BofA: Flow show (12/01/2024)

Dashboard Scores: Cryptocurrency 82.0%, Gold 27.4%, Stocks 20.2%, HY (High Yield) Bonds 8.0%, US Dollar 4.7%, Cash 4.8%, IG (Investment Grade) Bonds 2.8%, Commodities 2.6%, Government Bonds -1.9%, Oil -4.1% YTD.

November “Winners” and “Losers” : Bitcoin 31%, Speculative Tech (ARKK) 23%, US Banks 14%, US Small Businesses 10%, vs. China -6%, Gold Miners -8%, Renewables (TAN) -10%.

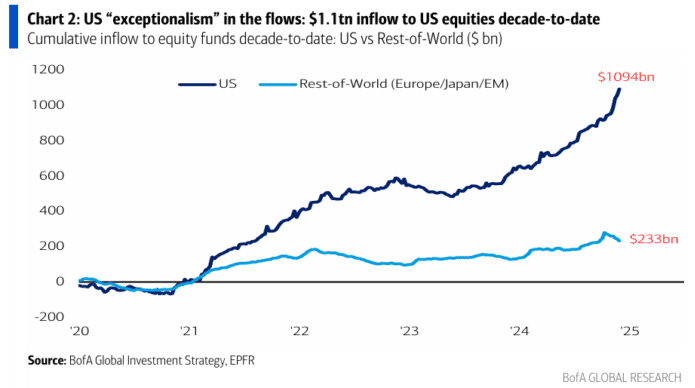

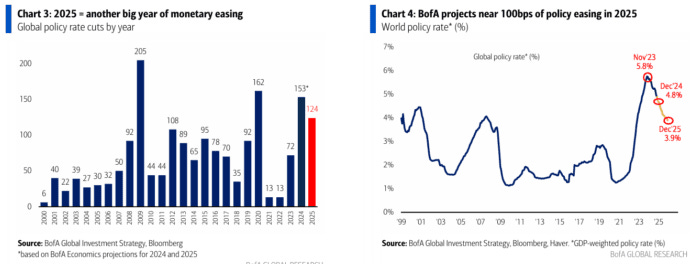

The Big Picture : Big policies, big moves, big extremes… The investment environment heading into 2025 is centred on a major economic disconnect between the US and the rest of the world (RoW), with aggressive US growth and trade policies accentuating the US boom and a global recession (Chart 2). There are 124 global policy rate cuts (Chart 3), an easing Fed with 3% inflation and 5%-4% policy rates (Chart 4), a policy panic in the EU and China – all at a time of elevated equity and corporate prices. In 2025, 25% deviations (over- or undervaluations of assets) are more likely than a mean-reversion year.

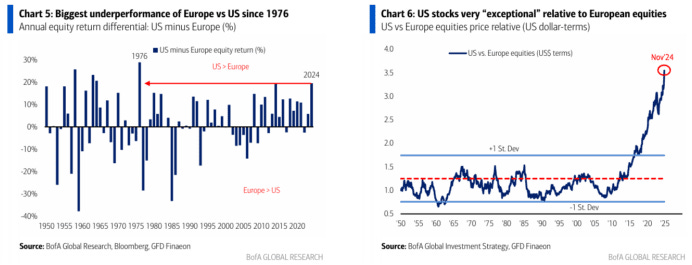

The Price is Right : 2024 marks the largest US outperformance of Europe since 1976 (+20% – Chart 5); US is very “outperforming” Europe in the 2020s… average GDP growth of 2.3% in the US vs. 1% in Europe, a $1.1 trillion inflow into US equities vs. a $0.3 trillion outflow from Europe… this explains why US equities are at their highest level in 75 years compared to Europe (Chart 5). However, more unconventional wisdom heading into 2025 suggests… Europe > US

Market Story : Go big in 2025 with this approach: Long “US boom” and short “global recession” strategies in Q1; buy global equities in Q2; inflation will surprise on the upside… long gold and commodities; a tighter Fed will make US Treasuries a big buy at 5%; “bubble” risks best hedged with crypto and Chinese stocks. We expect bonds, global equities, and gold to perform against the US exceptionalism consensus.

