Barclays: Easing time has come (09/06/2024)

While the US jobs report did not bring final clarity on the size and pace of Fed cuts, it did, together with Fed speakers, cement the easing to start this month. We remain firmly in the 25bp camp. The ECB is also likely to cut 25bp next week, when the focus will also be on US CPI, China data, and the Trump-Harris debate.

Monetary easing on the way

Fed to cut 25bp against a mixed job report

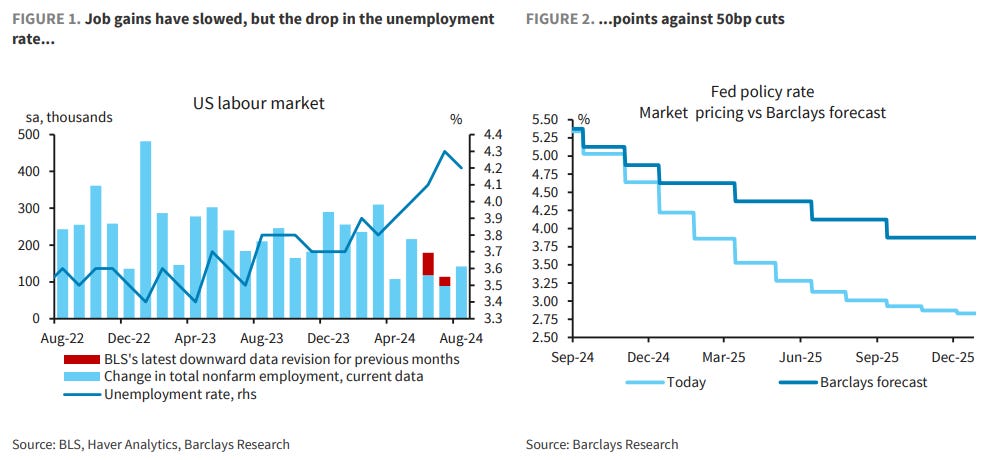

Despite the high anticipation, this week's employment report lacked definitive answers. The change in nonfarm payrolls was 142k, somewhat lower than expectations, and the prior two months were revised lower. This implies a 3mma rate of job gains at 116k, substantially slower than the 211k in the three-month period ending in May. Similarly, earlier in the week, the JOLTS estimates hinted at further deterioration in the labour market, as job openings continued to trend down and the ratio of job openings to unemployed dropped below pre-pandemic levels. On the other hand, the unemployment rate edged lower, rounding to 4.2% vs. 4.3% in July. Combined with the upticks in average hourly earnings to 0.4% m/m and the workweek, this suggests strong income growth, with the payroll income proxy at 4.6% 3m SAAR.

Overall, our read of this data is that the labour market continues to cool, but we see no sign of the kind of rapid deterioration in conditions that would call for a 50bp rate cut in September. Importantly, we also see no indication of any appetite for this in FOMC communications. Speaking after the payrolls, New York Fed President Williams indicated that the August employment data were consistent with the gradual labour market easing in recent months and reiterated his baseline outlook for solid growth (2.0-2.5%), the unemployment rate around current levels, and disinflation. Similarly, Governor Waller expressed support for a cut in two weeks' time, but described the labour market trajectory as one of softening, not deterioration, and signaled that larger moves are a question for subsequent meetings based on the totality of future data (he was opened-minded about whether that might prove necessary).

Based on this, we retain our call for the Fed to begin its cutting cycle at the 18 September meeting with a 25bp cut, followed by two more 25bp at the remaining two meetings this year and a total of 75bp of cuts next year.

This should also be supported by next week's August CPI, which we expect to bolster the FOMC's confidence that the disinflation process is intact, with core CPI continuing to round to 0.2% m/m. We forecast slightly less deflation on the core goods side, but steady core services.

