Goldman Sachs: CPI preview (12/10/2024)

GS ECON… CPI Previa – GIR

We expect a 0.28% increase in the November core consumer price index (CPI) (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.27% (vs. 3.3% consensus).

We anticipate a 0.28% increase in the November headline CPI (vs. 0.3% consensus), reflecting a 0.25% increase in food prices and a 0.3% increase in energy prices.

Our forecast is consistent with a 0.20% increase in the CPI core services index excluding rent and owner's equivalent, and a 0.20% increase in the core personal consumption expenditures (PCE) index in November.

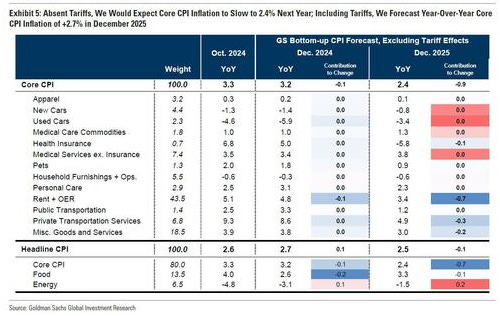

We project year-over-year core CPI inflation of 2.7% and core PCE inflation of 2.4% for December 2025.

Some more details: Goldman highlights three key component-level trends to expect in this month's report:

1. Used cars. After a 2.7% increase in October, Goldman expects a still-strong 2.0% increase in used car prices in November, reflecting the continued pass-through effect of the cumulative increase in used car auction prices.

2. Airfares. The bank expects airfares to rise 1.0% (up from 3.2% in October). The bank's online measure of airfares rose last month, but it expects a smaller boost due to residual seasonality than in recent months.

3. Auto Insurance. Finally, Goldman expects auto insurance prices to pick up (+0.5%) in November, reflecting continued, albeit slowing, premium increases. Rising auto prices, repair costs, and medical and court costs have put pressure on insurance companies to raise prices, but premiums have been passed on to consumers with a long lag, in part because insurers have to negotiate price increases with state regulators. Most of the gap between premiums and insurance costs has already closed. As a result, Goldman expects auto insurance CPI increases to return to their pre-pandemic pace next year. Auto insurance has a much smaller weight and is measured using different source data in the PCE index, so don’t expect these changes to have significant effects on PCE inflation.

Elsewhere in the CPI report, Goldman expects a 0.5% rise in apparel and a 0.1% rise in household goods, based on mixed data on holiday discounts and investment recovery from weaker readings in October. The bank also anticipates housing categories to slow, reflecting a 0.33% rise in owner-equivalent rent (vs. +0.40% in October) and a 0.28% rise in rent (vs. +0.28% in October). And it also expects seasonal distortions to weigh on the communications component (-0.5%) this month.

Looking ahead, Goldman expects monthly CPI inflation of around 0.20-0.25% over the next few months, though there may be a somewhat higher reading in January, reflecting a moderate boost from price increases earlier in the year. The bank also sees further disinflation in the works due to rebalancing in the auto, housing rental, and labor markets, though it expects offsets from catch-up inflation in healthcare and a boost from an escalation in tariff policy. Looking ahead, the bank expects year-over-year core CPI inflation of +2.7% and core PCE inflation of +2.4% in December 2025.

In terms of the market reaction function, Goldman's Lee Coppersmith expects the following based on what the core month-on-month CPI shows: