Deutsche Bank: Key Takeaways from EU elections

The two main take-aways of the election results are (1) the centrist majority in the European parliament is holding as the the right did not outperform and (2) the biggest impact could be at the national level with Macron calling a legislative election.

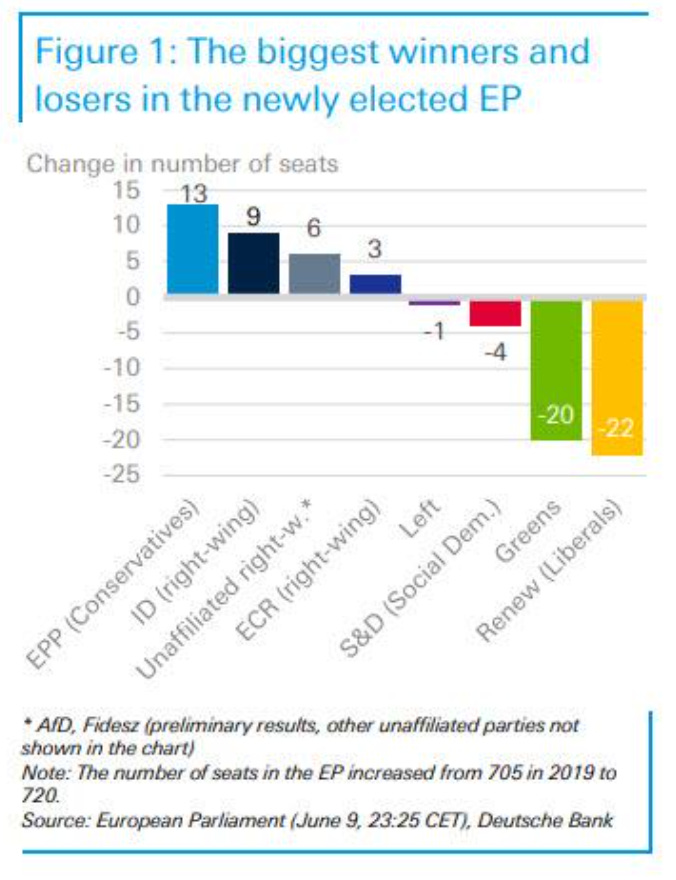

Centrist majority holds with 56% of total votes – EU likely to continue to run a centrist policy course. As widely, centrist parties have kept their majority. This means that the EU legislative process on future policy priorities (defense integration, boosting competitiveness) is unlikely to be hampered in the next 5-year legislative term. However, the shift to the right in the EP (all right-wing parties winning 22% of total votes) is likely to have some impact on the policy debate and could influence the shape of new legislation in policy areas like migration and the Green Deal.

