FOMC Interest Rate Decision

Starting with commentary BEFORE then after

Estimates are unanimous that the Fed will hold rates. This however is not my key focus. Also at 14:00 ET we get the statement on the decision (which is usually copied and pasted) but we’ll be watching the red-line, and the SEP econ projections, where the Fed gives valuable insights into what they forecast GDP, inflation, and interest rates to be in the near term.

Then, at 14:30 ET is the scheduled start of the live press conference with Chairman Powell, where he’s expected to give a short speech addressing issues and concerns since the last meeting (Jan 31st) and then take Q&A.

Powell’s press conference and the SEP will be my key focus.

These are the current dots:

Fed swaps market pricing in cuts beginning in June:

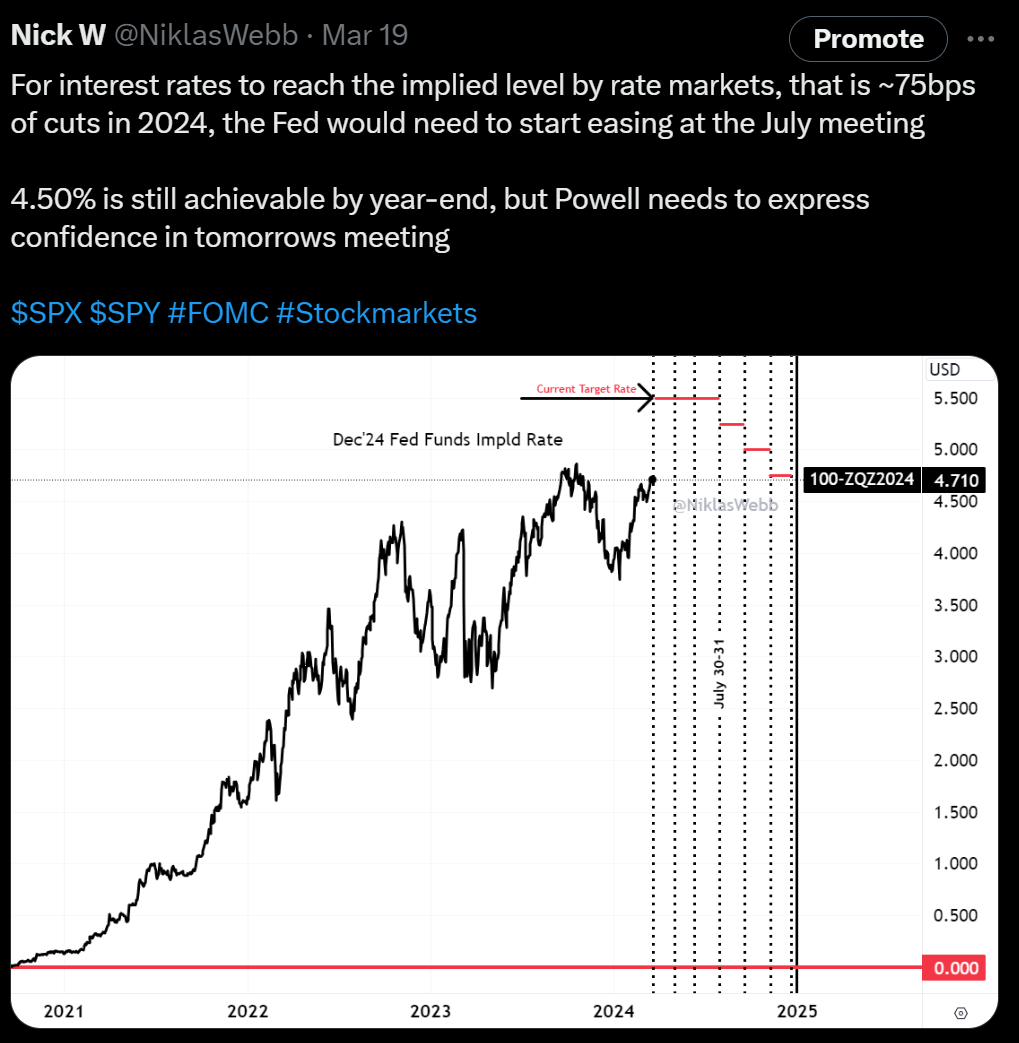

This is consistent with the need for cuts starting in July at the latest to achieve the markets anticipated monetary policy path:

With all firms anticipating no change in the target rate, I instead have provided some information on expectations for rate cuts:

Institution - Cumulative Cuts 2024; First Cut; Terminal rate

Barclays - 75bps; June; 2.5%

BofA - 75bps; June; 2.5%

BNP Paribas - 75bps; June; 2.5%

Citi - 125bps; June; 2.5%

Deutsche Bank - 100bps; June; 2.6%

Goldman Sachs - 75bps; June; 2.6%

JP Morgan - 75bps; June; 2.6%

Morgan Stanley - 75bps; June; 2.5%

Nomura - 50bps; July; 2.5%

RBC - 75bps; n/a; n/a

Societe Generale - 75bps; June; n/a

TD - 125bps; May; 2.6%

UBS - 225bps; June; 2.5%

Wells Fargo - 100bps; June; 2.5%

Some commentary from firms;

Barclays

Low option costs, consistent grind higher in equities, attractive option breakevens, markets near all-time highs and broadly stretched technicals make owning options attractive for directional trades, e.g. puts/collars for downside hedging and vanilla/appearing call spreads for equity replacement.

