BofA: The Flow Show (10/22/2024)

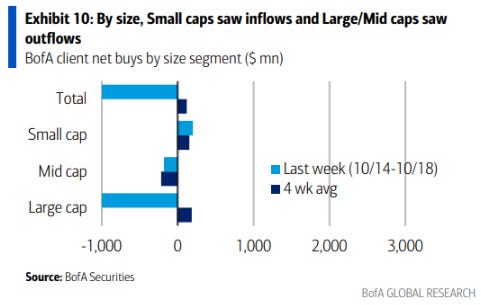

Last week, during which the S&P 500 rose 0.9%, BofA Securities clients were net sellers of U.S. equities (-$3.7 billion) for the second week in a row. Clients sold individual stocks but bought ETFs. Capital outflows were seen in large and mid-sized companies, while small companies saw capital inflows.

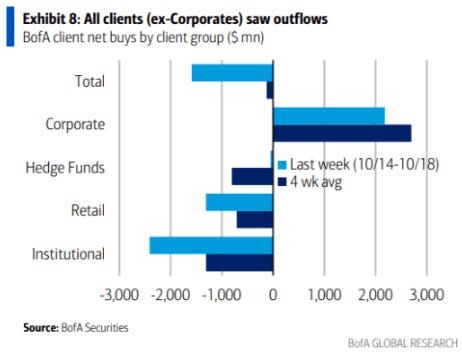

Hedge funds, institutional clients and retail clients were all net sellers. The former two were sellers for the fourth consecutive week, while private clients were sellers for the second consecutive week.

Buybacks remain strong: Buybacks by corporate clients accelerated last week and continue to be above seasonal levels as a percentage of S&P 500 market capitalization. Trailing 52-week buybacks as a percentage of S&P 500 market capitalization are at an all-time high in our database (since 2010).

Tax-loss selling flows: Stock sales by institutional clients typically spike this month ahead of the Oct. 31 deadline for most mutual funds to realize capital gains. In fact, this group has sold shares for the past four weeks. Sales by retail investors typically spike in December ahead of the 12/31 deadline for individual investors.

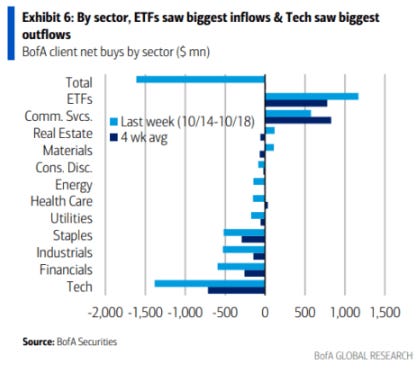

Individual stock outflows were led by Technology and Financials. Eight of the 11 GICS sectors experienced capital outflows, led by Technology, Financials and Industrials. Technology has seen outflows in three of the past four weeks, despite positive results in last week’s Semiconductor reports (see Week 2 Earnings Tracker).

There were inflows into Communication Services, Real Estate and Materials, with Real Estate seeing its first week of inflows in nine weeks (we favor Real Estate for its profitability and quality).

The Consumer Staples sector has the longest recent selling streak (four weeks), and we are underweight this sector due to its lower quality relative to history and weak guidance trends.