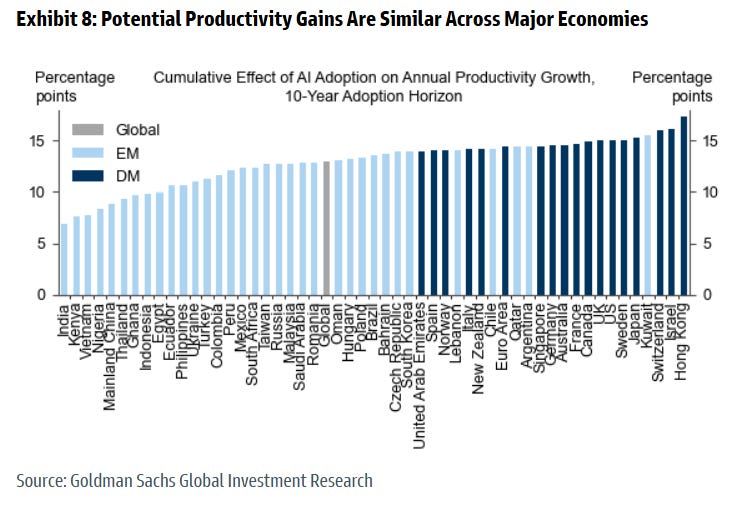

The emergence of a credible global competitor to US-based AI leaders also raises upside risk to global adoption and productivity through two channels. First, the potential automation and productivity gains from generative AI are similar across major economies, and foreign adoption (particularly in major EMs) would benefit from the emergence of non-US based platforms and applications. Second, increased global competition could prompt governments to coordinate investments or lower regulatory barriers in efforts to spur adoption.

DeepSeek Raises Micro Risks, Macro Upside

We have argued in a series of publications over the last two years that generative artificial intelligence (AI) could raise labor productivity and global growth, primarily from its ability to automate a large share of work tasks. Our baseline estimates imply 15% cumulative gross upside to US labor productivity and GDP levels (assuming the capital stock evolves to match increased labor potential) following widespread adoption of the technology.

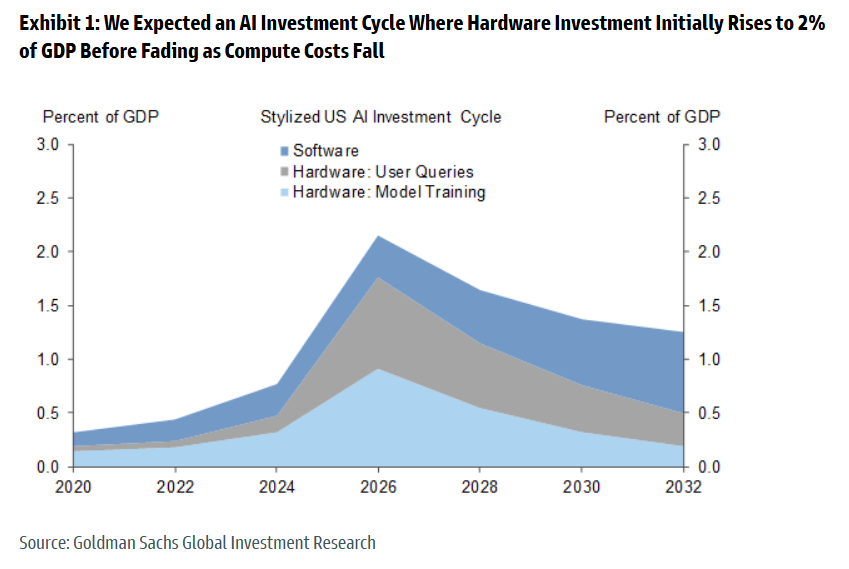

We also laid out the case in mid-2023 for an AI investment cycle reaching 2% of annual GDP, where 1) hardware investment necessary to train AI models and run AI queries initially surges but then fades as compute costs decline while 2) AI software investment increases steadily over time as end-user adoption increases (Exhibit 1).

The investment boom we forecasted has largely borne out so far, although admittedly in a much more frontloaded manner than we anticipated. AI hardware provider revenues surged by over $200bn (annualized rate) as of 2024Q4, and are projected to rise by another $125bn by end-2025.