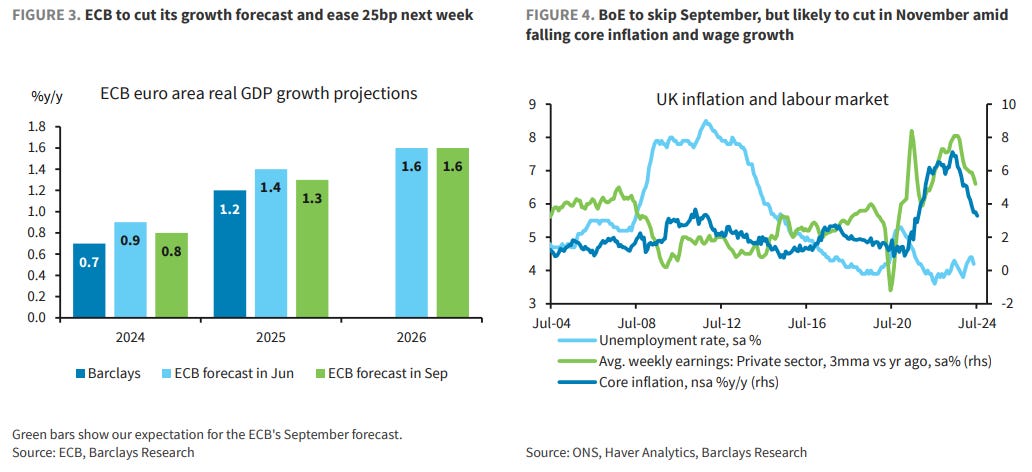

ECB to ease 25bp next week amid tepid growth

In Europe, Q2 final GDP (revised down 0.1pp, to 0.2% q/q) this week confirmed our suspicion that H1 headline growth was propped up by government consumption and the volatile components, while underlying domestic demand remains anemic. This is echoed by July retail sales, which showed positive but soft growth. Moreover, this week brought more signs of (structural) weakness in the manufacturing sector, as German industrial production contracted sharply and news reports suggest carmaker Volkswagen is considering factory closures in Germany.1 Next week, we will watch euro area industrial production.

Against this backdrop, we expect the ECB's new macroeconomic projections published next week to pencil in a slightly softer economic recovery in 2024. Inflation forecasts are likely to be revised up, but only marginally, and they should still feature a slow but sustainable convergence of inflation to the ECB's target. Given this, the fact that underlying inflation indicators show some progress, and evidence that monetary policy transmission continues to dampen growth, we think the Governing Council will conclude the outlook warrants an easing of the level of policy restriction and cut the deposit rate 25bp, to 3.5%. It will also implement the previously announced narrowing of the interest rate corridor.

However, we expect the Governing Council to remain cautious, with no change to the statement and the president reiterating data-dependence and a meeting-by-meeting approach. This lack of commitment implies that October will remain live, but we still think the path of least resistance is to maintain the quarterly easing path this year, given the differences in opinions on the committee. We thus expect the September cut to be followed by one in December. In 2025, we see cuts in January, March, and June.

BoE to skip September, but the case for November continues to build

In the UK, the data flow this week was limited, but the Decision Makers Panel and final PMIs showed further evidence of disinflation. Next week, we expect the labour market report to reinforce this signal, as we forecast private sector wage growth to ease to 4.9% 3m/y from 5.2% 3m/y. More generally, our models continue to point to a labour market that is loosening and will continue to do so over the coming 6-12 months. The single-month unemployment rate dropped in June, but we attribute this to noise and LFS survey issues and forecast a rebound in the July single-month reading reported next week (although the headline 3m average unemployment rate should edge down, due to past data). Moreover, after elevated growth rates in H1 (when the economy bounced back from the 2023 recession), we expect a deceleration in real GDP growth in H2. Next week, we forecast July monthly GDP to print 0.2% m/m.

That said, we still think the bar for a September cut by the BoE is prohibitively high, given some uncertainty about the labour market data, services and core inflation remaining elevated, an impending fiscal event, and the annual QT announcement taking centre stage at that meeting. However, as wage pressures ease and growth decelerates in the final quarter of this year, we believe the MPC should be increasingly confident in its need to reduce the extent of restriction and conduct three sequential 25bp cuts between November and February, before slowing the pace to quarterly for the final two cuts of the cycle (May 25 and Aug 25).

