BofA: Fund manager survey (12/19/2024)

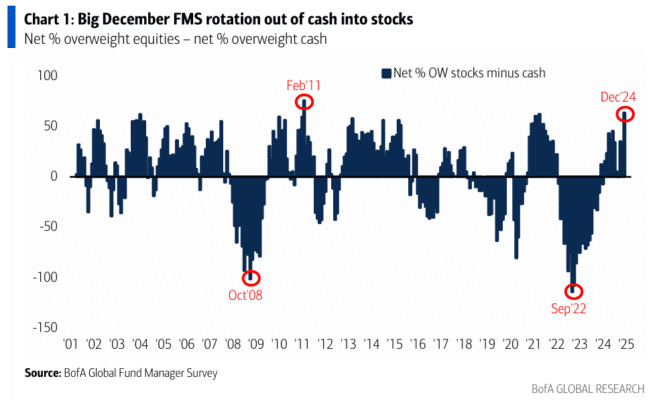

Big December rotation in FMS, from cash to stocks.

Our broadest measure of FMS sentiment, based on cash levels, equity allocation and economic growth expectations, rose to 7.0 from 5.2, the highest level since August 2021. December saw the largest monthly increase since June 2020.

The FMS cash level fell from 4.3% to 3.9% of AUM (assets under management), matching the lowest level since June 2021.

As the FMS cash level fell below 4.0%, BofA’s FMS Global Cash Rule triggered its second contrarian “sell” signal in 3 months.

Since 2011, there have been 12 previous “sell” signals, which resulted in global equity returns (ACWI) of -2.4% in the following month and -0.7% in the three months following the triggering of the “sell” signal (see Rules and Tools).

The FMS cash allocation fell to a net underweight of 14% (from a net overweight of 4%), the lowest level on record (at least since April 2001).

The 18 percentage point decline in December is the largest monthly drop in cash allocation in five years.

Previous low levels of FMS cash allocation coincided with significant spikes in risk assets (January-March 2002, February 2011).

In December, global growth expectations improved to a net 7% expecting a stronger economy (up from a net 4% expecting a weaker economy in November).

Global growth expectations turned positive for the first time since April 2024.

December's rise in global macroeconomic sentiment was led by increased optimism about US growth, with the highest percentage of FMS investors expecting a stronger US economy (net 6%) since at least November 2021.

The 'Trump 2.0' political agenda (tax cuts, deregulation) boosted earnings expectations, with 49% of FMS investors expecting an improvement in global earnings (up 22 percentage points from the previous month, hitting a 3-year high).

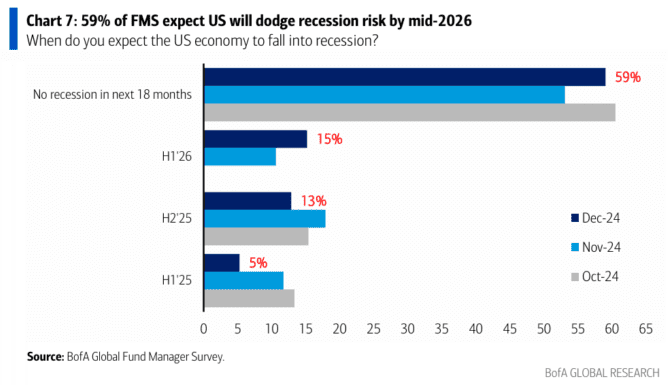

59% of FMS investors believe there will be no recession in the United States in the next 18 months.

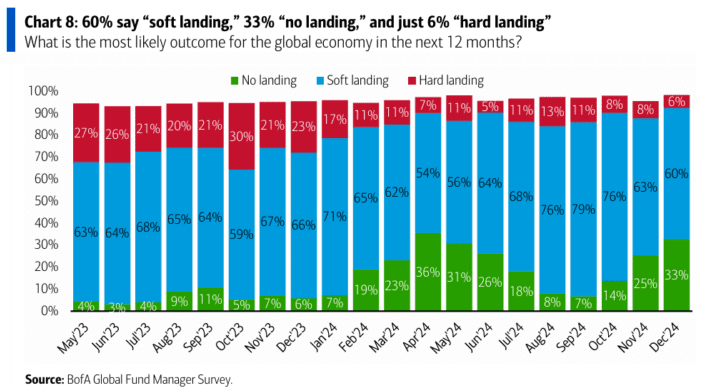

On landings… 60% of FMS investors expect a “soft landing”, while 33% now expect “no landing” (maximum in 8 months), compared to only 6% who anticipate a “hard landing” (minimum in 6 months).