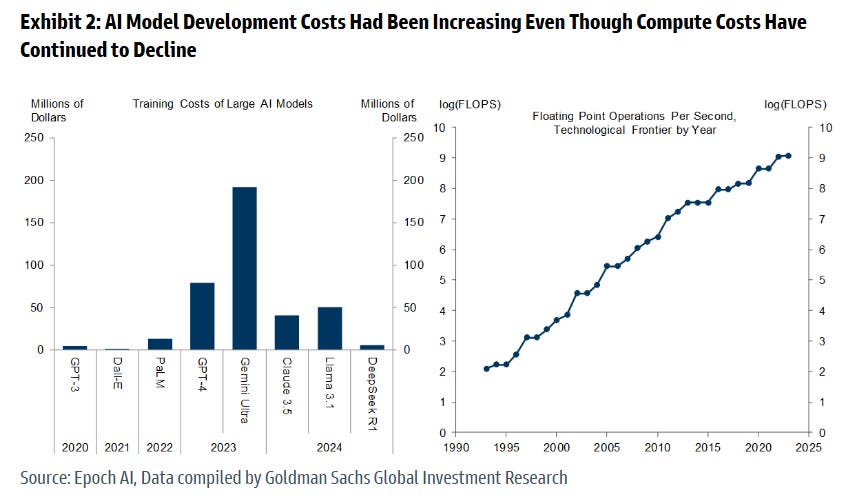

This weekend’s news that DeepSeek’s R1 AI model compares favorably in terms of performance to current leading models despite using less advanced hardware and costing much less to develop (left chart, Exhibit 2) has raised questions around whether the next stage in the investment cycle—where cost savings on compute costs lower the nominal hardware investment necessary to train and use generative AI models—is also arriving earlier than expected.

As noted by our equity analysts, there are valid reasons to question whether DeepSeek’s reported $5.6mn training cost fully reflects the cost of development or the hardware it was trained on. That said, DeepSeek has demonstrated that using novel computational techniques for model inferencing (i.e., multi-layer attention (MLA) and Mixture Of Experts (MoE)) and more efficient model training make it possible to produce highly capable AI models with more limited resources and at lower costs than previously believed. This breakthrough has potentially changed the competitive landscape for generative AI by challenging the widely held view that prohibitive investment costs are a barrier to entry at the foundational model level and raising the prospect that compute costs could continue to fall in line with historical trends (right chart, Exhibit 2).

From a macro perspective, the emergence of DeepSeek’s lower-cost models does not affect our view that the largest aggregate economic gains will come from the productivity boost enabled by generative AI.

If our longer-run estimates are correct and AI-enabled task automation raises the level of aggregate productivity by 15% over roughly 10 years, generative AI would unlock around $4½tn (=15% * $29.3tn US GDP) in annual value for the US economy (in 2024 dollars). This economic surplus will be split among all agents in the US economy, including (following the framework developed by our equity portfolio strategists) Phase 1 and 2 hardware and infrastructure providers, Phase 3 “enablers” that will develop AI platforms and applications, Phase 4 “AI productivity companies” that will use generative AI to improve productivity and realize efficiency gains, workers, and consumers.

The emergence of DeepSeek’s lower cost models raises valid questions around the distribution of the economic surplus created by generative AI across these various stakeholders. The distribution of economic rents depends on a number of factors, including market concentration, intellectual property rights, scalability, and ultimately competition. It is still too early to have confidence in the effect that DeepSeek's reported training innovations will have on the broader ecosystem. However, if expensive hardware and AI infrastructure are less essential to realize the economic potential of generative AI, then companies engaged in the buildout of physical infrastructure would likely capture a smaller share of the overall economic gains as profits. This view is reflected by the equity market’s reaction over the last few days.