Flows to Take into Account:

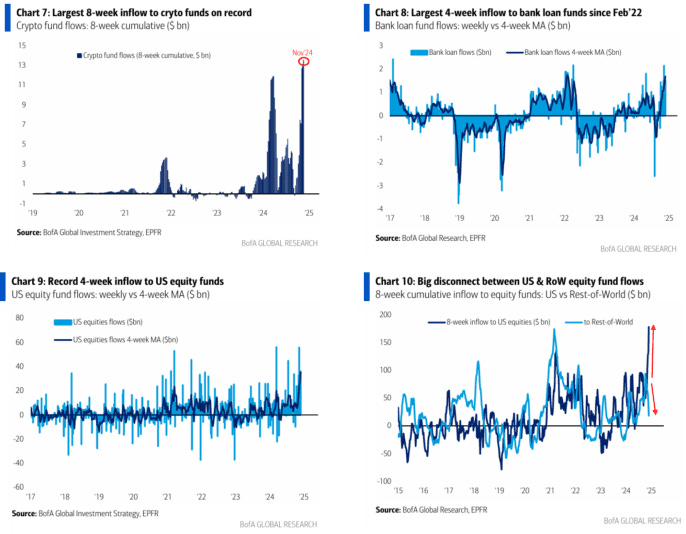

Cryptocurrencies : The largest 8-week cumulative flow on record ($13.5 billion – Chart 7), representing 30% of the total $45 billion inflows since 2019.

Bank loans : inflows over the past 8 weeks ($1.5 billion last week), marking the largest 4-week flow since February 2022 (Chart 8).

US stocks : Huge inflow of $36.1 billion, driving largest 4-week flow on record ($141 billion – Chart 9).

US vs Rest of the World (RoW) : Last 7 weeks…$176 billion inflows to the US vs $19 billion outflows from the RoW ($5.3 billion last week – Chart 10).

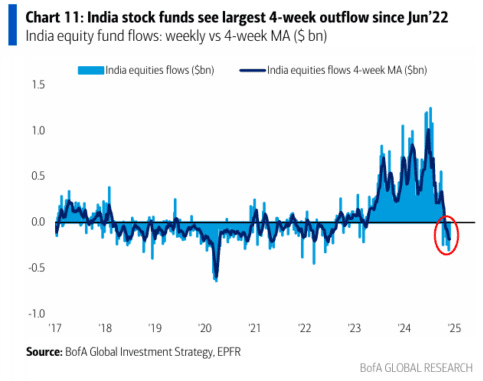

Indian stocks : Third consecutive week of outflows ($0.2 billion), marking the largest outflow in 4 weeks since June 2022 (Chart 11).

Financial sector : the largest flow in 4 weeks since January 2022 ($8.0 billion in the last 4 weeks).

Utilities sector : first positive flow in 5 weeks ($0.4 billion) and the largest in 11 weeks.

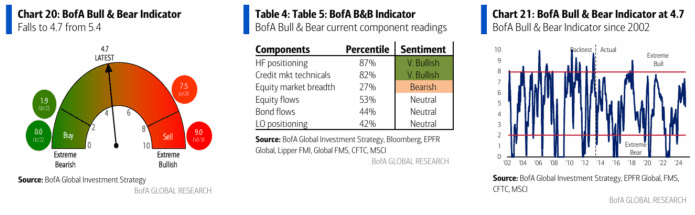

BofA Bull & Bear Indicator : Down from 5.4 to 4.7 (11-month low); the biggest weekly drop for the Bull & Bear Indicator since March 2023 due to equity and debt outflows, low equity market breadth (45% of regional indices trading below 50- and 200-day moving averages), and higher cash in the FMS. The drop in the Bull & Bear Indicator, which is the broadest gauge of global sentiment and positioning, from 7 to 5 over the past 6 weeks illustrates the extreme disconnect between investor optimism in US assets and pessimism in the rest of the world.

Going Big in 2025 : We forecast a buck-the-grain performance of bonds, global equities, and gold against the consensus of US exceptionalism, following this approach (more details in our “Year Ahead 2025” report):

First quarter : long positions on the “US boom” and short positions on the “global recession” due to a significant overvaluation of the dollar and US stocks.

Second quarter : International equity buying amid political panic in Europe/Asia and aggressive easing of financial conditions abroad.

2025 Full Year : Long positions in gold and commodities due to an upside inflation surprise.

US Treasuries at 5% : Buy at this level as it would induce (a) volatility and losses in risk assets, (b) the peak of the “inflation boom,” and (c) innovative solutions to reduce the US budget deficit, such as new government-sponsored entities to encourage US home equity lending, increase tax revenues, and reduce interest payments.

Long crypto and Chinese stocks as a hedge against bubbles… the best moves to take advantage of extreme risks in the AI/Magnificent 7 “bubble” (the most obvious risk in 2025).