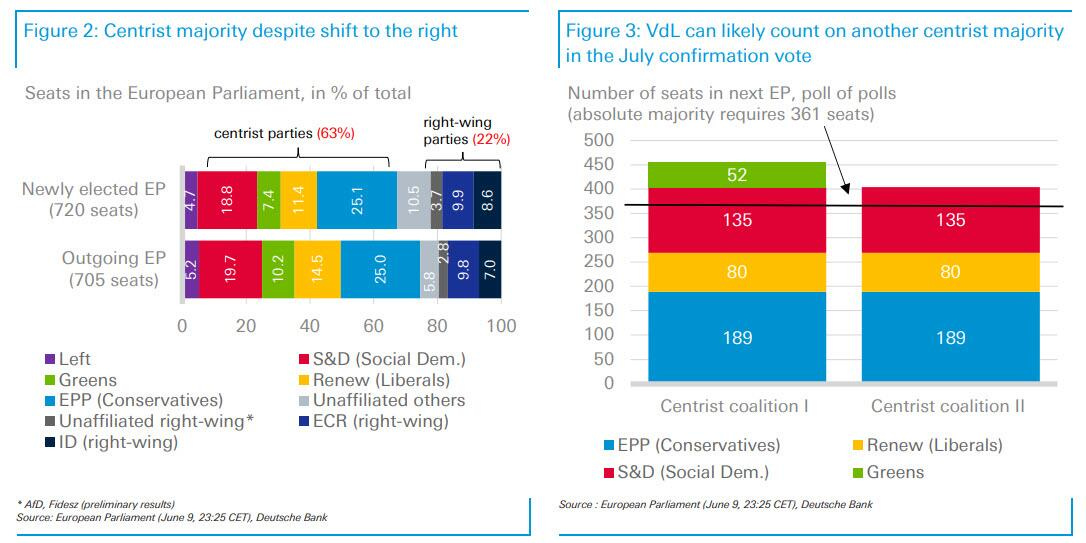

Von der Leyen (VdL) likely to remain head of the EU executive, but parliamentary confirmation vote could remain tight. EU leaders are likely to formally nominate VdL for the next Commission presidency on June 27-28, not least as the majority of EU leaders are from her party group. The subsequent parliamentary vote (now likely to happen on July 18) still looks tight and will probably require some deft negotiating (e.g. programmatic concessions, tactical alliances).

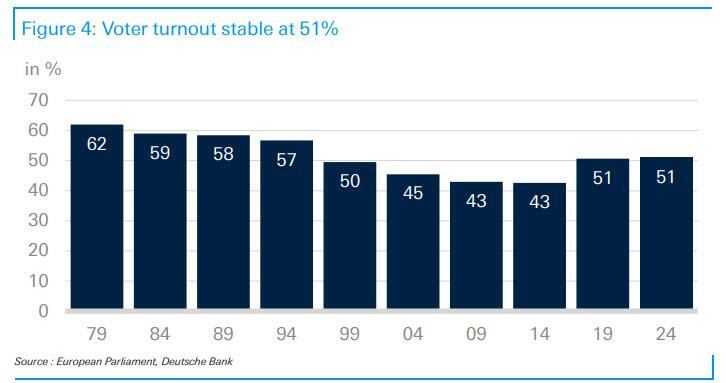

Same voter turnout as in 2019 – no further Europeanisation of politics. Voter turnout remained steady at 51%, which suggests that a majority of the electorate does not consider EP elections to be second-order events. However, heightened geopolitical uncertainty did not mobilize more voters and raise awareness for EU-level action needed to solve current challenges around security and industrial competitiveness.

Further insights into policy priorities expected in mid-July when VdL (or another candidate for Commission presidency) will present her/his new work program to the EP. Given headline concerns, it is likely to be centered around the priorities of competitiveness , security & defence and enlargement and common financing thereof.

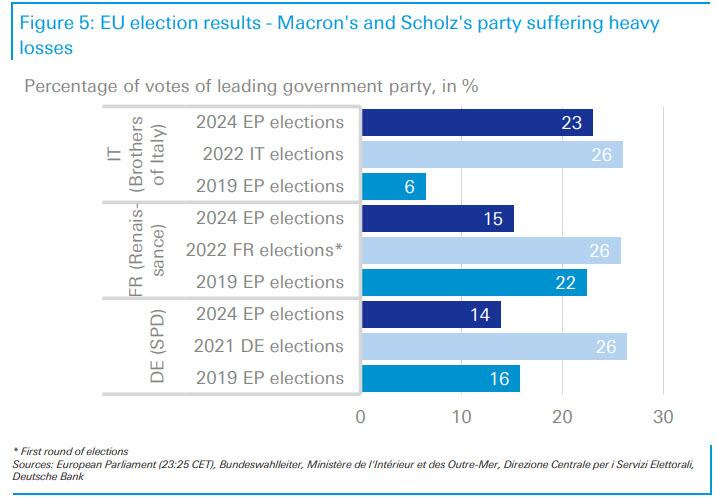

Macron dissolves parliament and calls early elections on June 30 for round 1 and July 7 for round 2. Macron’s Renaissance party suffered heavy losses in the EP elections and he dissolved parliament yesterday night. Macron himself will stay in office as president. Domestic government stability in other major eurozone economies is unlikely to be affected by the elections (despite the electoral defeat of Scholz's SPD).