PBoC to ease policy in face of deflationary tendencies

The PBoC's financial stability and currency concerns have constrained its easing efforts thus far. However, incoming data continue to highlight that more accommodating policy is needed. This week, the August NBS composite PMI declined for the fifth straight month, printing just slightly above the expansionary threshold (50.1, -0.1pp), due to declines in manufacturing and construction readings. The broader set of August high-frequency data have remained weak as well (a fifth month of contraction in auto sales, a worsening housing market, contracting box office revenue, and cooling mobility-related indicators).

Next week, the first batch of August hard data should reinforce this weakness. In the credit release, we expect TSF growth to remain unchanged at 8.2% y/y, with continued weakness in private sector credit demand. We also expect export and import growth to slow to 6.5% y/y and 3% y/y, respectively. Most important, we forecast headline and core CPI readings to remain at the subdued 0.5% y/y rates, while PPI deflation may widen to -1.3% y/y, keeping deflationary risks elevated.

Given such poor fundamentals, we expect the PBoC to take the further steps to ease policy in the coming months. In this context, comments by former PBoC Governor Yi Gang that swift action to reverse deflationary pressures was needed were noteworthy.2 First, we think the PBoC will deliver a 50bp cut in the banks' reserve requirement ratio (RRR) in the coming weeks, likely in September, followed by another 50bp cut in H1 25. Second, following the main policy rate (7d OMO rate) cut in July, we forecast another three 10bp cuts, in Q4 24 (likely after Q3 GDP data) and Q1 and Q2 25. Third, we expect the PBoC to guide mortgage rates on existing mortgages lower. According to news reports,3 financial regulators have proposed reducing rates on outstanding mortgages by a total of 80bp, with the first cut coming in the next few weeks and the second taking effect at the beginning of 2025.

Political uncertainty remains high

All eyes on next week's US presidential debate

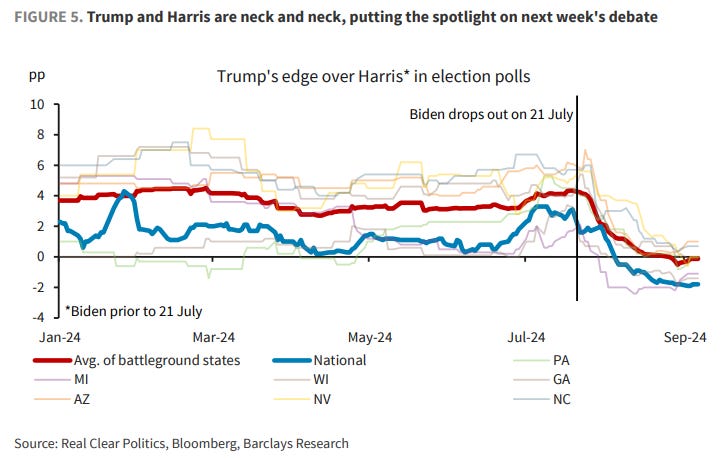

The US presidential election, now only two months away, remains very close and tightening, with polls showing Harris and Trump neck and neck in the key battleground states. In this context, all eyes next week will be on the presidential debate (10 September), which will be particularly important, given that it is Harris's first unscripted performance.

The debate will also likely again shine the spotlight on the two candidates' sharply different policy proposals, eg, on taxes. However, the extent to which either of them will be able to implement their agenda will still depend on the down-ballot races, where Republicans remain favoured to win the Senate, while the Democrats are still slightly favoured to win the House, implying a divided government.

France finally appoints a PM to a frail government

Meanwhile, in Europe, regional election results in two east German states were roughly in line with expectations, showing a notable defeat for the three parties forming the federal government coalition in Berlin amid a surge of far-right and far-left parties. This demonstrates the increasing political divide in Germany and the unpopularity of the federal government, which is struggling to find solutions to the country's growing structural economic weakness.

In France, after lengthy consultations, President Macron appointed the former centre-right minister Michel Barnier as prime minister. While the size of the coalition to support him is not yet clear, it will not have an outright majority in parliament, instead relying on the far-right RN party abstaining in no-confidence votes to remain in power. Thus, while Barnier's appointment clears some political uncertainty, the frailty of the incoming government implies meaningful fiscal consolidation is unlikely.

