Bloomberg: No End in Sight for Ozempic-Fueled Drop in Medical-Device Stocks

Year-end portfolio manager selling set to hit sector: JPMorgan Dialysis stocks battered by Ozempic kidney trial update

October 11, 2023 at 6:18 PM UTC

Medical-device stocks hard hit by the rising popularity of a new class of weight loss drugs are poised to extend a precipitous drop into year end.

That’s according to JPMorgan Chase & Co. analyst Robbie Marcus, who says the sector will see more declines before sentiment shifts as big-money investors steer clear. “Long-only portfolio managers are just exiting these positions and avoiding the space,” he wrote in a note Wednesday.

While a case could be made for a near-term recovery, Marcus says it’s prudent to “be realistic and acknowledge that if these levels of fear and doubt remain the primary emotional response, then MedTech could suffer without long-only portfolio managers returning to the space.”

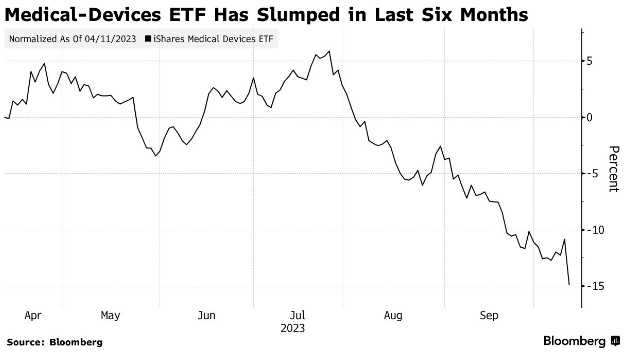

Mania surrounding injectable drugs Ozempic and Wegovy — known as GLP-1s — has wreaked havoc across markets and especially medical technology stocks, sending the iShares U.S. Medical Devices ETF down roughly 15% over the past six months.

The early stop to a trial of Novo Nordisk A/S’s Ozempic after showing effectiveness in kidney failure further upended health stocks on Wednesday, pummeling dialysis companies including Baxter International Inc. and DaVita Inc. They’re not alone either. The whole health-care complex has been left out of the broader market gain this year with the makers of diabetes-tied devices, Dexcom Inc. and Insulet Corp., among the worst performers, falling about 31% and 55%, respectively.

Read more: Novo’s Diabetes Drugs Are Shaking Up Stock Markets Again

As patients continue to drop pounds investors are betting there’s a likelihood that diabetes cases may decline, eventually cutting back on the need for medical devices that provide insulin. If the worst-case scenario is taken to its extreme — the need for procedures from heart to knee surgeries will also disappear, especially when a next-generation weight-loss drug appears in pill form.

“We don’t see that pill today, but in the future we can’t discount that it won’t happen given how much money is now being thrown at it,” Marcus said.

Still “it’s disingenuous” he argued to assume there would be further advances in weight-loss drugs “and yet give no credit to further MedTech innovation, which is robust and with high percentage win rates.”

ResMed Inc., Baxter and Inspire Medical Systems Inc. have each lost roughly a third of their value so far this year leaving investors to wonder when the worst-case has been fully priced in.

For now Marcus expects “GLP-1 noise will remain, enthusiasm on the drug side will be high, and pipeline drug development will continue.”

Read more: Weight-Loss Drugs Divide Wall Street on Device Stocks