Centrist majority holds – but parliament is more fragmented and has shifted to the right

Centrist majority holds with 56% (63% incl. the Greens) of total seats. Polls were a good predictor of the EP election outcome as centrist parties have kept their majority, despite the Greens and Liberals suffering heavy losses. This means that the EU legislative process on future policy priorities (defense integration, boosting competitiveness) is unlikely to be hampered in the next five-year legislative term. This also means that VdL‘s re-election is now relatively likely (see more below).

Right-wing parties to win around 22% of total seats – impact on EU policy course should be limited (for now). The shift to the right in the EP (summing up votes for ID, ECR and unaffiliated parties like Fidesz and AfD) is likely to have some impact on the policy debate. It could influence the shape of new legislation in policy areas like immigration and the Green Deal. However, this will only be the case if the centrist majority is divided and there are defections on key votes. As long as the centrist majority acts as a unified bloc, and the right-wing groups remain a non-coherent bloc, the impact on the course of policy will remain limited. Fears of a populist shock seem to have been premature, but they may serve as a barometer of where national politics is headed.

More complex decision-making in a fragmented parliament. As the vast majority of EU laws are jointly adopted by the EP and the Council, a more fragmented EP could make the adoption of new legislation more cumbersome. While the EP only needs to be consulted in policy fields such as internal market exemptions and competition law, co-decision (e.g., energy, economic governance) and consent powers (e.g., on accession) cover most areas of Union action.1 The EP can also veto the EU budget as a whole, but has not used this power since 1984.2

Same voter turn-out as in 2019 - no further Europeanisation of politics

Same voter turn-out as in 2019 – no further Europeanisation of politics. Voter turnout remained steady at 51%, which suggests that a majority of the electorate does not consider EP elections to be second-order events. However, heightened geopolitical uncertainty did not mobilize more voters and raise awareness for EU-level action needed to solve current challenges ranging from guaranteeing national security to reacting to more active industrial policy and potential trade protectionism in the US and China. A recent study shows that the crises that hit the EU over the past few years have strengthened the sense of belonging to the EU among citizens of all age groups.

VdL to head the EU executive – confirmation vote in parliament in on July 18

VdL likely to be endorsed for a second term by EU leaders on June 27/28. Traditionally, the Commission president comes from the largest group in the EP, which is again the conservative EPP. Hence, the EPP’s lead candidate, VdL, has a good chance of securing the nomination of the EU heads of state at their June 27-28 meeting. The EPP’s dominant position in the Council (11 of 27 EPP heads of state) and the Conservatives' steady performance in the elections underpin this. However, the Council’s negotiations on EU top jobs are not entirely predictable and a surprise candidate – although it seems unlikely – cannot be entirely ruled out (VdL herself was a surprise candidate in 2019).

VdL confirmation vote in parliament on July 18 still looks tight. VdL – should she be nominated by the Council – needs to be confirmed by the EP with a minimum of 361 votes. Due to the losses of the Greens and Liberals, the centrist majority in the EP has shrunk to 456 seats (404 seats without the Greens). This means that VdL cannot sustain more than 21% defections in the case of a broad centrist coalition (or more than 11% in the case of a narrow centrist coalition without the Greens). These are not comfortable buffers. It will probably require some craft (e.g. programmatic concessions, tactical alliances) for VdL (or any other candidate) to secure a majority in the new EP in the confirmation vote on July 18.

What happens if VdL fails to receive the needed majority in parliament on July 18? If VdL(or an alternative candidate) does not achieve an absolute majority in the EP, the Council would have to propose another candidate within a month. This could be another EPP candidate (e.g. Romanian President Klaus Iohannis, Croatian PM Plenković, Greek PM Mitsotakis have all been mentioned in the press ). The candidate subsequently needs to be confirmed by the EP. There is no historical precedent for such a scenario of prolonged leadership uncertainty in the EU.

What is the impact of the election on domestic politics in key EU member states?