Japan's LDP leadership contest officially starts next week

Finally, in Japan, the ruling LDP party is still engaged in the leadership context that will determine who will replace Kishida as prime minister. While a number of candidates have already confirmed their bids, including former Environment Minister Koizumi this week, the campaign period will officially begin next week (12 September), with the election held on 27 September.

Growing downside risks to global growth

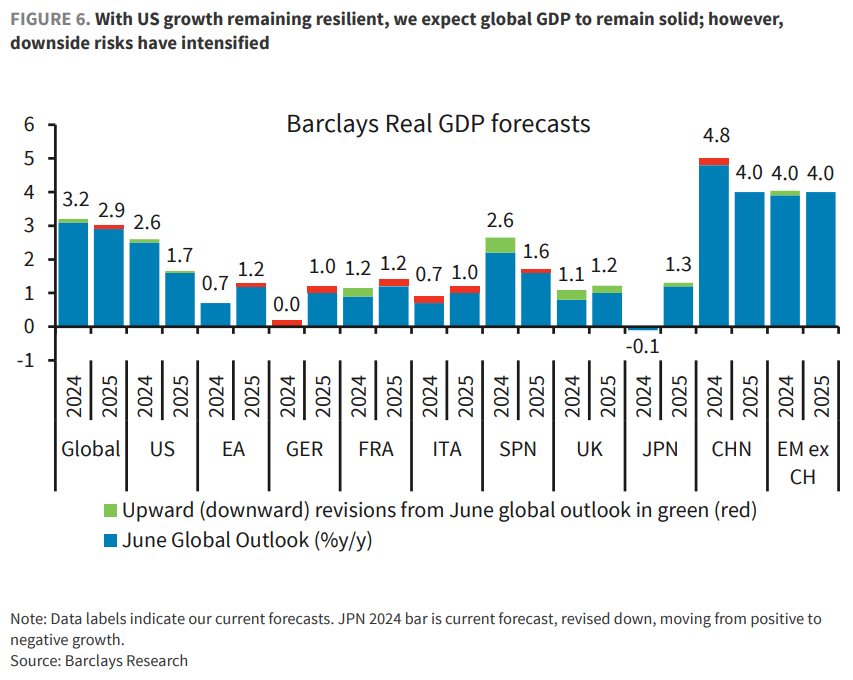

In Global Outlook: Calm on the surface in June, we expected uneventful and largely favourable macroeconomic conditions (steady growth, uneven but continued progress on inflation, and a gradual easing cycle), while pointing to risks related to optimistic equity markets and political uncertainties. Some of these have realised over the summer, most notably the market turbulence in the face of the JPY carry trade unwind and the change in the Democratic presidential candidate.

Our macro forecasts remain largely unchanged, but the risks have shifted: while in June we may have been concerned whether our disinflation predictions for H2 were too optimistic, we now feel less confident that our growth projections will hold. At the same time, this has increased our conviction in our expected rate cutting cycles.

For global growth, we now expect 3.2% in 2024, which is similar, but a touch higher, than the 3.1% we had penciled in in June. In particular, the upside surprise in headline Q2 GDP led us to nudge up our 2024 annual forecast for the US. Meanwhile, our forecasts for the euro area and for emerging markets as a whole are little changed. In the latter, we downgraded 2024 growth in China, following the poor Q2 GDP print, but this was offset by slightly stronger growth in Latin America, EM Asia ex-China, and EEMEA. In 2025, we expect global growth to slow slightly, to 2.9% (-0.1pp vs. the previous Global Outlook). The downward revisions to 2025 growth are led by the euro area and LatAm.

At the same time, we see more evidence that services remain the engine of growth globally, while the recovery in manufacturing is not materialising. This week, the August global manufacturing PMI declined for the second consecutive month (49.5, -0.2pp) and the output reading entered contractionary territory. In contrast, global services PMI picked up further, to 53.8 (+0.5pt).