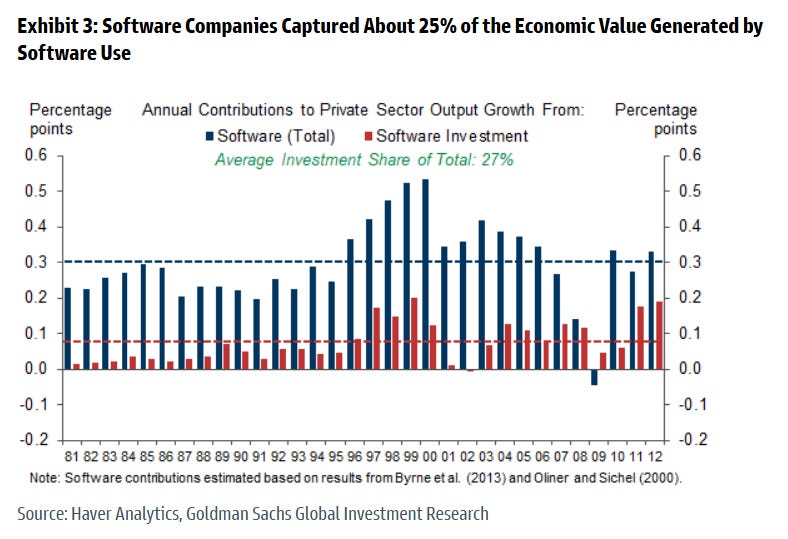

To provide a historical example of how the economic value created by technological change is distributed, in Exhibit 3 we report the estimated contributions of software—reflecting both changes in investment and productivity—to output growth from 1981 to 2012 based on an approach developed by researchers at the Federal Reserve Board.[1] We then compare those contributions to those from software spending, which represent the economic value that accrued to software companies. This analysis suggests that software spending accounted for about a quarter of the economic gains from software adoption, as the significant market power of a few leading “superstar” firms[2] enabled them to capture a large share of the overall economic value. This dynamic is a main reason why average software spend has risen to around $4,500 per US worker in 2024.

While uncertainty around the distribution of the economic surplus created by generative AI is clearly important from the perspective of equity investors, it is less relevant for the macroeconomic outlook since GDP (i.e., the value of production) does not depend on who benefits specifically. As a result, we see the macroeconomic implications of DeepSeek’s breakthrough as somewhat limited, and most likely positive on net.

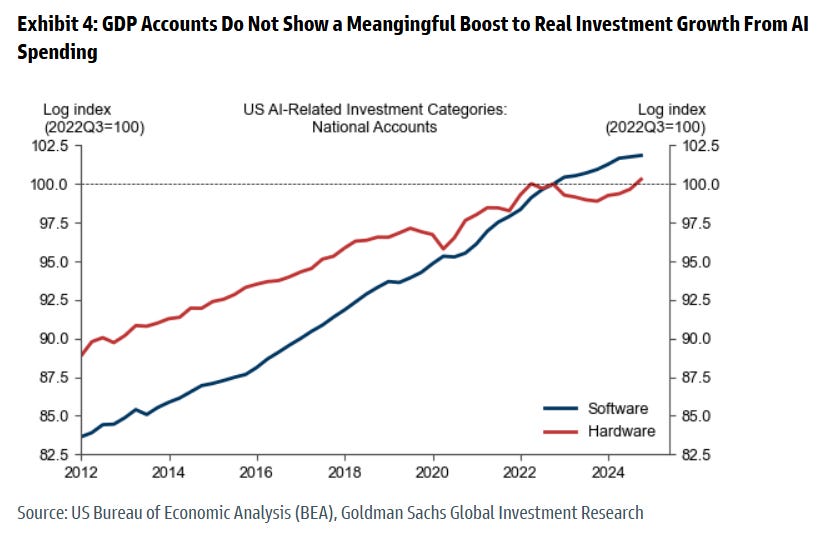

The main near-term risk to GDP is that more efficient model training and declining compute costs could lower AI-related capex, which as noted above, equity analysts project will rise to $325bn by 2025Q4. However, we view this risk as limited for two reasons.

First, AI-related investment has so far had limited impact on real investment growth in official GDP accounts (Exhibit 4) despite reported increases in AI-related capex at the firm level, likely for several reasons. First, public company revenues are generally reported in nominal terms, which have been boosted by cost inflation despite more moderate increases in the quantity of shipments (which are more relevant for real GDP calculations). Second, publicly reported AI revenues reflect global, not just US, spending. Third, difficulties in identifying semiconductors imported as intermediate vs. final investment goods could lead to some undermeasurement. Fourth, timing differences in the recording of national accounts investment (which is measured at the time of delivery) may be limiting the measured AI impact. Regardless, the lack of a positive investment impulse thus far limits GDP downside even if AI-related investment does slow.

Second, our equity analysts do not expect companies to significantly adjust capital allocation on the back of the recent DeepSeek news. While they acknowledge some risk that the build-out of AI infrastructure could be negatively affected should current leaders reassess their forward capex plans, they also highlight that DeepSeek could catalyze higher levels of real hardware spending if it pushes incumbents to invest more to maintain their lead in AI capability.

More fundamentally, if the novel computational techniques employed by DeepSeek’s models indeed increase competition and lower costs, they could catalyze a faster buildout of AI platforms and applications that have so far posed a bottleneck to adoption and the impact on productivity, thereby raising macroeconomic upside.