The biggest impact of the election result could be at a national level with President Macron announcing the dissolution of the French parliament after the defeat of his Renaissance party. Moreover, the election outcome may serve as a barometer to where national politics is headed in other EU member states:

France - Macron dissolves parliament and calls early elections on June 30 for round 1 and July 7 for round 2 . Macron’s Renaissance party suffered heavy losses in the EP elections and the French President immediately announced the dissolution of parliament. A legislative election does not affect Macron's status as President. At the EU level, Le Pen's National Rally will likely continue to be a part of the far-right fringe party group ID, with limited influence in the EU parliament. Domestically, the weak showing of French President Macron’s Renaissance party (coming in second place in the EP election) might provide tailwinds for Le Pen's National Rally in the legislative election. The strong result of the centre-left Socialist party might have consequences for the centre-left/left bloc in France. The EP results and recent polls suggest that the outcome of the legislative elections might lead to a government less likely to easily comply with EU fiscal rules either intentionally or as a result of a potential weak political alliance.

Germany – Weak election result of Scholz's SDP might fuel a debate about Scholz’s nomination for a second term for the 2025 national elections. Scholz’s Social Democrats secured 14% of total votes Figure 5 , which is roughly the same as in the last EP elections in 2019, but far less than in the general elections 2021. This rather weak result might fuel a debate about whether he is the right candidate to lead the SPD into next year's general elections. The budget process for 2025 is shaping up to be a critical test for the coalition's cohesion in the coming months.

Italy – increasing leverage at the EU level? Although Giorgia Meloni’s Brothers of Italy did less well than expected (with approval rates falling below 26%), this is unlikely to have an immediate impact on domestic government stability. At the European level, she has gained influence as (tacit) support for VdL might give her increasing leverage at the EU level (including a powerful portfolio in the next commission; e.g., the internal market portfolio).

Work programme to provide insights into policy priorities by mid-July

VdL's (or any other candidate's) campaigning for the EP confirmation vote will start now, after the elections. Once nominated by EU leaders, VdL (or another candidate) will likely present a work program for the coming 5-year term to secure election in the European Parliament. The program that VdL presented in 2019 on the day of her election by the EP formed the basis for her Commission’s priorities and guided the EU lawmaking over the 2019-24 term (despite new priorities being added due to the Covid-19 pandemic and the war in Ukraine). An assessment by the EP research service shows that of the approximately 660 initiatives announced, about 530 (80%) were converted into proposals and roughly 60% of these were adopted or close to adoption in April 2024.

The new work program will likely be inspired by the Council’s strategic agenda for 2024-29 (expected to be adopted on June 27/28) and will likely be centered around competitiveness, security & defence and enlargement and common financing thereof.

Next steps - should be a smooth , but lengthy leadership transition

First indications of who might become the next Commission president are expected by end-June. But the formation of the new EU leadership team will take time. Key steps to watch are:

Next few days - formation of European party groups – no big changes likely for the centrist majority. The newly elected MEPs will now start to form political groups. Only a small share of the unaffiliated may join a centrist group such as the EPP (e.g. MEPs from the Hungarian "Respect and Freedom" party). Rather, a considerable share of the unaffiliated could join the right-wing groups ECR or ID. A merger of the two right-wing groups seems unlikely for now given their different stances on Russia.

June 27-28 meeting - EU leaders will likely nominate VdL. EU leaders will start discussing the allocation of EU top jobs at the G7 summit and at an informal meeting in mid-June. They will likely formally announce whom they endorse for the Commission presidency at their June 27-28 summit.

July 18 – Parliament confirmation vote (presumably of VdL ) . The EP is likely to already vote on the Commission presidency during its first session taking place on July 16-19.6 There is only one EP session before the summer recess and EU decision-makers may want to avoid prolonged leadership uncertainty given the current geopolitical backdrop.

November/December 1 - new Commission takes office. The current Commission will act as a caretaker Commission until that point, assuring the EU's ability to act in the event of a crisis or external shock.