A net 1% of FMS investors in December expect lower long-term rates, down from a net 7% in November. Expectations for lower bond yields have fallen to their lowest level in 2 years.

Meanwhile, a net 80% of FMS investors expect lower short-term rates in 2025, explaining why 8 in 10 anticipate a steepening of the yield curve.

Trade is seen as the most likely policy area to be impacted by the Trump administration, according to 64% of FMS investors.

Immigration follows in second place (13%) and regulation in third (8%).

When asked which development would be considered the most bullish in 2025…

Respondents to the December FMS survey cited accelerating growth in China (40%), followed by productivity gains thanks to AI (13%), a peace deal between Russia and Ukraine (13%) and tax cuts in the United States (12%).

When asked which development would be considered the most bearish in 2025…

FMS respondents in December pointed to a global trade war (39%), followed by a disorderly rise in bond yields (28%) and rate hikes by the Fed (26%).

On tail risks… 37% of FMS investors in December see a global recession triggered by a trade war as the top tail risk, while another 37% see inflation-driven Fed rate hikes as the top tail risk. Ten percent of FMS investors identify geopolitical conflicts as the top tail risk.

On crowded trades… “Long Magnificent 7” continues to hold the top spot as the most crowded trade for the 21st consecutive month, with 57% (the highest level since July 2024).

15% of investors say that “long US dollar” is the most popular trade.

Allocation to US equities increased 24 percentage points month-on-month, reaching a net overweight of 36%, the highest level on record.

The jump in December was the largest seen since September 2023.

FMS investors are positioned for a “US inflation boom” next year, given the announced pro-growth policy outlook.

In relative terms…FMS investors are at their highest level of overweight in US equities relative to emerging market equities since June 2012.

FMS investors are at their highest level of overweight in US equities compared to Eurozone equities since June 2012 (Eurozone debt crisis).

The US relative overweight to the Eurozone is the fourth largest in the past 24 years.

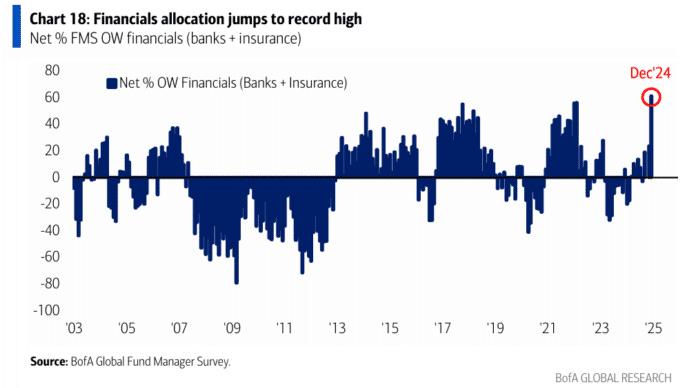

The FMS allocation to the financial sector (net overweight percentage in banks and insurance) reached an all-time high in December.

Allocation to banks increased 23 percentage points month-on-month (the largest monthly increase on record), reaching a net overweight of 41%, the highest level since January 2022.

The allocation to insurance rose 15 percentage points month-on-month to a net overweight of 20%, the highest level since February 2014.

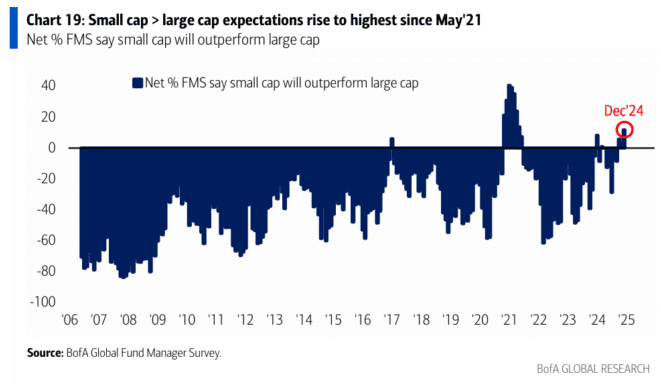

A net 12% of FMS investors expect small-cap stocks to outperform large-caps, the highest level since May 2021.

This chart shows monthly changes in FMS investors' allocation in November.

Investors increased their allocation to the United States, the financial sector (banks and insurance) and equities…

…and reduced the allocation to emerging markets, the Eurozone and cash.

This chart shows the absolute positioning of FMS investors (net overweight percentage).

Investors are more overweight in stocks, banks and the US, while they are more underweight in the Eurozone, commodities and bonds.

This chart shows the positioning of FMS investors relative to the long-term average positioning (approximately the last 20 years).

Compared to history, investors are overweight financials (banks and insurance), US equities and utilities…

…and are underweight cash, Eurozone equities and energy.