Goldman Sachs

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

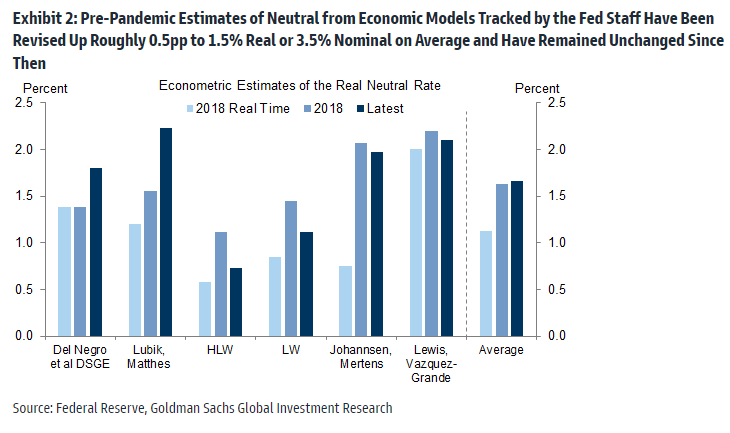

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies.

Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

JP Morgan

At next week’s meeting we expect the FOMC will leave rates on hold and make few changes to the post-meeting statement. In the dot plot we think there are better than even odds that the median dot for this year moves to showing two 25bp cuts by YE24 vs. the three such cuts in the December dot plot.

We also think there’s a good chance the median longer-run dot moves up from 2.5% to 2.625% or 2.75%. We expect little change in the median economic forecasts, though the median core PCE forecast for this year could move up a tick.

At next week’s meeting we expect the FOMC will leave rates on hold and make few changes to the post-meeting statement.

In the dot plot we think there are better than even odds that the median dot for this year moves to showing two 25bp cuts by YE24 vs. the three such cuts in the December dot plot.

We also think there’s a good chance the median longer-run dot moves up from 2.5% to 2.625% or 2.75%. We expect little change in the median economic forecasts, though the median core PCE forecast for this year could move up a tick.

Morgan Stanley

On the net, we think not much has changed for the Fed…We expect changes to the Summary of Economic Projections (SEP) will paint a picture of optimism around supply-driven growth – higher GDP forecasts coupled with an unchanged forecast for core inflation.

We think the median view for rate cuts remains at three this year. And we continue to expect the first rate cut in June, followed by a pause, then cuts in September, November, and December.But there is a risk that the median moves to two cuts.

After a pop in January, incoming inflation data point to a big reversal in core PCE services inflation excluding housing – a key focus for the Fed. At a higher level, assuming our core PCE forecast of 0.32%M for Feb-24 is correct and that Jan-24 is revised to 0.46%M, to achieve the Fed’s forecast of 2.4% core PCE in 2024, the monthly pace would need to average 0.17% for the rest of this year.

Such a run rate is a low bar that implies a risk of upward revisions to inflation next week. It is a close call, but we still believe that the Fed’s inflation forecasts will remain unchanged for 2024. As a reminder, the monthly pace of core inflation was below an average 0.17% in 2H23.

Nomura

We expect a hawkish update to the summary of economic projections at the March FOMC meeting.

The year-end inflation forecast for 2024 should move higher in the wake of two months of upside surprises.

In our view, it is more likely than not that the median dots move higher for 2024 and 2025, which is consistent with our own monetary policy outlook. In addition, we expect the average of longer-run dots to move up, while its median likely remains unchanged.

Wells Fargo

The Federal Open Market Committee (FOMC) will hold its next regularly scheduled policy meeting on March 19th-20th.

We do not expect any policy changes at this meeting, an expectation that is held by most market participants.

Recent data, including the 275K jobs that were added to payrolls in February and the 0.4% increase in the Consumer Price Index (CPI) in February relative to January, give the Committee little incentive to ease policy at this time. In that regard, we revised our outlook for Fed policy in the US Economic Outlook that we published this week.

Previously, we had looked for the first rate cut at the May 1st FOMC meeting, but it appears that Fed policymakers need greater confidence that inflation is indeed receding to 2% on a sustained basis before they sanction an easing of the policy stance.

We now believe the Committee will wait until its June 12 meeting before reducing its target range for the federal funds rate by 25 bps. We then look for the FOMC to cut rates by 25 bps at each of its meetings in July, September and December.

That said, we readily acknowledge that the risks to our federal funds forecast are skewed to later rather than sooner.

That is, we believe the probability that the FOMC waits until its meeting on July 31 to commence its easing cycle is higher than the probability that it cuts rates at its May 1 meeting.

If the Committee waits until its July 31 meeting to begin cutting rates, then it likely will not deliver the 100 bps of total easing that we anticipate this year.

Could the FOMC refrain from cutting rates at all this year? Perhaps, but we do not think the probability of that scenario is very high. The real fed funds rate is 2-1/2% at present.

The current level of the real fed funds rate is significantly higher than it was at any point during the economic expansion of 2010-2019.

You can find updates & real-time commentary here starting at 14:00 ET today