As discussed above, the main macroeconomic impact from generative AI will come from the efficiency gains from AI-driven automation as companies incorporate the technology into regular production. So far, any aggregate productivity uplift from generative AI has been extremely limited, mostly because very few companies have adopted the technology. As shown in Exhibit 5, the Census Bureau’s Business Trends and Outlook Survey reports that only 6% of companies report using AI for regular production today, only a slight uptick from the 4% adoption rate when Census began collecting data in late 2023.

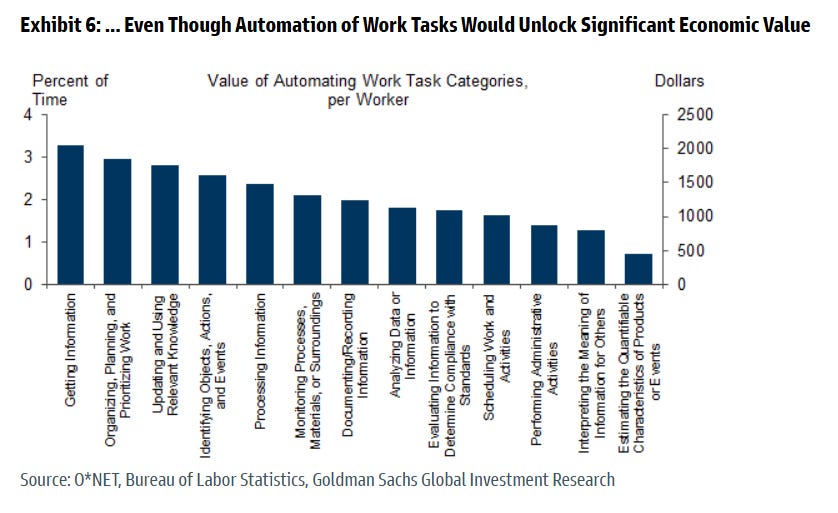

We have long expected that adoption rates would rise in the medium-term, mostly because the types of work tasks automatable by generative AI would result in several thousands of dollars of cost savings per worker per year (Exhibit 6). Given that potential cost savings from generative AI are large and the marginal cost of deployment once applications are developed will likely be very small, we see adoption of generative AI as more of question of “when” rather than “if”.

The potential for a faster buildout of AI platforms and applications—which we continue to see as the necessary step to facilitate adoption across a wide swath of companies—raises the prospect of a more optimistic adoption and productivity boost timeline. Our forecasts currently assume that US adoption reaches levels necessary to impact aggregate productivity statistics in 2027 with a peak impact in the early 2030s, with other DMs and major EMs lagging this timeline by a few years. The recent DeepSeek reports suggest adoption could happen sooner, thereby reinforcing our equity analysts’ and portfolios strategy team’s prior views that investors should increasingly focus on the “Phase 3” platform and application companies that will benefit from AI-enabled revenues.

At the same time, we caution that the near-term impact will remain limited until the anticipated application buildout becomes a reality. Few companies report costs as a primary barrier to adoption (Exhibit 7), suggesting that most companies in the US are waiting for a “plug and play” solution that facilitates easy automation of existing business practices. Until available, we expect that adoption rates (and associated macroeconomic upside) will remain low.

We also see DeepSeek’s reported breakthrough as posing upside risk to global GDP. The emergence of a credible competitor to US-based AI leaders could provide an uplift to global adoption and productivity through two channels.

First, the potential automation and productivity gains from generative AI are generally similar across major economies, reflecting similarities in industry composition of employment (Exhibit 8). While we still expect that the US will adopt AI more quickly than other countries given its leadership in AI model development, the emergence of non-US based platforms and applications could accelerate the adoption timeline elsewhere (particularly in major EMs).

Second, global governments could see the recent breakthroughs of China-based AI models as raising the importance of developing domestic AI capabilities for geopolitical purposes. If so, increased global competition could prompt governments to coordinate investments or lower regulatory barriers to encourage AI development and adoption. Along these lines, the US recently announced a $500bn private sector funding scheme to raise AI infrastructure investment, while China has set a strategic objective to become the global leader in AI. Increased focus and support from an AI arms race could similarly lead to an accelerated adoption timeline.

Taken together, the recent emergence of DeepSeek’s low-cost AI models have prompted a rethink of the overall AI investment thesis. While we are sympathetic to the view that these developments raise company-level micro risk, they have also, if anything, added to our confidence that AI-enabled productivity gains will be a major macroeconomic story in coming years.

h/t Joseph Briggs